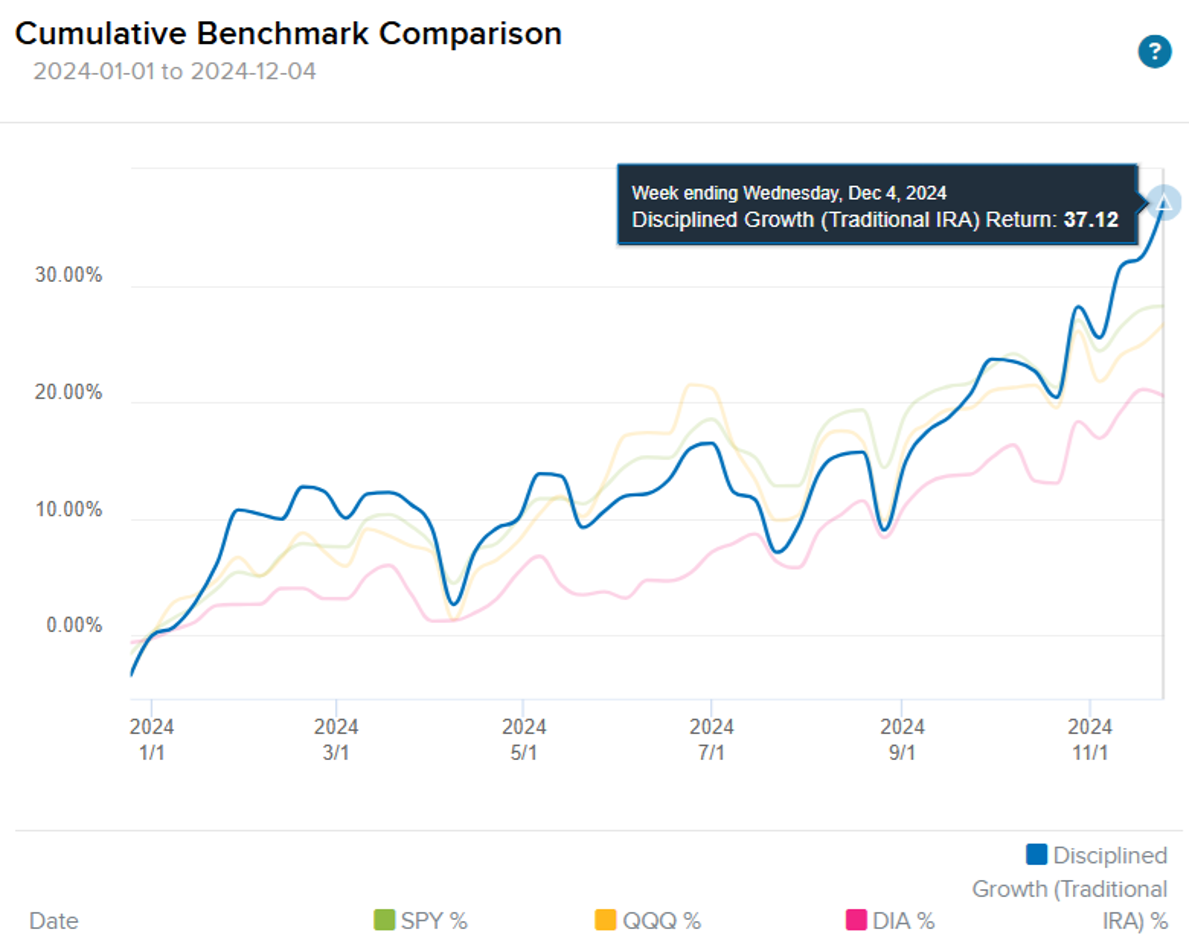

The Top 10 Growth Stocks tear sheet has been updated for December, and so has the complete Disciplined Growth Portfolio. As a reminder, these are NOT “swinging for the fences” types of strategies (although the Disciplined Growth Portfolio is up nearly 40% this year). Rather, they are disciplined, long-term, real money strategies, and they are beating the living pants off “Vanguard Target Date funds.”

For starters, here is the link to the updated Top 10 Growth Stocks and The Disciplined Growth portfolio:

Top Idea and Portfolio Updates:

As you can see, there are two new names in the Top 10 and one complete sale in the Disciplined Growth Portfolio. However, critically important are the portfolio weights (see the “Port Wgt” column) to get an idea of where and how we are allocating our dollars. And also notice the color key (light red and light green are decreased or increased position sizes, while dark red and dark green are complete sales and new buys, respectively).

Also, the "ratings” (e.g. “buy,” “strong buy,” “hold,” “review,” etc.) are based on the monthly “buy under prices” and update in real time (up to a 15 minute lag) based on the market price.

Performance:

The Disciplined Growth Portfolio is intended simply to give you ideas in managing you own portfolio (it is NOT advice), and it is “disciplined” in the sense that it is diversified across sectors and market caps (i.e. this is not a “swinging for the fences” strategy, it’s a disciplined long-term growth strategy.

And it is outperforming all the major benchmarks this year (S&P 500, Nasdaq 100 and Dow Jones) thereby adding to its long-term compound growth. Noteworthy, this is performance “after fees” (I charge a fee on this strategy to be fair to other portfolios I manage that also have to pay fees).

It’s also beating Vanguard Target Date Funds, which typically have significant allocations to non-US stocks and bonds (which tend to not perform as well over time, bonds especially). For example, the Vanguard 2030 Target date fund is up only about 13.5% so far this year.

Nonetheless, you always need to do what is right for you, based on your own individual situation.

More Data:

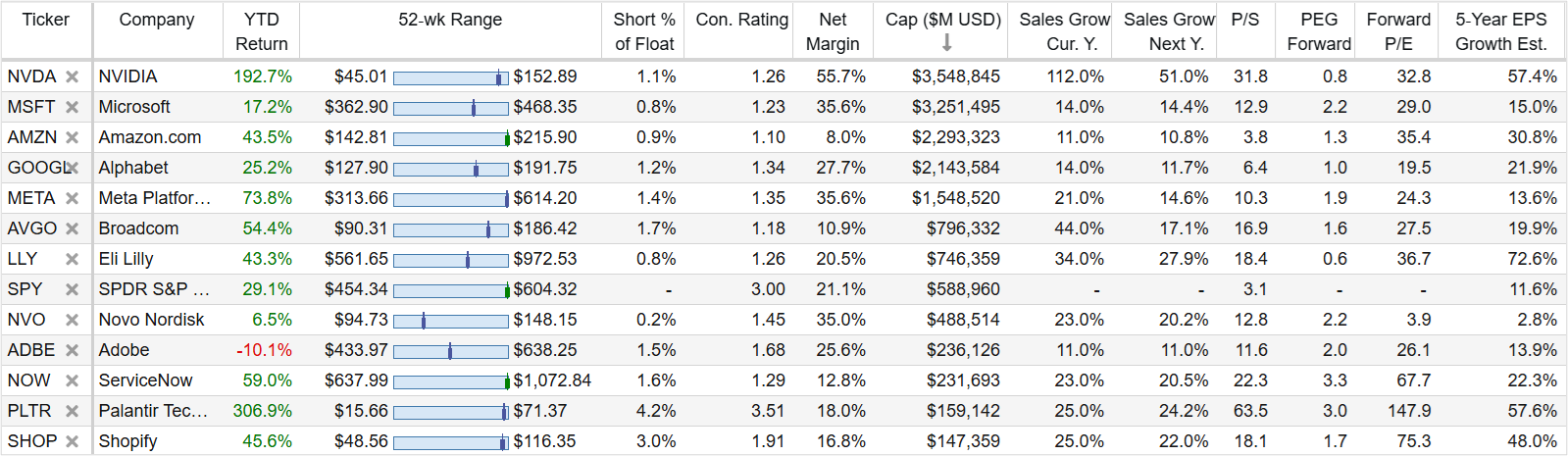

For reference, here is some additional data on the Top 10 Growth Stocks (as well as a few more that are on our watch list). There are a variety of metrics that you may find useful and worth considering as you manage your own investments.

Bottom Line:

At the end of the day, disciplined, goal-focused, long-term investing continues to be a winning strategy. Nothing in this note is advice. You need to do what is right for you.