We first purchased Shopify at ~$143 per share in August of 2018. It now trades at ~$333 per share. Not a bad return—until you realize the shares have fallen over 80% in the last 6 months! This report compares Shopify’s business fundamentals (including its business strategy, ongoing revenue growth and margins) to its current valuation, and then examines the question of whether Shopify CEO, Tobias Lütke, continues to imprudently push an easy-money, high-growth business strategy in an increasingly sober new market paradigm—now characterized by higher costs of capital and a starkly less friendly meme stock environment (yes—Shopify is a meme stock). We conclude with our opinion on who might want to invest—or if it’s simply time to sell and move on.

What Does Shopify Do?

Shopify helps people start, run and grow businesses by giving them tools to sell anywhere (websites, in-person, social media), market and manage operations. Shopify is sort of an “anti-Amazon” because instead of trying to hide your brand every step of the way (like Amazon) Shopify helps you promote it, strengthen it and grow it.

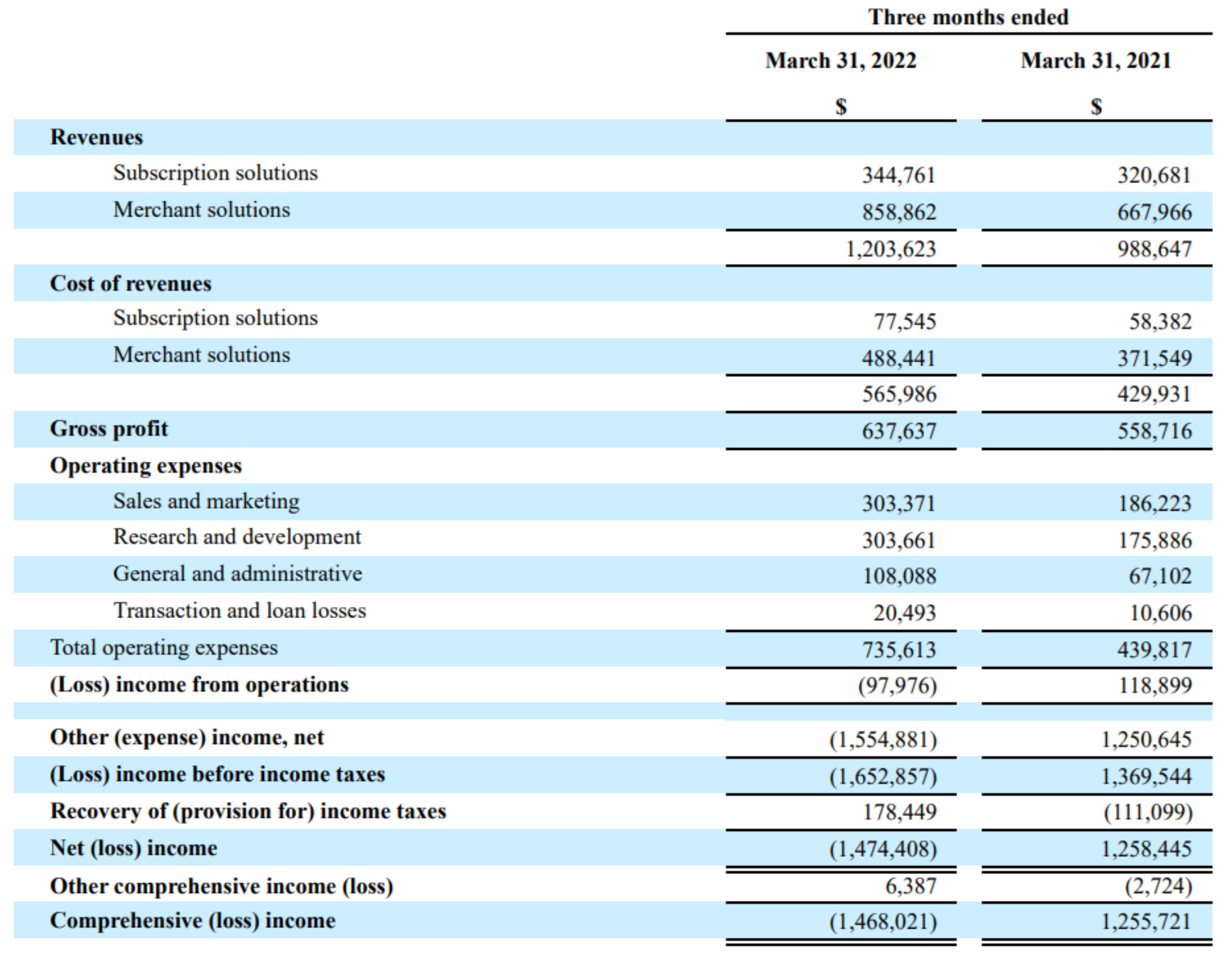

From a reporting standpoint, Shopify divides its business into two segments, Subscription Solutions and Merchant Solutions, and you can see the high-level revenues and costs of those two segments in the table below:

source: Shopify

But to get into more specifics, Shopify offers solutions to help its customers, including Shopify Payments, Shop Pay Installments, Shopify Shipping and Fulfillment Network, Shopify POS, Shopify App Development, crypto payments and more.

Massive Growth, Total Addressable Market:

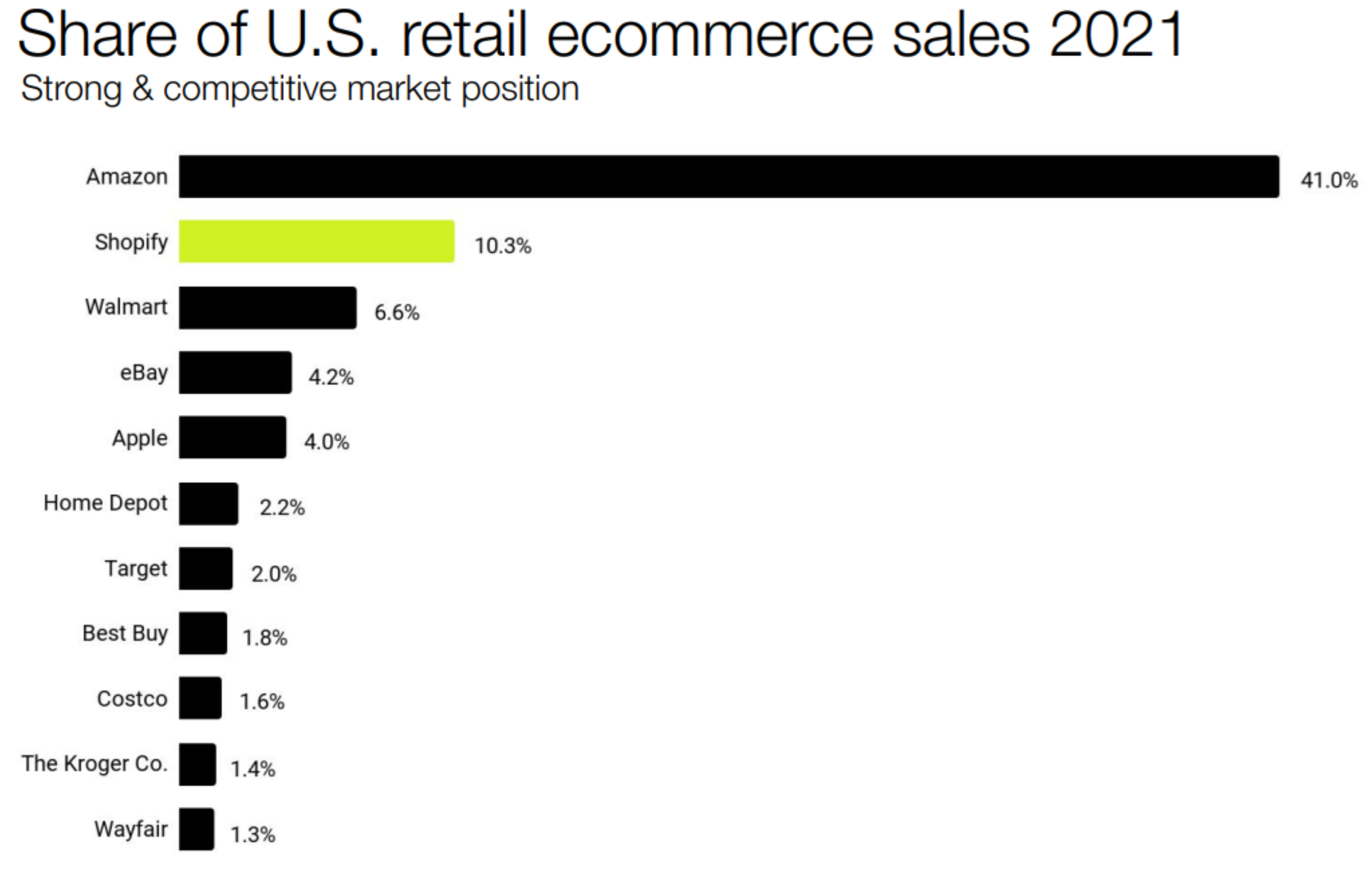

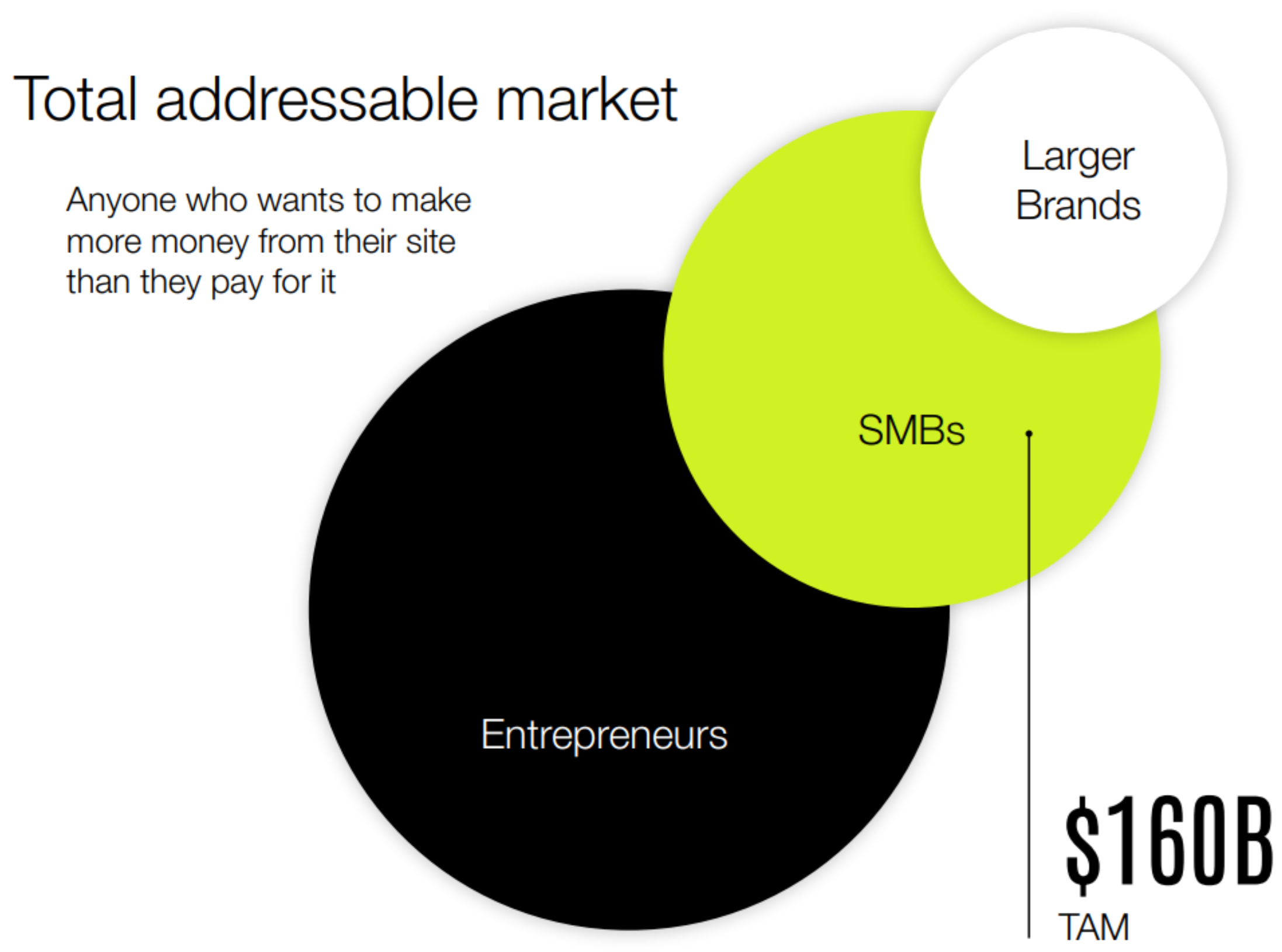

From a growth stock investment standpoint, two of the most important things to look for are a high-growth trajectory and a large total addressable market (“TAM”) opportunity. Shopify has both.

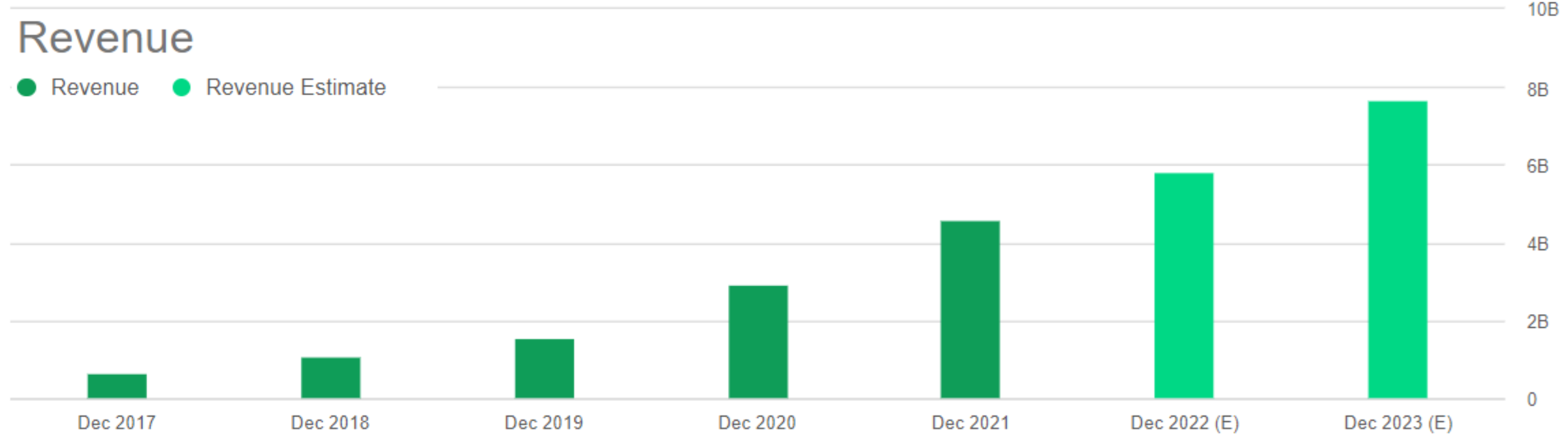

First, here is a look at Shopify’s ongoing high-growth revenue trajectory.

source: Seeking Alpha

In fact, Shopify is expected to grow revenues 28.2% this year and 29.5% next year. This is a very-high and very-attractive revenue growth rate, especially when you consider the massive TAM opportunity (so Shopify can keep growing).

Shopify has a massive market opportunity from smaller entrepreneurs, small-and-mid-sized businesses, and larger brands, all of whom can and do benefit significantly from Shopify’s offerings. Shopify has a lot of room to keep growing (this is a good thing).

Not Profitable

In business, the concept of the “j-curve” basically means businesses lose money at first when they start up, and then eventually become very profitable and make a lot of money down the road (something along the lines of “it takes money to make money”). However, in recent market cycles, a growing number of businesses have extended the “not profitable” part of the curve to very long periods of time, as easy money has made access to capital almost automatic (more on easy money later). For example, Twitter has had so much access to easy money during the last market cycle that the culture evolved into “ideology, which is what led us into not being profitable.” And Twitter is not alone, as so many high-growth stocks (including as Shopify) have been able to simply hang their hats on massive revenue growth without ever really giving much consideration for increasing profits (the assumption by investors being: profits will come later). Specifically, here is a look at Shopify’s mostly negative profit margins (i.e. Shopify continues to lose money).

source: YCharts

In Shopify’s defense, the company has very high gross margins (consistently in the 50-percent range), but then spends heavily on the future by investing in sales and research & development (see our earlier Income Statement table).

Easy Access to Capital

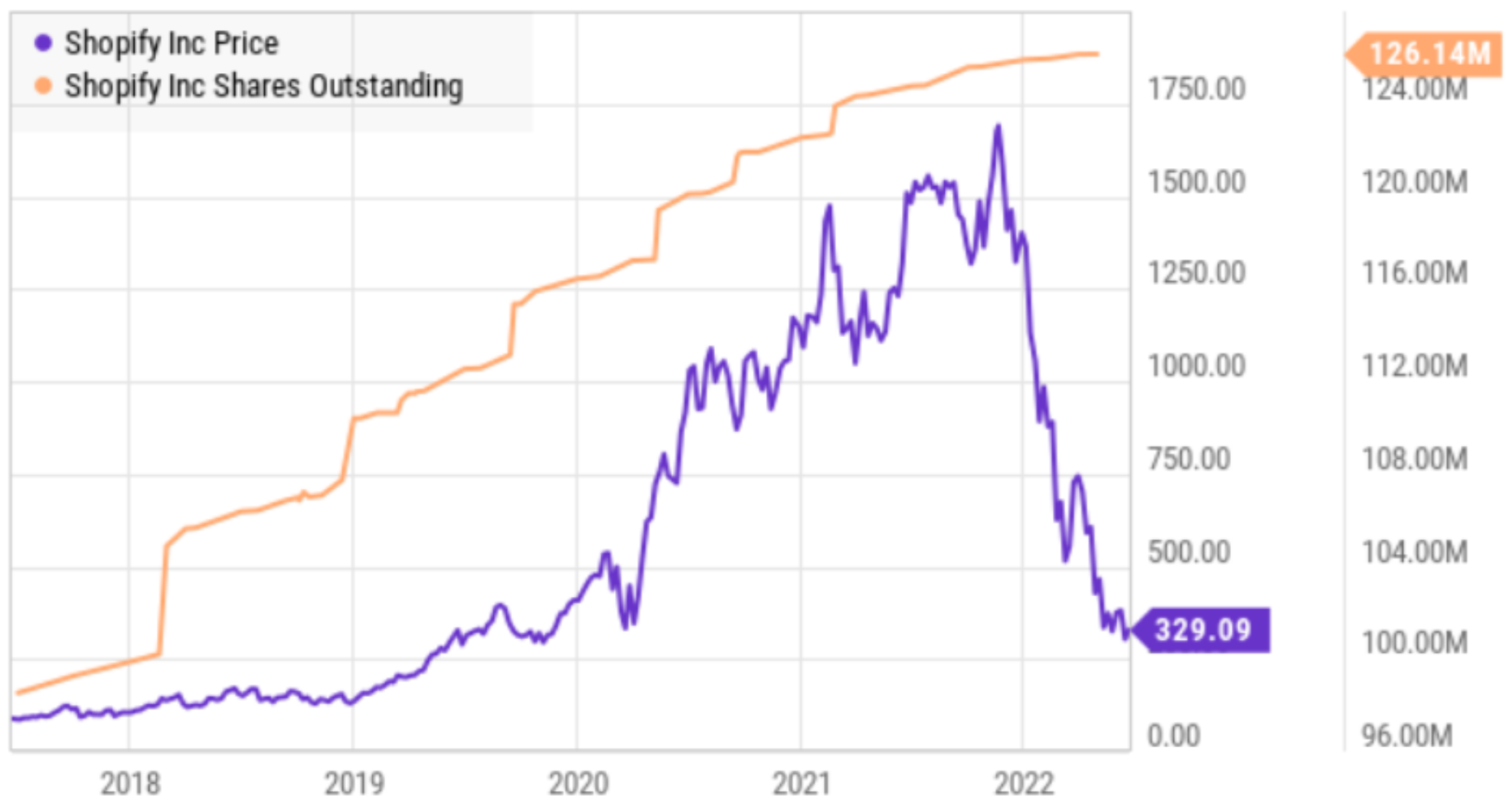

Despite Shopify’s essentially non-existent profits, the company has had plenty of access to easy money to keep funding its revenue growth. For starters, Shopify was able to access capital by issuing more shares, and the amount of money was boosted dramatically by the company’s massively growing market valuation (i.e. they could sell shares at a very high price).

source: YCharts

In Shopify’s defense, why wouldn’t you raise capital by issuing shares (considering the stock price was so high), and they really didn’t issue that many shares (not on the same extreme level that some other company’s have diluted their shareholders). Further, raising capital to fund an unprofitable growth business has been increasingly common practice in recent market cycles.

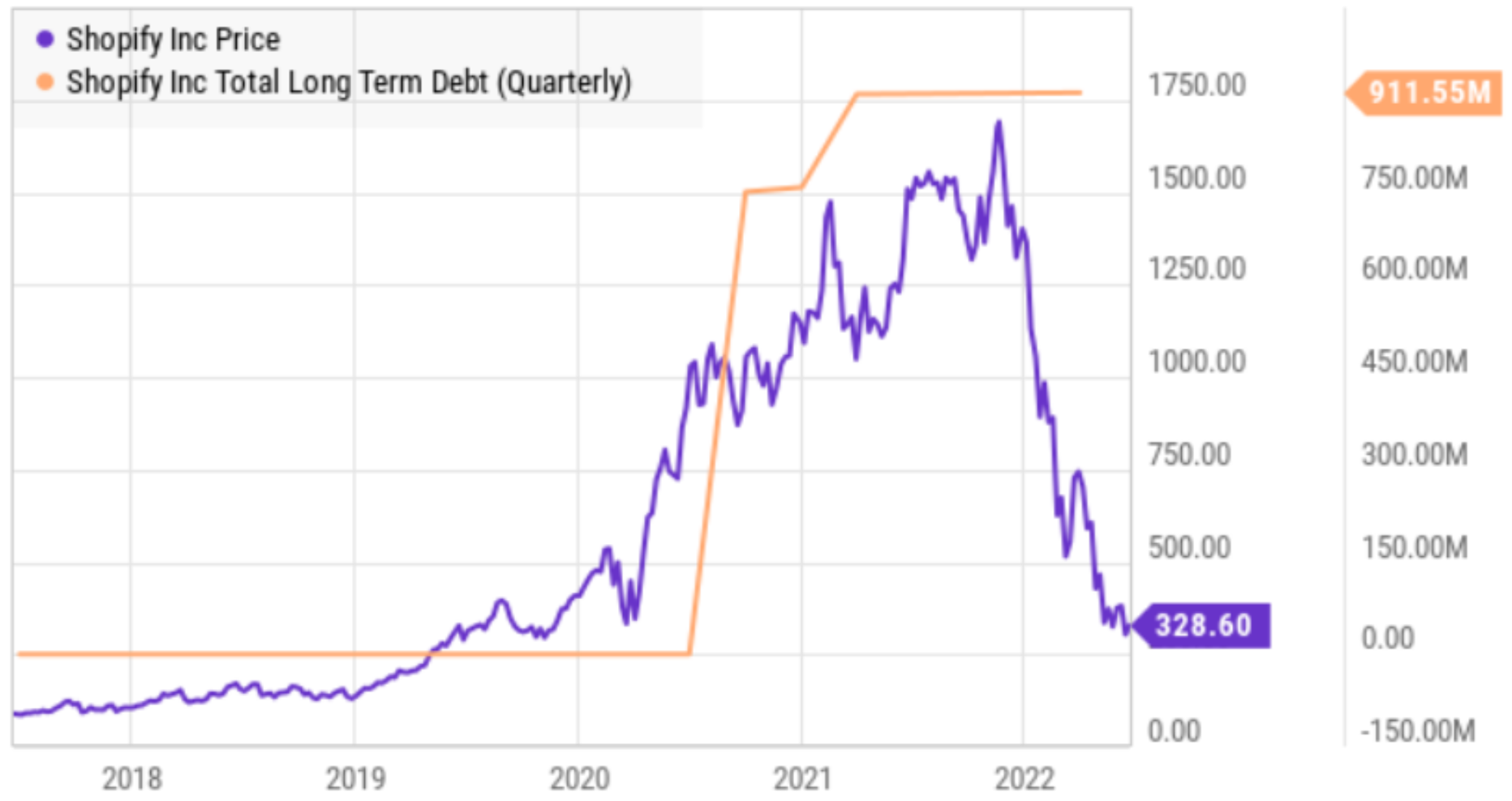

Interestingly, Shopify just recently took on long-term debt, as you can see in this next chart.

On one hand, it was wise for Shopify to raise capital to fund extraordinary growth accelerated by the pandemic’s stay-at-home bump. And it was brilliant that the debt was added before rates started to rise (as they have been this year). However, the business remains unprofitable, and we may have just entered a dramatically different market paradigm.

A New Market Paradigm:

Negligible-profit, high-revenue-growth business were soaring to extreme levels prior to the pandemic, and the government’s extraordinarily easy monetary and fiscal policies accelerated the valuations of these companies (including Shopify) into the stratosphere. However, we are now dealing with a dramatically shifted market paradigm, whereby easy money is evaporating and investors are placing relatively much higher value on companies with strong current profits (i.e. value stocks, not growth).

Companies like Shopify can no longer raise massive cash by selling more shares, considering share prices have plummeted. And they cannot easily raise debt because the cost of debt (interest rates) is now significantly higher than it was, and on a trajectory to keep going higher.

Regarding Shopify, the company may have been brilliant to take on debt financing when it did (i.e. when rates were lower), but the the market’s appetite for ultra-high growth seems to have shifted. Specifically, Shopify’s massive pandemic revenue bump has ended and the government’s now inflation-hawk posture may drive us into an ugly recession. Further, the obnoxious 25-year old “fintwit” experts that coerced their friends to (a) spend their stimulus checks on meme stocks and bitcoin, and (b) tell all their friends to do the same—have largely fizzled out (for now).

Valuation:

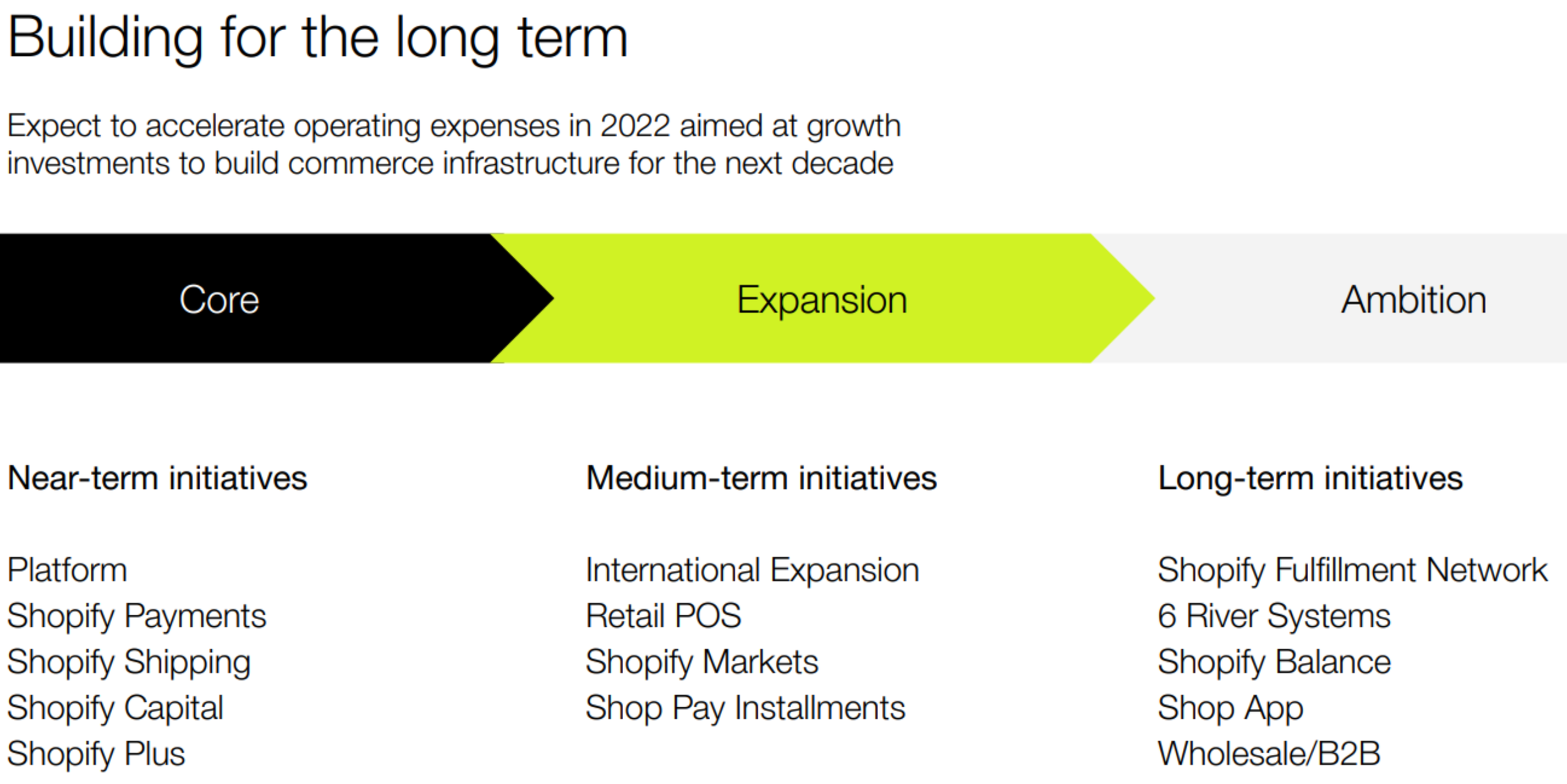

Assuming Shopify does want to make money someday (you know, that whole fiduciary responsibility to shareholders thing), they are in a good position to (eventually) do it. In fact, if Shopify immediately dropped all its research & development—they’d become profitable very quickly. And if they stopped with all the expensive sales & marketing—the company could quickly become even more profitable. But truth be told, that’s not the right thing to do for the long-term value of the company. The company can dramatically increase future profits by forgoing current profits and instead focusing on growing future revenues and profits.

The question for Shopify is what is the right balance? Is Shopify really trying to maximize future profits (and the value of the company for its shareholders) or is the company just caught up in other aspirations (similar to how Twitter employees state profits don’t ever matter, as mentioned earlier). We’ll have more to say about this later, when we discuss the company’s leadership (CEO Tobias Lütke), but assuming that Shopify hasn’t completely forgotten its actual fiduciary responsibility to shareholders, let consider its valuation multiples.

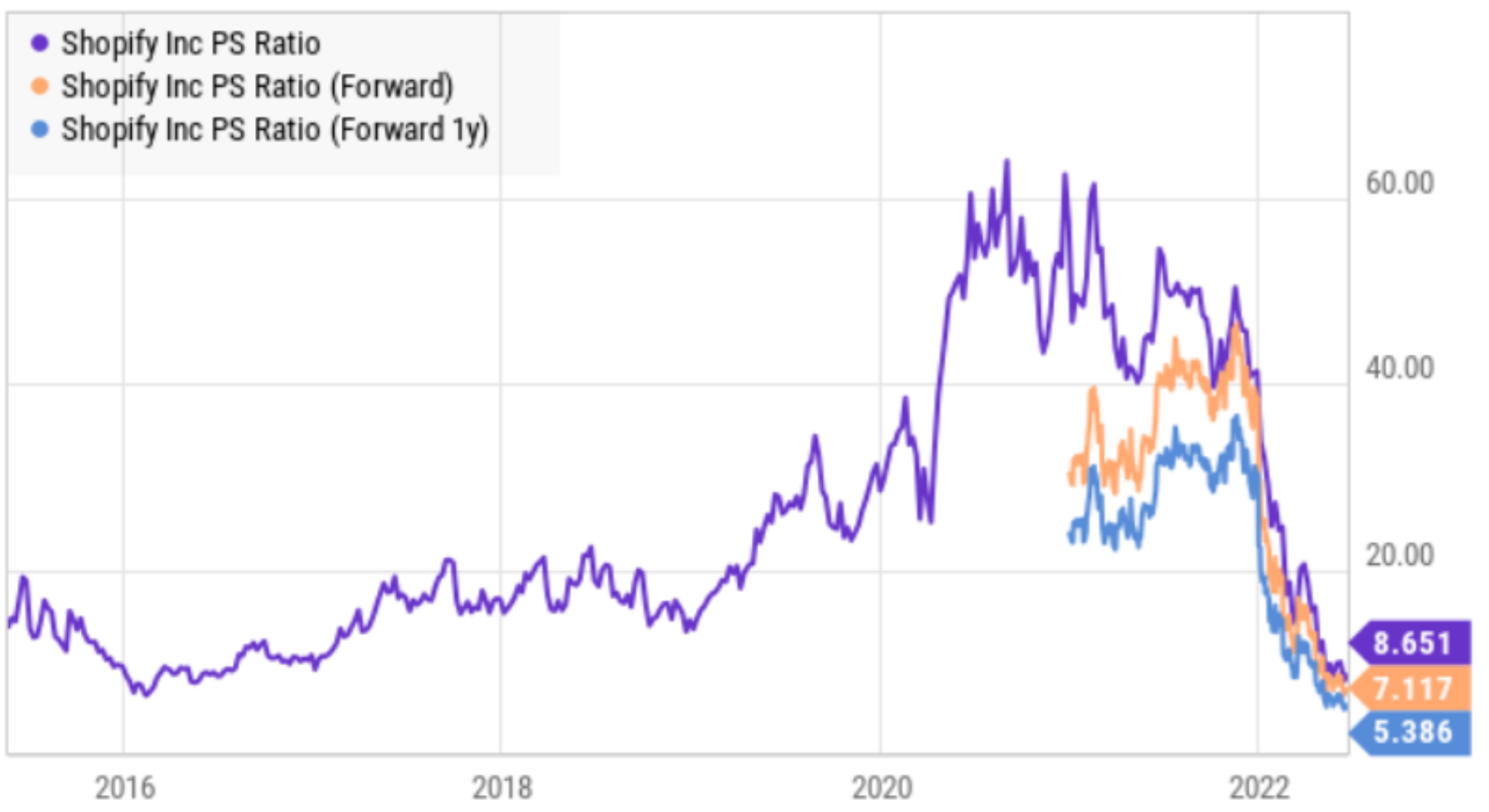

From a price-to-sales standpoint, the shares are a lot less expensive than they were a year ago. In fact, as you can see in the following chart, the ratio has fallen from over 60x one year ago, to around 8.7x now.

And at 8.7 times sales, Shopify’s valuation is much more reasonable, especially considering it has a revenue growth rate close to 30%, gross margins above 50% and a massive TAM opportunity. Just remember to take the lower valuation with a grain of salt considering we are in a new slower-growth higher-cost-of-capital environment. To put things in some perspective, here is a look at SHOP’s growth, valuation and margins versus other popular high-growth stocks and e-commerce retailers (sorted by price-to-sales).

In our view, Shopify is more reasonably priced at this level, but still not cheap as compared to some peers. Of course these business are differentiated, and Shopify does enjoy a variety of unique advantages, and could extend its high revenue growth rate for years longer than some of the other companies listed in the table considering Shopify’s massive TAM, sticky customer base and long-term initiatives.

Leadership:

Shopify in a founder-led business. CEO Tobias Lütke, along with Daniel Weinand and Scott Lake, founded Shopify as an online snowboard company, but eventually shifted focus to e-commerce. They took the company public in 2015, and Tobias still owns about 7% of the shares outstanding.

Interestingly, Tobias recently received shareholder approval for a special founder class of shares that guarantee him at least 40% of Shopify’s voting rights. Investors are putting a lot faith in Tobias, a young guy, that continues to focus on the very long-term (for example, his 100-year plan). In his 2015 letter to shareholders (a letter still prominently highlighted on the Shopify Investors website), Tobias explained:

“We do not chase revenue as the primary driver of our business. Shopify has been about empowering merchants since it was founded, and we have always prioritized long-term value over short-term revenue opportunities. We don’t see this changing.”

In the “olden days,” companies highlighted their fiduciary responsibility to maximize shareholder wealth (typically through long-term profits). Not only does Tobias not mention profits as a goal, but he doesn’t even prioritize revenues over empowering merchants. This may be a powerful long-term strategy and attractive marketing, but he is thumbing his nose at his shareholders, and for a young CEO that has only led his public company during times of historically easy money, he may not yet fully appreciate the funding challenges Shopify could face in the years ahead as we begin to operate in the new market paradigm (as described above) that could continue to make high-spending on growth more challenging.

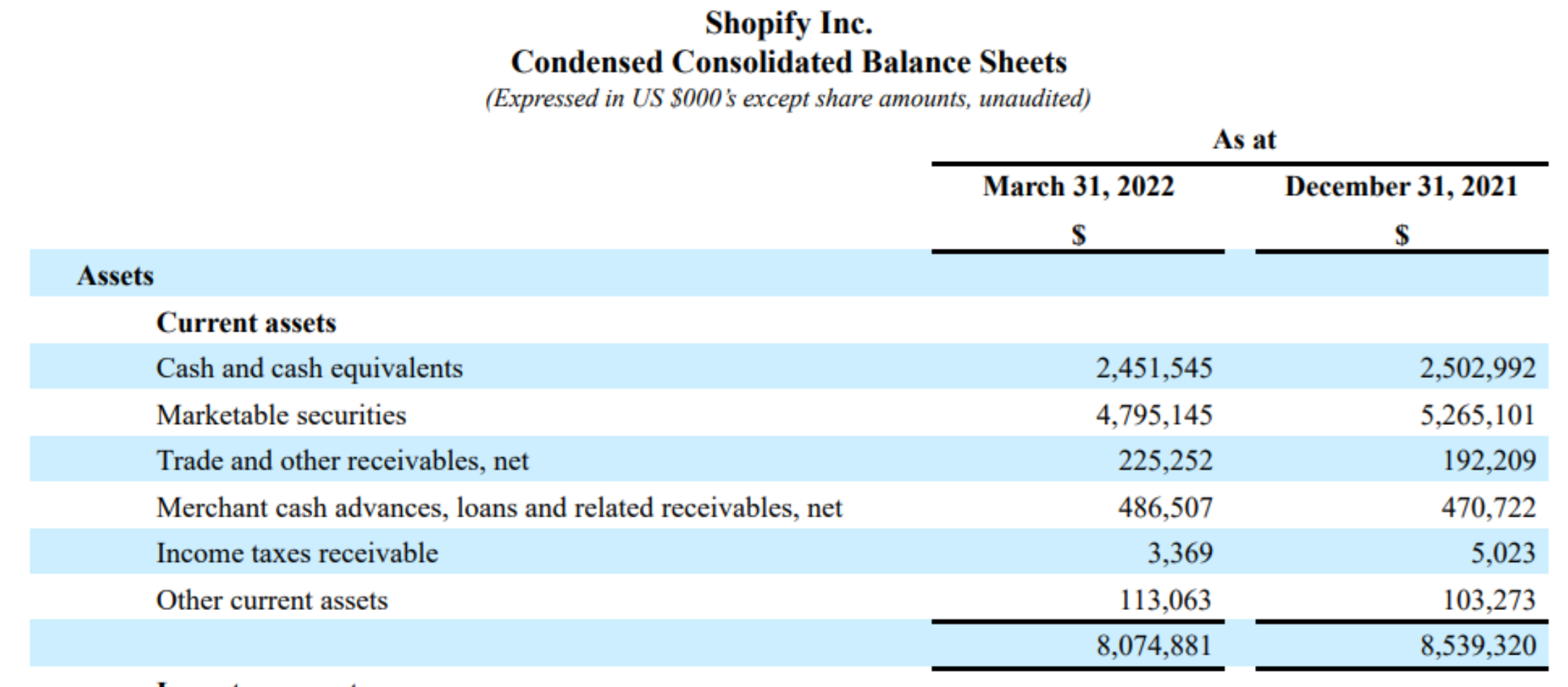

Shopify may be flush with cash now (see above), but the company will burn through the $8 billion in current assets on its balance sheet rather quickly considering the $2.5 billion annual run rate on R&D and Sales & Marketing expenses, combined with the company’s typically negative net income (aside from the pandemic bump anomaly) and the fact that it generally gets harder to keep growing revenues so rapidly as a company gets bigger.

We’re not saying Shopify has any immediate cash flow problems (they do not), just that the company may have to make adjustments (either less spending or more profits) considering the potentially new market paradigm, as described earlier.

Risks

Despite the recent dramatic share price decline, Shopify still faces a variety of risks that are important to mention. For example, Shopify is already a large company, and as companies get larger it becomes harder to generate such high levels of growth. Additionally, the new founder share class creates agency risks. Also, the pandemic bump was an anomaly that is now over, and the shares continue to face tough comps and some over enthusiastic shareholders. Not to mention, the new market paradigm (as described earlier) can make it harder to fund growth. Also, as a meme stock, Shopify could face more short-term pain as investor sentiment could continue to sway negative (the market is a voting machine in the short-term, but a weighing machine in the long term). Also, if the economy goes into recession, that can cause more near-term pain. Finally, Shopify actually does face some upside risk, as in—if the Fed eases up on its inflation hawkishness, then Shopify’s valuation multiple could expand and the share price could go higher in the relatively short-term.

Conclusion:

Shopify was one of the ultimate pandemic meme stock that soared to incredible levels, and has now come crashing down. And depending on the whimsical nature of the markets in the short term—Shopify can still fall further. However, in the long-term, this remains an exception revenue growth machine—with the potential to transform those massive revenues into massive profits. And what’s more, if the US inflation rate slows down, or if the US Fed finds any other reason to slow the rate hikes, this stock has risk in the other direction—that is risk to the upside. If the markets calm down, the shares of this business can benefit from multiple expansion too.

As a long-term high-growth investment, Shopify has exceeded to the upside on price volatility and price gains. Some shorter-term investors may not be able to stomach the volatility (and that’s fine), but the long-term business continues to improve—and the share price will eventually follow. We are long shares of Shopify in our Disciplined Growth portfolio, and we have no intention of selling. Disciplined, goal-focus, long-term investing is a winning strategy, and owning high-growth long-term businesses (like Shopify) can pay off handsomely over the years.