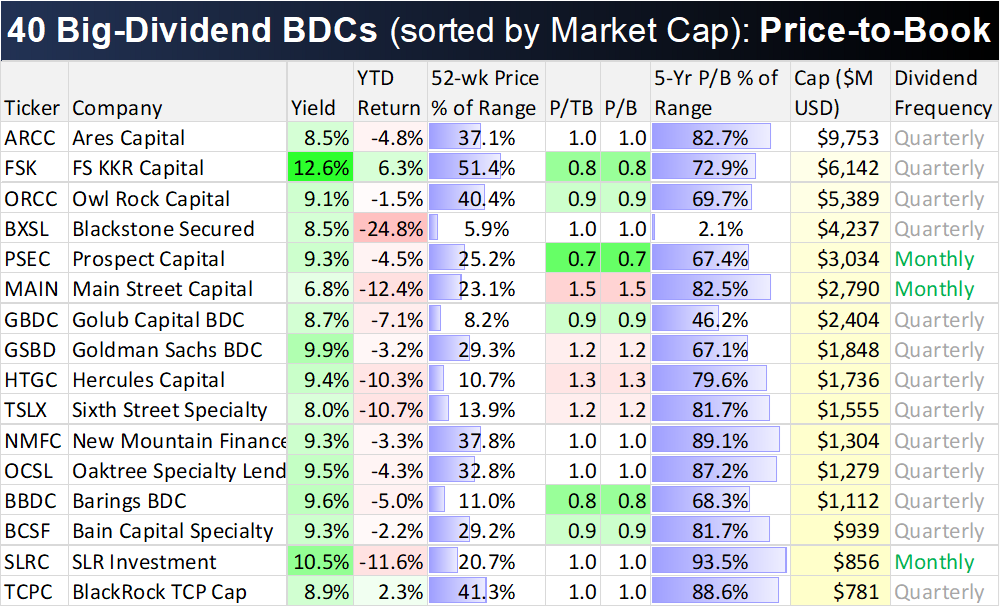

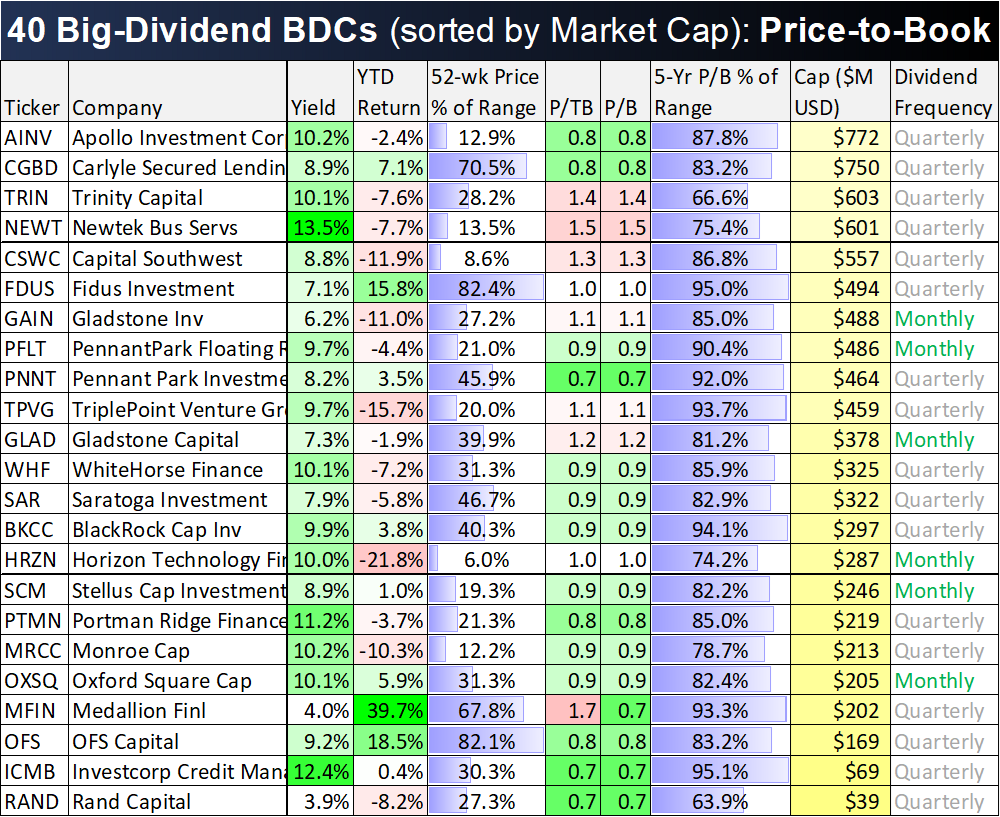

A lot of big-dividend BDCs are down this year and sitting closer to their 52-week lows than their 52-week highs. But that doesn’t necessarily mean they are good buys. In fact, one of the most common BDC valuation metrics (price to book value) shows these same BDCs aren’t necessarily that cheap; this means that this year’s price declines have been accompanied by book value declines (as at least some BDC investments have been written down or sold off).

First the pandemic wreaked havoc on many of the small businesses that BDCs fund, and now rising interest rates is creating more challenges for these small businesses and the BDCs themselves.

In our view, BDCs aren’t all a screaming buy here. However, the ones that can navigate the current environment are set to climb higher. For example, we continue to like (and own) shares of Owl Rock Capital (it currently yields 9.1%) and we believe its set to climb higher in the second half of this year. You can read our latest Owl Rock Capital report, here.