If you like your investments to pay big monthly income, PIMCO is the bond fund industry leader, with lots of double-digit yields to choose from. This report compares data on 10 taxable PIMCO closed-end funds (CEFs), and explains why the Dynamic Income Opportunities Fund (PDO) is particularly attractive right now.

10 Big-Yield Funds Compared

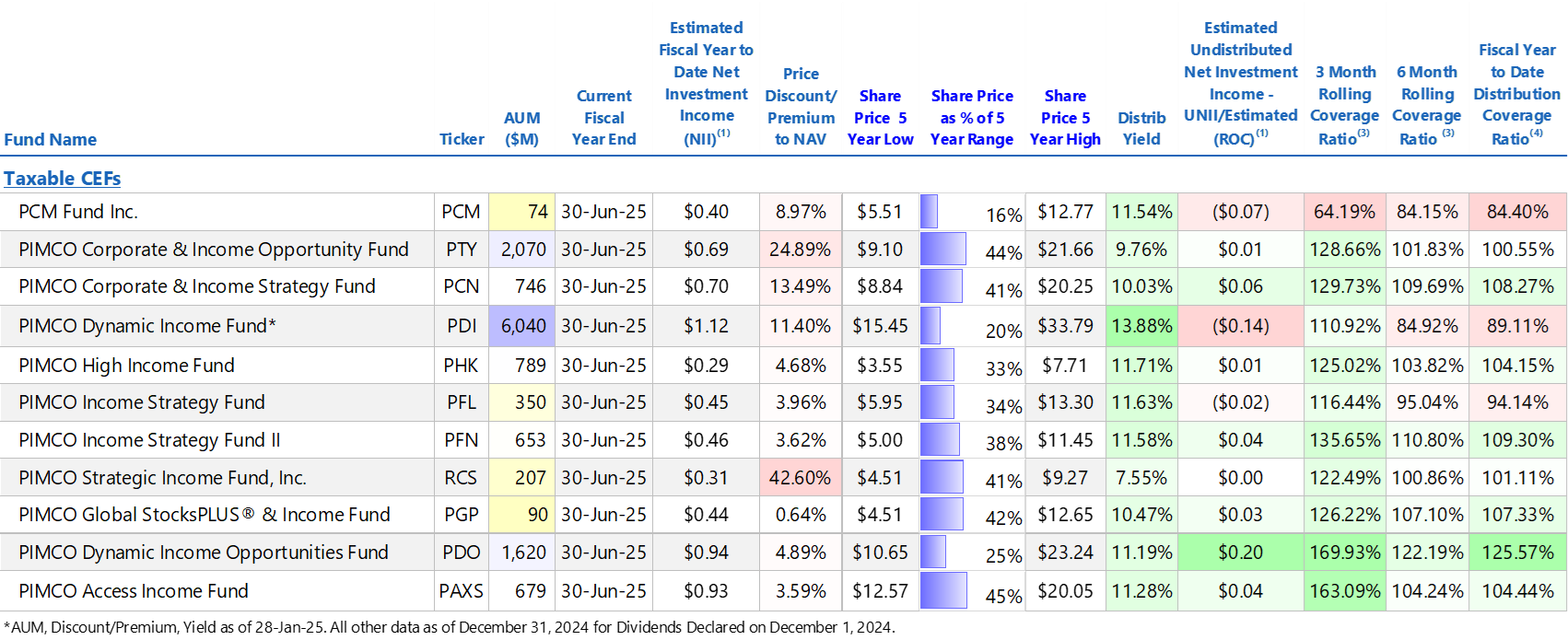

As you can see in the following table, PIMCO has an impressive roster of big yielders, all paying monthly (see the “Distribution Yield” column below). I’ll refer back to this table throughout the remainder of this report.

What is a Closed-End Fund?

A closed-end fund, or CEF, is a basket of investments that trade together as one unit. For example, the PIMCO bond funds in the table above include predominantly individual bonds (in some cases, thousands of them). So when you invest in a CEF, in some sense, you get some instant diversification.

Big Distribution Yields are a reason may investors choose CEFs. However, before investing, it is critically important to understand how these yields are sourced.

For starters, these are “distribution yields,” which means they are not purely bond coupon payments or stock dividends, or anything like that. Rather, fund distribution yields can be sourced from a combination of the above (dividends and coupon payments), along with capital gains (long and/or short-term) as well as a potential return of capital, or ROC, whereby the fund returns some of your original investment dollars just to maintain the big distribution.

How a fund sources its distribution is critically important for investors because sometimes a fund will sacrifice long-term price gains in exchange for steady current income (which is exactly what some investors want/need, and exactly what some investors want to avoid like the plague—know your personal goals!).

Premiums and Discounts are another critical factor for CEF investors to consider. Specifically, unlike traditional mutual funds, that trade at exactly their net asset value (or “NAV,” which is the aggregate value of all the underlying holdings), and unlike exchange traded funds (“ETFs”) that have mechanisms in place to keep the price close to the NAV, closed-end funds can trade at large premiums and discounts to their NAV in the market.

All else equal, I’d always prefer to buy a CEF at a discounted price (not a premium) because it’s like getting something on sale. However, as the industry leader, PIMCO funds often trade at large premiums (as you can see in the earlier table) as many investors are willing to pay up for PIMCO.

7 Big-Yield CEF Considerations

Before getting into more detail on the specific PIMCO funds in the earlier table, here are seven big-yield CEF questions to always ask yourself before investing.

Dynamic Income Opportunities (PDO):

If your primary objective is current income, PDO may be worth considering. Here is the fund’s objective:

“Seeks current income as a primary objective and capital appreciation as a secondary objective.”

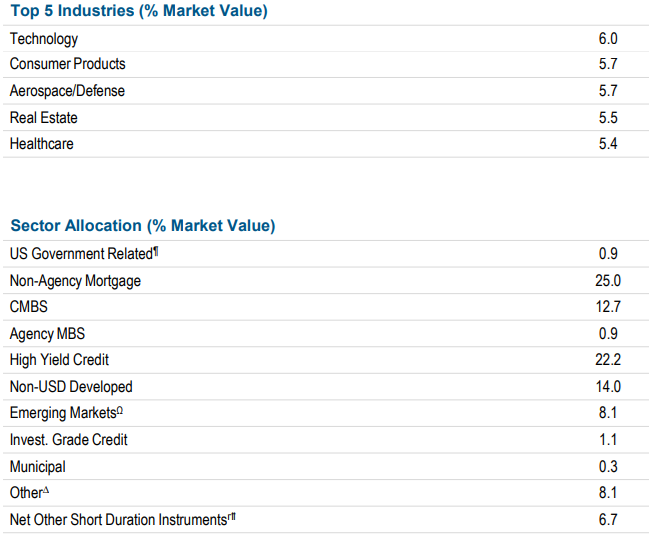

And you can get a feel for the types and industries this fund’s investments consist of in the tables below (i.e. a lot of non-agency mortgage bonds/securities and a lot of high-yield bonds/credit).

Distribution Safety:

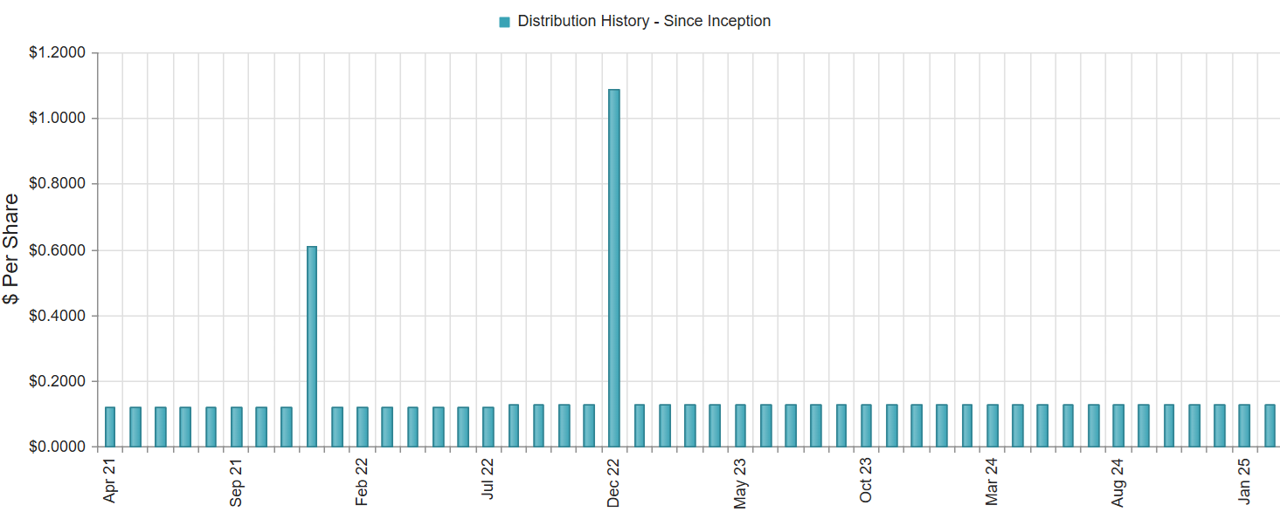

And here is a look at PDO’s distribution history (it’s been steady with a couple special dividends too):

And as you can see in our earlier table, PDO’s distribution is covered (by net investment income) better than all the other PIMCO funds in our table over the last 3 and 6-month periods (a very good thing in terms of stability, and the possibility for future special distributions too).

Leverage:

PDO recently used approximately 36.72% percent leverage (or borrowed money). Leverage can help magnify income and returns in the good times. But it can be a detractor and a risk factor when the market is going down. PDO’s leverage ratio is consistent with a lot of PIMCO bond funds, and the company has done well to maintain it over the years while delivering the steady income investors want.

Expenses:

Expenses are another key consideration, as they detract from performance. PDO’s management fee of 1.15% is reasonable for this type of strategy. However, the total expense ratio is a bit higher than it has been historically. The total expense ratio includes the interest expense for borrowing (leverage) and the borrowing rate has climbed in recent years as interest rates have gone back up.

Despite the interest expense (which is similar for other levered bond funds), PDO is worth considering for investment.

Management Team:

PIMCO is generally considered the best in the business, and as such, the hefty expense ratio and price premium are well worth it, in the minds of many investors as long as the fund keeps delivering those big monthly income payments (which is has—and appears positioned to continue per the well covered distributions as compared to net investment income).

PDO Versus Other PIMCO Funds:

PDO currently appears quite attractive as compared to other PIMCO funds, as per a variety of data.

Yield: PDO’s yield is large and healthy compared to its peers (well into double-digit yield territory).

Distribution Coverage: PDO’s distribution is well covered (more so than peers) as per the table above and our previous discussion.

Small Price Premium: The price premium on PDO is nearly the smallest among its peers, and attractive for a PIMCO fund.

Price Performance: in addition to the compelling yield, PDO’s price has been healthy compared to peers. As you can see in the table, it currently trades at a strong percentage of its 5-year price range. This is different than PDI, for example, which trades lower in the range—likely an indication of the stress placed on price by its higher distribution yield.

Risks:

Of course all of these funds face a variety of risk factors that should be considered.

Interest Rate Risk: PDO has a duration of 3.62 years (see our earlier graphic). This is a measure of interest rate risk, and it is reasonable. It means if rates rise, the price of PDO will fall. PDO’s duration is similar to other PIMCO bond funds.

Return of Capital is another risk. For example, the fund sent seven 19a notices to investors in 2024, such as this one (below) from September. The 19a notices convey what portion of the distribution is from “Paid-in Surplus or Other Capital Sources” which is basically a nice way of saying they’re paying out more in distributions than they’re taking in from coupon interest and capital gains, even though they haven’t yet officially recognized it as a taxable ROC (because they’re typically “hiding” it with interest rate derivatives which may or may not offset the “Paid-in Surplus” at some point down the road). It’s basically a risk.

Leverage is another risk. As mentioned, this funds use of borrowed money magnifies returns and income in the good times, but can cause larger losses in the bad times. PIMCO has a long history of prudently managing its leverage (currently 37.6%).

Price Volatility is another risk factor. This fund does hold high yield bonds, which can get volatile in times of market stress. However, recall this fund’s primary objective is current income (capital appreciation is secondary), and the fund has a strong history of delivering steady attractive current income (again, which is exactly what a lot of people want).

The Bottom Line

If you are looking for steady big income, PIMCO has a lot to chose from. At the current moment, PDO looks like a particularly attractive option versus its peers, considering its big, well-covered, distribution yield, and its growing long track record of success.

PDO also has risks (as mentioned in this article) that should be considered. However, if you are an income-focused investor, PDO is absolutely worth considering for a spot in your prudently-diversified, goal-focused, long-term investment portfolio.