The well-managed, blue-chip, Business Development Company (“BDC”) we review in this report currently trades at a compelling price, it offers a healthy dividend, and it sits at an attractive spot in the current business cycle. But is it worth investing? This report reviews all the details and then concludes with our opinion on investing.

Main Street Capital (MAIN), Yield: 7.1% (paid monthly)

Business Development Companies, or BDCs, basically provide financing (capital) to companies that are often too small, unique or risky for traditional banks. Main Street takes debt (it makes loans) and equity (it takes partial ownership) positions in the companies it provides financing too, and it eliminates a lot of the company-specific risks by prudently diversifying and through its experienced management team.

Thesis and “Buy Under” Price:

Our basic thesis for Main Street Capital is that the price is down (and the valuation is attractive) due to the current market cycle (the fed is raising rates to slow inflation), and investors will get paid a big, healthy, monthly dividend as they wait for the shares to eventually rebound. The rebound will be driven by higher rates (similar to a traditional bank, MAIN will earn a higher net interest margin as rates rise) and the shares will also benefit as the market eventually recovers from the current slowdown (mainly a slowdown in share prices so far). We currently own shares of Main Street Capital, and we have assigned it a “Buy Under” price of $40/share within our Income Equity Portfolio (the shares currently trade at around $36.

Business Overview:

Based in Houston Texas (but with business diversified across the US), Main Street basically divides its business into four parts, including Lower Middle Market (49% of the investment portfolio at fair value), Private Lending (34%), Middle Market (11%) and Other Portfolio Investments (6%).

Main’s believes its heavy focus on lower middle market opportunities (basically businesses with revenue between $5 million and $50 million, roughly) give it a unique advantage (because they have less competition and more opportunity in this space, as compared to the simply “middle market” opportunities where many other BDCs focus).

Internal Management: Main Street’s internal management team also gives the business an advantage as compared to most other BDCs which are externally managed. Main Street’s internal management team is able to offer lower management fees (a good thing for investors) and less conflicts of interest (also a good thing). Main Street’s management team also has a significant ownership interest (owning 3,125,030 shares as of March 31st), owing about 4.2% of the shares outstanding.

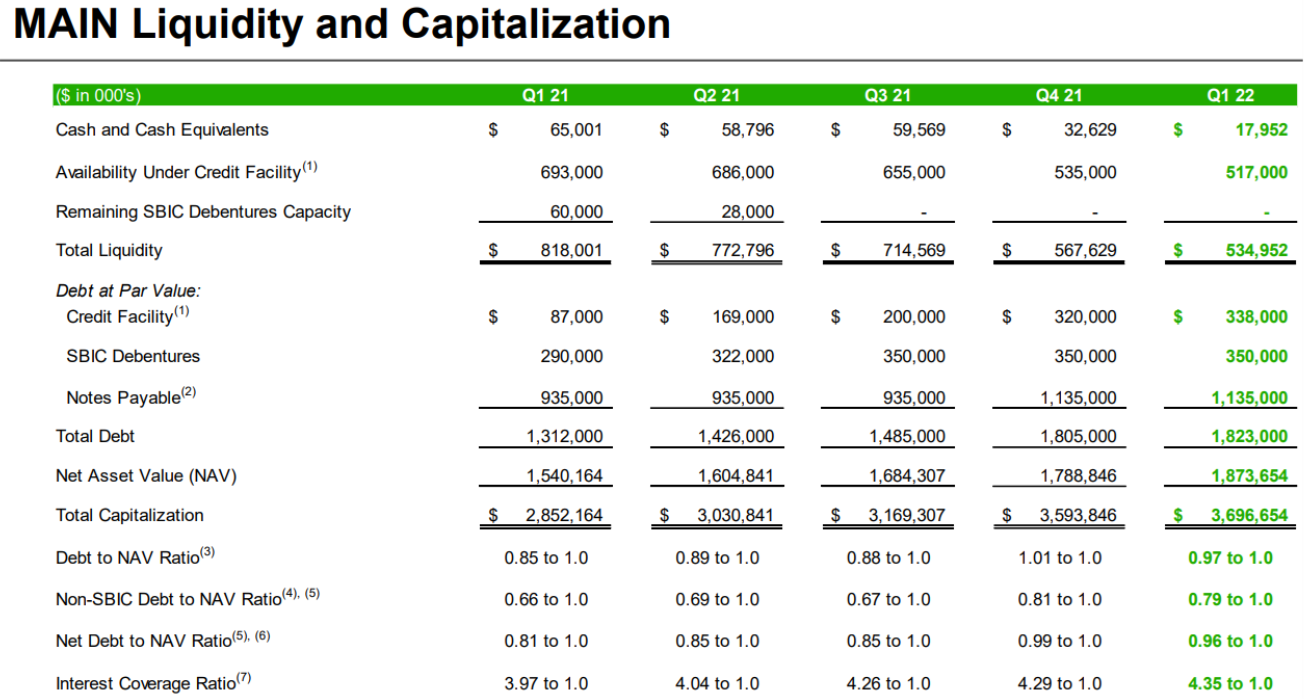

Strong capitalization and liquidity position:

Important to note, Main Street in in a healthy liquidity position, and this will help the company whether challenges as well as take advantage off opportunities. For example, Main Street maintains an investment grade rating of BBB-/Stable from Standard & Poor’s Rating Services.

Main Street also owns two Small Business Investment Company (SBIC) Funds, and this provides it access to 10-year, low cost, fixed rate U.S. government-backed leverage. Specifically, Main Street has total SBIC debenture regulatory financing capacity of $350.0 million, the maximum amount permitted under current SBA regulations. The two funds are (1) Main Street Mezzanine Fund (2002 vintage), and (2) Main Street Capital III (2016 vintage).

The Dividend:

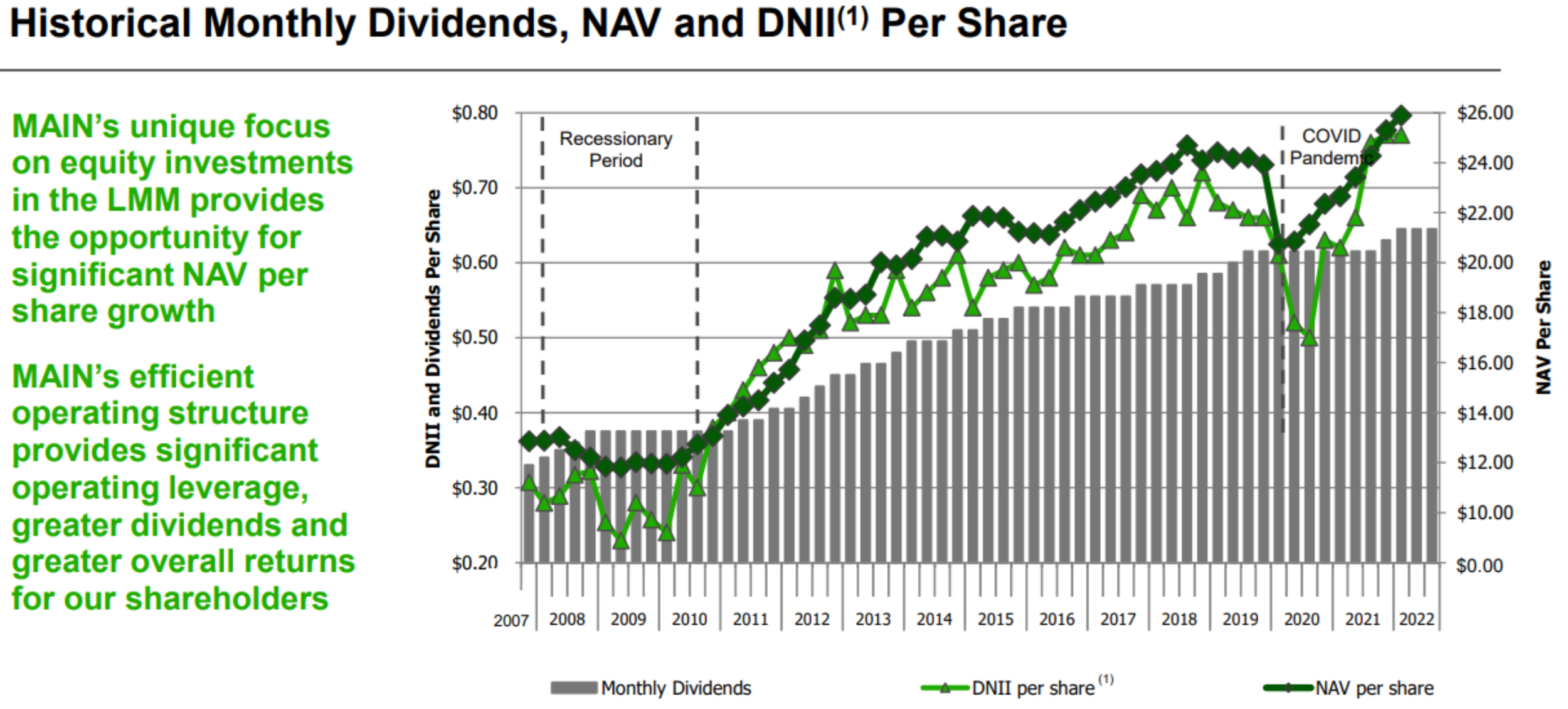

Main Street currently offers a 7.1% dividend yield, paid monthly. What’s more, Main Street has never reduced its dividend (including through the 2008/2009 recession and the 2020/2021 COVID-19 pandemic). In actuality, Main Street has increased its monthly dividend 95% from $0.33 per share paid in Q4 2007 to declared dividends of $0.645 per share for Q3 2022. Futhermore (and importantly) Main Street has grown its net asset value (“NAV”) per share by 101% from $12.85 at December 31, 2007 to $25.89 at March 31, 2022 (a CAGR of 5.0%).

And worth mentioning, for those of you that own MAIN in a taxable account, the operating structure allows a portion of the dividend payments to be qualified, thereby potentially reducing your tax liability (a good thing).

Valuation:

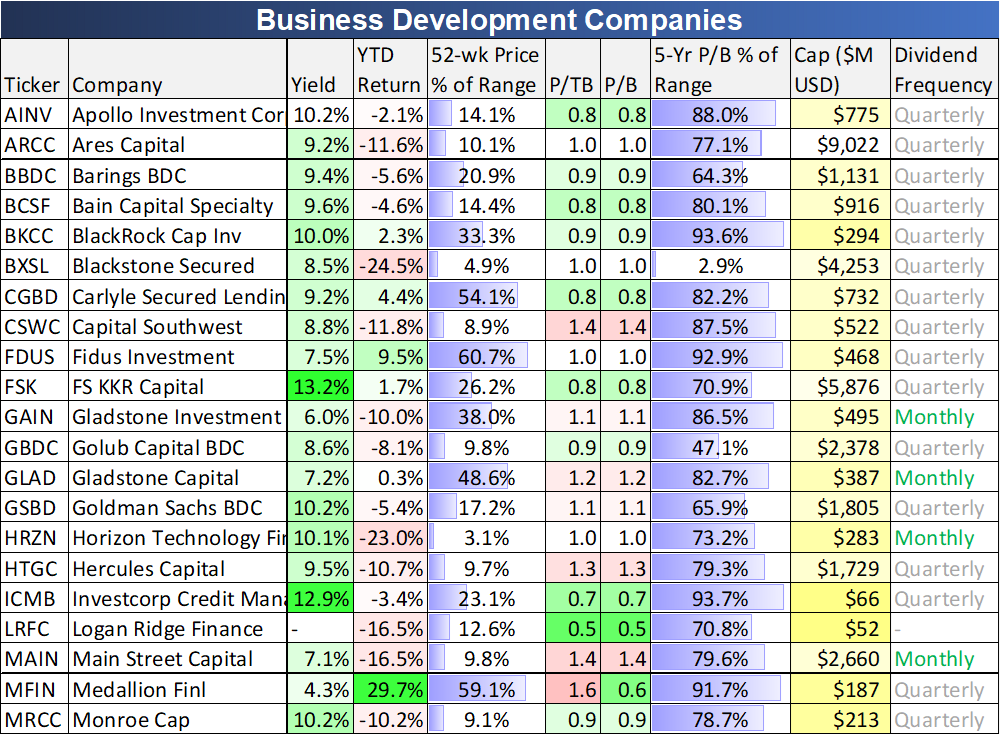

Similar to traditional banks, one of the most basic way to value a BDC is by considering the share price to book value multiple. For perspective, here is a look at price-to-book (or price to “NAV”) for Main Street versus other BDCs.

The first thing you might notice is that Main Street appears expensive relative to other BDCs. However, Main Street has historically always traded at a significant premium (investors appreciate the unique lower middle market strategy and the internal management team). Further, Main Street actually trades at a low valuation multiple as compared to its own history (also a good thing, considering the strong liquidity, dividend and business). Historically, it has not been uncommon to see Main Street trading at a price-to-book of 1.8x and 1.9x for an extended period of time. It is currently around 1.4x.

Risks:

The market cycle is perhaps the biggest risk to Main Street Capital. Because Main Street provides financing to riskier small and micro-cap companies, this increases the risks during downturns in the market cycle. For example, as you can see in our earlier chart, Main Street’s “Distributable Net Investment Income” (or DNII) pulled back significantly in ‘08-’09 (Financial Crisis) and again in ‘20 (when the covid pandemic hit). It is true the business faced significant challenges during these periods (as some of the underlying portfolio companies struggled mightily), but it is important to note that Main Street never reduced its dividend payment.

Currently, we are at a point in the market cycle where the fed is tightening, and this is coming at a very short time period after the fed was loosening dramatically to deal with covid. Share prices across the market (including BDCs) have fallen this year. Depending on the severity of the current market pullback (which remains to be seen), Main Street could fall further. However, given the company’s strong liquidity position (and well diversified portfolio), we believe Main Street will be able to whether even a significantly more extreme pullback, and we also believe the dividend will likely remain steady. Further still, we believe the market will get better, and Main Street’s share price, dividend and NAV will all rise again in the future.

The Bottom Line

BDCs are a bit risky by nature. That’s why banks generally stay away from the types of loans and financing that BDCs provide to portfolio companies (especially considering the more stringent bank regulations put in place following the ‘08-’09 Financial Crisis). However, BDCs have growing track records of success in navigating market cycles, Main Street Capital in particular.

Main Street has a relatively strong liquidity position, a healthy dividend, an experienced internal management team and a relatively attractive valuation. The share price is down as the broad market faces challenges, but Main Street has navigated significant challenges in the past, and we believe they will this time too (especially as business adjusts to the attractive long-term potential for higher net interest margins—from rising rates—and higher profits). We are currently long shares of Main Street in our Income Equity portfolio, and regardless of any near-term volatility—in the long term we expect the dividend, NAV and share price to all increase.