It’s going to get worse. That’s how many people feel about the current stock market selloff, and based on history—they could be right. But before going down the pointless rabbit hole of attempting to perfectly time the bottom, there is another way to invest. It’s called income investing. And in this report, I share 5 big-yield investment strategies (plus a handful of individual top ideas) that some investors may want to consider as a critical component of their long-term investment strategy.

The Market Has Been Ugly

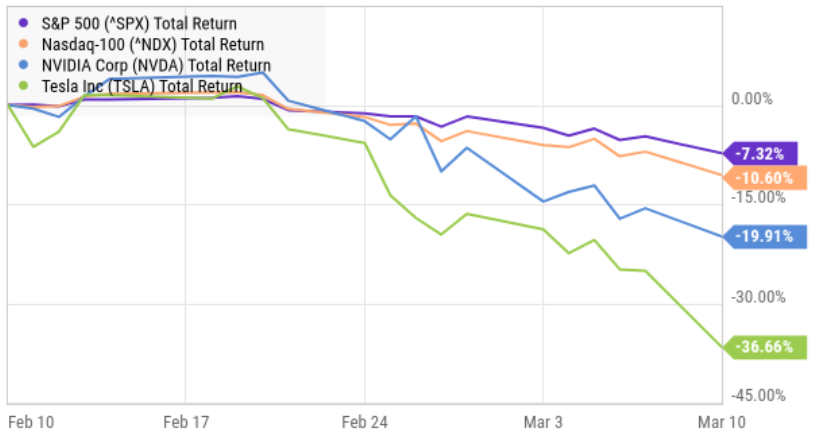

In case you haven’t been paying attention, here is a look at what has been happening to the major stock market indexes, and top growth stocks, over the last 1-month (i.e. it’s been ugly).

And as you can see above, the indexes are only down around 10%, which is small in comparison to some historical selloffs (which indicates to many that things can still get much worse).

And before we start playing the blame game for the selloff (e.g. Trump’s tariffs are a leading candidate in many investors’ minds), there is another way to invest. It’s called income investing, whereby you focus on owning investments that pay big steady income, thereby making price volatility less of a concern (i.e. as long as those big steady income payments keep rolling in—you’re good).

5 Big-Yield Income Strategies

Here are 5 big-yield income investment strategies (starting from lowest to highest yields) for you to consider.

1. Bond ETFs (3-5% yields):

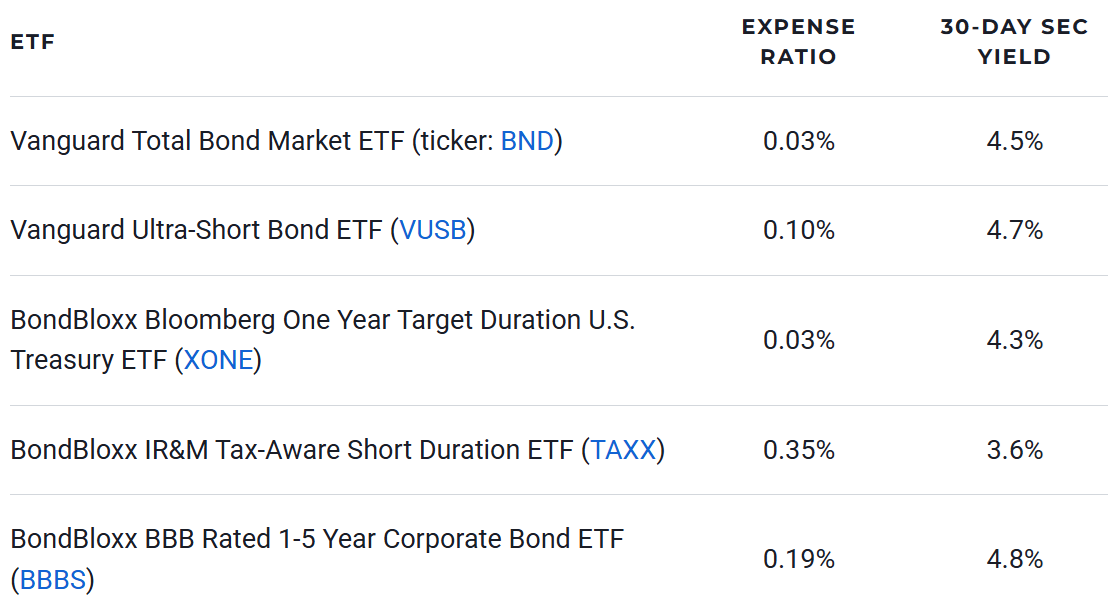

If you are looking to ditch volatile stocks and add some steady income to your investment portfolio, owning bond ETFs (exchange traded funds) is a quick way to do it. Bonds are less correlated with stocks, typically less volatile and pay steady income. Here is a quick list of several of the biggest, lowest costs and most popular bond ETFs, sorted by yield (many pay monthly).

These bond ETFs can provide important, steady, income payments and be a great lower-volatility diversifier with stocks (just also know that bond ETF prices can move significantly if the fed gets aggressive with interest rates changes; for example when rates rise, bond prices fall, and vice-versa). Nonetheless, the steady income persists.

2. Individual Bonds (3-6% yields):

To manage the bond price volatility of bond ETFs, some investors choose to own individual bonds, whereby they can simply collect the steady interest payments, but also hold them to maturity at which time they know how much principal they will also get paid (e.g. a “bond ladder”). This can be a great way to avoid the price volatility challenges of bond ETFs, but it also involves a little more active management (you have to buy another bond every time one matures). You online broker likely has a tool where you can screen for bonds you like (based on credit rating, current yield and more).

3. Dividend Stock ETFs (3.5% yield)

To generate steady income, and to reduce the extreme volatility of high-growth stocks, some investors prefer to own a diversified basket of dividend-value stocks instead (through ETFs, such as the popular Schwab U.S. Dividend Equity ETF (SCHD)). This way they get steady dividend income, coupled with some price appreciation, and less price volatility to boot. Arguably, you may give up a little long-term price appreciation with such an ETF strategy (because you omit all the zero-dividend high-growth stocks), but depending on where you are in life—this could be absolutely perfect addition to you personal portfolio.

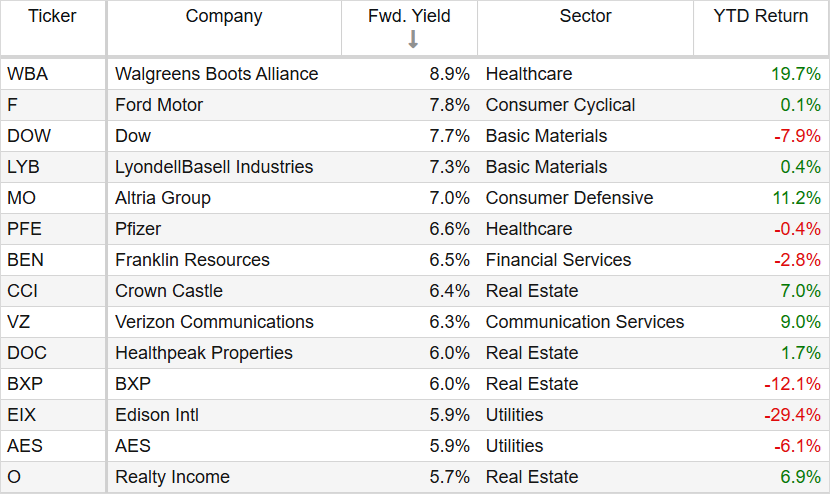

4. Individual Qualified Dividend Stocks (5-8% yields):

Rather than going the dividend ETF route (such as SCHD above) some investors prefer to own individual high-dividend value stocks. Not only do they pay steady income, and provide some lower volatility price-appreciation potential, but many of them pay qualified dividends, which can be taxed at a lower rate (depending on your tax bracket, and if you own them in a taxable account). A few popular qualified dividend stocks (from the S&P 500) include Dow (DOW), LyondellBasell (LYB) and Altria Group (MO).

Just be aware that Real Estate Investment Trust (“REIT”) dividends (such as the popular Realty Income (O)) are typically NOT qualified.

5. Monster Yields: (8-10%+ yields):

Finally, we have the monster yield category, which can include Business Development Companies (“BDCs”) like Capital Southwest (CSWC) Closed-End Funds (“CEFs”) like PIMCO Dynamic Income (PDI) and Master Limited Partnership (“MLPs”) like Energy Transfer (ET). This category can often yield in excess of 8% to 10%, as you can see in the table below.

Just understand that this group comes with its own risks, such as lower (and possibly negative) long-term price returns, non-qualified dividends and potential tax issues if you own MLPs in an IRA.

The Bottom Line:

The stock market has been terrible this year, and things could still get a lot worse. However, rather than focusing on stock prices and trying to perfectly time the bottom (which is a fool’s errand), some investors prefer to focus on owning things that pay big steady income (such as the examples reviewed in this report).

At the end of the day, you need to do what is right for you, based on your own individual situation. Disciplined, goal-focused, long-term investing continues to be a winning strategy.