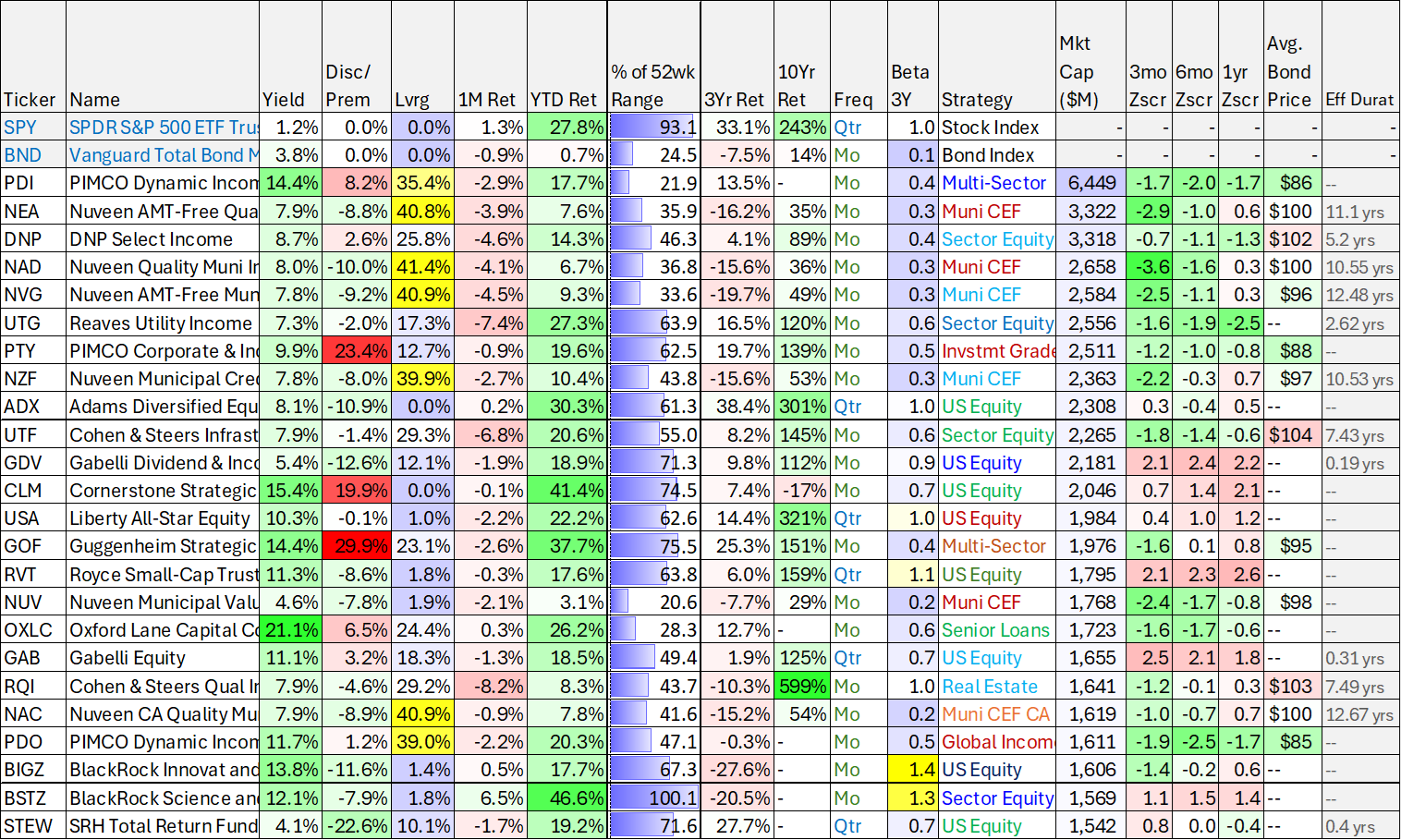

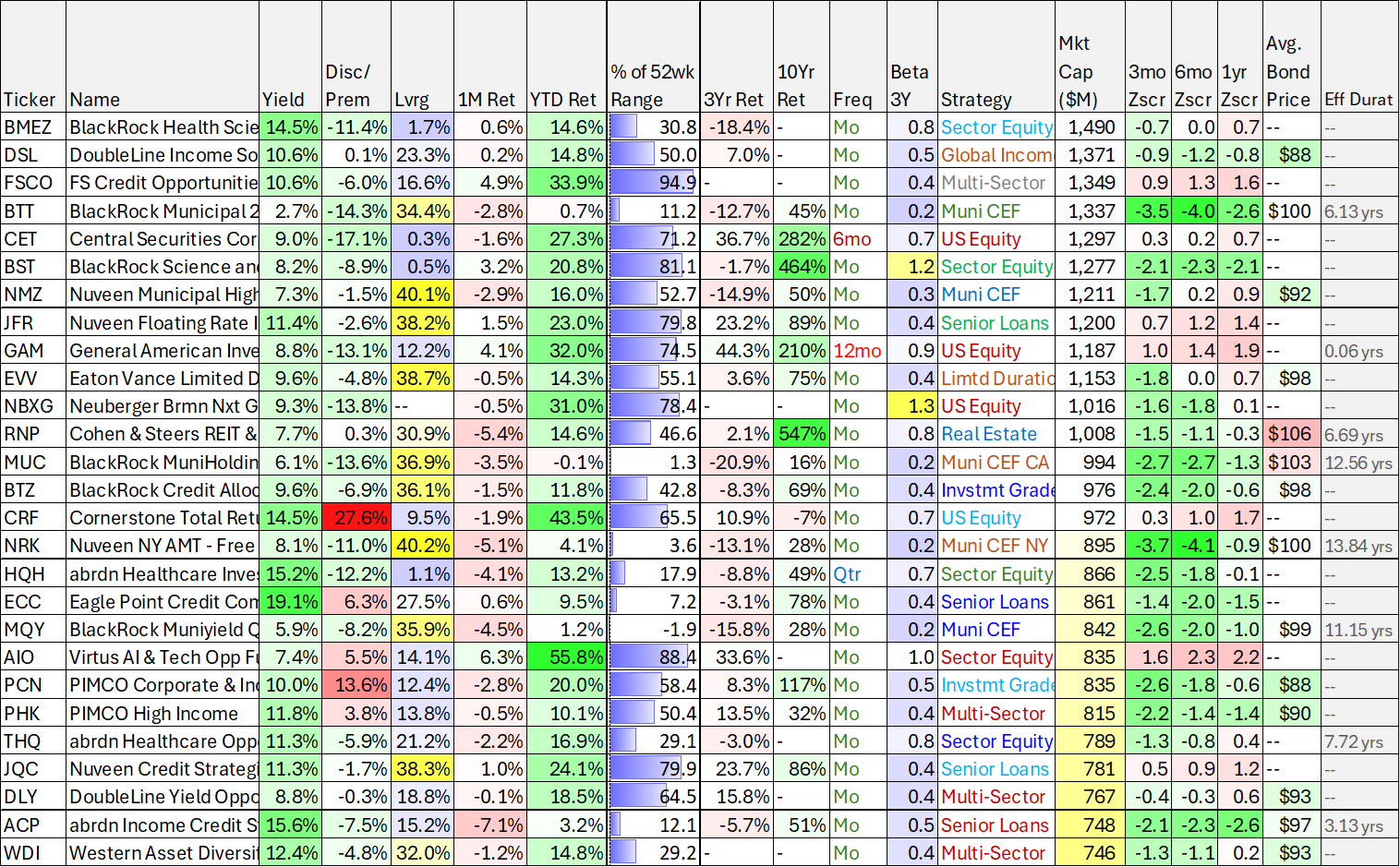

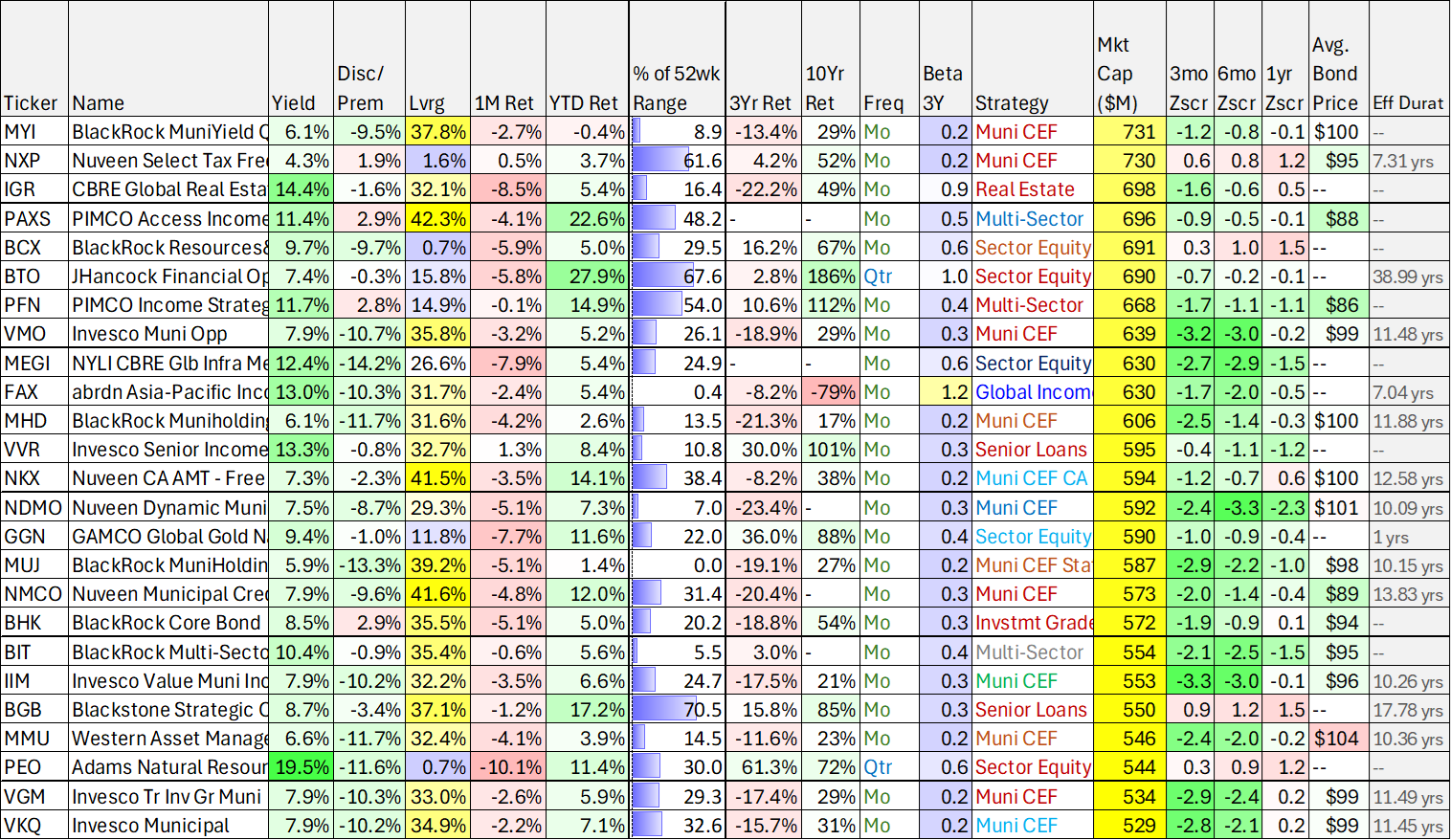

Happy Holidays and Merry Christmas! Here is a look at big-yield CEF data for over 75 top funds. As you can see, the premiums have come down on several popular big-yield bond funds (attractive). Further still, municipal bond funds continue to be attractive, selectively.

PIMCO Bond Funds

In particular, the premiums on popular big-yield PIMCO bond funds has come down (attractive), especially as the fed reduces the pace of rate cut expectations. In particular, we currently own PAXS, PDO and PDI in our Blue Harbinger High Income NOW Portfolio, and all three remain attractive (although, PDO and PAXS are our favorites).

Also worth mentioning, BlackRock offers attractive big-yield bond funds to diversify away some of your PIMCO exposure (PIMCO has risks, largely from higher leverage and legacy unrecognized return of capital—from a taxation basis anyway). For BlackRock, we like BTZ and BTI (prices have gotten increasingly attractive).

Muni Bond Funds

If you are in a higher tax bracket, and have a lot of money in a taxable account, municipal bond funds remain compelling for their safety and persistently discounted prices (attractive). We like NEA and NAD from Nuveen.

More Big-Yield CEF Ideas

We also continue to like The Adams Diversified Equity Fund (ADX) for its diversified, high-distribution, exposure to the equity markets (more long-term total return potential). ADX recently increased its distribution policy (from 6% to 8% annually, and that’s the minimum—it’s usually higher).

We’ve also written recently about the attractiveness of diversified lower-volatility holdings exposure of the DNP Select Income Fund, which continue to trade at an attractive small premium (+2.6%).

Bottom Line:

Overall, if you are looking for big-yield opportunities, a lot of CEFs just got more attractive (discounts widened / premiums shrunk as the fed reduced its level of “dovishness” on interest rates).

Be sure to know your goals (e.g. high steady income) and be sure to be diversified (risk reduction) and think long-term. The market continues to offer select attractive big-yield opportunities.