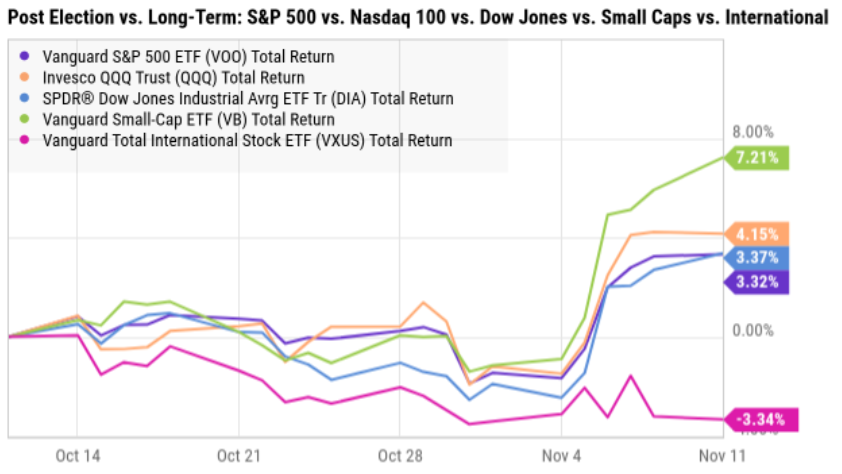

It’s been a big week for geopolitics and for the stock market (some sectors more than others). In this note, we review the performance of various stock market styles (eg. Small Caps, International, Large-Cap Tech and more), and then share some insights as to whether your personal investment portfolio is positioned corectly for what is coming next. For starters, here is a look at how various stock categories have performed since the election (obviously some big changes)…

Perhaps most obvious in the chart above, international stocks have perfomed worst (some argue this is because the incoming president-elect has a strong US-bias), and small-cap stocks have performed best (some will also argue this is an indication that the new administration will implement pro-business policies more likely to benefit small-company stocks more than the large-cap S&P 500).

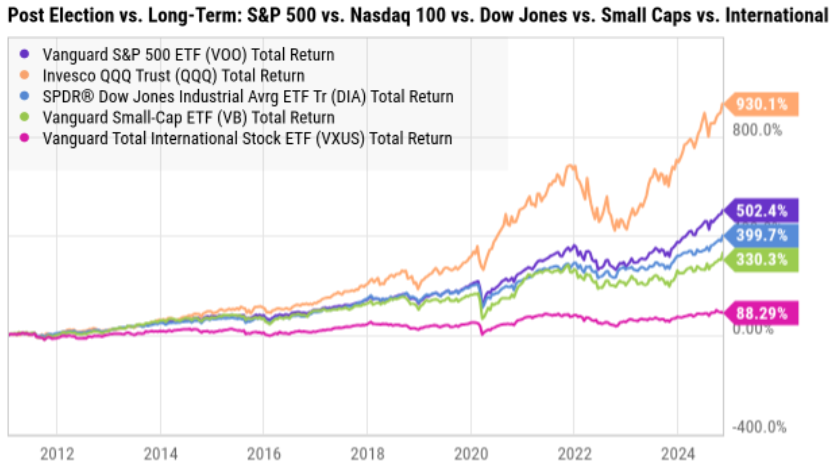

But before drawing any near term conclusions, let’s take a look at the longer-term performance of this same group (see chart below), which tells a somewhat different story (e.g. international stocks have still been weak, and large-cap tech, as measured by the Nasdaq 100, has been clearly dominant).

Risk Management Matters

You may be saying to yourself, who cares about the performance of these broad market indexes, tell me more about individual stocks. But the reality is, you may have some pretty alarming holes (and risks) in your aggregate investment portfolio if you are not paying attention to your investment allocations (such as small cap versus large cap, and international versus US).

For example, if you’ve been buying more “value stocks, such as the Dow Jones Industrials average (which has more of a slight value tilt than other indexes) you have missed out on a lot of returns over the last decade (relatively speaking).

Similarly, if you have been drinking the “target date fund” kool-aid, you have had big exposure to international stocks over the last decade which has hurt your overall relative returns pretty badly.

How to Build a Diversified Investment Portfolio

The truth is, if you are making big bets (in terms of small cap or large cap, or US versus international, for example), you are exposing yourself to risks that can (and likely will) dramatically overshadow your individual stock (or fund) picking skills.

Rather, staying fairly diversified across investment styles, and then making smaller bets with your individual stock picking skills can lead to better results (in terms of actual performance and your psychological health).

So What Is Coming Next?

The market hates uncertainty, and with the 2024 presidential election seemingly behind us, a lot of uncertainty has been removed (and stocks have performed well since the election, as a result).

US. Stocks: The incoming administration has an “America First” mentality, but the reality is a strong US economy will be good for the rest of the world (including international stocks, which have underperformed for years (see our earlier chart) and may be due for a rebound).

Inflation: Given the incoming administration’s strong focus on spurring economic growth, it seems inflation is likely to remain (perhaps on a level a bit higher than long-term averages of around 2.5% to 3.0%). This means owning assets (like stocks) is a good way to avoid getting left behind by the economy (i.e. sitting in too much cash is probably a bad long-term idea).

Small Caps: Small company stocks have underperformed the market over the last decade, and this is not normal. Over previous long periods, small caps tend to outperform large caps (albeit with more volatility). However, given the strong performance reaction we’ve seen since the election, there may be more big gains for small caps ahead. Said differently, small caps still seem undervalued and the recent small gains for small caps (relative to the rest of the market) may be just the beginning (i.e. small caps may continue to perform very well from here).

Big Tech: Large cap technology and growth companies (such as the magnificent 7) are not going to just die following the election. To the contrary, these are dominant business and a critical part of the US (and global) economy. Don’t expect large cap growth stocks to just crash as the new administration steps in. Rather, these business are are attractive and they are going to keep growing.

The Bottom Line

The market has reacted positively now that the election appears to be behind us. And the incoming administration will be extremely focused on strengthening the economy (perhaps with a little extra inflation as the side affect).

The solution is to own stocks (to help you stay ahead of inflation), and to own stocks across styles (such as large/small, US/international and growth/value). Picking attractive individual stocks remains a critical component of a prudent goal-focused investment strategy, but you can inadvertently overshadow your stock picking if you’re not paying attention to your broad portfolios styles and biases.

Small bets (on styles and individual stocks) are good. And over the long-term, this market is going higher. Don’t make unnecessary risk management mistakes, and don’t miss out on the gains.

Buy good stocks. Construct a prudently diversified portfolio, and enjoy the power of a growing economy and long-term stock market appreciation.