Roku (ROKU) shares are down 85%. And while some investors celebrate the bursting of what they believe was an obvious pandemic bubble stock, things could still get worse. For example, the Fed’s hawkishness is driving us into recession, Roku’s earnings are again negative and the shares remain highly shorted right along with many other now infamous “high-growth” stocks. In this report, we review Roku’s business, its growth opportunities, its valuation, the multitude of headwinds that many investors are now increasingly aware of (such as supply chain issues, competitive threats, slowing growth), and then conclude with our opinion on investing.

About Roku:

If you don’t know, streaming TV is the digital distribution of television content over the Internet, And Roku is the leading streaming TV platform in the US. This is a very big deal because, while streaming TV is still relatively new, it is unlocking massive targeted advertising opportunities (which translate to massive revenues). In much the same way that companies like Google (GOOGL) and Facebook/Meta (META) used the Internet to capture user data thereby allowing highly efficient targeted advertising campaigns, so too is Roku using streaming TV. For perspective, here is a look at the massive secular trend (streaming TV) in the US.

According to Roku’s latest investor letter:

“The secular shift to TV streaming continues, and we are investing in the significant opportunity ahead of us. Our unique assets, including the Roku OS, Roku TV, The Roku Channel, and our sophisticated ad platform continue to position us to extend our leadership in the years ahead. We remain excited about executing against this opportunity as more content, viewers, and advertisers move to TV streaming.”

Roku delivers steaming TV through its own operating system, which comes preinstalled on many smart TVs and is also available for purchase through a relatively low-cost dongle that users can hook up to their televisions. As such, Roku enable users to access the steaming content they want, it allows content publishers to build and monetize large audiences, and it provides advertisers the unique capabilities to engage (target) customers.

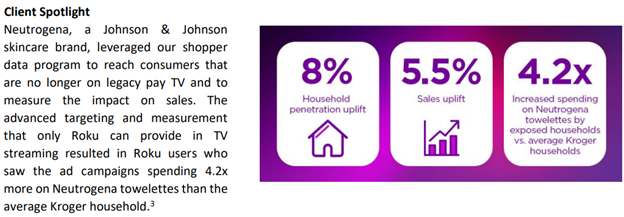

For a little perspective, here is an example of a Roku advertising client success story:

And important to note, Roku is led by Anthony Wood, an accomplished businessman and entrepreneur, who also has some history working at Netflix (he was VP InternetTV at Netflix from 2007-2008). Wood is a self-made billionaire, and Roku (which means “six” in Japanese) is the sixth company founded by Wood.

Roku’s Growth Opportunities

Roku has been rapidly growing its revenues, and is expected to continue growing revenues rapidly, as you can see in the following chart.

And Roku possesses the key attributes that many investors like to see in a growth stock, including a high revenue growth rate, a large total addressable market (“TAM”) opportunity (the secular shift to streaming TV) and a successful founder-led business (Anthony Wood).

For a little more perspective on the growth opportunity, Morningstar analyst, Neil Macker, explains:

“We think revenue will grow 21% on average over the next five years and moderate to 9% annual growth over the subsequent five years…”

And according to Roku’s latest quarterly shareholder’s letter, dated April 28, 2022:

“Our first quarter performance was solid, with Platform revenue up 39% year-over-year, benefitting from higher content distribution and advertising revenue. In particular, The Roku Channel’s expanding Active Account reach and Streaming Hour engagement have significantly increased the advertising opportunities available on our platform.”

Roku’s Valuation:

Valuing a high-growth stock, like Roku, can create consternation for some investors because its latest quarterly operating income was negative. However, many long-term growth investors are comfortable with negative earnings if the reason is because the company is spending heavily in order to capture large growth opportunities—which is what Roku is doing as it pursues the massive secular growth opportunity in streaming TV.

As such, price-to-sales ratios are one way to gauge a growth company’s value (when earnings are still negative). Here is a look at recent price-to-sales ratios for Roku, and as you can see—recent performance has been ugly!

However, keep in mind that while the price and price-to-sales ratios for Roku have been crashing, the revenues have continued to grow (a good thing) as we saw in our earlier chart. As such, Roku shares now trade an astounding 85% lower than their 52-week high, and the price-to-sales ratios are now quite reasonable—especially for a company with such a high growth trajectory. Generally speaking, a price-to-sales ratio above 10 is exceptionally high, and requires exceptional growth (which Roku has) to even be considered at that level. And now at only 3.5 times sales (and 2 times 1-year forward sales), the share price of Roku is extremely interesting. But why has the price gotten so low?…

Headwinds and Fearmongers:

Less than one year ago, before the market started to sell off, investors were touting the extreme attractiveness of the Roku growth story—even when it was trading at over 30 times sales. Now, at 3.5 times sales, the narrative has shifted dramatically. Specifically, investors seems to be focused more on fearmongering with regards to all the headwinds and challenges the company faces. Here are examples:

Rising Interest Rates by the US Fed are hitting growth stocks (like Roku) hard. The fed is hiking rates in an attempt to slow inflation (CPI growth is at a 40-year high), but it is also slowing growth. Growth stocks tend to be hit harder by rising rates because, in theory, it will be more expensive for them to access the capital they need to fund growth (and because future earnings are worth less when discounted back to the present at a higher rate). However, in Roku’s case, the company already has tons of cash on its balance sheet, very little debt, and the business is already free cash flow positive. In theory, if the Fed’s interest rate hikes drive us into recession (which they may be willing to do to fight inflation) then consumer spending on Roku could take a hit, but the secular trend will likely remain largely intact, and Roku is in a much better position than many other growth stocks.

Slowing Growth is another risk for Roku. And the fearmongers are playing this one up. Like many socially-distanced, stay-at-home stocks, Roku’s business was helped by the pandemic, and that leaves it in a “tough comps” position. Specifically, some analysts point to slower growth numbers (when compared to last year) when in reality it’s just a blip related to tough pandemic comps and the longer-term trend remains firmly intact. Roku recently noted in its quarterly letter that:

“In Q1, we added 1.1 million incremental Active Accounts to reach 61.3 million. As expected, year-over-year Active Account net adds moderated given the end of government stimulus payments that served to temporarily drive discretionary consumer spend in Q1 2021”

Supply Chain Challenges have helped fuel the negative narrative about Roku’s lack of positive earnings. But in reality, here is what Roku had to say about that:

“Additionally, ongoing supply chain disruptions contributed to increased U.S. TV prices in Q1 2022, resulting in industry-wide TV unit sales that were below 2019 (pre-COVID) levels. Our streaming player unit sales remained above 2019 (pre-COVID) levels but were down 12% year-over-year. Importantly, our strong and growing ARPU has allowed us to strategically prioritize account acquisition and insulate consumers from rising material and shipping costs in our player business.”

Roku is operating from a position of strength to navigate macroeconomic disruptions and challenges.

Competitive Threats are another headwind to the stock price being driven by fearmongers. The narrative says there are many bigger companies (with deeper pockets) that could easily create existential threats to Roku’s business. For example, if Google were to aggressively pursue television manufacturers to pre-install a Google operating system, Roku would be in trouble. However, in reality, it would take some time for the big boys to even pursue such an aggressive strategy, and then it would take more time to displace Roku’s leading position and platform. It also helps that Roku’s service is steaming-neutral, meaning it allows content on its platform from other providers, such as YouTube, Netflix and Disney+. There may also be reason to believe other competitors might look for ways to work with Roku, considering its leading position, such as recent rumors that Netflix may even try to acquire Roku (which would undoubtedly be at a very large premium to the current share price).

Conclusion:

Roku is not for everyone. The extreme price volatility over the last year may simply cause too much stress and anxiety for some. However, if you are truly a long-term investor (for example, if you have a 5 to 10+ year investment horizon), Roku’s business remains attractive. And the valuation is compelling, particularly as the streaming TV trend remains firmly intact and Roku remains in a leading position to benefit. The recent sell off (which has been extreme) has created some margin of safety for long-term investors.

We are currently long shares of Roku in our Disciplined Growth portfolio, and have no intention of selling anytime soon. Disciplined, goal-focused, long-term investing is a winning strategy.