There is a lot to like about the highly-profitable business we review in this report, including its high margins, powerful revenue growth, large total addressable market opportunity, impressive history of dividend growth (10+ years) and its compelling valuation. The company helps consumers and small businesses make short work of their financial responsibilities and challenges. And the shares have absurdly lost nearly 50% of their value since November as they’ve gotten caught up in the recent market-wide high-growth selloff. Yet, yesterday’s earnings announcement makes clear this business is still quite healthy (they again exceeded expectations) and on track to do even better (perhaps dramatically so) in the years ahead.

Intuit (INTU)

Intuit offers technology-based financial solutions, including TurboTax, QuickBooks, Mint, Credit Karma and Mailchimp. Quickly, if you don’t know, here is an overview of each:

TurboTax: a software package to prepare tax returns.

QuickBooks: an accounting software package for small and medium-sized businesses to accept business payments, manage and pay bills, and payroll functions.

Mint: a personal financial management website and mobile app that allows users to track bank, credit card, investment, and loan balances and transactions through a single user interface, as well as create budgets and set financial goals.

Credit Karma: a free credit and financial management platform that also offers monitoring of unclaimed property databases and a tool to identify and dispute credit report errors. Revenue from targeted advertisements for financial products offsets the costs of its free products and services. Credit Karma earns revenue from lenders, who pay the company when Credit Karma successfully recommends customers to the lenders

Mailchimp: a marketing automation platform and email marketing service for managing mailing lists and creating email marketing campaigns to send to customers.

The company breaks its business down into four segments for financial reporting:

Small Business & Self-Employed: The Small Business & Self-Employed segment provides QuickBooks online services and desktop software solutions comprising QuickBooks Online Advanced, a cloud-based solution; QuickBooks Enterprise, a hosted solution; QuickBooks Self-Employed solution; QuickBooks Commerce, a solution for product-based businesses; QuickBooks Online Accountant and QuickBooks Accountant Desktop Plus solutions; and payroll solutions, such as online payroll processing, direct deposit of employee paychecks, payroll reports, electronic payment of federal and state payroll taxes, and electronic filing of federal and state payroll tax forms. This segment also offers payment-processing solutions, including credit and debit cards, Apple Pay, and ACH payment services; QuickBooks Cash business bank account; and financial supplies and financing for small businesses.

Consumer: The Consumer segment provides TurboTax income tax preparation products and services; and personal finance.

Credit Karma: The Credit Karma segment offers consumers with a personal finance platform that provides personalized recommendations of home, auto, and personal loans, as well as credit cards and insurance products.

ProConnect: The ProConnect segment provides Lacerte, ProSeries, and ProFile desktop tax-preparation software products; and ProConnect Tax Online tax products, electronic tax filing service, and bank products and related services. It sells products and services through various sales and distribution channels, including multi-channel shop-and-buy experiences, websites and call centers, mobile application stores, and retail and other channels.

Investment Thesis and “Buy Under” Price:

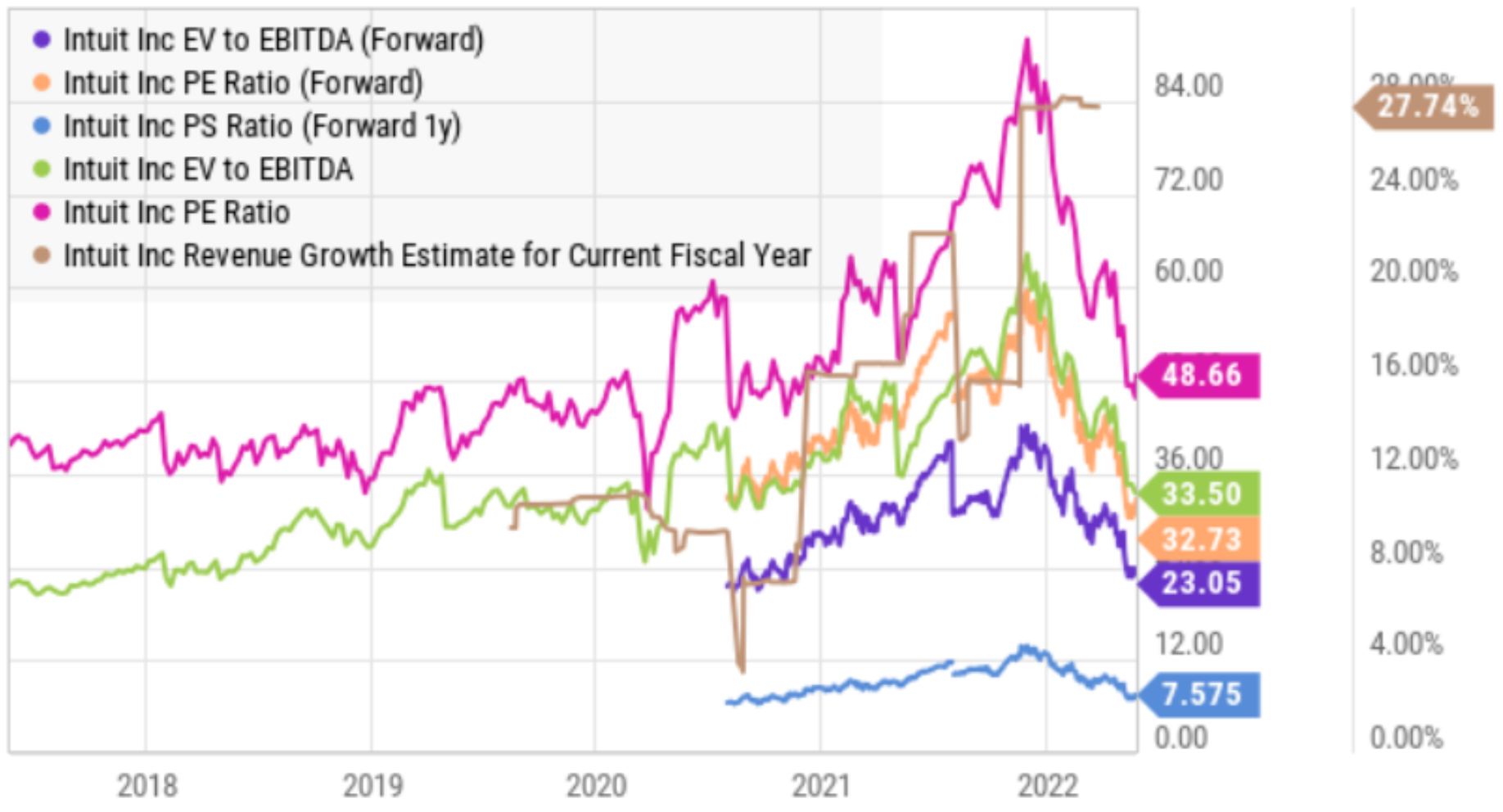

Our basic investment thesis is that Intuit’s business is so profitable and growing at such a healthy clip (with such a large market opportunity) that it would be surprising if the share price doesn’t go dramatically higher in the years ahead. Trading at 28.3 times (non-GAAP) earnings, 8.2 times forward sales and with a growth rate of 22.9%, the share price should simply be dramatically higher. It can be difficult for some investors to be optimistic when the market sells off dramatically (like it has in recent months), but Intuit is basically a gift to investors at its current share price. We assign Intuit a “buy under” price of $400 (realistically, it can go much higher), and we currently own shares in our Income Equity Portfolio (the impressive dividend growth trajectory makes it a highly-attractive opportunity). Important to note, there are high “switching costs” for Intuit customers that form a competitive advantage (high customer retention) for Intuit.

High Revenue Growth and TAM

On yesterday’s quarterly conference call CEO Susan Goodarzi explained:

We have a nearly $300 billion addressable market driven by tailwinds that include shifts to virtual solutions, acceleration to online and omnichannel capabilities and digital money offerings. This, combined with the team’s execution, is contributing to the strength of our performance.

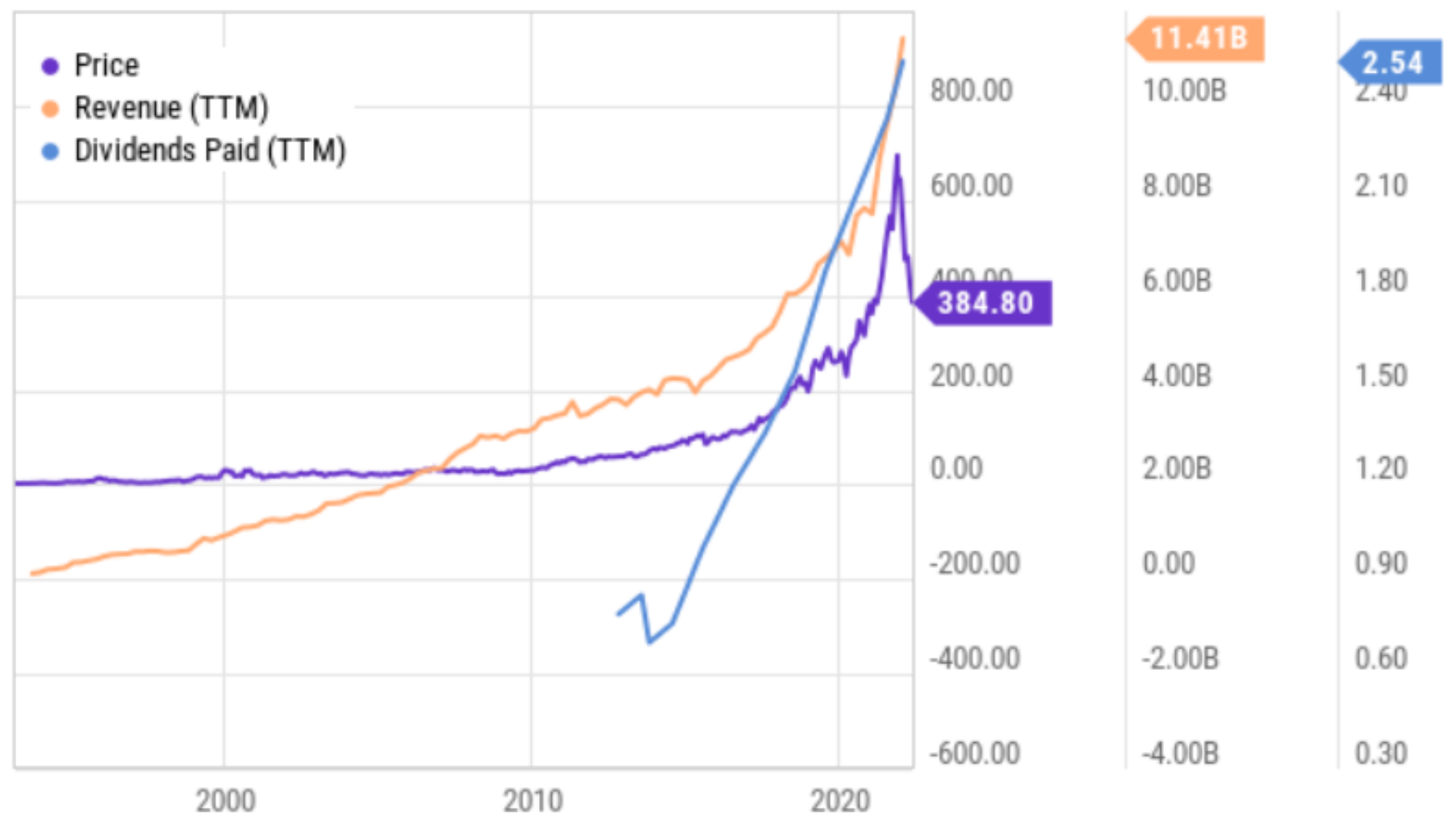

That market opportunity is vast as compared to the $11.4 billion in total revenue generated by Intuit over the last 12 months. Specifically, there is a lot of room for continuing growth, especially as the company is projecting forward revenue and EBITDA growth of 22.9% and 24.3%, respectively. In fact, on the quarterly call Intuit announced that it had again exceeded growth expectations. In the third quarter alone, revenue grew 35% (including 6 points from the recent MailChimp acquisition—i.e. lots of organic growth (the best kind!)).

Powerful Dividend Growth

Intuit has growth its dividend for 10 years straight. And as you would expect a prudent capital allocator to do, Intuit returns extra cash (that it cannot reinvest prudently in the business) to shareholders through dividends and share repurchase. Here is what CFO Michelle Clatterbuck had to say on yesterday’s call:

We return excess cash that we can’t invest profitably in the business to shareholders via both share repurchases and dividends. We finished the quarter with approximately $3.9 billion in cash and investments on our balance sheet. We repurchased $489 million of stock during the third quarter. Depending on market conditions and other factors, our aim is to be in the market each quarter. The Board approved a quarterly dividend of $0.68 per share, payable July 18, 2022. This represents a 15% increase versus last year.

Some investors may not be overly impressed with Intuit’s 0.8% current yield, but keeping that in perspective is critical. The shares currently trade at around $380, but that is dramatically more than the approximately $54 they traded at 10 years ago. From a “yield on cost” basis, Intuit yields over 5%. A 418% price gain plus a yield on cost of over 5% is a lot more attractive than a 5% yield and a stock price that has gone no where over the last decade (such as names like IBM and AT&T, for example).

Attractive Valuation

As mentioned, the share price has sold off nearly 50% since November as Intuit has gotten inappropriately caught up in the whole high-growth stock sell off. But what the market fails to recognize is that unlike other high-growth stocks, Intuit is actually already very profitable. Gross margins are around 68.8% (very high) and net income margin is around 27.8% (extremely attractive). And when you combine the company’s low share price (and now dramatically lower valuation multiples) with its highly profitable growth trajectory—you’re left with an extremely compelling investment opportunity.

Risks

Of course Intuit does face risks. One risk is that it is not able to achieve all of the synergies it hopes from its diverse ecosystem. For example, the recent acquisition of MailChip is a little outside-the-box as compared to Intuit’s other businesses, and integration and synergies may be more challenging to achieve than Intuit expects (as is often the case when companies complete acquisitions).

Another risk is a recession. As the fed keeps raising rates to combat inflation they could drive the economy into recession thereby making it less likely for Intuit to achieve the high growth it expects. That said, a lot of uncertainty is already priced in (the shares have sold off hard) and much of Inuit’s business is mission-critical for its customers (meaning they cannot easily get rid of it).

Another risk is simply that Intuit may be too aggressive with its growth estimates. For example, the company plans to expand internationally, which can be more difficult than anticipated. Also, Intuit’s tax prep software could face pressure from government to give away more features for free, as well as the potential for the government to eventually create its own tax prep software.

Despite these risks, Intuit growth, value and dividend remain compelling.

The Bottom Line

Intuit is a fast-growing, profitable business, that offers impressive dividend growth and an increasingly compelling valuation as the shares have inappropriately gotten caught up in the market’s recent rejection of anything growth (i.e. this baby has been thrown out with the bathwater). In our view, Intuit is a gift from the market at its current price, and it will likely be trading higher (perhaps dramatically higher) in the quarters and years ahead. We are long Intuit.