The Schwab US Dividend Equity ETF (SCHD) is about to create a lot of stock market winners. In this report, we review five reasons why it is a superior strategy for many investors right now (including its volatility characteristics, current market conditions, dividend flows, tax advantages and clear practicality benefits), plus one critical risk factor investors need to consider. We conclude with our strong opinion investing.

Schwab US Dividend Equity ETF (SCHD), Yield: 3.5%

SCHD invests in high dividend-yield stocks. Specifically, it is a passive Exchage Traded Fund (“ETF”) designed to track the Dow Jones US Dividend 100 index. This index focuses on stocks with a record of consistently paying dividends, selected for fundamental strength relative to their peers, based on financial ratios. Here is a look at the fund’s recent top 10 holdings and percentage weights as per the fund fact sheet (many of which you probably recognize).

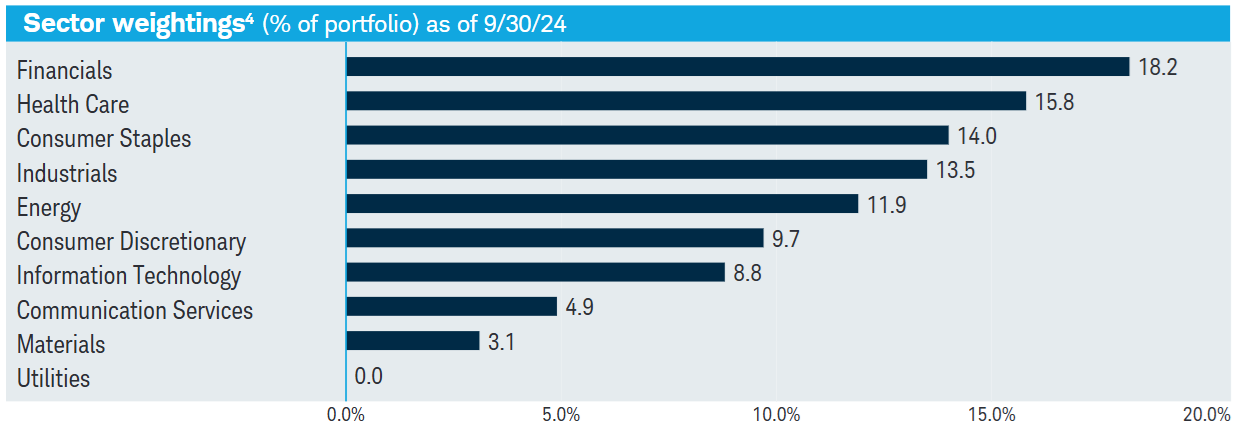

And for more perspective, here is a look at the fund’s sector weights (we will refer back to this later in this report).

Attractive SCHD Characteristics:

SCHD is a very large ($63 billion in assets) and popular (25th largest) ETF. And here are five reasons why it is a superior strategy for so many investors right now.

1. Low Beta, Low Volatility

If you are at a point in life where you have already built up a significant nest egg, swinging for the fences (with high-growth, high-volatility stocks) may not make a lot of sense for you. SCHD can help you take some volatility and beta risk off the table.

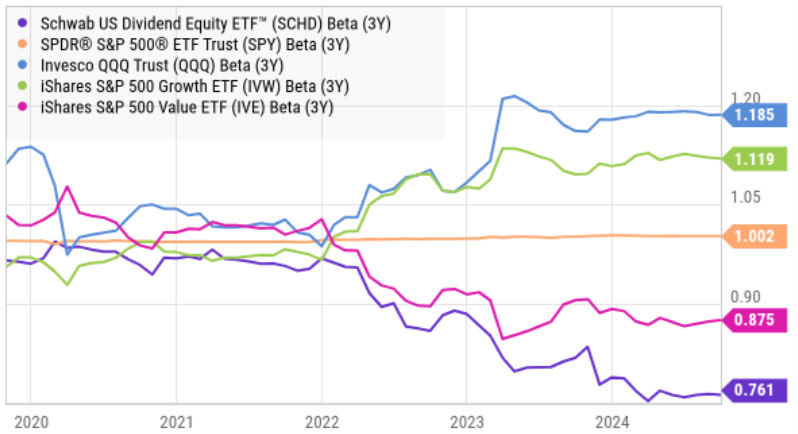

For example, here is a look at SCHD’s 3-year beta risk, as compared to other popular ETFs. As you can see, SCHD has a lower beta than the benchamark S&P 500 Index (SPY). It also has lower beta than the tech-heavy Nasdaq 100 (QQQ), and less than the S&P 500 Growth (IVW) and S&P 500 Value (IVE) ETFs too.

Beta is basically a statistical metric comparing a stock (or ETF) return with the market's return (such as the S&P 500) over a certain period of time (such as 3-yeas in the chart above). Stocks with beta above one are generally considered more volatile and risky, while stocks with a beta below one are less so.

For further perspective, here is a look at SCHD’s decline versus these other indexes when the market sold off following the relatively-recent “pandemic bubble.” As you can see, SCHD provided more stability and less downside risk than other popular ETFs (not to mention it kept paying a bigger dividend too).

Also important to note, SCHD has provided strong gains, but still performed worse than the overall market (in terms of total returns: price gains plus dividends as if they were reinvested) in recent years, as you can see below.

SCHD did provide strong positive gains (with less volatility and a higher dividend yield) during this period, but it’s relative underperformance may be about to change (we discuss why in the next section).

2. Attractive “Contrarian Value” Opportunity

In addition to the big dividend yield and lower volatility, SCHD is also tilted towards value stocks (and away from growth stocks), a characteristic that may bode well for its relative performance ahead.

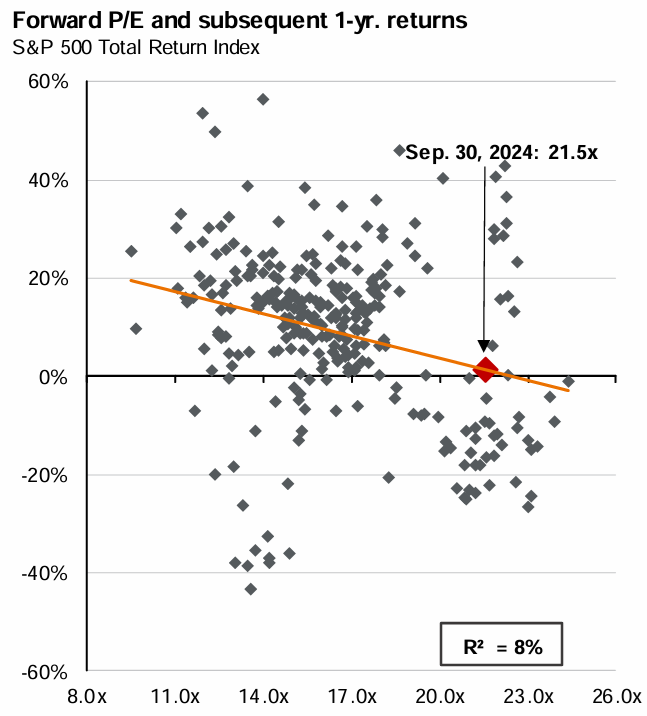

Specifically, value stocks look particularly attractive right now on a valuation basis, as you can see in this next chart.

In fact, considering how strong growth stocks have been performing (relative to value, as we saw in our earlier chart), the entire market looks a bit expensive, and value stocks (particularly those that pay big steady dividends, like SCHD) can be a great place to be invested if/when the market get choppy.

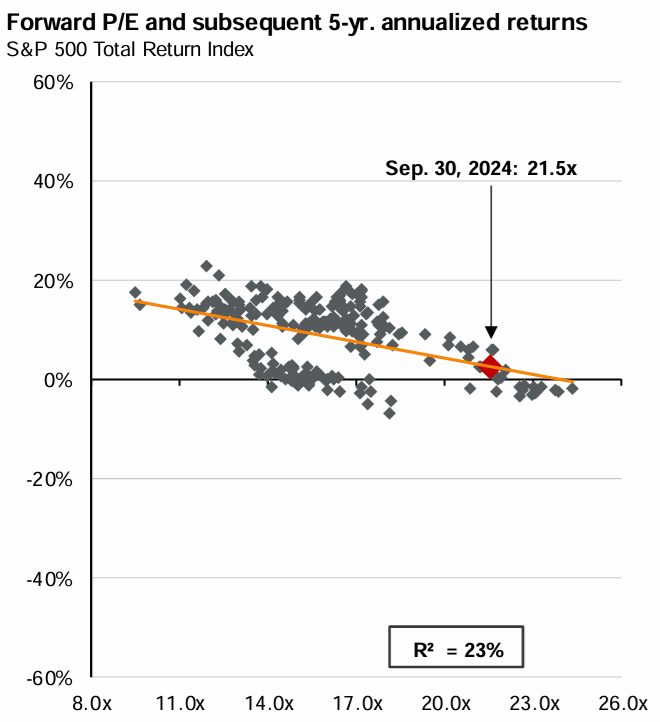

For example, you can see the subsequent one-year returns (above) and five-year returns (below) the last time the market was this expensive (another indication that the tide may turn on growth in favor of value like SCHD).

More broadly speaking, SCHD’s strong-value, high-dividend, high-quality, low-momentum strategy appears an increasingly compelling contrarian opportunity based on current market conditions.

3. Steady Dividend Income

Steady high-dividend income is another attractive characteristic of SCHD, especially for some investors in particular. For example, if you are counting on your nest egg to provide cash flow to meet your spending needs, SCHD can help you avoid the ugly situation of being forced to sell shares (for cash) after a market decline.

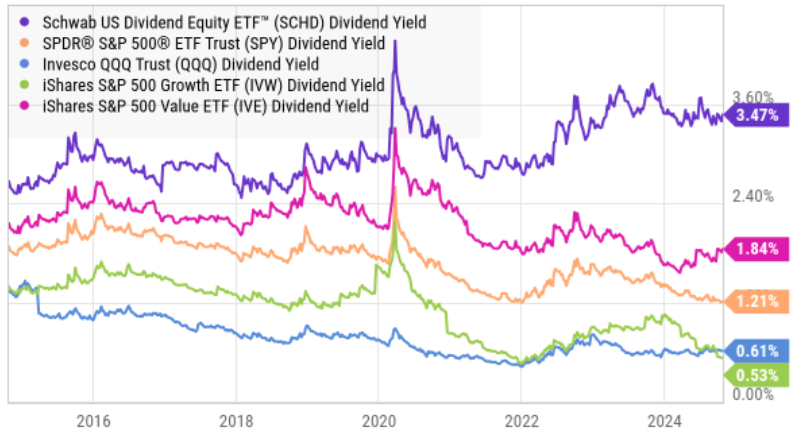

Rather, steady (higher) dividend income (see above) can make market declines signficantly less painful (because it’s a lot easier to spend a 3.5% dividend yield (“SCHD”) than a 0.6% dividend yield (“QQQ”).

4. Tax Advantages

Another attractive SCHD characteristic is that it offers “potential tax-efficiency,” as it is focused on qualified dividends (i.e. they’re eligible for the lower qualified-dividend tax rate, instead of your ordinary income tax rate). This is different than other income-focused strategies, such as business development companies or “BDCs,” where distributions are often taxed at your ordinary income tax rate, and real estate investment trusts, or “REITs” (which are excluded from SCHD) where dividends are also often taxed at your ordinary income tax rate.

Also, the type of account your own SCHD in makes a difference. Here is how Schwab explains it in its prospectus:

“Unless you are investing through an IRA, 401(k) or other tax-advantaged account, your fund distributions generally have tax consequences.

Each fund’s net investment income and short-term capital gains are distributed as dividends and will be taxable as ordinary income or

qualified dividend income.

Be sure to consider your personal tax situation and consult with a qualified tax-professional before investing.

5. Practicality Benefits

SCHD also offers several “practical” benefits that should not be overlooked.

Low Fees: For starters, SCHD has a low expense ratio of 0.06%, annually. This is significantly better than many other ETF strategies, and any money you save on expenses flows through to your bottom line.

Instant Diversification: It is a lot easier to invest in SCHD (i.e. a diversified portfolio of dividend stocks) than to try to pick individual dividend stocks (which can take a lot of time, cause frustration and may be more prone to error).

Psychological Benefits: Owning SCHD can also help investors avoid psychological mistakes. For example, individual stocks can be a lot more volatile than a diversified portfolio like SCHD, and by owning the SCHD portfolio many investors reduce the chances of overreacting to the short-term volatility of anyone stock. Additionally, owning the portfolio can provide the discipline to avoid psychological mistakes like “trying to time the market” (which almost always leads to worse performance over the long term).

The Big Risk:

The biggest risk for SCHD investors is simply that it may not be the right strategy for your own personal situation. For example, if you are a younger investor with a very long investment horizon, you simply may not “need” the dividend income at this time, and you may be in a better position to handle higher volatility investments (higher volatility than SCHD) and the higher long-term returns that can come with it.

For example, SCHD is a “mega-trend-light” strategy. This means it is underweight the market sectors that are focused more heavily on low-dividend innovation, such as the artificial intelligence and cloud opportunities in the information technology sector (SCHD is underweigt tech stocks as compared to the broader market as measured by the S&P 500). However, given the relative strength of growth and technology (which some believe are getting frothy, as demonstrated with the valuation metrics earlier in this report), SCHD may be just what the doctor is ordering.

Also realize, for some investors, SCHD is still too risky and volatile. For example, if you have a large enough nest egg, you may be comfortable owning 100% bonds (no stocks, such as SCHD) because the current yield on bonds (which is relatively quite low) may be more than adequate to cover your individual needs and help you sleep better at night. Every investor’s personal situation is different.

The Bottom Line:

SCHD continues to be a long-term winner, and the rate at which those wins compound may be about to accelerate. While some investors point to SCHD’s lower returns relative to the broader S&P 500 in recent years (see our earlier chart), others happily note SCHD has still delivered strong positive gains, and with less stress-causing volatility.

Furthermore, considering the extent to which growth stocks are increasingly “frothy” (from a valuation standpoint), value-focused opportunities, such as SCHD, become increasingly compelling from a contrarian standpoint, especially considering the outsized dividend-yield helps many people sleep better at night.

Disiciplined, goal-focused, long-term investing continues to be a winning strategy.