This quick note shares data on over 100 big-yield (7% to 14%+) bond Closed-End Funds (“CEFs”), including discounts/premiums, recent returns, amount of leverage, and more. Returns have been ugly this year (as interest rates have risen), and they could get uglier considering the Fed is set to keep raising, losses will be magnified by the use of leverage, and forced “fire sales” could make matters worse as the funds mathematically bump up against regulatory leverage limits. Caveat Emptor.

Market Conditions for Bond CEFs are Dicey

As some of you are aware, we sold our bond CEFs from the Blue Harbinger Income Equity Portfolio as the environment has been increasingly dicey. Brave contrarians may be considering “dividing back in” to bond CEFs (as the prices are very low, but before you play contrarian hero—there are a few things you should keep in mind. We’ll get into those, but first the data.

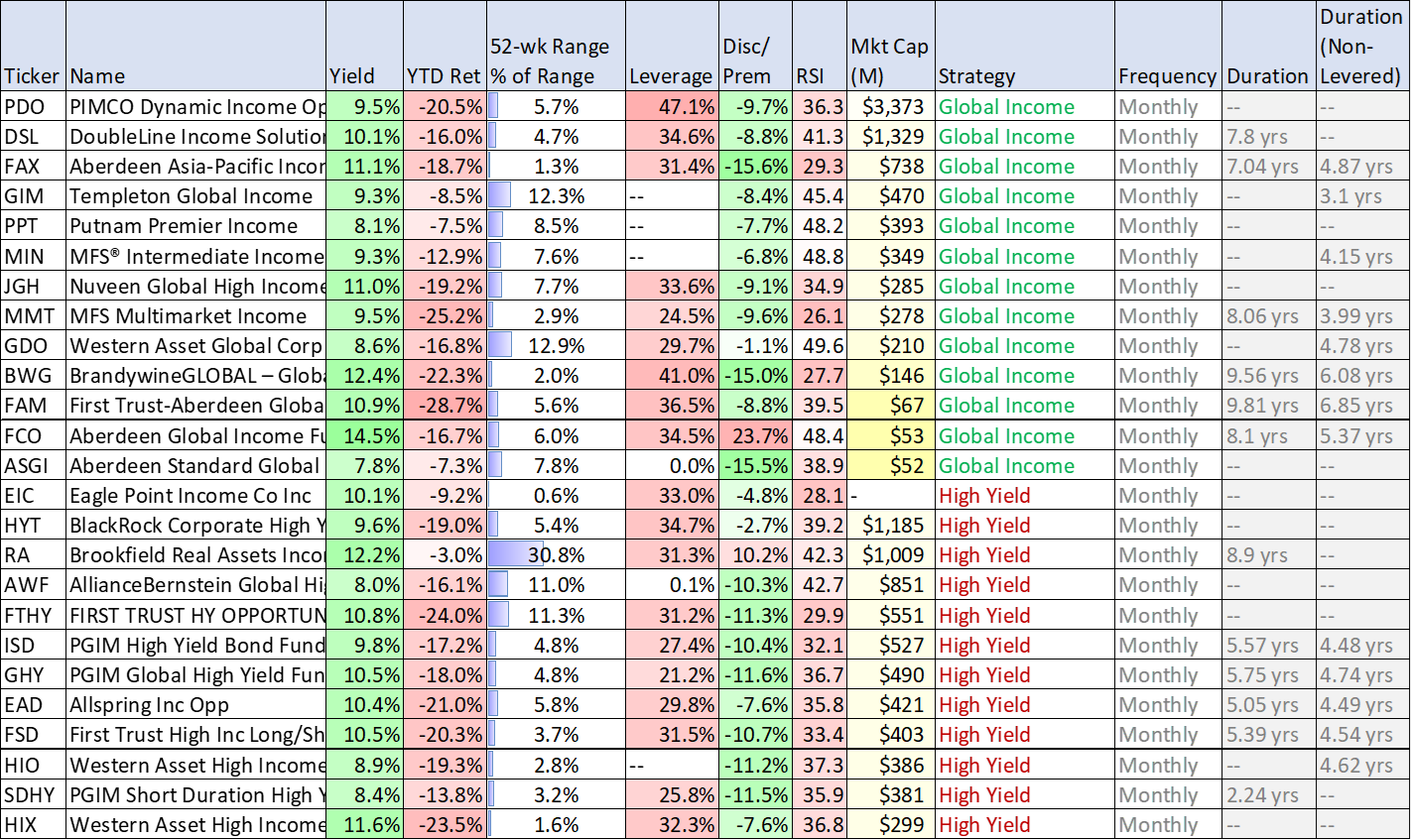

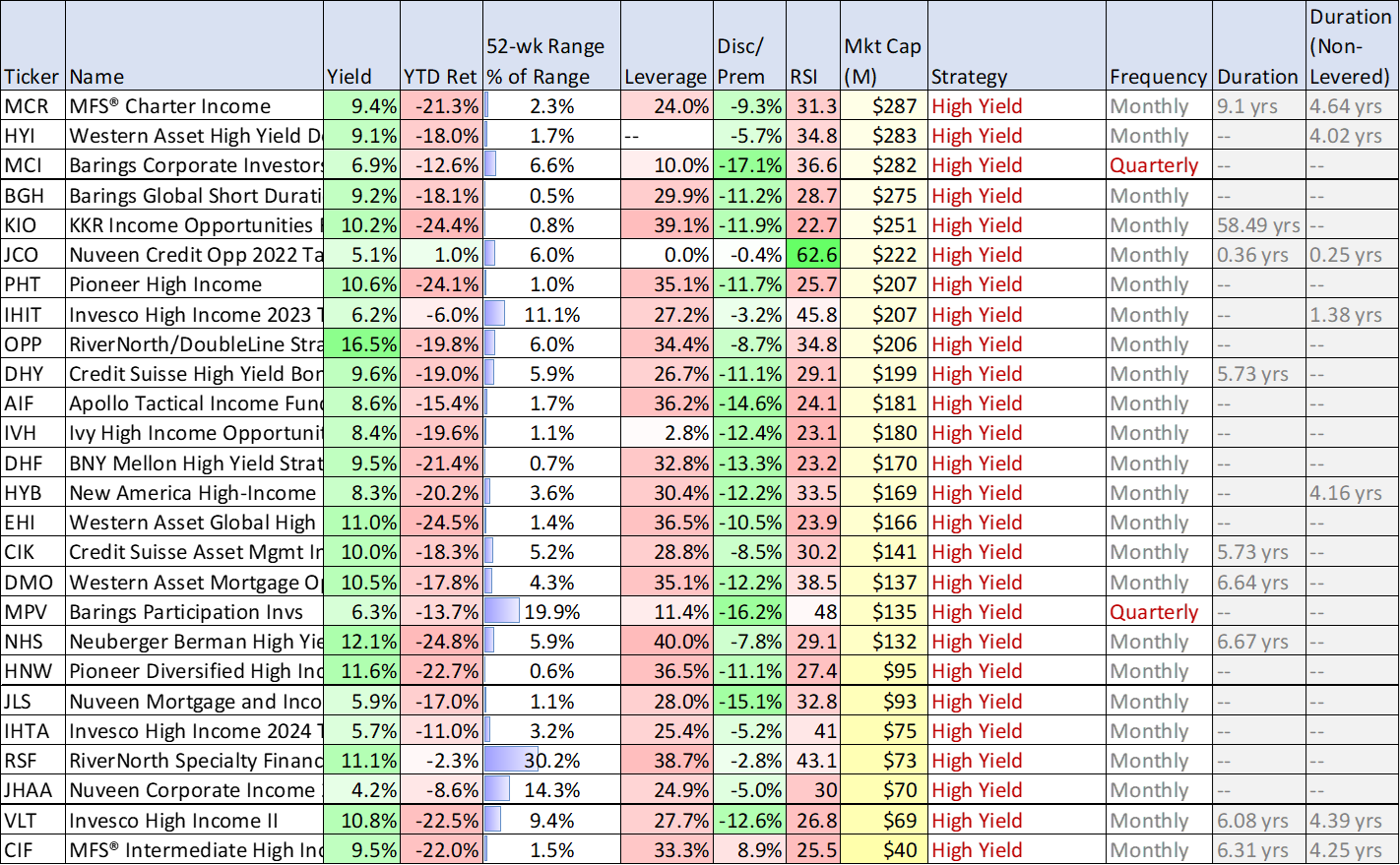

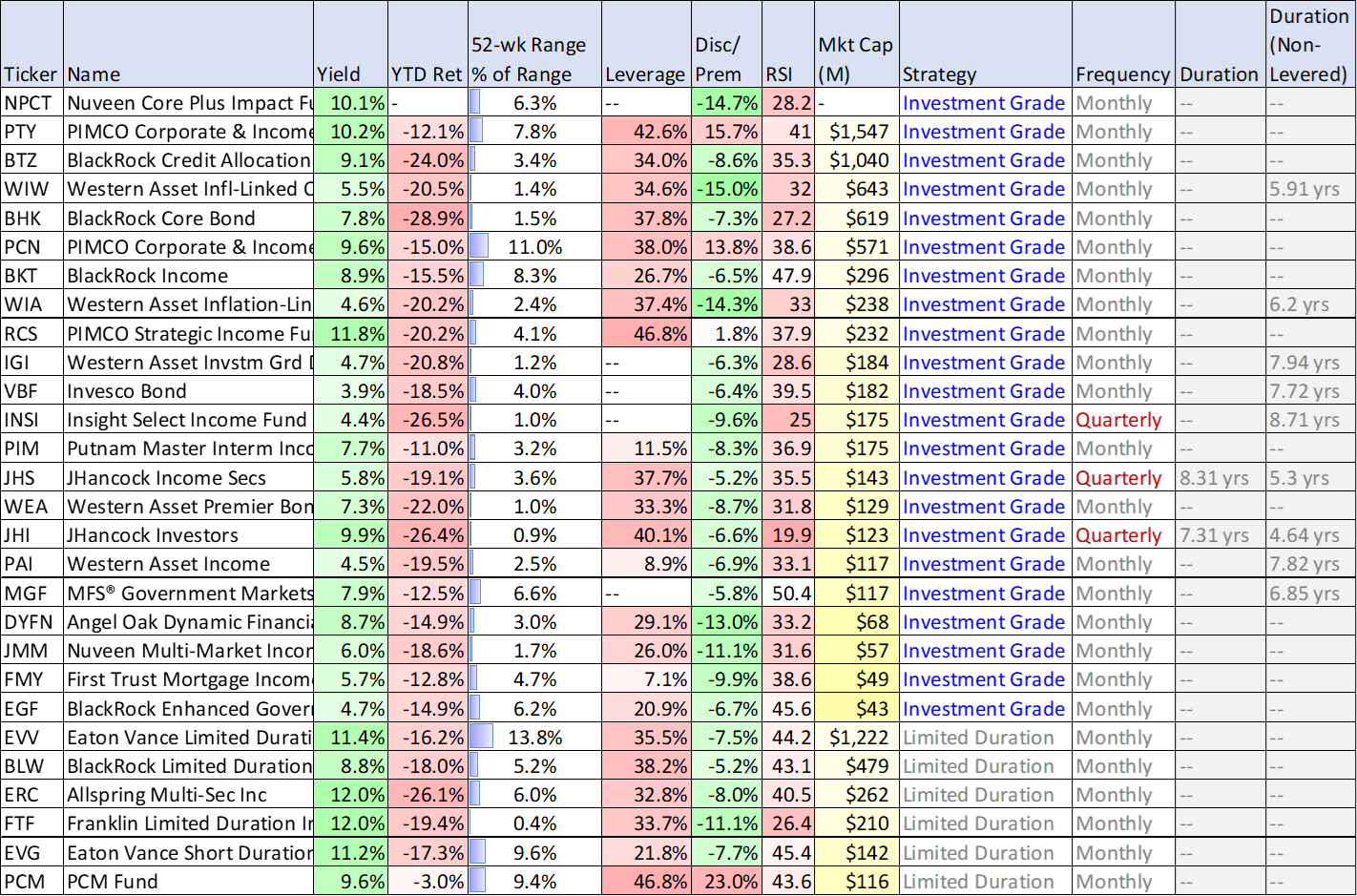

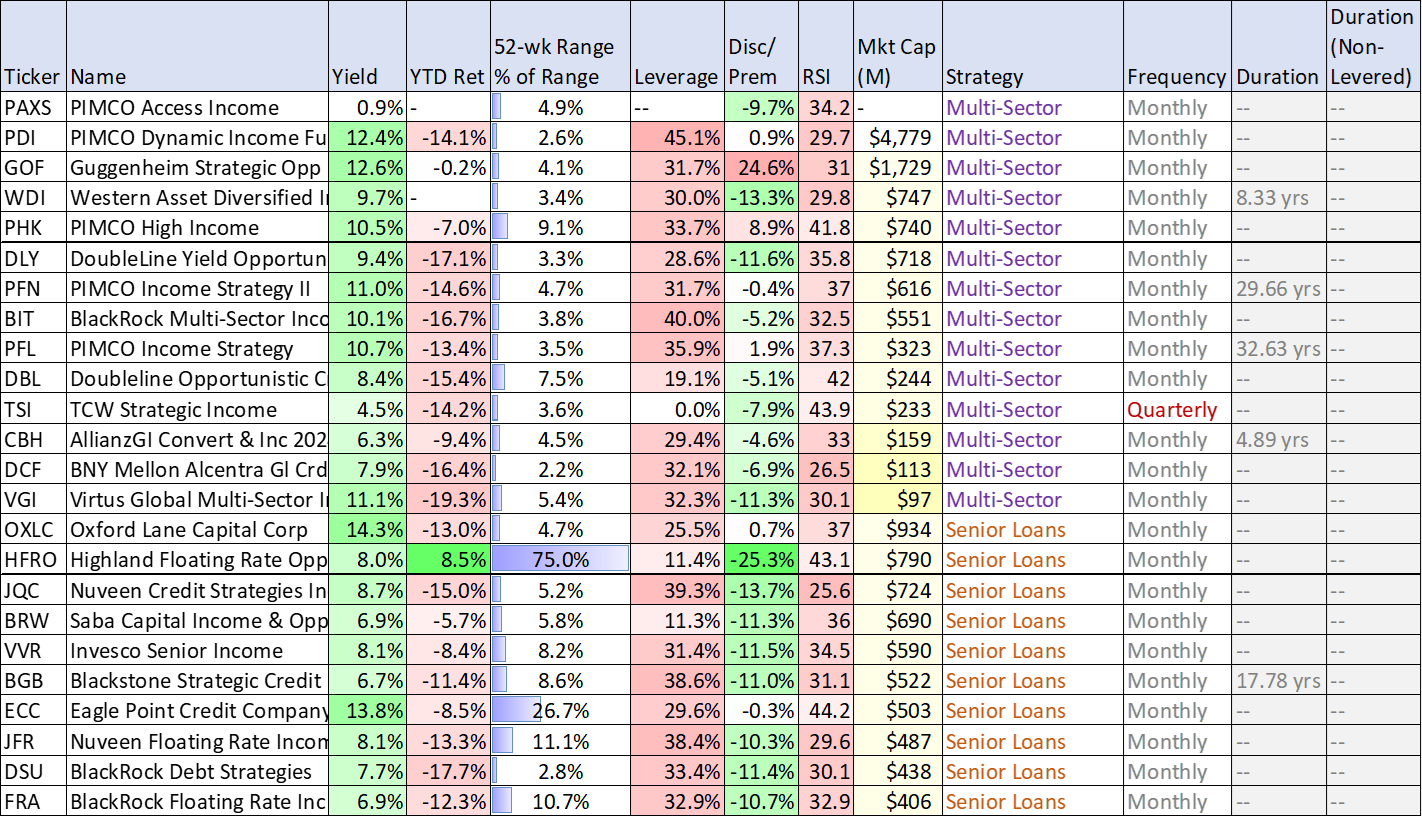

Bond CEF Data:

Interest Rates

Ceteris paribus, as interest rates rise, bond prices fall. We’ve seen this already in 2022 as the fed raises rates to fight inflation. And you can see it in the ugly year-to-date returns of the Bond CEFs in the table above.

Leverage

Most Bond CEFs use leverage (see table above) to magnify returns and yield. When conditions are good—this can be great, but when conditions are bad—this can be terrible. Year-to-date, the leverage used by many Bond CEFs has magnified loses. Yuck.

Leverage Limits and Fire Sales

Depending on the strategy, closed-end funds have regulatory limits to the amount of leverage they are allowed to use. For example, the 1940 Act generally limits bond funds to a maximum of 50% leverage, and as you can see in our earlier table, some of the funds (including some very large popular ones, like PIMCO’s PDO at 47.1%) are getting dangerously close to the limit. And once they hit the limit, they’ll be forced to sell some of their holdings at “fire sale” prices and essentially lock in losses for shareholders. Yuck. And for perspective, as rates keep rising, bond prices will fall, and leverage levels with mathematically rise—a potentially very ugly situation! (e.g. vicious cycle).

Conclusion:

If you are dramatically overweight bonds CEFs in your portfolio—be careful! You’re probably already reeling from the losses this year. And part of you probably thinks the market will rebound, and you want to avoid selling at the bottom. If inflation rates decline dramatically (which they could as pandemic stimulus fades), then the fed will ease up on its interest rate hike trajectory, yields could fall, and bond CEFs could rebound significantly. But if rates keep rising, the pain for leveraged bond CEFs can still get much worse. Caveat Emptor!