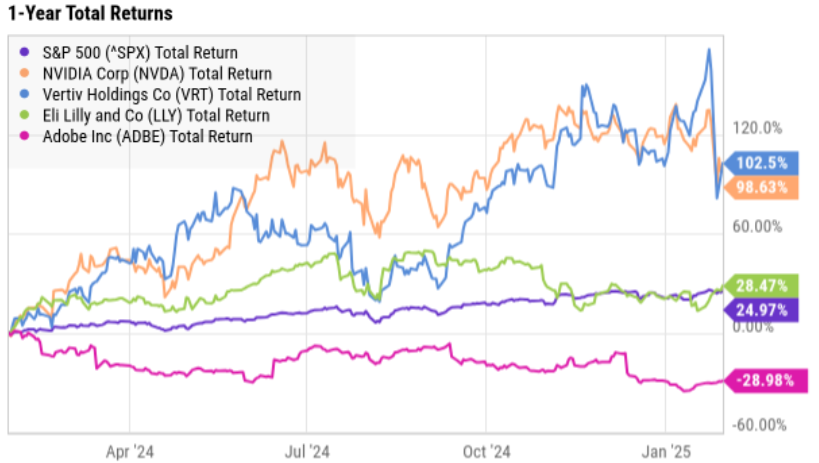

Separating the hype from the fundamentals, a handful of good stocks have just gone on sale following the recent DeepSeek drama and despite ongoing broad market strength. This report highlights four (4) fundamentally compelling businesses, currently trading at attractive prices (especially compared to ongoing growth trajectory), and positioned to do very well in the years ahead.

1. Eli Lilly (LLY)

Eli Lilly is particularly attractive right now for several reasons. For starters, it has an impressive revenue growth trajectory thanks in particular to its blockbuster drugs like Mounjaro and Zepbound, which are used for diabetes and weight loss. These drugs have not only boosted current sales but are on a path for substantial future growth in the very lucrative obesity market (i.e. people are willing to pay up for weight loss).

Secondly, Lilly's expansion into oncology and other therapeutic areas (including its clinical pipeline) diversifies its portfolio thereby reducing its reliance on any single product.

Further, the Lilly shares are highly rated by analysts (see table below, 1.0 is a “strong buy” and 5.0 is a “strong sell”), and they give it over 20% immediate upside price appreciation potential. Further still, the financial fundamentals are very strong, including high profits, a low PEG ratio (price / earnings to growth) and impressive 5-year earnings per share growth potential.

If you are a long-term investor that likes to purchase quality businesses at an attractive price, Eli Lilly is compelling and absolutely worth considering.

2. Adobe (ADBE)

Continuing with our theme of attractive growing businesses trading at compelling valuations, Adobe shares stand out. Adobe is a creative, marketing, and document management solutions/software company with continuing high growth potential from its leadership position.

Adobe's growth potential and total addressable market (TAM) are impressive. For example, the introduction of its “Firefly AI” models has already seen over 16 billion generations thereby strengthening the company’s leadership position in the AI-creative market. Furthermore, Adobe’s integration across Creative Cloud, Document Cloud, and Experience Cloud, combined with its products like Adobe Express, targets a wide range of users from individuals through large enterprises.

Furthermore, Adobe ranks extraordinarily high in quality (see table), yet the share price sits below its 200-day average and near the low end of its 52-week range (following weaker forward guidance than the street expected). However, the company continues to grow rapidly and with extremely attractive profit margins and low (attractive) valuation metrics. Analysts give the shares over 30% immediate upside from here, and over the long term Adobe has even more impressive potential.

3. Nvidia (NVDA)

Everyone kept saying they were waiting for a pullback in leading AI-chip maker, Nvidia, before they bought shares. However, now that the price pullback has arrived, people are too afraid. The news (at the end of January) of Chinese AI startup DeepSeek sent shockwaves through the market (and many AI-related share prices sold off hard, including Nvidia) based on fear that DeepSeek could produce better AI results with far less compute power (thereby making Nvidia less attractive in some people’s minds). In reality, as AI models improve (and AI companies copy each other, including through open source) the demand for compute (and leading AI GPU maker, Nvidia) will increase.

From a financial metrics perspective, Nvidia scores a perfect 100 in “Quality Score,” has a very attractive PEG ratio (below 1.0), insane continuing profitability and growth (i.e. they are the unquestioned leader and in very high demand space). The AI and cloud/digital megatrends are still just getting started, and Nvidia STILL has tons of upside.

Worth mentioning, because Nvidia’s market cap is so huge, it is a very large percentage of the S&P 500 index (~7%) relative to everyone else. So if you don’t own at least some Nvidia, you’re making a pretty big bet against the S&P 500, especially on a business with tons of long-term growth and still a very attractive valuation.

4. Vertiv (VRT)

Related to Nvidia and the AI megatrend, Vertiv makes electrical components for the data centers that house Nvidia chips (and power the cloud / digital revolution). Vertiv sold off very hard “in sympathy” with Nvidia, and it now trades at an attractive valuation as compared to its massive ongoing growth trajectory.

More specifically, Vertiv is a key player in providing data center infrastructure, particularly critical cooling solutions for AI workloads (which are surging in demand).

Moreover, Vertiv's strategic position in the AI infrastructure market, combined with the global trend of increasing data center investments, supports its long-term growth trajectory. The company's recent financial beats and raised guidance further underscore its operational strength and market confidence.

Just know that this one (Vertiv) can be very volatile, so unless you have an iron-clad stomach, watch your position size closely—and buckle up—it will likely be a long volatile ride with lots of long-term upside.

Bonus Idea:

Vanguard Total Market ETF (VTI)

You may be wondering why anyone would include an ETF (exchanged-traded fund) in a “4 good stocks” list. But this particular low-cost Vanguard Total (US) Market Index Fund (VTI) is truly special for a lot of reasons.

For starters, it is a GREAT place to park your money if you are a long-term investor. Specifically, you don’t have to worry about anyone nickel-and-diming you to death on fees and expenses (this one charges only 0.03% for expenses each year), and it gives you instant diversification and exposure to the entire US stock market without ever having to worry what to buy or sell.

*(the market has been averaging close to a 12% annual return for the last 10 years, and closer to 9% for the last 80+ years).

VTI basically just holds everything, approximately 3,600 US stocks, and in percentage weights similar to their market cap. So mega cap names like Nvidia and Microsoft make up relatively large percentages (recently over 5% each), and you also get exposure to the entire small cap portion of the market (over 2,000 small cap stocks that many contrarians believe are increasingly due for a strong relative rebound).

Worth mentioning here, one of the main reasons a lot of investors cannot outperform a market index like VTI is because they take big risks with their stock picking that they are not even aware of. For example, a lot of people held shares of Nvidia in 2024 (the stock was up over 170%), but they held only 2-3% of their assets in Nvidia when the index holds over 5%... this one-stock underweight alone caused a lot of individuals’ performance to lag the market index in 2024.

And just like not holding enough Nvidia in 2024 caused many investors to underperform, not having enough small caps could cause investors to underperform in 2025 and beyond. VTI solves this problem with a healthy allocation (~15%) to small cap stocks (potentially, a very important piece of the overall market performance pie).

So if you do like to buy individual stocks, but you’re not inclined to follow 25-30+ individual stocks (a number that could potentially give you enough risk-reducing and prudent diversification); holding only 5 or 6 individual stocks in combination with a big allocation weight to VTI could be the right answer for you, your long-term returns, and your pocket book (of course depending on your own personal situation and goals).

Bottom Line:

There are a lot of stocks out there to choose from, and a lot of short-term stock price volatility to deal with. And compounding the short-term investment “challenges,” there are also a lot of cheerleaders and fearmongers pushing certain stocks in the short term (and by sheer chance, a handful of them get it right and look smart).

But the reality is, no one knows where the market is going in the short term. But over the long-term it is likely going much higher (don’t bet against the long-term economic and financial growth of the US and of the world), and by owning fundamentally attractive business at attractive valuations you can reap the benefits of the overall market’s gains, plus additional benefits from the outperformance (and lack of psychological mistakes) of your picks versus the market.