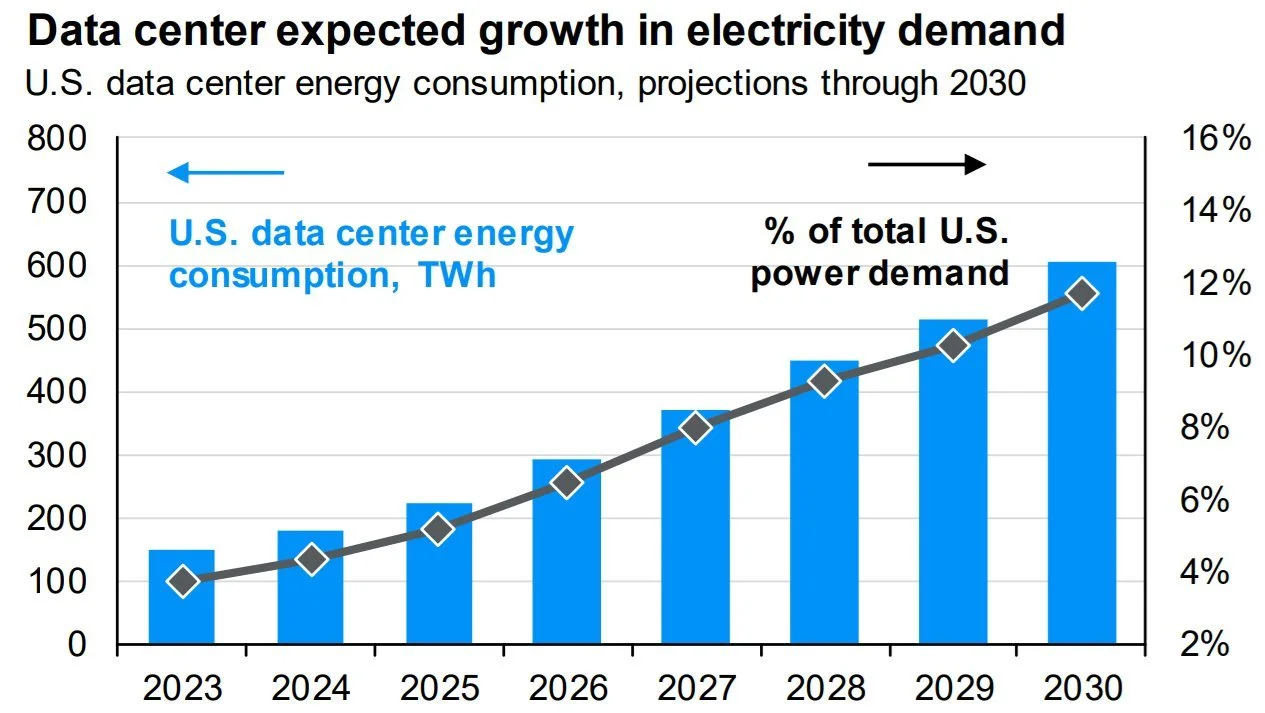

If you read any stock market news whatsoever, you’ve likely heard about the incredible growth in Artificial Intelligence (AI). But instead of investing only in the chip stocks (Nvidia) and hyperscalers (Meta, Google, Amazon), you might also consider investing in the utilities companies that will be supplying the incredible energy demands of new data center AI technologies. Here is an overview of 7 highly-rated utilities stocks that are set to benefit dramatically.

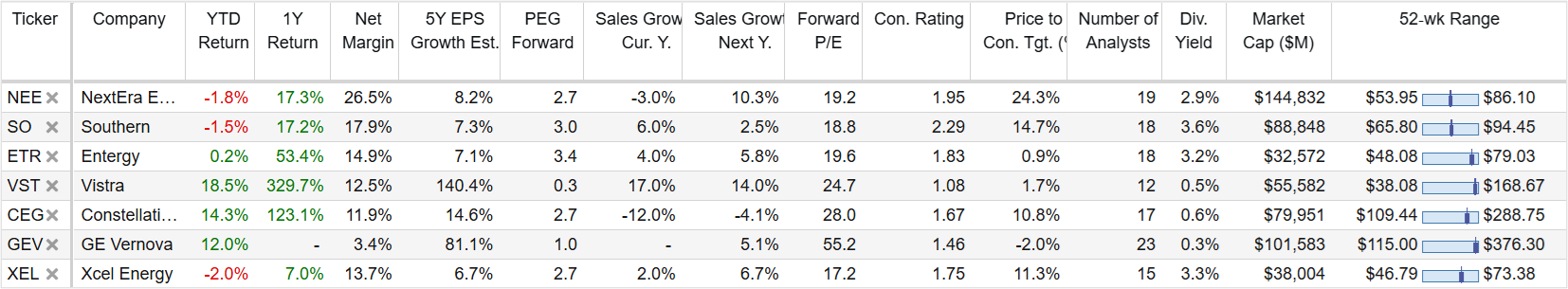

Before getting into the overview on the names, you’ll notice in the table, they’re all highly-rated by Wall Street (1=strong buy, 5=strong sell), and the expected 5-year EPS grow estimate is enormous for a couple of them.

So with that backdrop in mind, let’s consider the individual names:

Constellation Energy (CEG): This company is noted for being the largest nuclear operator in the U.S., which positions it well for the growing demand for carbon-free power in data centers. It has been highlighted for its potential in the AI-driven market, with analysts giving it favorable ratings.

Vistra Corp (VST): Vistra has seen significant stock price increases due to its natural gas and nuclear power facilities, which are ideal for meeting the scalability and reliability needs of data centers. It has been identified as one of the top performers in the utility sector due to the AI data center boom.

NextEra Energy (NEE): Known for its renewable energy segment, NextEra is uniquely positioned for handling AI data load and has available interconnection queues, making it a strong contender in the utility sector for data center growth.

Southern Company (SO): Southern Co. is expected to benefit from data center growth through strategic investments in generation capacity. It's highlighted as a regulated utility ready to serve the increasing demand from data centers.

Xcel Energy (XEL): Xcel is another regulated utility with exposure to power generation needs supporting data center expansion, particularly in regions like the Midwest ISO.

GE Vernova (GEV): As a spinoff from General Electric focused on energy, GE Vernova is set to capitalize on the demand for gas turbines, which are crucial for data center energy needs. Its stock has shown remarkable growth, reflecting investor confidence in its role in the data center sector.

Entergy (ETR): Entergy is considered undervalued and well-positioned for rising electricity demand, with significant investments planned for grid upgrades and clean energy expansion, which aligns with data center requirements.

These stocks are recognized for their potential to benefit from the increased energy demands of data centers, particularly those powered by AI technologies. They vary in their focus on different energy sources like nuclear, natural gas, and renewables, catering to the diverse needs of data centers.

You might want to consider an allocation to one or more of these names in your own prudently-diversified, long-term investment portfolio.