In the accelerating race to build-out artificial intelligence (AI) at scale, just a small handful of companies hold the literal "on/off switches" for the infrastructure powering it all. Dubbed "chokepoint kings," these firms control irreplaceable elements amid surging demand. Here are the four AI Chokepoint Kings, including a description of what they do, how they are currently being valued by the market, and my opinion on investing.

BH20 Growth Stocks: Separating The "Most Liked" from "The Best"

No one has a working crystal ball, but it’s not hard to see where the market is going (e.g. the “cloud AI megatrend,” for example). Where uncertainty starts to creep in is the likely winners (e.g. mega-cap hyper-scalers) versus the less-certain long-term winners with more volatile upside (e.g. the nuts-and-bolts hyper-scaler suppliers and datacenter component makers). This week’s BH20 fast-paced growth stocks shares a handful of top ideas from the latter group (e.g. huge upside “potential” but volatile and less-certain).

BH High Income Portfolio: Big Yield, Small Rebalance

The 25-position Blue Harbinger “High Income Portfolio” continues to offer a high yield (currently 9.6%). There have been no new buys or complete sales, but the existing portfolio positions have been rebalanced to trim some winners (trading at higher prices) and add more to attractive opportunities trading a bit lower (attractive). You can access the updated holdings in this report.

The S&P 500 Cloud-AI Bubble: Huge Pain Ahead!

Far more money has been lost waiting for the market to correct than in the actual corrections themselves. That is a paraphrase of Peter Lynch, and it’s likely a wise warning for investors in the current “cloud-AI bubble” led by a small handful of US mega-caps stocks. The warning cuts hard both ways, as many investors will likely face huge financial pain in days ahead. This report reviews the current state of the cloud-AI bubble, considers a secular market paradigm shift, discusses the huge financial pain many investors are about to inevitably face, considers a handful of S&P 500 risk metrics and then concludes with my strong opinion on how to defend yourself against the growing cloud-AI bubble.

BH20 Growth Stocks: Aggressive Longs → Now Aggressive Shorts

The rats are abandoning ship as the top performing AI and growth stocks this year are quickly becoming top short candidates (look out below!). Specifically, the hard selloff in speculative AI stocks (over the last 2 weeks—see table) is not something I am buying as the BH Sentiment Index has fallen sharply (Now 38 out of 100—Fear!)—and it’s not the type of fear I am buying. Previous top ranked growth stocks (e.g. IREN and Bloom Energy) are crashing.

10 Contrarian GARP Stocks to Buck the AI Bubble

If you are concerned about inappropriately high valuations for top growth stocks currently benefiting from recent AI hype (increasingly being described as an “AI bubble”), here are 10 top contrarian growth stocks with less ties to AI, but that still have healthy growth trajectories, much more reasonable valuations (e.g. low price/earnings to growth (PEG) ratios) and a lot of upside as per Wall Street analysts estimates. I currently own several of these names in my prudently concentrated/diversified, long-term, BH Disciplined Growth Portfolio. Enjoy!

BH20 Growth Stocks: Hyperscaler Spending Good Sign for AI "Picks-and-Shovels" Companies

There is a new #1 in town, as Bitcoin-turned-AI-HPC-cloud company, Iren (IREN), has been dethroned by this accelerating fuel cell provider for AI datacenters. Massive runway for fast-paced growth, especially if this market stays healthy—which it may with stong AI momentum signs from megacap hyperscalers this past week. So much concentrated data and compelling opportunities in this market if you know where to look (such as this report). Enjoy!

BH20 Growth Stocks: Massive Earnings Week Ahead

This upcoming week is the “Super Bowl” of earnings with 5 stocks (Meta, Microsoft, Alphabet, Amazon and Apple—commanding rougly 25% of the S&P 500’s total market cap) all announcing mid week. And with the market on eggshells lately (e.g. tariff concerns and arguably “frothy” valuations, especially for AI) this week could set the direction for stocks for weeks (perhaps until Nvidia announces on 11/19). What’s more, this week could slow the rapid price gains for the stocks listed in this week’s “BH20 Fast-Paced Growth Stocks" Ranking, or it could catapult these names even dramatically higher in a hurry. Enjoy the data—these stocks are special!

The Disciplined Growth Portfolio: More Wins, More Upside Ahead

High Income Portfolio: New Risks, New Opportunities

This report shares recent data on all 25 positions in the 9.8% aggregate yield “High Income Portfolio,” and highlights notable risks and investment opportunities as you manage your own income-focused portfolio. Notably, we’ve seen some share price movements (as the market continues to digest tariffs, interest rate dynamics and the ebbs and flows between value and growth) that are worth considering as you manage your own investments.

20 Top Stocks at Risk of AI Disruption

A lot of attention is given to stocks "benefiting" from AI, but there are also plenty of businesses that will suffer because of it. This report highlights 20 businesses that could suffer significantly because of AI (i.e. investment returns could be decreased, stocks could meaningfully underperform expectations, the market and leading AI competitors). Several of the names on this list were absolute "untouchable" powerhouses just a few years ago, but are now feeling the pressure from AI. Enjoy!

BH Weekly: Tariff Fear Creates Opportuniy

The market sold off hard on Friday after President Trump announced plans for a new 100% tariff on all Chinese imports starting November 1st. You likely remember how hard the market sold off in April when Trump first announced his “Liberation Day” tariffs (it was ugly), but then rebounded sharply demonstrating (yet again) that fear creates opportunity. This report tests out a new format for the Blue Harbinger Weekly and shares 4 top stock ideas for the week ahead.

Accelerating AI Momentum: Ranking The Mag 8 + 2

As the AI megatrend continues to accelerate, the Magnificent 8 (plus 2) continues to widen its lead (some more than others) and will thereby continue to benefit. Just this past week, for example, OpenAI unveiled "Sora 2," an advanced video generation model and a creation-first social feed (with API and Android integration planned). Also, Anthropic's "Claude Sonnet 4.5" (their most intelligent model yet) is now generally available on Google Vertex AI (enabling developers to build sophisticated applications). This all spells "more growth" and more need for chips, data centers and energy-efficient solutions. In a nutshell, more upside for AI ahead.

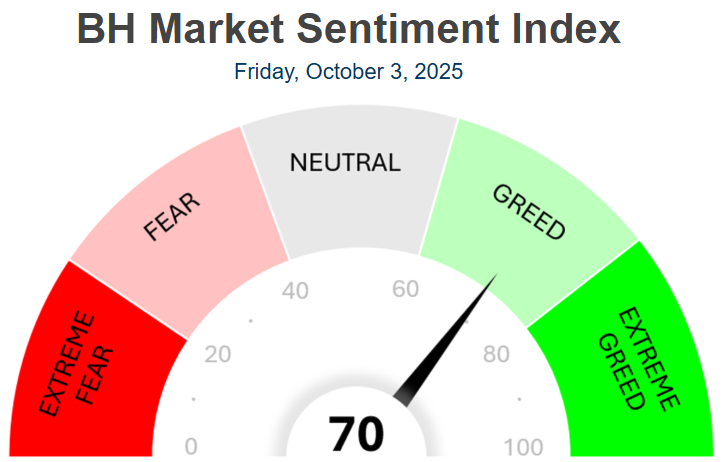

BH Market Sentiment Index

The market is shrugging off the government shutdown as the S&P 500 just hit a new all-time high, and all of this in the face of a slowing labor market, some persistent inflation and arguably high market valuations (which are attributable to large-cap growth and the AI megatrend in particular). And the 14-day Money Flow Index into the S&P 500 (SPY) increased to 63 from 62 over the last week, another indication of market strength. Treasury yields continue to normalize as the fed has been more dovish.

Overall, this is still a greedy bull market, with a 70 (out of 100) on the BH Market Sentiment Index.

Top 10 Quantum Stocks (Big Disruptive Potential)

Quantum computing (which uses qubits to perform complex calculations much faster than today's systems) has the potential to transform the world, but is still many years away from widespread commercial use. The industry is valued at $3.5B, but could hit $20.2B by 2030 (41.8% CAGR) as per a McKinsey study. As such, the stocks have massive upside, but also huge volatility risks; and investors may want to pick entry points discriminately at this nascent point. The group is coming off extreme momentum, and opportunities to add a few shares (to a more broadly-diversified, goal-focused portfolio) may become increasingly compelling. This is a high-risk, potentially very-high-reward space. Here are 10 stocks worth considering.

BH Market Sentiment Index

The market is shrugging off the government shutdown as the S&P 500 just hit a new all-time high, and all of this in the face of a slowing labor market, some persistent inflation and arguably high market valuations (which are attributable to large-cap growth and the AI megatrend in particular). However, the 14-day Money Flow Index into the S&P 500 declined from 71 to 63 over the last week, one indication of dwindling upward momentum. Treasury yields continue to normalize as the fed has been more dovish. Overall, this is still a greedy bull market, with an 80 (out of 100) on the BH Market Sentiment Index.

Top 10 AI Energy Stocks (Big Datacenter Upside)

AI is a megatrend, and the datacenters powering it need massive energy. This disruption will continue to create exceptional investment opportunities (ranging from nuclear energy to infrastructure and supporting technologies). This report ranks my top 10 AI energy stocks set to benefit from the megatrend, starting with #10 and counting down to my very top ideas. Enjoy!

Big Tech Slowdown: Top 10 "Next Phase" AI Stocks

Market styles can ebb and flow, but it’s still underlying fundamentals that ultimately drive business and economic growth. Big tech and the “Mag 7” have dominated in recent months (and years) and they are absolutely not going away. But, if you are looking for some non-mega-cap stock ideas, that will also benefit from the biggest secular trend (call it a mega-trend) in many years (i.e. the cloud and artificial intelligence), here are 10 top non-mega cap names (explained and ranked, with current attractive value propositions highlighted), especially as the megacaps may be about to give back a little, relatively speaking, in that ongoing “ebb and flow” cycle (as you can see in the chart below).

Top 10 Disruptive Growth Stocks (Members-Only Version)

On social media, the line is often blurred between attractive growth stocks and ugly (emotionally-charged) meme stocks. And when you throw in an overly-sensationalized dose of internet fear mongering and logic-defying greed, investors are often left in the lurch. In this report, I rank and countdown my top 10 disruptive growth stocks, including an attractive mix of blue-chip megatrend leaders as well as lesser-known up-and-coming market disruptors (carefully balancing current valuations against long-term potential, and thereby keeping emotions in check). Enjoy!

Top 10 Meme Stocks, Here's When the Bubble Bursts

If you haven’t been paying attention, you might not realize the market is up 20% (S&P500) since the depths of the Trump tariff turmoil 3 months ago. And select high-growth stocks (arguably “meme” stocks) are up dramatically more (see table below). Some media pundits are arguing we’re in a bubble, while others suggest “this time it’s different.” In this brief report, I argue my case for when this “bubble” will burst and how you might want to play it.