In the “olden days,” it was widely accepted that value stocks outperform growth stocks over the long-term. But as central bankers have gotten increasingly involved in the last few batches of market cycles, growth stocks (supported by easy money) have been dominating—until this year. And if the US Fed’s now increasing interest rate trajectory is any indication, value stocks may again return to extended periods of outperformance. Shares of diversified industrial company, Honeywell (HON), fall into the value stock category, and may be worth considering. This report reviews Honeywell’s business, its valuation and risks, and then concludes with our opinion on investing.

Top Sales Growth: 20 Worst Performers

Shopify: Meme Stock, New Market Paradigm

We first purchased Shopify at ~$143 per share in August of 2018. It now trades at ~$333 per share. Not a bad return—until you realize the shares have fallen over 80% in the last 6 months! This report compares Shopify’s business fundamentals (including its business strategy, ongoing revenue growth and margins) to its current valuation, and then examines the question of whether Shopify CEO, Tobias Lütke, continues to imprudently push an easy-money, high-growth business strategy in an increasingly sober new market paradigm—now characterized by higher costs of capital and a starkly less friendly meme stock environment (yes—Shopify is a meme stock). We conclude with our opinion on who might want to invest—or if it’s simply time to sell and move on.

Top 10 Big Dividends: REITs, BDCs, Bond CEFs, Energy and More (4-10% Yields)

When it comes to income investing, investors have a lot of choices. And considering the current macroeconomic environment (inflation, the fed, market declines, recession risks) many investors are left flummoxed concerning their next move. In this report, we share our top 10 big-dividend opportunities, including two ideas from each of the following five categories: REITs, BDCs, Bond CEFs, dividend-growth stocks and energy investments. The yields range from 4% to over 9%, and we share some high-level macroeconomic perspective before we get into the countdown.

The Big-Dividend Report

Verizon: 5.2% Yield, 4 Risks Worth Considering

The share price of steady dividend-growth stock, Verizon, is still down more than 11% following its latest earnings release. And the 5.2% dividend yield is increasingly tempting for many income-focused investors (especially in our current volatile market). But the outsized dividend doesn’t come without risks. In this report, we review Verizon’s business, its dividend safety, the current valuation and four big risks the company currently faces. We conclude with our opinion on who might want to consider investing.

Chip Stocks: Price-to-Sales Ratios Decline

Roku: Despite Massive Sell Off, False Headwinds Still Exist

Roku (ROKU) shares are down 85%. And while some investors celebrate the bursting of what they believe was an obvious pandemic bubble stock, things could still get worse. For example, the Fed’s hawkishness is driving us into recession, Roku’s earnings are again negative and the shares remain highly shorted right along with many other now infamous “high-growth” stocks. In this report, we review Roku’s business, its growth opportunities, its valuation, the multitude of headwinds that many investors are now increasingly aware of (such as supply chain issues, competitive threats, slowing growth), and then conclude with our opinion on investing.

Looming Recession?

STAG's 4.4% Yield: 3 Big Risks Drive Price Lower

If you are an income-focused investor, you probably like investing in REITs for their often big, steady, dividend payments. However, you may have noticed that following years of strong outperformance, the industrial REIT sector (including monthly-dividend payor, STAG Industrial (STAG)) has recently sold off hard. This report reviews STAG’s business, including information on the 3 big risk factors contributing to its relatively lower valuation multiple—as compared to industry peers (especially following the recent big Industrial REIT sector sell off), and then concludes with our opinion on investing.

China "Tech Crackdown" Reversing

40 Big-Dividend BDC's: Price-to-Book Values

CrowdStrike: This “Ain’t” Their First Rodeo

CrowdStrike founder and CEO, George Kurtz, has founded and led multiple successful cybersecurity businesses, and he knows the drill. Specifically, CrowdStrike is a high-margin Software-as-a-Service company with highly attractive recurring revenues that continue to grow rapidly in a large (and expanding) total addressable market (cybersecurity). What’s more, despite the continuing rapid growth, the valuation has come down, thereby making the shares even more compelling to some investors. In this report we share our opinion on whether CrowdStrike is worth considering for investment at these levels (valuation), or if it’s just another overhyped growth stock that is being valued too much on a euphoric narrative and not enough on its underlying fundamentals.

High Growth Stocks - with Room to Run

These are potentially “rocket fuel” stocks in the coming months, IF inflation has peaked and the Fed becomes less hawkish. It also doesn’t hurt that China has decided to lighten up on its crack down on tech. The “% of 52-Week Price Range” shows how much more upside these stocks could have relatively to where they sit between their 52-week highs and lows.

Owl Rock’s 9.1% Yield: Credit Spread Risks, Rewards

Business Development Companies, or BDCs, make the loans that big banks generally will not (or cannot, due to regulatory rules). However, like big banks, BDC bottom lines usually come down to simply net interest margins (i.e. the margin between the rate they borrow at and the rate they lend at), assuming they can survive any macroeconomic turmoil, considering they have much higher sensitivity than do the big banks. Interest rates are trending sharply higher (as the Fed fights inflation), and this can be very good (or very bad) for big-dividend BDCs (like Owl Rock). In this report, we share our opinion on whether Owl Rock’s big 9.1% dividend yield is attractive and worth considering, or whether the risks are simply too great and if investors should avoid the shares.

The Tech Bubble Took Over 2.5 Years to Fully Burst

The Tech Bubble (QQQ) peaked on 3/10/2000 and it took more than 2.5 years for it to fully burst. We are in a different environment today (i.e. low rates rising, massive revenue also rising for top growth stocks), but here is sector performance when the bubble burst (the first year and peak to bottom). Cathie Wood’s ARKK ETF peaked in June 2021 and the Nasdaq (QQQ) peaked in late 2021.

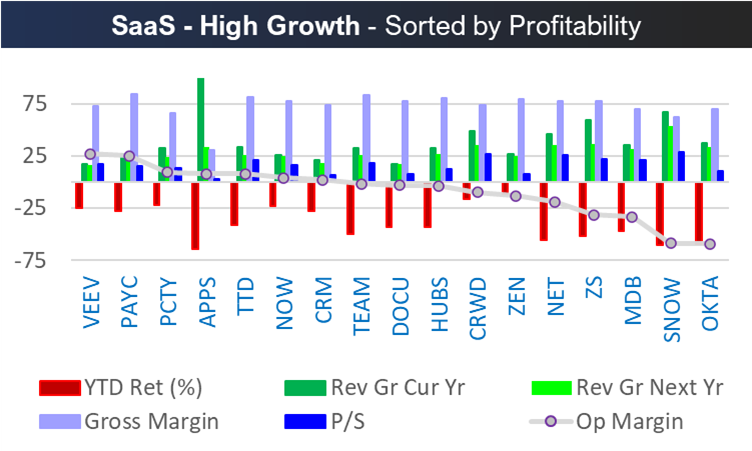

SaaS - High Growth - Sorted by Profitability

Growth Stocks (1-Day vs YTD)

Disruptive Finance Stocks (sorted by Growth)

This Steady Growth Juggernaut is a Gift from the Market

There is a lot to like about the highly-profitable business we review in this report, including its high margins, powerful revenue growth, large total addressable market opportunity, impressive history of dividend growth (10+ years) and its compelling valuation. The company helps consumers and small businesses make short work of their financial responsibilities and challenges. And the shares have absurdly lost nearly 50% of their value since November as they’ve gotten caught up in the recent market-wide high-growth selloff. Yet, yesterday’s earnings announcement makes clear this business is still quite healthy (they again exceeded expectations) and on track to do even better (perhaps dramatically so) in the years ahead.