A lot of investors think Private Equity (“PE”) is some magical, uncorrelated, rich-person recipe for wealth. But in reality, it’s based on the same economy as public equities (i.e. stocks), the low correlation is largely a mirage (PE just provides less frequent/delayed valuations), the fees and expenses are higher, and the operational and opportunity costs (of inconvenient capital calls and lockup periods) are a royal pain.

PE Diversification Is A Mirage

For starters, here is a look at the relative performance of private equity “marks” versus publicly-traded private-equity firms. It appears the private market investments have completely missed the recent public equity markets selloff?…

…In reality, however, private equity investments are just valued less frequently, such as only once per quarter or once per year (as compared to public markets which are valued every single day the stock market is open—big difference!).

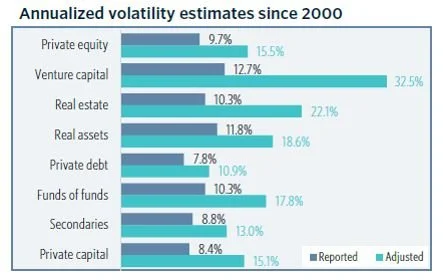

A lot of investors will get duped into the notion that private equity investments add important low-correlation diversification to their investment portfolio. But in reality, it’s all based on the same economy, and private equity investment valuations are declining too, they’re just not reflecting it in their prices yet. These less-frequent valuations create a false sense of lower volatility and diversification. Again, it’s all the same economy.

High Expenses

In addition to the false sense of low-volatility diversification, private equity investments are typically a lot more expensive. They charge MUCH higher fees than public markets, and this comes out of your bottom line as an investor. You can get really inexpensive exposure to public equities through ETFs and individual stocks charge virtually no additional fees.

Opportunity Costs

Further still, private equity investments come with big opportunity costs. For starters, there are lockup periods (typically a few years) and redemption delays (when you finally can sell it can take an entire calendar quarter (or more) to get your money back. Whereas with public market stocks, you can simply sell any day the market is open (and get your cash money back, to spend on anything you want, much quicker!).

Moreso, private equity funds have capital calls, whereby you, as the investor, agree to contribute capital whenever the fund calls you to do so. This is a pain in terms of time and because they often call capital right when you are ready to invest it in something else (or worse, you have to sell some of your perfectly good stocks to fund your private equity fund’s capital call—such a pain!).

The Bottom Line: Is private equity even worth it?

If it is your own private equity investment (say you own a profitable company that doesn’t trade publicly) then yes it can absolutely be worth it. But if it is an organized private equity fund—then it may only be worth it for the people running the fund (because they get to collect high fees every quarter—at your expense!—and just to give you a different flavor of exposure to the same overall economy).

Further, private equity investments lack liquidity, aren’t as uncorrelated as they are often touted, and they are a pain in terms of capital lockup periods and simply logistically dropping what you are doing to fund their capital calls.

At the end of the day, some organized private-equity fund investments are worth it. But in a lot of cases they are not (for the reasons described above).

Before you go subscribing to some private equity fund investment (because someone sold you on the idea that it’s a secret recipe for wealth available only to “rich” people) think long and hard about the risks (described above) and make sure it’s right for you and your personal situation.

Be smart, people!