With the turn of every new year, stock market pundits love to look at what performed best and worst last year, as if that magically gives them some hidden wisdom about what will perform the best in the year ahead.

And while momentum and contrarian investment philosophies may both have some merit, a better bet is always to invest in businesses that are fundamentally promising in the years ahead, and also trading at reasonable valuations.

Of course there are correct and incorrect valuation metrics, depending on the type of company you are considering (one size does NOT fit all when it comes to valuing companies).

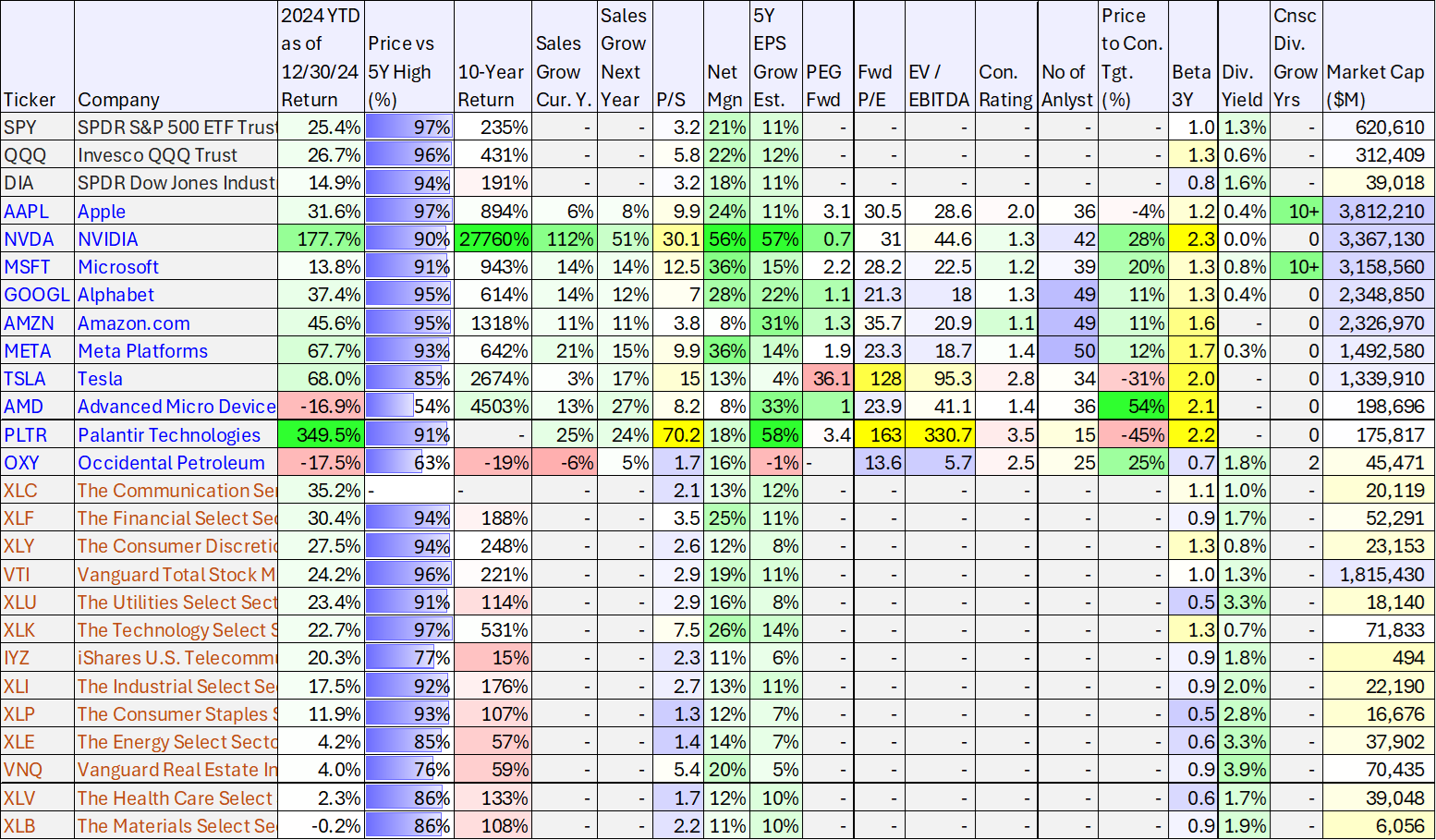

(data as of 12/30/2024, source: StockRover)

In the report, we take a closer look at “4 Good Stocks,” all of which appear extremely promising in the year (and years) ahead, assuming of course you are a patient investor looking to make a lot of money.

Let’s get into it…

1. Alphabet (Google) (GOOGL):

Of the 49 Wall Street analysts covering this stock, “Strong Buy” is the average rating. And while these analyst believe the shares have only 10.4% upside (as compared to their average price target), the reality is these shares have MUCH more price appreciation potential over the long term (and that is despite all the naysayers and negativity surrounding the company).

Let’s start with the negative things about Google, just to get it out of the way (before diving into more detail on what makes it special and why the shares have so much long-term price appreciation potential).

Misnomer #1: It seems the general market perception is that Google is behind the curve in terms of AI (artificial intelligence), and “ChatGPT” (and other burgeoning AI search capabilities) are going to completely dethrone Google.

In reality, Google is not that far behind the trend on this massive, early-inning, secular trend, and the company will likely come out ahead considering its massive existing network across Google search, youtube, Google Cloud, Android, and more (not to mention the company’s enormous cash flow and financial resources). For example, in December Google released its Gemini 2.0 LLM (large language model / AI), as well as “Project Mariner” and “Jules,” two AI applications that assist users with browser navigation and fixing errors in computer code.

Misnomer #2: A lot of investors also believe recent antitrust concerns will paralyze Google going forward (i.e. a lot of regulators around the globe have expressed concerns around Google’s dominance in search). In reality, it seems unlikely anyone will replace Google considering its leadership position and technological prowess combined with financial resources. Said differently, the concerns just create a “buy low” opportunity.

How to value Google: Considering the company’s relatively new dividend, it seems likely Google will become an impressive “dividend growth stock” in the years ahead, much like Apple and Microsoft—two megacaps that have increased their dividends steadily for over a decade and thereby command a higher valuation multiple (such as P/E ratio) in the market (i.e. a lot of investors are willing to pay up for the steadiness and financial strength of the company).

For example, as you can see in our earlier table, Google has room for multiple expansion in the P/E department versus Microsoft and Apple, and we expect this to happen in the years ahead. Additionally, Google still has profound growth potential, as shown in its impressive PEG ratio (price/earnings to growth) which currently sits at an impressive 1.1x.

The market is undervaluing Google on its current growth, and underestimating Google’s potential for multiple expansion (the company deserves to trade at a higher valuation multiple as it becomes an increasingly proven dividend growth stock).

Overall, Google is a fundamentally attractive business, trading at an attractive valuation. And in the years ahead it is poised to continue outperforming the market.

2. Occidental Petroleum (OXY):

To play “devil’s advocate,” why on earth would anyone invest in a petroleum company? Occidental is an integrated oil and gas company (i.e. they drill for it, transport it and refine it), and a lot of people think oil and gas is about to go the way of the dodo bird (i.e. go extinct) because of alternative energy sources (electric vehicles, nuclear). In reality, oil and gas will continue to be a critically important (and massive) part of the economy for many decades, and Occidental is well positioned to benefit.

For starters, Occidental has a best-in-class position in the Permian Basin (the cheapest production source (shale) in the US, located in West Texas) and is expected to be a major driver of growth in the years ahead.

The company also has more conventional assets in the Gulf of Mexico and the Middle East, which provide nice diversification to its shale operations in the US (and potentially much longer and steadier production lives).

Further still, energy provides some outstanding diversification versus the rest of the economy because of its steadier demand. Also, oil prices have not been particularly strong, something a lot of investors view as attractively contrarian.

Worth mentioning, Mr. Warren Buffett’s Berkshire Hathaway has been steadily building a large position in Occidental shares, at significantly higher prices than now (the shares are down again), and Buffett is known for his very wise, long-term, fundamental investments.

From a valuation standpoint, Occidental trades at only 13x forward earnings, and only 5.2x EV/EBITDA, both impressive versus its own history and the rest of the market. And despite a significant debt load, Occidental has a track record of generating strong free cash flow to reduce debt, pay dividends, repurchase shares and/or reinvest in the business.

Overall, Occidental Petroleum shares are a compelling contrarian value play at this point in the cycle, and they are absolutely worth considering for investment.

3. Vanguard Total Market ETF (VTI):

You may be wondering why anyone would include an ETF (exchanged-traded fund) in a “4 good stocks” list. But this particular low-cost Vanguard Total (US) Market Index Fund (VTI) is truly special for a lot of reasons.

For starters, it is a GREAT place to park your money if you are a long-term investor. Specifically, you don’t have to worry about anyone nickel-and-diming you to death on fees and expenses (this one charges only 0.03% for expenses each year), and it gives you instant diversification and exposure to the entire US stock market without ever having to worry what to buy or sell.

*(the market has been averaging close to a 10% annual return for the last 10 years, and closer to 9% for the last 80+ years).

VTI basically just holds everything, approximately 3,600 US stocks, and in percentage weights similar to their market cap. So mega cap names like Nvidia and Microsoft make up relatively large percentages (recently over 5% each), and you also get exposure to the entire small cap portion of the market (over 2,000 small cap stocks that many contrarians believe are increasingly due for a strong relative rebound).

Worth mentioning here, one of the main reasons a lot of investors cannot outperform a market index like VTI is because they take big risks with their stock picking that they are not even aware of. For example, a lot of people held shares of Nvidia in 2024 (the stock was up over 170%), but they held only 2-3% of their assets in Nvidia when the index holds over 5%... this one-stock underweight alone caused a lot of individuals’ performance to lag the market index in 2024.

And just like not holding enough Nvidia in 2024 caused many investors to underperform, not having enough small caps could cause investors to underperform in 2025 and beyond. VTI solves this problem with a healthy allocation (~15%) to small cap stocks (potentially, a very important piece of the overall market performance pie).

So if you do like to buy individual stocks, but you’re not inclined to follow 25-30+ individual stocks (a number that could potentially give you enough risk-reducing and prudent diversification); holding only 5 or 6 individual stocks in combination with a big allocation weight to VTI could be the right answer for you, your long-term returns, and your pocket book.

4. Advanced Micro Devices (AMD):

AMD is currently 53% undervalued according to the 36 Wall Street analysts covering it, and this cutting edge semiconductor company has much more long-term upside thanks to the massive digital revolution (and in particular, the AI megatrend that needs semiconductor chips to even operate).

In a nutshell, the reason AMD shares have been weak is because AMD is NOT Nvidia (NVDA). Nvidia is the industry leader in semiconductors and has posted incredible growth in recent quarters and years. However, given the massive size of the digital revolution, there is room for more than one winner, and AMD’s business has actually been doing quite well and growing (despite its share price weakness).

For example, AMD has gained market share from Intel in the PC CPU market in recent years. Plus, AMD’s partnership with semiconductor chip manufacturing leader Taiwan Semiconductor has allowed the company to deliver increasingly compelling products, faster.

From a valuation standpoint, AMD is very impressive with a forward PEG ratio (price/earnings to growth) of only 1.0x, and a 5-year EPS growth estimate of 32.9% (impressive!). And despite the 26.9% expected revenue growth, the shares were down roughly 17% in 2024 (thereby making it a very compelling long-term buying opportunity).

Conclusion:

There are a lot of stocks out there to choose from, and a lot of short-term stock price volatility to deal with. And compounding the short-term investment “challenges,” there are also a lot of cheerleaders and fearmongers pushing certain stocks in the short term (and by sheer chance, a handful of them get it right and look smart).

But the reality is, no one knows where the market is going in the short term. But over the long-term it is likely going much higher (don’t bet against the long-term economic and financial growth of the US and of the world), and by owning fundamentally attractive business at attractive valuations you can reap the benefits of the overall market’s gains, plus additional benefits from the outperformance (and lack of psychological mistakes) of your picks versus the market.