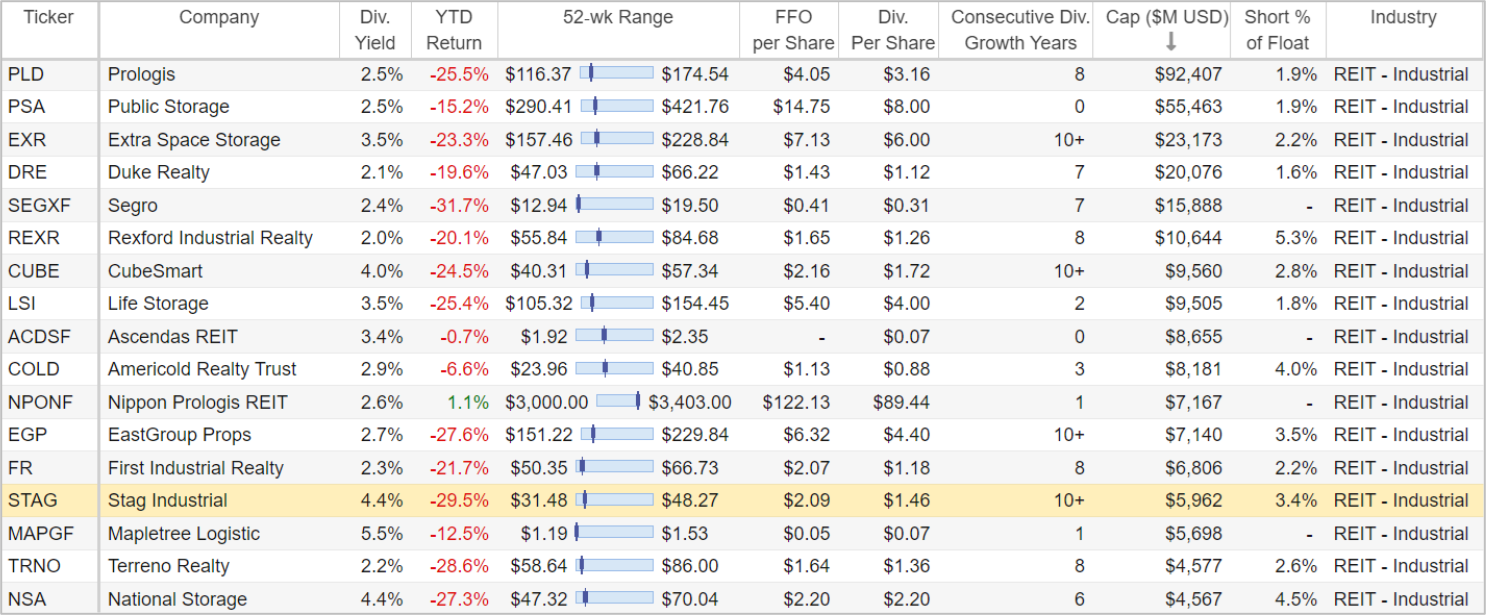

If you are an income-focused investor, you probably like investing in REITs for their often big, steady, dividend payments. However, you may have noticed that following years of strong outperformance, the industrial REIT sector (including monthly-dividend payor, STAG Industrial (STAG)) has recently sold off hard. This report reviews STAG’s business, including information on the 3 big risk factors contributing to its relatively lower valuation multiple—as compared to industry peers (especially following the recent big Industrial REIT sector sell off), and then concludes with our opinion on investing.

Overview: STAG Industrial

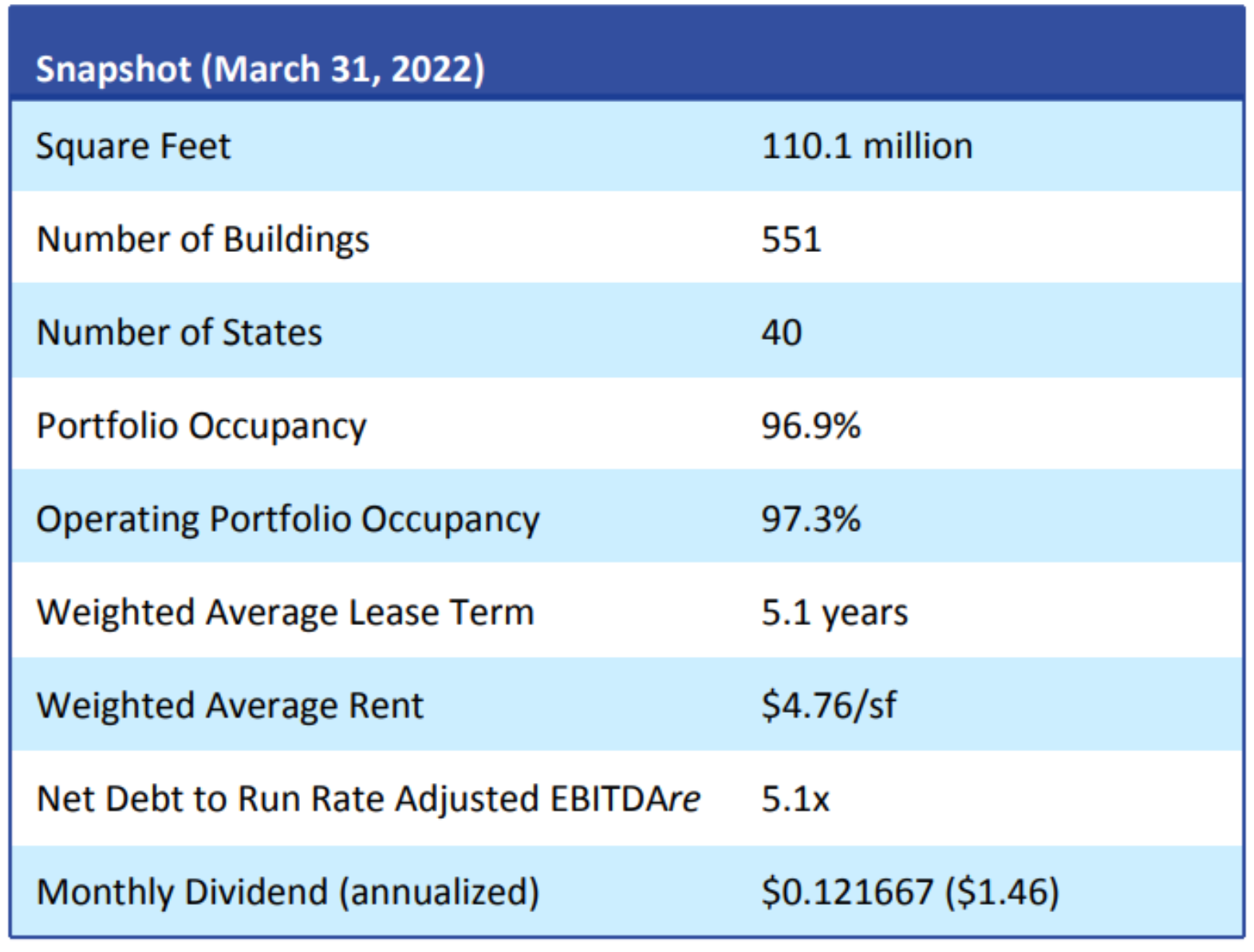

STAG Industrial is a real estate investment trust (“REIT”) focused on the acquisition and operation of single-tenant, industrial properties throughout the United States.

STAG has a market cap of just below $6 billion (far from the biggest), and it has a 10+ year history of increasing its annual dividend (which is paid monthly).

What’s more, STAG has worked hard to grow and improve its business since its IPO in 2011. For example, it has dramatically grown its number of properties, it has achieved multiple investment grade credit ratings, and it has expanded from simply secondary and tertiary properties to many more desirable property locations.

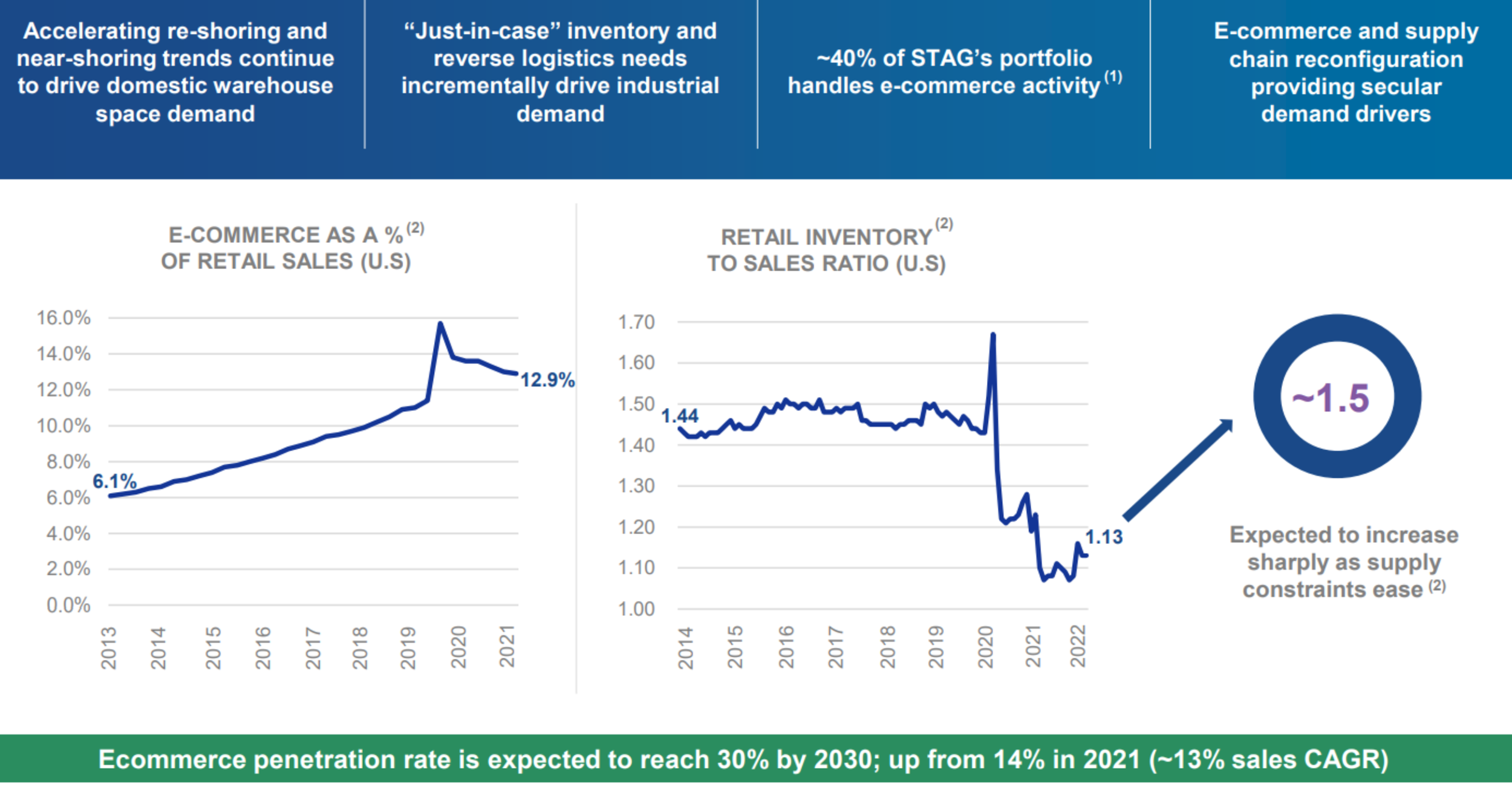

Also interesting to note, currently approximately 40% of STAG’s portfolio handles e-commerce activity—a market segment that is expected to keep growing as a percentage of total US retail sales (i.e. a nice secular trend).

Dividend History:

As mentioned, if you are an income-focused investor, REITs can be attractive, especially monthly dividend payors like STAG. STAG has grown its dividend every year since its IPO in 2011, and it moved from paying quarterly to paying monthly in 2013. What’s more, as you can see in our earlier table, the dividend is well covered by FFO (Funds from Operations) a good thing for dividend-paying REITs—in terms of dividend strength and safety.

Industrial REITs Sell Off Hard:

As you can see in our earlier performance table (and the chart below), industrial REITs (including STAG) have sold off hard this year (significantly harder than the overall market—as measured by the S&P 500).

In our view, there are 3 big risk factors that have driven the price of STAG (and the entire industrial REIT sector) lower.

STAG’s 3 Big Risks:

1) Slowing Demand for industrial properties is a big risk for the sector and for STAG in particular. For example, Amazon (AMZN), a huge customer of industrial REITs, recently made more explicitly clear that it would be pulling back on e-commerce operations—thereby clouding the future for industrial REITs. Amazon is STAG’s largest customer, but STAG is so well diversified that Amazon is still only about 3.2% of the REIT’s total annual base rent (not a lot). However, Amazon’s direction could foreshadow similar moves by other big tenants across the industry, such as FedEx and Costco, for example. For more perspective, the graphic below shows the sharp spike in demand for ecommerce (and therefore industrial REITs) when the pandemic first hit, as well as the dynamic inventory challenges created by supply chain issues.

2) Single-Tenant, Secondary-and-Tertiary Properties is another big risk for STAG. As mentioned earlier, STAG has done a lot to improve its business since its IPO in 2011—however, the business still owns many properties in secondary and tertiary markets (less desirable than the prime location properties that other industrial REITs own). And if demand is slowing down, secondary and tertiary properties could potentially get hit much harder than prime location properties (this is one of the reasons STAG trades at a lower valuation multiple than other industrial REITs—more on this in the next section). Also important, STAG owns primarily single-tenant properties, and these are riskier by definition (as compared to multi-tenant properties). Single tenant properties is another big risk for STAG, especially if demand is slowing down (because if a property tenant goes under, the entire property is at risk).

3) Looming Recession is another big risk for industrial REITs, and for STAG in particular. For starters, a recession would slow the demand for just about everything, and this would cause pain for REITs, However, STAG in particular would be hard hit because of its riskier property types (i.e. single tenant, secondary and tertiary properties). Also, the Fed’s efforts to fight inflation (by raising interest rates) is weighing on the economy and dragging us closer to recession. Here is what STAG’s president, Bill Crooker, had to say on the most recent earnings call:

“Rising interest rates have caused a slight slowdown in the longer term lease transaction market. Fortunately for STAG, our disciplined process for identifying and closing on industrial acquisitions is focused on relative value. This allows us to still accretively acquire assets that will deliver long-term returns to our shareholders.”

Valuation:

REITs are often valued based on funds from operations, or “FFO”, which is basically cash flow from operations (calculated by adding depreciation, amortization, and losses on sales of assets to earnings and then subtracting any gains on sales of assets and any interest income).

The table below shows current and historical price-to-FFO multiples for several popular industrial REITs, including STAG. The first thing to note is that STAG historically trades at a lower multiple, and this is because its properties are generally considered riskier (i.e. they are single-tenant, and include a lot of non-prime locations).

You might also notice that even though STAG’s price-to-FFO multiple has recently come down, it is not exactly low by historical standards, especially considering we could be heading into a recession—which STAG would be particularly sensitive too.

Dividend yield is also often considered a valuation metric because it can be a signal from management about where they believe the price should be (higher or lower). For example, management sets the dividend at a level the business can handle, and when the yield gets too high—that can mean the price is too low (and vice-versa). In STAG’s case, the dividend is…

Even though dividend yields have been on the rise this year, they’re still not necessarily that low by historical standards. Although in STAG’s case, as the company continues to transition into a safer REIT (versus the REIT is was at its IPO), a lower yield (on par with other safer industrial REITs) can make a lot of sense.

As another indication of current Industrial REIT valuations, news recently broke that Prologis made an attractive offer to acquire the smaller REIT, Duke Realty (DRE). These types of acquisition offers often take place when the acquisition target is underpriced—perhaps an indication from Prologis that they believe the industrial REIT space is currently being undervalued by the market.

Conclusion:

Rising interest rates—as we head into a potential recession—have elevated the risks for industrial REITs, especially as they continue deal with the unique supply chain disruptions created by the pandemic (for example, a spike in new demand from top customer Amazon, followed by a now a sharp expected decline). And these risks are elevated for STAG Industrial because its business is already riskier than other industrial REITs (due to its single tenant properties, often located in secondary and tertiary locations, not prime).

Taking into consideration the big risks that STAG currently faces, combined with its current valuation (it trades at 14.8 times FFO, low—but not too low—by historical standards, the shares are increasingly compelling. We haven’t yet pulled the trigger on a new purchase, but we believe the shares are attractive, and STAG remains high on our watchlist for now (i.e. we may add shares in the near future).