CrowdStrike founder and CEO, George Kurtz, has founded and led multiple successful cybersecurity businesses, and he knows the drill. Specifically, CrowdStrike is a high-margin Software-as-a-Service company with highly attractive recurring revenues that continue to grow rapidly in a large (and expanding) total addressable market (cybersecurity). What’s more, despite the continuing rapid growth, the valuation has come down, thereby making the shares even more compelling to some investors. In this report we share our opinion on whether CrowdStrike is worth considering for investment at these levels (valuation), or if it’s just another overhyped growth stock that is being valued too much on a euphoric narrative and not enough on its underlying fundamentals.

About:

CrowdStrike Holdings, Inc. (CRWD) is a cybersecurity company (a large and rapidly growing industry). It provides cloud-delivered protection across endpoints and cloud workloads, identity, and data.

The company primarily sells subscriptions (an attractive business model) to its Falcon platform and cloud modules through its direct sales team (that leverages its network of channel partners). Servicing customers worldwide, CrowdStrike is based in Austin, Texas.

George Kurtz (Founder):

CrowdStrike was co-founded in 2012 by George Kurtz (current CEO), Dmitri Alperovitch (former CTO) and Gregg Marston (former CFO, retired), and began trading publicly on the Nasdaq in June 2019.

Important to note about George Kurtz is that this is “not his first rodeo.” He previously founded a company called Foundstone and was Chief Technology Officer at McAfee. This is important because it speaks to his experience, knowledge and success in the industry. He also co-wrote a successful book in 1999 called Hacking Exposed. It can be critically important for a CEO to have the right background, and Kurtz’s background demonstrates he knows how to have success in the cybersecurity industry. More specifically, he know the steps and format of a successful cybersecurity company (more on this in a moment), and CrowdStrike benefits.

An Exceptional Growth Story:

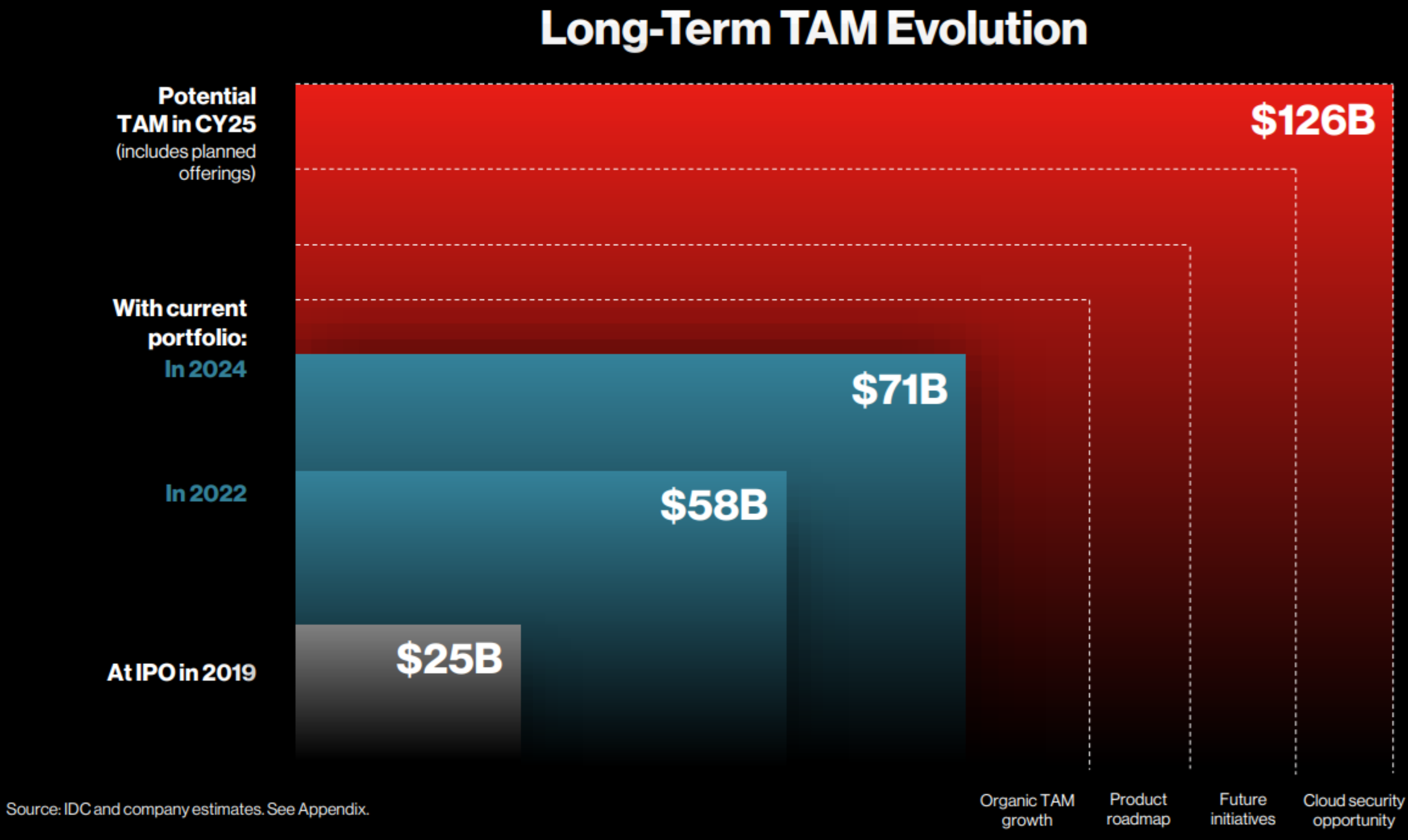

Only in recent market cycles has the power of subscription-based recurring-revenue businesses caught on widely, and that is the growth recipe CrowdStrike has followed to a tee. Specifically, CrowdStrike has all the main characteristics of an exceptional growth story, including a recurring-revenue subscription model, with a high retention and a high growth rate within a very large and expanding total addressable market opportunity (cybersecurity). Not to mention, Kurtz’s knowledge of fast-functioning, cutting-edge, cybersecurity solutions.

It is this recipe that has allowed CrowdStrike to post exceptional growth numbers and it has also made CrowdStrike a darling in the minds of many growth investors. Many growth-oriented investors love CrowdStrike.

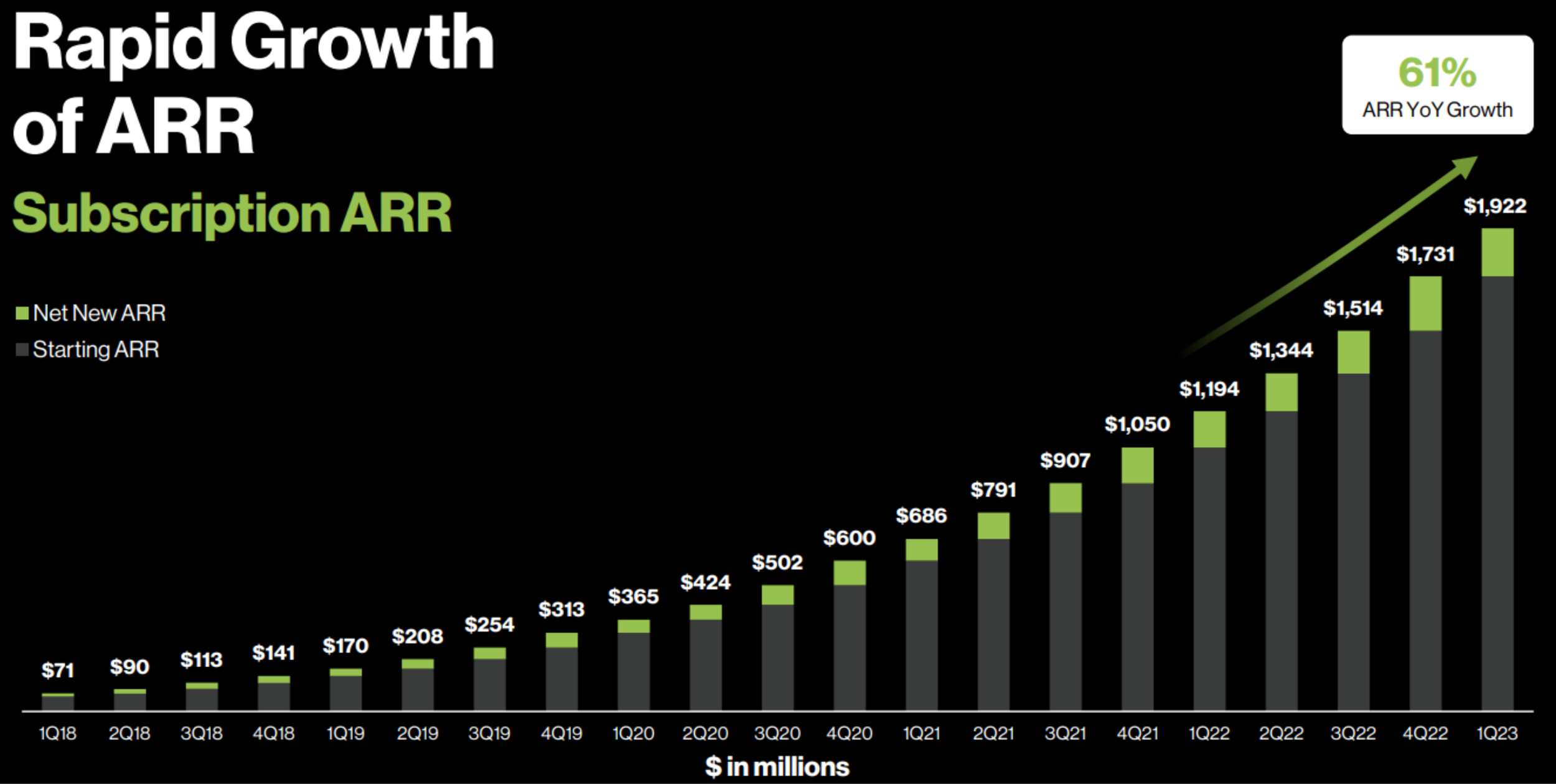

For a little more perspective, here is a look at the company’s annual recurring revenue (“ARR”) growth trajectory.

The Current Valuation:

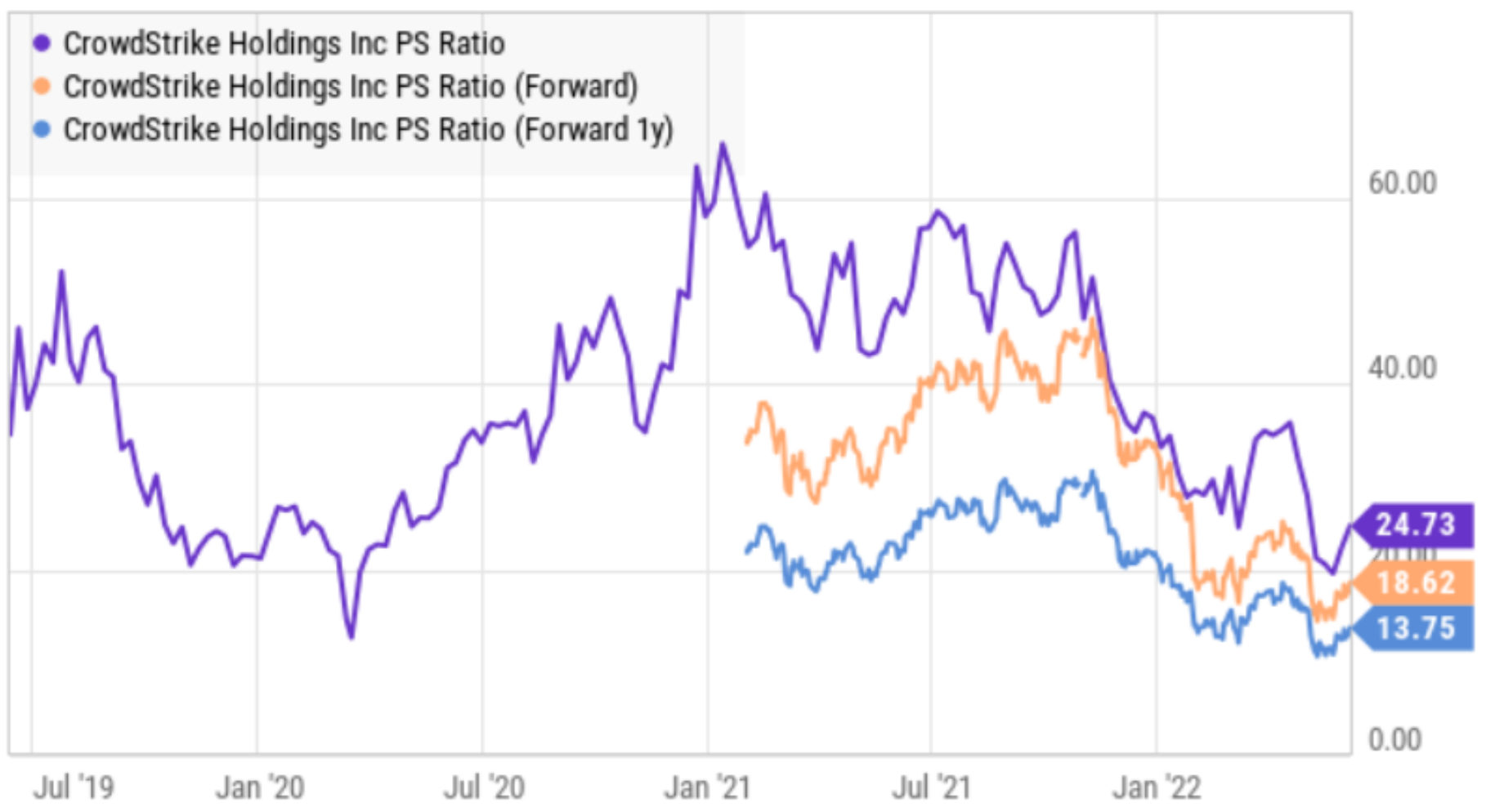

CrowdStrike current trades at around 24.7 times sales, which is down dramatically from a year ago (as growth stocks across the board have been selling off extremely hard).

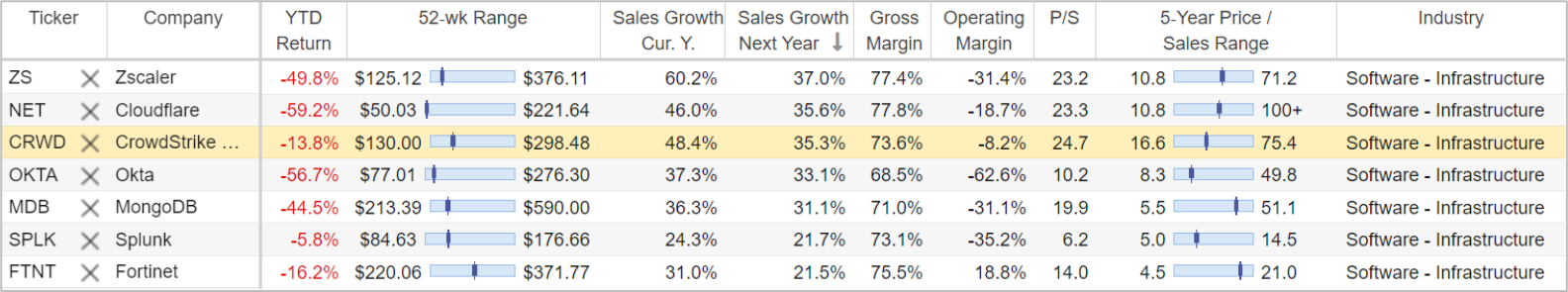

And here is a look at CrowdStrike’s price-to-sales ratio as compared to its expected growth rate (this year and next) and as compared to a variety of other high-growth recurring-revenue, SaaS companies.

To put things in some perspective, the companies in the table above all have very high growth rates and very high price-to-sales ratios. A typical S&P 500 company might have a growth rate of only 4% and a price-to-sales ratio of 3x. CrowdStrike has a very high price relative to its current sales, but sales are expected to grow rapidly (for many years, based on the large TAM) and this makes the valuation more palatable and reasonable to many investors.

Bulls Say:

CrowdStrike is an impressive high-growth business that will eventually grow into its high price-to-sales ratio (based on the large and growing TAM), and it is particularly attractive now that the price (and valuation multiple) has come down.

CrowdStrike’s CEO is a strong leader with the experience to execute on the massive industry opportunity,

Cybersecurity is a constantly growing threat, and one companies cannot ignore. Once a company starts paying for cybersecurity they cannot just quit. Protecting data is not a luxury, it’s an absolute requirement.

Bears Say:

CrowdStrike is an impressive growth business, but the valuation has way too much long-term optimism baked in—even after the price decline over the last year—at 24 times sales, it’s still way too expensive.

CrowdStrike is still not GAAP profitable. The company argues it has negative GAAP profits because it is spending so heavily to maximize future earnings by capturing the massive growth opportunities today.

CrowdStrike keeps diluting current shareholders through its heavy stock-based compensation. For example, annual stock-based compensation for 2022 was $0.31B, a 107.08% increase from 2021; annual stock-based compensation for 2021 was $0.15B, a 87.23% increase from 2020; annual stock-based compensation for 2020 was $0.08B, a 289.86% increase from 2019. Stock-based compensation is the reason the company is not GAAP profitable (even through the company reports non-GAAP numbers (excluding stock-based compensation) that makes the company appear profitable).

Conclusion:

We believe in the long-term CrowdStrike growth story, and we also believe the shares are worth considering (especially after the recent sharp share price decline) if you are a long-term growth-oriented investor that can stomach near-term volatility. As such, we have assigned the shares a $200 “Buy Under” price (the shares currently trade at around $177), and in reality we believe the shares can go much higher than this over the long-term. We currently own shares of CrowdStrike within our prudently-diversified, long-term, Disciplined Growth Portfolio.