So Artificial Intelligence (AI) darling of the world, Nvidia (NVDA), was down 17% on Monday following news that China startup, DeepSeek, had created an AI application “superior” to US leaders (e.g. OpenAI), and DeepSeek had accomplished this on only a tiny fraction of the budget. Specifically, DeepSeek doesn’t need all those expensive Nvidia chips that the rest of the world has been spending hundreds of billions of dollars on. Here are 5 lessons for Nvidia investors to keep in mind.

1 . Stay Prudently Concentrated:

Nvidia had grown to the largest stock in the world, with a market cap near $4 trillion, and comprising roughly 7% of the S&P 500. This is bigger than several of the 11 broad US market sectors (such as real estate, materials and utilities). It’s also bigger than many foreign country economies by a lot. And most importantly, these stats should give investors a big clue about how much Nvidia they should be holding.

Specifically, you should NOT have been holding much more than 7% Nvidia in your US stock market portfolio. If you are one of these Nvidia cheerleaders owning 20% to 30%, or more, of your investment portfolio in Nvidia—this sell off should be a wake up call. Unexpected “black swans” happen, and this is why we don’t put all our eggs in one basket—diversify prudently for goodness sake!

2. DeepSeek is GOOD for the economy.

Many people are panicking like the stock market is going to end because China has DeepSeek. To the contrary, it’s an indication that the economy can grow faster as AI gets less expensive (and becomes more of a commodity).

The lesson here is similar to the one above (diversify!), but expands upon it (i.e. invest in the overall economy because it continues to generate powerful growth!)

3. China is Dishonest

China has a long history of stealing US technology, and in the case of DeepSeek, China may be lying about the cost. Telsa CEO Elon Musk suggested online that DeepSeek probably has a lot more Nvidia chips than they are letting on. Specifically, even DeepSeek uses Nvidia chips, and probably a lot more than they are admitting.

4. The Semiconductor Industry (Nvidia) has always been volatile.

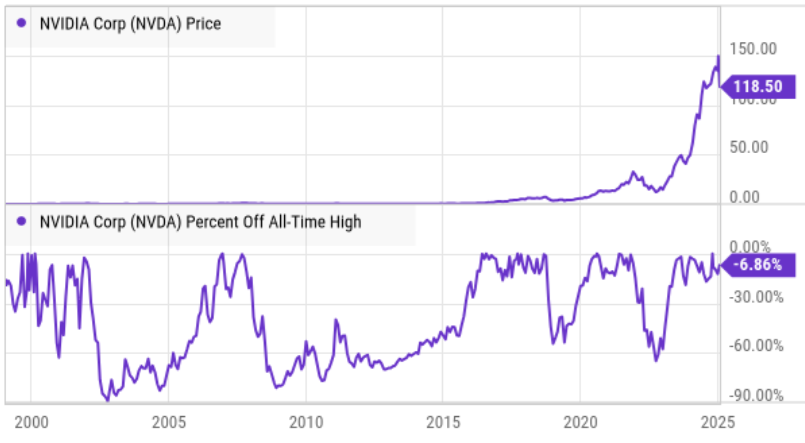

In case you don’t know, chip stocks (semiconductors) are notoriously volatile (and cyclical), and Nvidia’s 17% decline is small compared to its own history. Specifically, >60% declines for Nvidia have happened repeatedly throughout history.

So again, this volatility/cyclicality is why you should “never bet too much of the farm on one stock.”

5. A Golden Buying Opportunity

The AI megatrend is still just beginning, and today’s sell off creates a golden buying opportunity. For example, if you’ve been meaning to pick up a few shares of Nvidia, they’re now “on sale” versus last week (just don’t go overboard).

Furthermore, a lot of AI stocks sold off today, and this provides a golden buying opportunity to add a few shares at lower prices.

In particular, big AI innovators (Microsoft, Google), that also have unique data (to train AI models) will continue to benefit from the long-term AI megatrend. A few other companies (with unique data) that could now be even better positioned to benefit, include Salesforce (CRM), ServiceNow (NOW) and Adobe (ADBE).

The Bottom Line:

If you have more than 10% of your lifesaving in Nvidia, you deserve today’s pain for being too concentrated. You may be right in the long-run (i.e. Nvidia may continue to outperform), but you may be wrong too. Own multiple good stocks, and use prudent concentration levels.

It’s going to be fun to watch the AI drama play out in the market over the next few days, especially as we hit the heart of earnings season. But in the mid to long-term, AI is still a powerful megatrend, and this market is eventually going much higher.

Stay prudently concentrated and stay focused on the long-term—that’s where all the real money is made.