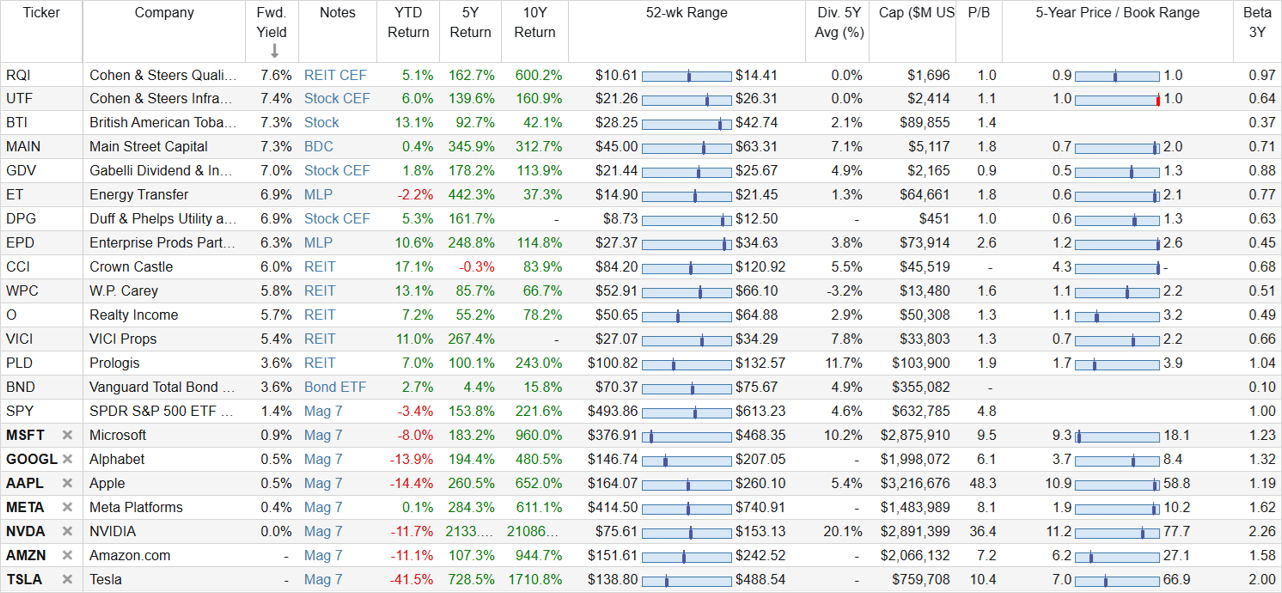

There are lots of yields over 10% to choose from (such as those in the table below), and some of them are actually worth considering (especially 2 of the top 3 specifically highlighted in this report). But how safe is it really to own such massive income-producing investments? (especially at this point in the market cycle). We’ll build up to that answer (in the conclusion) by reviewing three specific big yielders (one REIT, one BDC and one CEF). Enjoy!

For starters, hopefully the data table (above) is useful (we’ll refer back to it throughout this report). And before getting into the three specific big yield opportunities, let’s first consider the critical question…

Why Big Yield?

We get it. You’re at a stage in life where generating steady income from your investments is more important than suffering the slings and arrows of outrageous volatility (such as the amount we have yet again been experiencing in recent weeks—which may continue—and will absolutely rear its ugly head again at some point in the future). For example, check out the recent ugly performance of the “Magnificent 7” in our earlier table.

By focusing instead on steady big income payments, many investors sleep much better at night. Afterall, why sweat the dramatic short-term ups and downs, so long as those big steady income payments (often in excess of 10%) keep rolling in.

Is 10% Plus Really Safe?

But how save is a 10%+ yield? Really? Obviously, there must be some risks and tradeoffs for focusing on steady big income instead of volatile long-term price appreciation potential—right?

The conventional argument is for investors to focus on total returns (i.e. dividends, as if they were reinvested, plus price appreciation). But a lot of people are not reinvesting the dividends. Instead, they’re spending some of them to cover living expenses, retirement account RMDs (required minimum distributions) and simply because they don’t want to live and die (financially) by whatever lame-brained drama is coming out of Washington DC to roil the markets this week.

For many people, big-yield investing simply means addressing the needs of your own personal situation without being distracted by all the noise (and there is a lot of noise—from a lot of sources—impacting the market).

Just know, if you are investing in 10%+ yields, you may be sacrificing some long-term price appreciation potential—which may be perfectly fine, depending on your own unique situation.

So with that backdrop in mind, let’s get into it.

Real Estate Investment Trusts (REITs)

If you just threw up a bit in your mouth at the mention of REITs, you are not alone. The group as a whole has performed terribly over the last decade as interest rate volatility has been high (courtesy of increasingly emboldened monetary and fiscal policies following the tech bubble bursting, then the great financial crises, and more recently the pandemic bubble’s meteoric rise and then fall thanks to runaway inflation as rates bounced hard off an artificially low rate near 0.0%).

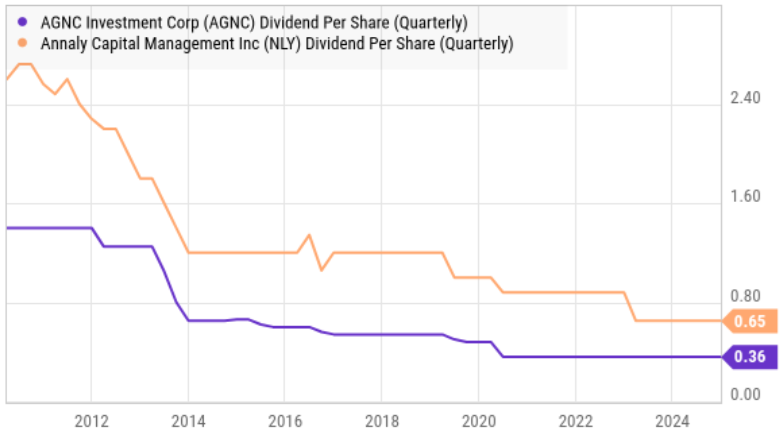

Further still, REITs have suffered as the economy has shifted to more work from home (less demand for office real estate) and shop online (less demand for shopping malls), to name a couple (dramatic impacts to mortgage rates also slammed mortgage REITs hard as their dependence on leverage and borrowing rates has roiled many of those businesses more than once—for example, see the negative 5-year dividend growth rates for mortgage REITs in our earlier table).

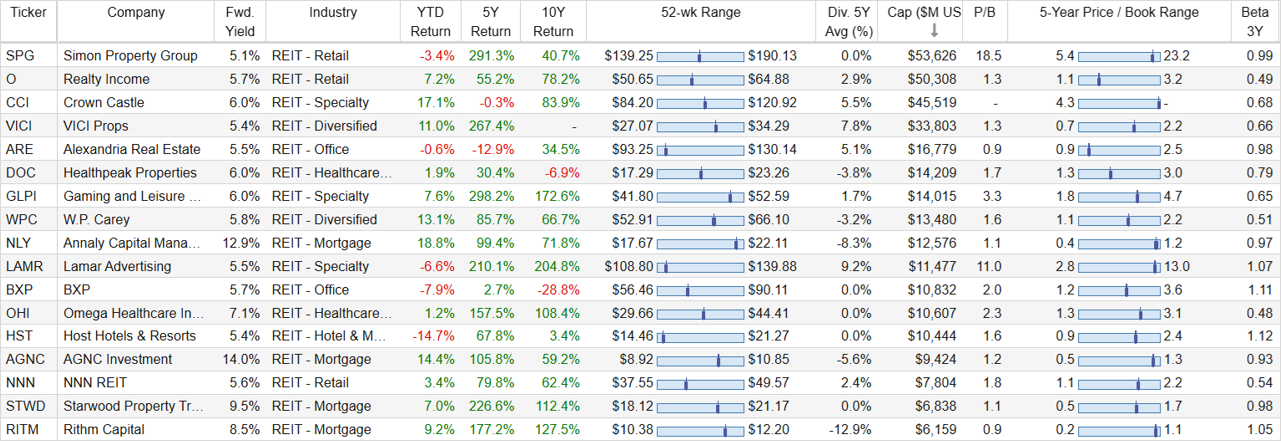

And here is a look at the recent performance (and current yields) of additional top REITs (organized by type). As you can see, the longer-term returns have lagged the market (as measured by the S&P 500), but some of them have managed to maintain the big steady dividend income payments (that help many investors sleep much better at night too).

And from this group of REITs, one very popular standout name is AGNC Investment Corp.

AGNC Investment Corp (AGNC)

Yield: 14.0%

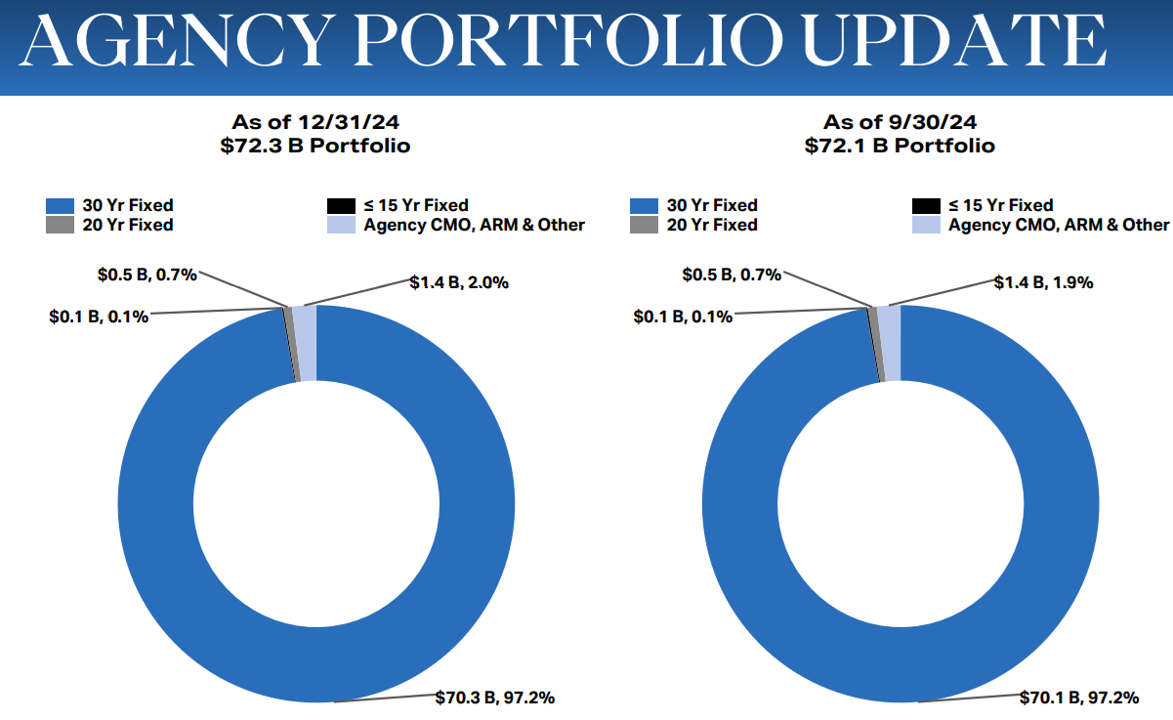

To be clear, mortgage REITs (such as AGNC) are very different than property REITs. Specifically, where property REITs own mainly physical real estate properties, mREITs own real estate securities (such as those issued by US federal government agencies to fund home ownership).

Mortgage REITs generally offer higher yields than property REITs, but they also come with unique risks (such as higher leverage, or borrowed money).

In the case of AGNC, this mortgage REIT invests mainly in Agency Mortgage Backed Securities, which are considered particularly safe (they’re guaranteed by US government-sponsored agencies). However, AGNC uses significant leverage (recently 7.2x) to magnify the otherwise low returns on these securities, which also magnifies the risks (particularly when interest rates get choppy or when credit spreads widen).

As you can see in our earlier tables, AGNC (and other mREITs offer attractive double-digit yields, but they also have a history of declining prices and dividend cuts over time.

So if you are going to invest in mREITs, be aware of the dividend and price dynamics (which are totally fine to some investors who just want the outsized dividends, despite the potential for declines over time), whereas others are turned off by the price declines and relatively lower long-term total returns.

A lot depends, or course, on market conditions and valuations (such as price-to-book values, as you can see in our earlier table, which are not currently at attractive sub-1.0x multiples, as they can be from time to time).

As such, you might consider less risky property REIT names, such as Realty Income (O), the monthly dividend company, which still offers a decent yield (just not double digit), trades at a compelling valuation (it’s a value stock/REIT) and has a very long history of actually increasing its dividend. But of course, it depends on your need for current income versus total returns.

One additional caveat with REITs, however, is that most of their dividends are not qualified (meaning they are taxed at your ordinary income tax rate, instead of the lower qualified rate—similar to the lower capital gains rate). So keep this in mind depending on how REITs compare to your other investments and whether you are owning them in your taxable investment account or a tax-advantaged retirement account. At the end of the day, its the after-tax take-home dividend income that matters more.

Business Development Companies (BDCs)

Another completely different category of big-yield investments are the BDCs. This group makes money by providing capital (mainly loans) to small (middle-market sized) business that pay higher rates on the loans (considerably higher than the 10-year treasury rate, for example) because they are riskier business. However, by building a group of these loans, across a diversified portfolio of small businesses, BDCs can reduce risks and thereby pass along high dividend yields to you—the investor.

Worth mentioning, BDCs also use a little bit of leverage (or borrowed money) to magnify the interest rate on the loans they make. For example, BDCs can borrow at relatively lower interest rates (because they are considered safer) than the companies they are lending to (at higher rates) because they are riskier. BDCs profit off the spread between these two rates (which is magnified by prudent leverage) and pocket the difference. Worth mentioning BDCs use a lot less leverage than mortgage REITs (discussed earlier).

Technically, BDCs are required to pay out the majority of their would-be net income as dividends (to investors) in order to avoid being taxed. This is an incentive created by congress to help small business industries, and it also benefits high-income-focused investors too.

You can see (in our earlier table) the recent performance and dividend yields currently offered by top BDCs.

Capital Southwest Capital (CSWC),

Yield: 11.4%

CSWC is a big-yield (double-digit) middle-market lending firm (it’s a BDC) focused on supporting the acquisition and growth of middle-market companies across the capital structure. Based in Dallas, Texas, and with only 33 employees, it is internally managed (this is important) and it has total balance sheet assets of around $1.8 billion.

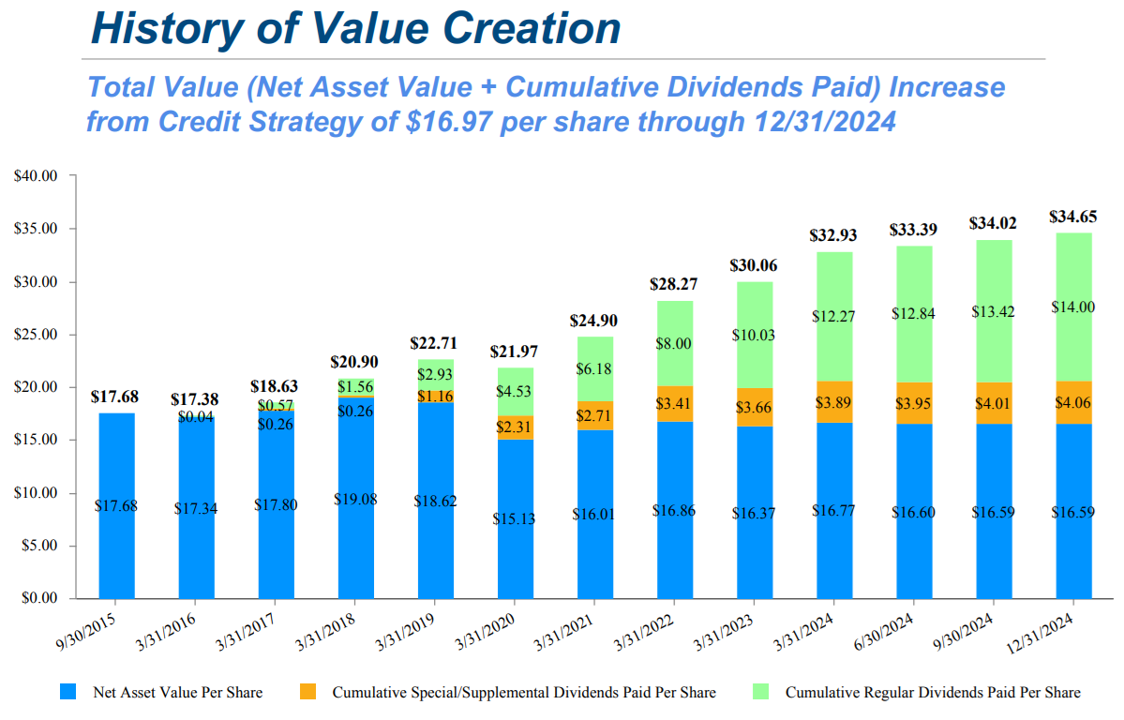

Importantly, Capital Southwest has a strong history of creating value for investors through both a healthy net asset value and strong, growing dividend payments.

CSWC also has an investment-grade credit rating (Baa3 from Moody's and BBB- from Fitch) which is better than the companies it lends to, but also a benefit of being a diversified BDC with a strong balance sheet (and loans heavily tilted towards first lien, safer, at 98%).

From a valuation standpoint, the shares are down over the last month (as investors react to net valuation write downs of $0.54 cents per share to the debt portfolio, as several of its 118 portfolio companies were moved to tier 3 and 4 ratings, despite steady new deal flow continuing), and the shares now trade at 1.4x net asset value (“NAV”), which is low by historical standards for this healthy internally-managed BDC (see historical book value (i.e. NAV) range in our earlier table).

If you have been waiting for a pullback in share price and price-to-book-value (“NAV”) for this healthy, long-term BDC, the recent market price declines provide you with some additional margin of safety.

Closed-End Funds (CEFs)

CEFs are another category of big-yield investments that can be particularly attractive to income-focused investors. They come in a wide variety of shapes and sizes (ranging from bond CEFs to stock CEFs, for example), and they offer the benefit of immediate diversification because they own a lot of individual investments (e.g. stocks and/or bonds).

CEFs also use leverage (or borrowed money) to magnify returns. This can be a very good thing, if done so prudently, but it also introduces risks, particularly when the stock or bond markets sell off. Notably, CEFs use a lot less leverage than mortgage REITs (they’re somewhat similar to BDCs in the leverage department).

CEF Expense Ratios: Some investors despise CEFs because they appear to have high expense ratios. But in many cases the very high rates can be worthwhile considering a huge portion of it is simply interest paid on the leverage, or borrowed money (plus, they get you access to a lot of “institutional securities” that you could not access on your own). For perspective, BDCs can have similarly large interest expenses, but its often hidden to investors because it is reported differently (as an operating / financing expense in the financial statements), so just know the high expense ratios on select BDCs can be completely acceptable—despite the initial sticker shock some investors may experience.

Afterall, every publicly traded stock (with any debt on its balance sheet) is leveraged too. It’s just that investors can view it very differently when it is broken out as an “expense ratio) on a CEF, for example.

You can see many of the top BDCs in our earlier table.

PIMCO Dynamic Income Opportunities Fund (PDO), Yield: 11.1%

When it comes to closed-end fund (“CEFs”), PIMCO is the premier industry leader, and its Dynamic Income Opportunities Fund stands out right now for big, steady, well-covered, monthly income and its reasonable price premium for a top PIMCO fund.

In addition to its very attractive monthly income payments, this fund also has risks investors should consider (such as leverage, expenses, price volatility, interest rate risks and the potential for ongoing returns of capital (as we recently wrote about in great detail here).

But at that end of the day, if you are looking for big steady income, PDO is absolutely worth considering.

The Current Market Environment

If you have been paying attention, the stock market has been very volatile over the last month (stocks are down significantly), and if you have been paying “too much” attention, you may be panicking and making bad investment decisions.

However, if you are focused on income-producing investments, that can help you sleep well at night—despite the never-ending flow of sensationalized news headlines which seem designed with nothing good in mind—yuck!

One way many investors are able to deal with the volatile news flow is to instead focus on investments that generate steady income (instead of worrying too much about share prices—which again, are down in recent weeks). And depending on where you are in your personal investment lifecycle, focusing more on income investing can become increasingly attractive.

The Bottom Line

Not all big yields are created equally. And depending on your own personal situation, some of them are actually worth considering (especially Capital Southwest, certain REITs and select PIMCO CEFs, as highlighted in this report).

Just understand that if you own big-yield investments—you may end up sacrificing significant long-term price appreciation potential (as offered by certain zero-dividend growth stocks), but you are also giving up some extreme volatility and sleepless nights (a good thing for many) as you focus mainly on the steady big income (instead of the short-term—often stressful—price volatility).

At the end of the day, you need to do what is right for you. Disciplined, goal-focused, long-term high-income investing continues to be a winning strategy.