When it comes to income investing, investors have a lot of choices. And considering the current macroeconomic environment (inflation, the fed, market declines, recession risks) many investors are left flummoxed concerning their next move. In this report, we share our top 10 big-dividend opportunities, including two ideas from each of the following five categories: REITs, BDCs, Bond CEFs, dividend-growth stocks and energy investments. The yields range from 4% to over 9%, and we share some high-level macroeconomic perspective before we get into the countdown.

The Shifting Macroeconomic Paradigm

If you have removed yourself from “the grid,” you’re probably a better long-term investor for it. But if you are like the rest of us, there is no place to hide from the relentless media warnings of impending doom as the US Fed marches forward with steep interest rate hikes to battle excruciatingly high inflation regardless of the fact that their actions are slowing the economy and perhaps driving us into an ugly recession. And this new macroeconomic paradigm sharply contrasts the environment just one-year ago when rates were essentially zero and the markets were hitting new highs regularly, while growth stocks were soaring to Kid Icarus levels (they’ve since crashed hard).

And while optimists may find a few bright sides to the current market environment (for example, interest rates on savings accounts are starting to move from “absurdly low” to just “very low,” and rapid home price inflation is finally getting people who bought during the last bubble out from under water).

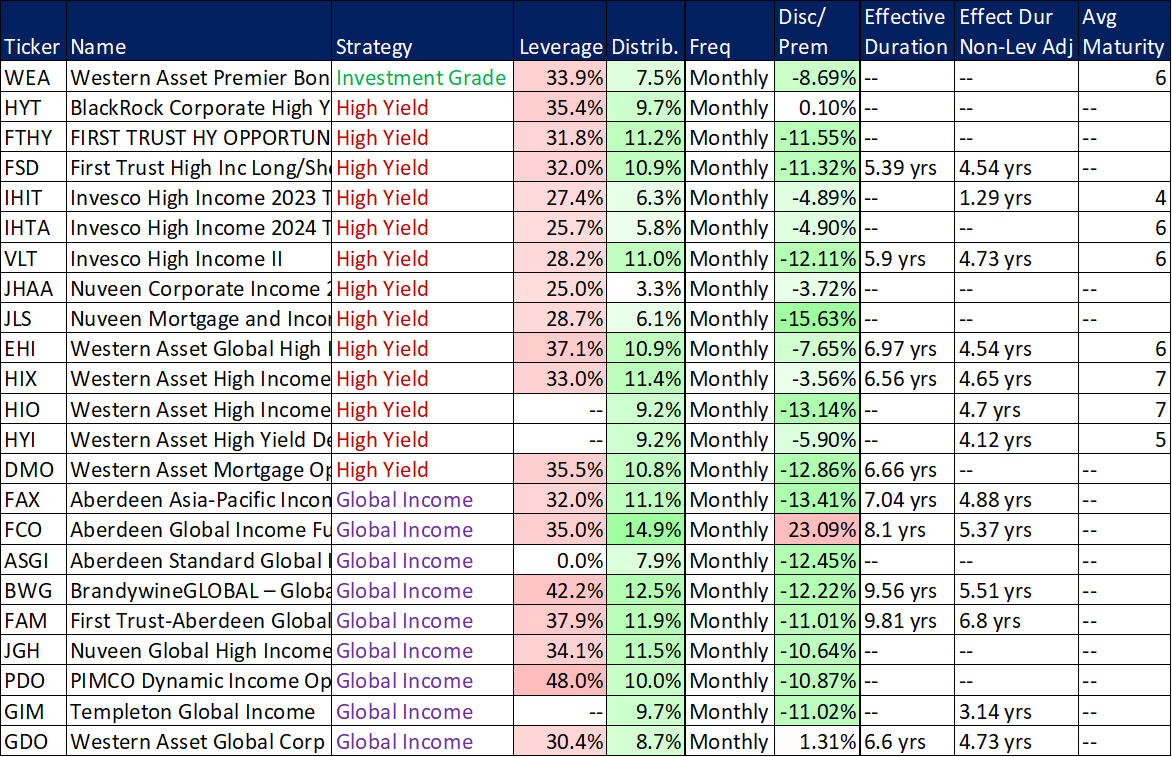

The bottom line with regards to the macroeconomic environment is that we’re in a new world order now. Not only is inflation at a 40 year high, but interest rates are set to rise (after declining for essentially 40 years straight), and this time around the fed may actually NOT be bluffing. Higher interest rates make growth stocks less valuable (because their present values are based more heavily on future earnings, which are discounted back at higher rates—not to mention raising growth capital becomes more expensive), while cash and short-duration assets become particularly valuable (for example, long-dated bonds are down dramatically this year, while the near-term maturity bond holdings in PIMCO’s Bond CEF (PDI) may actually save it as rising rates drive the NAV lower and the leverage ratios above regulatory limits thereby triggering forced sales at discounted prices—yuck!—more on this later in this report).

With that backdrop in mind, let’s get into the Top 10.

The Top 10

We have broken our top 10 down into five categories (REITs, BDCs, Bond CEFs, energy and blue-chip dividend growth stocks) and we have included two investment ideas from each category. For diversification reasons, it can make a lot of sense to achieve your high-income needs from across multiple categories. Let’s start with REITs.

Real Estate Investments Trusts (REITs)

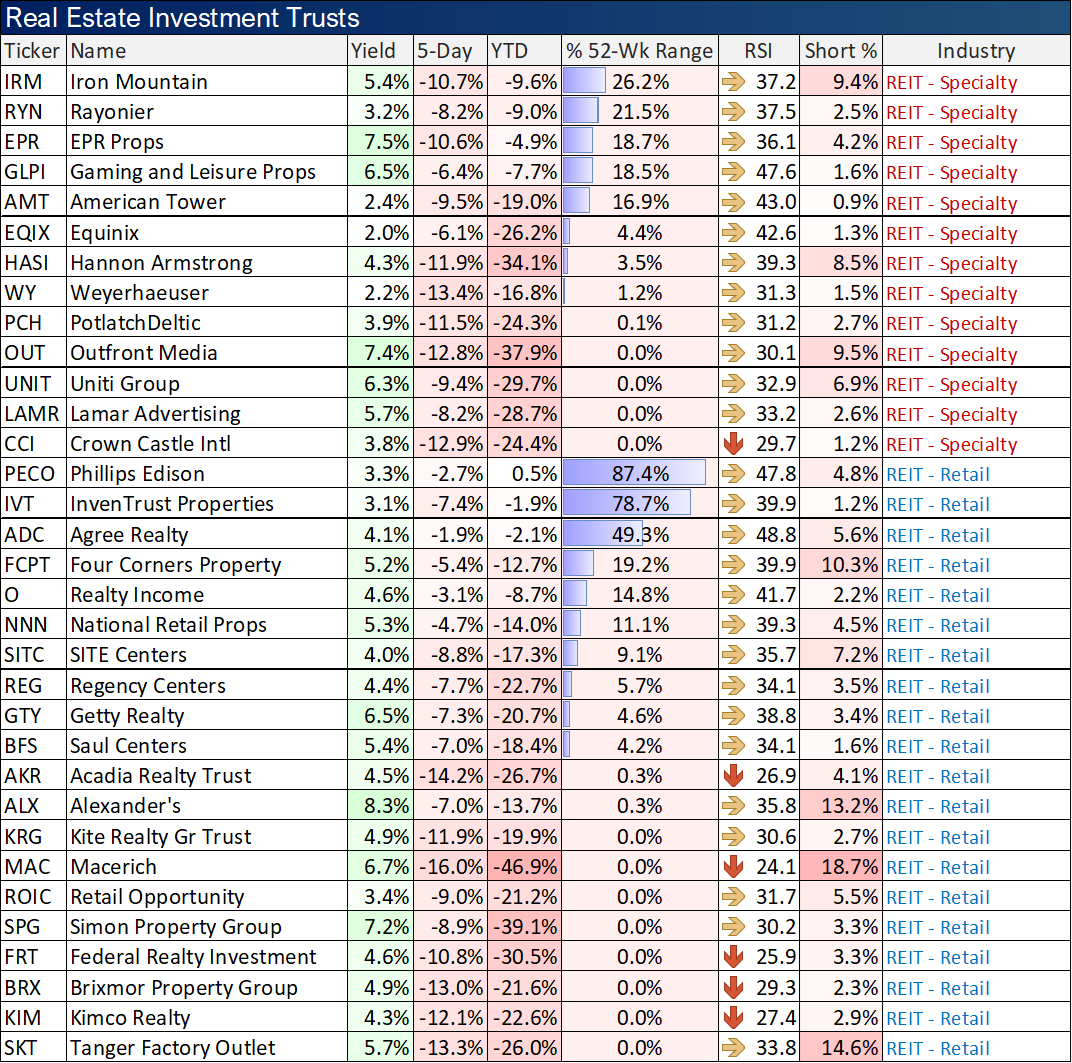

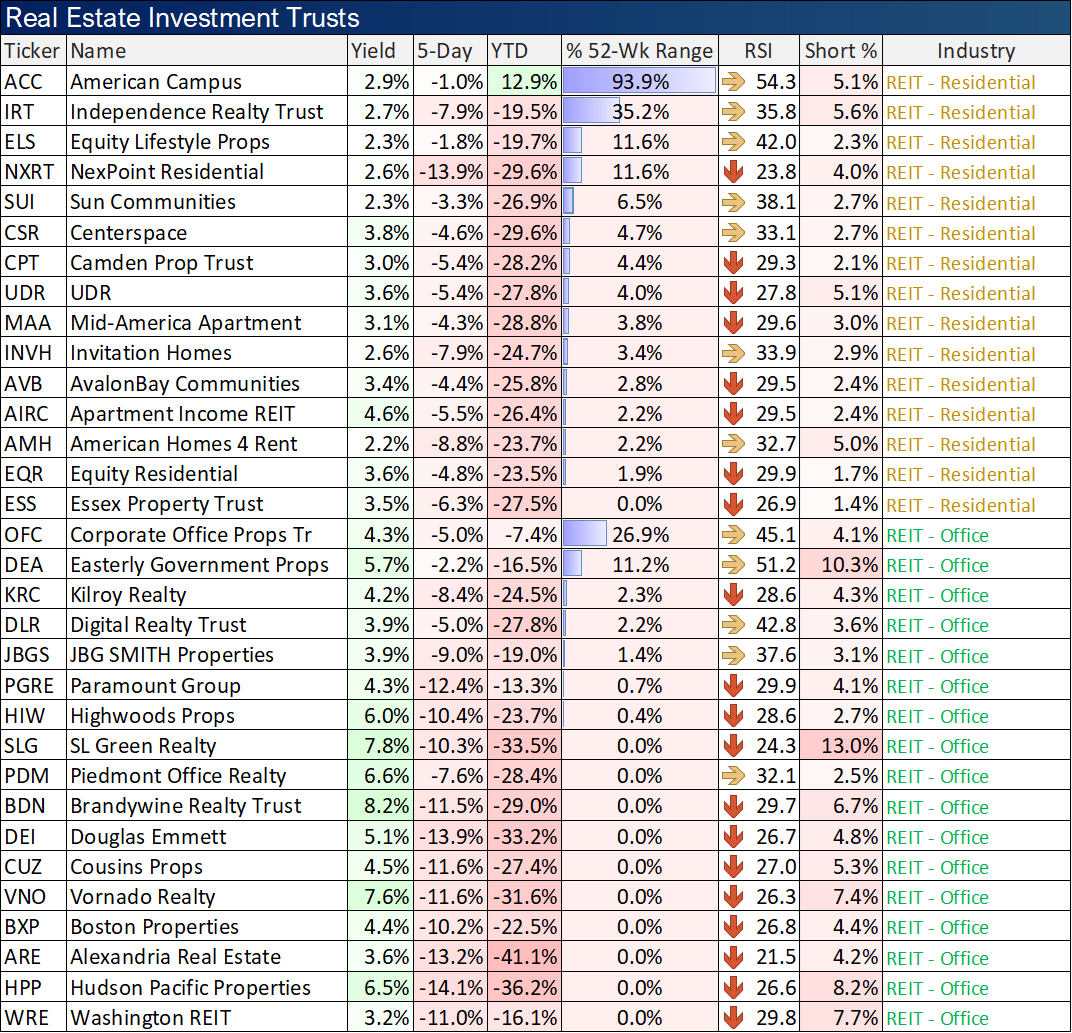

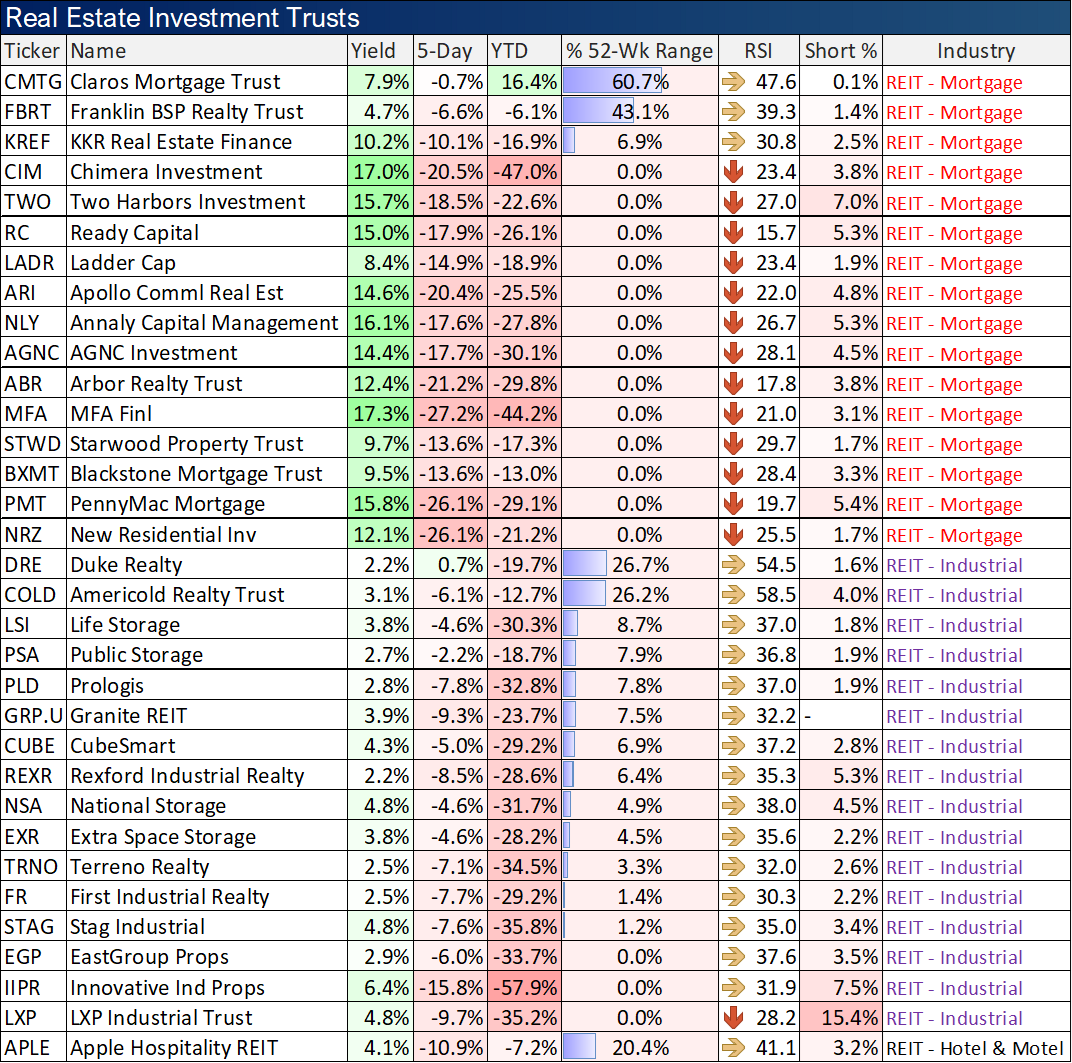

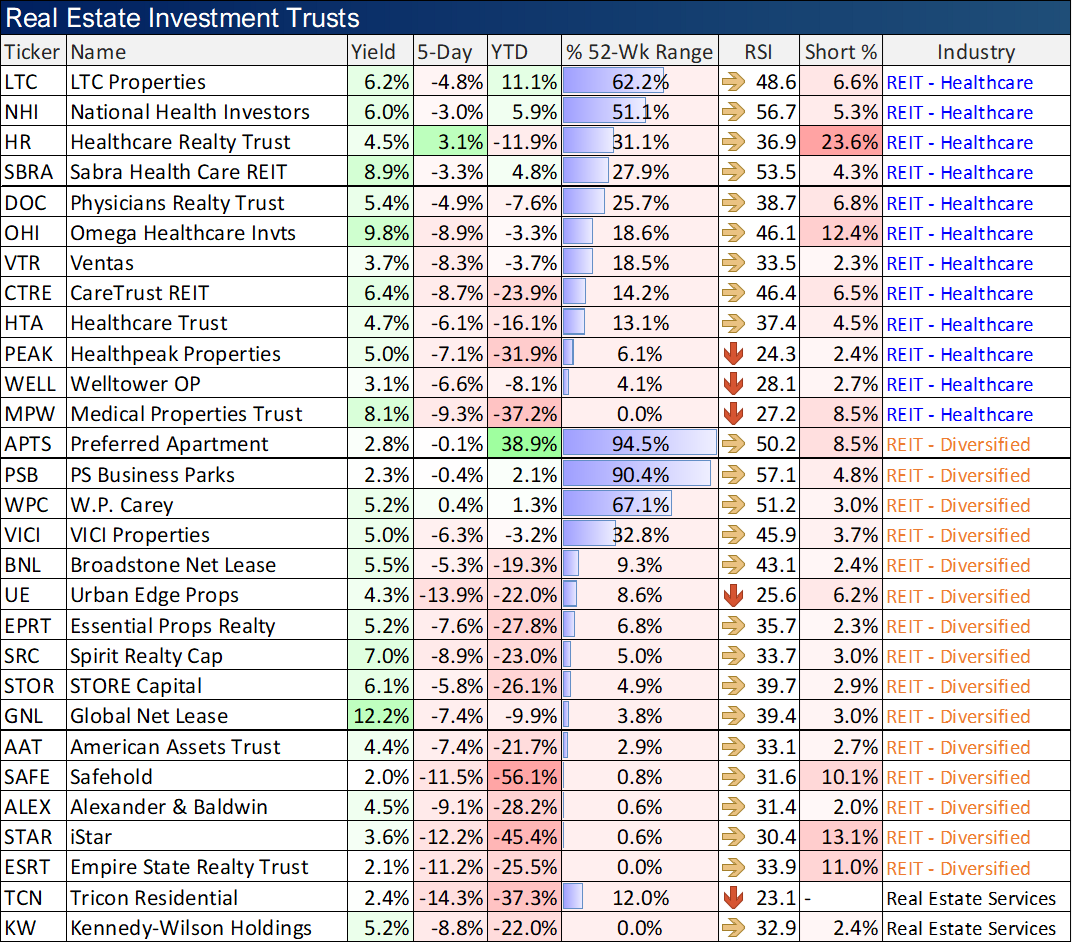

REITs can be a perennial income-investor favorite because of their often big, steady, dividend income, but they may be particularly attractive to contrarian investors now as the market has declined significantly (more so for some REIT industries than others). To give you some perspective, here is a look at the REIT sub-section of one of our favorite reports, The Big Dividend Report.

The table is organized by REIT industries (you’ll likely see at least a few of your favorite REITs on the list), and you may also notice that industrial REITs (which happen to have some very strong 5 year returns) have been particularly weak this year so far. The weakness is related to the challenging stock market in general and the possibility of slowing demand growth for industrial REITs in particular (for example, Amazon (AMZN) a massive industrial REIT customer, recently warned about a slowdown).

You may also notice in the table that mortgage REITs offer very high-yields and have absolutely plummeted this week in price. That’s because these highly levered vehicles absolutely despise the challenges short-term interest rate volatility creates for their businesses.

With that backdrop in place, let’s get into the specifics.

10. Stag Industrial (STAG), Yield: 4.8% (paid monthly)

Stag Industrial has not been spared from the recent market wide selloff (as you can see in our table above), and it has been hit especially hard because it is an industrial REIT caught up in the recent Amazon-induced selloff for that sub-industry (as described earlier). This recent sharp decline has some contrarians salivating at the opportunity to “buy low,” especially considering Stag has increased its dividend for over 10 years in a row, and the dividend yield has mathematically risen as the share price has fallen. Not to mention, Stag pays its dividend monthly (which can be particularly compelling to some investors) and it continues to benefit from the ongoing e-commerce secular trend (currently approximately 40% of STAG’s portfolio handles e-commerce activity).

However, before investing in Stag, there are some risks investors should consider. For example, we went into detail on three big ones in this report, including (1) slowing demand (i.e. Amazon is signaling challenges ahead, as mentioned earlier, (2) the risks of Stag’s single-tenant properties, which also happen to be secondary and tertiary locations (not prime) in many cases, and (3) the looming recession.

Despite the risks, we believe Stag currently offers an attractive entry point for disciplined long-term income-focused investors. We haven’t added shares yet, but it is high on our watchlist.

Bond Closed-End Funds (“CEFs”):

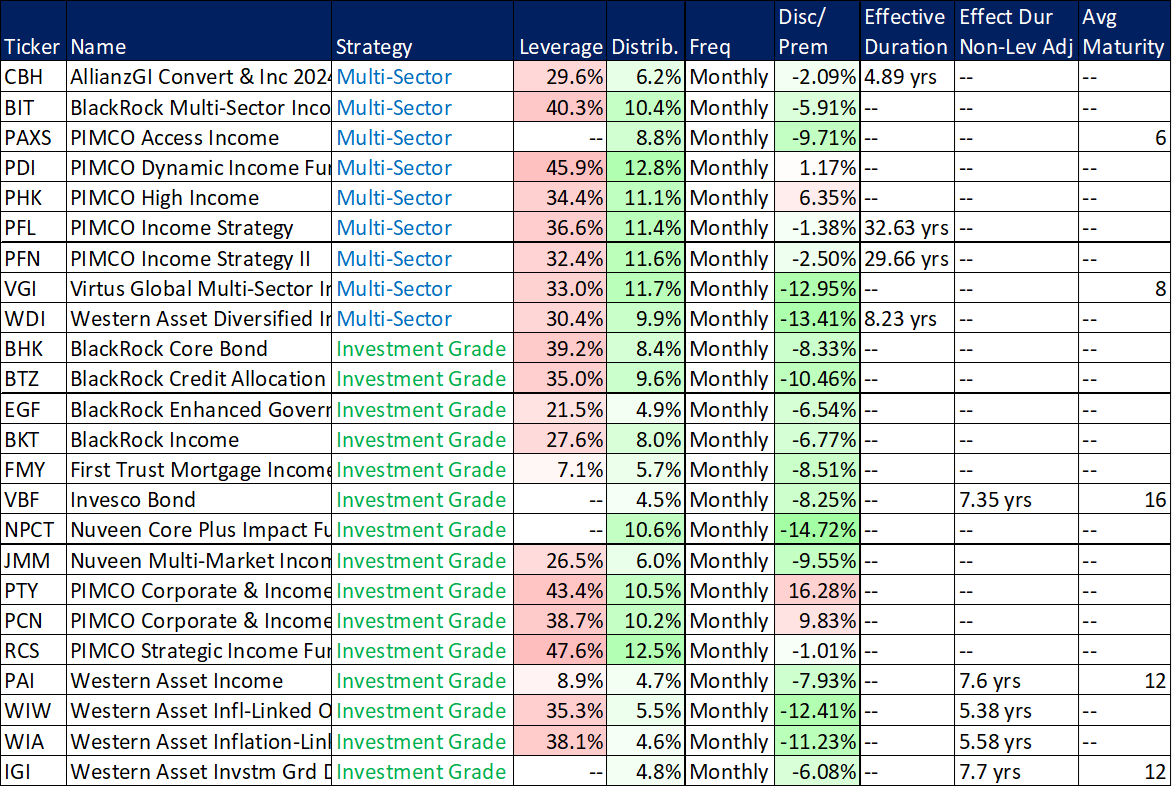

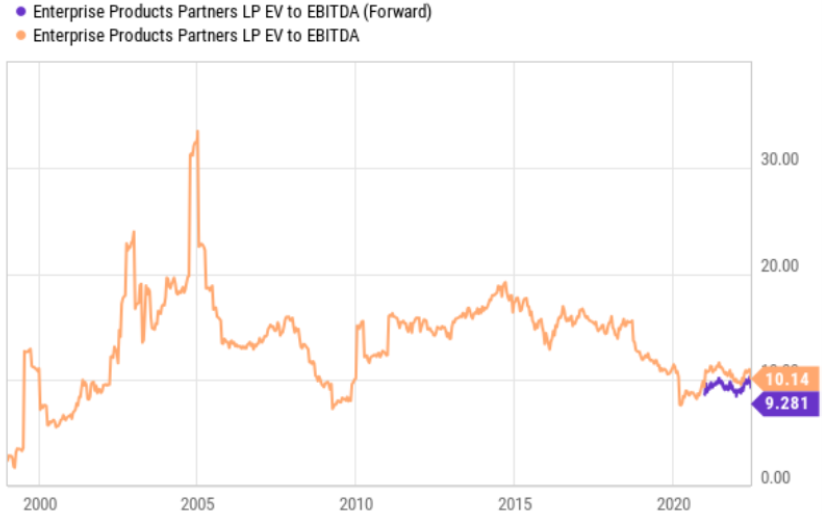

A closed-end fund, or “CEF,” is basically a basket of investments (in this case bonds) held in a single fund. This can bring the benefits of instant diversification and professional management. Also, unlike mutual funds and exchange trade funds, there is no immediate mechanism in place to ensure the market price of a CEF matches the aggregate net asset value of its underlying holdings, and as such, CEFs can trade at significant premiums and discounts to their NAVs, thereby creating risks and opportunities. To give you some perspective, here is a look at the bond CEF subsection of one of our favorite reports, The Big Dividend Report.

Aside from the discounts and premiums (prices versus NAVs), you also notice in the table that many CEFs use leverage (or borrowed money) to essentially magnify their returns and their income for investors. This can be really great during good times, but really challenging when the market sells off (like it is right now).

9. PIMCO Dynamic Income (PDI), Yield: 13.3%

PIMCO’s PDI has been an income investor favorite for years, but it is facing dire challenges this year. For starters, it owns a lot of fixed income investments (e.g. bonds) and as the Fed keeps raising rates, bond prices keep falling (as rates go up, bond prices come down). A lot of bond investors aren’t used to this because interest rates have been essentially coming down (with a little volatility) over the last 40 years straight—and now they seem set to keep going up, meaningfully!

And for PDI, the declines in the bond market have been magnified because the fund uses a significant amount of leverage (i.e. borrowed money). As mentioned, leverage can magnify returns in the good times, but magnify losses in the bad.

And making matters even worse, as PDI’s value has been falling, its leverage level has been mathematically rising. This is particularly problematic because the regulatory leverage limit is 50%, and as PIMCO funds bump into this limit (see table above), management is forced to sell underlying holdings at unattractive prices (recall, bond prices are down a lot this year). PIMCO funds ae among the most leveraged funds, fortunately they have some short duration and near-term maturity assets that help keep interest rate risks down.

And further still, PIMCO has a fair amount of higher risk (lower credit rating) assets, which presents yet another risk if we go into a deep recession (i.e. credit risk).

With all these negatives about PDI, you might be wondering how it has made it onto our top 10 list. The answer, simply, is that PIMCO can survive once the market has more clarity on future interest rates (the fed has been highly unpredictable in its recent inflation-fighting interest rate hikes) and because PDI holds a decent-amount of shorter maturity bonds that will make forced sales a little less painful than if they were forced to sell only longer-duration assets.

Further still, as the once-beloved PDI has been falling out of favor with investors, its once large premium to NAV has fallen to almost par thereby allowing investors to pick up shares at a much more attractive price.

We have owned PDI shares (and one of its predecessors, PCI) in the past, but we sold earlier this year. This year’s selloff is very different than the one we saw in early 2020 (that was a liquidity crisis that the Fed was ferociously working to end), whereas this time around it’s the Fed’s inflation-fight that is actually driving these shares lower.

In our view, once inflation is under control (and there is more clarity on interest rates) the NAV of PDI will stabilize, the roughly par-price will start to revert to a larger premium, and PDI will once again make for a very attractive high-income investment. We haven’t re-purchased shares of PDI yet, but we are watching closely, and we don’t blame aggressive contrarian investors for at least starting to invest here (considering the large price decline and more attractive price versus NAV).

Energy Stocks

Just two years ago, much of the energy sector was left for dead. But with the recent record inflation, declines in domestic production and the horrific Russia-Ukraine conflict, the energy sector has soared dramatically higher.

8. Enterprise Products Partners (EPD), Yield: 7.7%

Enterprise Products Partners provides midstream oil and gas services. Its business is based largely on long-term fees which insulate it from shorter-term energy price volatility. However, the recent spike in energy prices strengthens the businesses of many of EPD’s customers (i.e. less chance of bankruptcies and default) thereby strengthening EPD’s business over the long term.

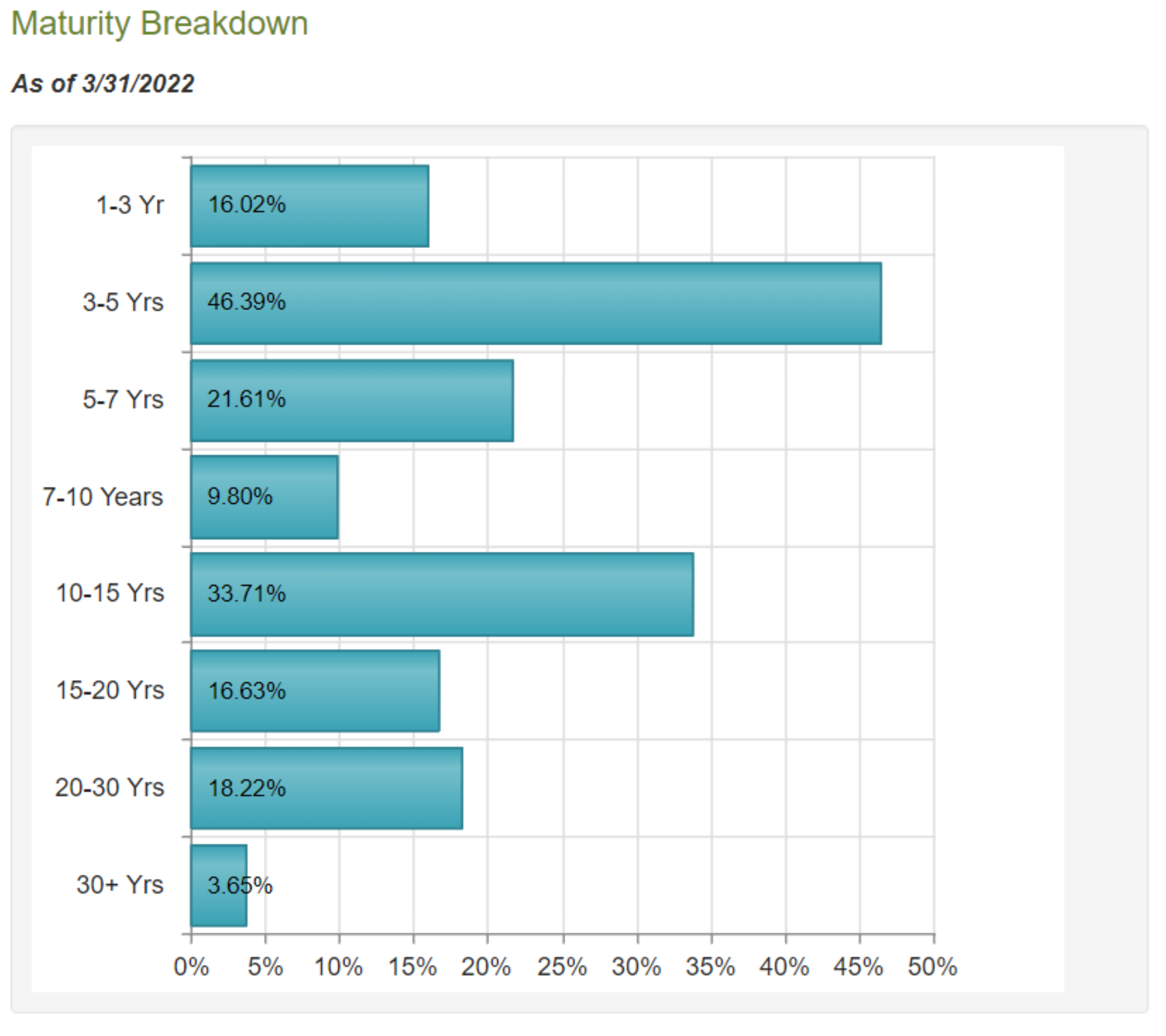

EPD has advantages over peers, including is extensive midstream network (including over 50,000 miles of natural gas, NGL, crude oil, refined products and petrochemical pipelines), relationships with major energy companies, a large platform for expansion and a cost of capital (~7%) below its return on invested capital (~9-10%) thereby making it a very profitable business. And trading at a forward EV/EBITDA of below 9.3x—makes EPD quite attractive in our view.

Important for investors to note, EPD is organized as a master limited partnership (“MLP”) which means different tax treatment and receiving a K-1 statement at tax time. This is especially important if you own EPD in an IRA because it could actually trigger some tax consequences if your position generates more than $1,000 in unelated business taxable income. Specifically:

“If your IRA earns more than $1,000 in unrelated business income as reported on the K-1s you received, the IRA must pay unrelated business income tax – UBIT – on the amount above the $1,000 cutoff. Not all of the distributions you receive from MLP investments will be UBI, and many partnership investments will report little or no UBI on the K-1s they send out. If the K-1s you received total to less than $1,000 in UBI, there is nothing you need to do. With more than $1,000 in UBI you need to contact your IRA custodian.” -Zacks

For some investors, the MLP structure is not an issue, but for others (particularly large IRA holders), avoiding MLPs can make life easier (and less expensive). Nonetheless, Enterprise Products Partners is one of the most attractive income investments around considering its strong business, lower share price (and valuation) and its large distribution payments to investors.

Blue-Chip Dividend-Growth Stocks:

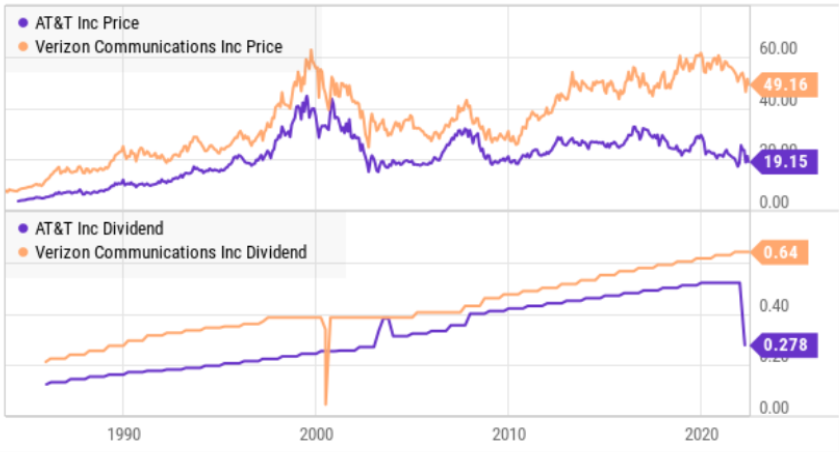

One of the most common (and costly) mistakes income-focused investors make is to chase after the highest yields instead of the best yields. Everyone’s situation is different, but sometimes it can make a lot more sense to focus on “yield on cost” instead of simply pursuing simply the highest “current yield.” For example, we have been a long-term owner of Verizon (VZ) instead of its competitor AT&T (T), even though AT&T offered a much higher yield for many many years. We warned of the dangers of chasing after AT&T’s high yield years ago (see AT&T’s Dividend, It’s a Red Herring), and unfortunately those fears came true. Verizon has been a much better investment from a total return basis (while AT&T’s dividend has been cut and its share price performance has been terrible).

7. Verizon (VZ), Yield: 5.2%

When it comes to investing, there comes an important point in many investors’ lives where investing becomes more about protecting your nest egg than growing it. And with the new macroeconomic paradigm increasingly taking hold, Verizon is interesting. Not only is it a value stock, but it also pays a large dividend that has been growing every year for 18 years straight. Granted, the 5.2% dividend yield won’t even cover the current 8.5% level of inflation in the economy, but the dividend plus long-term price appreciation probably will, and of course the Fed is dead set on bringing inflation down—seemingly no matter what the collateral damage to stocks (especially volatile growth stocks) in the process. If you are looking for a big-growing-dividend value stock, shares of Verizon are worth considering.

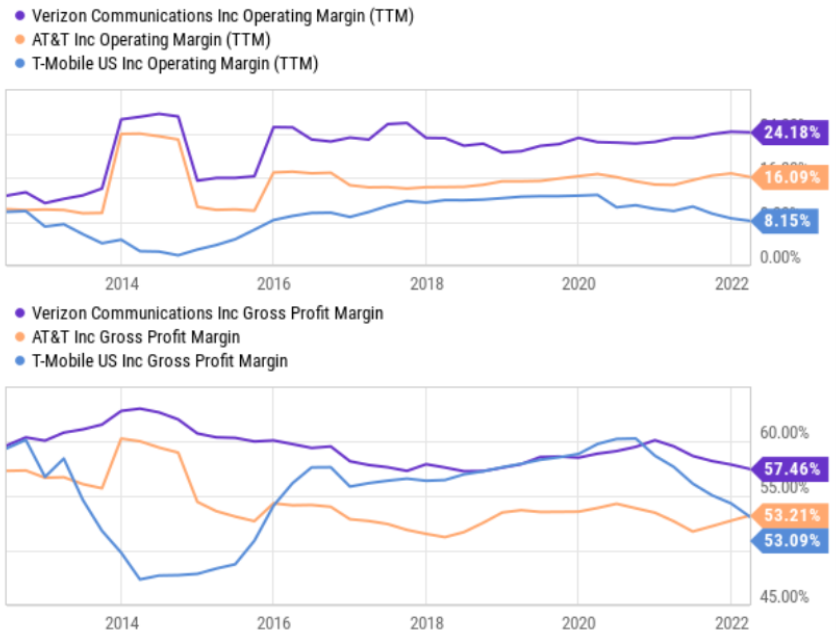

For some additional perspective on Verizon, we also like it because it is not a yield-chaser stock, like its competitor, AT&T. AT&T set its dividend too high for years (to appeal the the yield-chasers) and ultimately was forced to reduced the dividend dramatically and AT&T shares fell hard. Yet despite AT&T’s supposedly right-sized dividend now, it still has lower margins than Verizon, and AT&T continues to rely on inorganic growth efforts, unlike organic-growth Verizon. We warned of the dangers of AT&T’s over-extended dividend back in 2015, and we were right considering the dividend was dramatically reduced and the total returns have been terrible for the last 7+ years.

Of course there are risks to Verizon too (such as slower growth than some stocks, regulatory risks, an anemic legacy wireline business and of course the threat of an ugly recession—although Verizon is a lot better positioned for recession than most). Nonetheless, if you are an income-focused value investor that likes dividend and share price growth, Verizon is worth considering. We are currently long shares of Verizon.

Business Development Companies (“BDCs”):

BDCs are basically finance companies that are focused on making loans (and sometimes taking equity stakes) in smaller (or middle market) businesses. BDCs were created by Congress in the 1980’s to help smaller business grow, and similar to REITs, BDCs can avoid corporate income tax if they pay out 90% of their net income as dividends. As such, BDCs are another often popular investment category for income-focused investors.

In theory, rising interest rates are a good thing for BDCs because it increases their net interest margins. Like traditional big banks, BDCs borrow money at a lower rate and then lend it out at a higher rate, and the profit margin between those two increases as rates rise. The problem is that BDCs make loans to riskier businesses than big banks, and when rates rise it can cause a lot value-destroying turbulence (e.g. defaults) for BDCs. As such, investors need to be cautious about which BDCs they invest in, and where we are in the market cycle when they invest.

6. Owl Rock Capital (ORCC), Yield: 10.1%

Owl Rock is a well-managed big-dividend BDC that focuses on upper middle market companies and that trades at an increasingly attractive market price relative to its long-term value. And the shares also trade at an attractive discount as compared to their mostly recently reported quarterly net asset value. We recently wrote in great detail about Owl Rock for our members, and you can read a copy of that report here.

5. VICI Properties (VICI), Yield: 5.0%

VICI Properties Inc. (VICI) is a triple net lease REIT that owns properties in the gaming and entertainment industry. For example, VICI’s largest tenant is Caesars Palace in Las Vegas, Nevada. More specifically, VICI’s portfolio consists of 29 gaming facilities comprising over 47 million square feet, approximately 17,800 hotel rooms and over 200 restaurants, bars, nightclubs and sportsbooks (both in Las Vegas and in regional markets throughout the US). VICI also owns four championship golf courses and 34 acres of undeveloped land adjacent to the Las Vegas Strip.

VICI’s business and shares currently offer a number of attractive qualities, including enhanced scale, marquee S&P500 tenants, industry leading lease duration, an embedded growth pipeline, a strengthened credit profile, a well covered 5% dividend yield, and a compelling valuation (it trades at a forward price-to-FFO of around 15.2). In our view, all of these things combine to make VICI an attractive opportunity for income-focused investors that also like share price appreciation potential. We recently purchased shares of VICI in our Income Equity Portfolio, and you can read our previous report here.

4 . Exxon Mobil (XOM), Yield: 3.9%

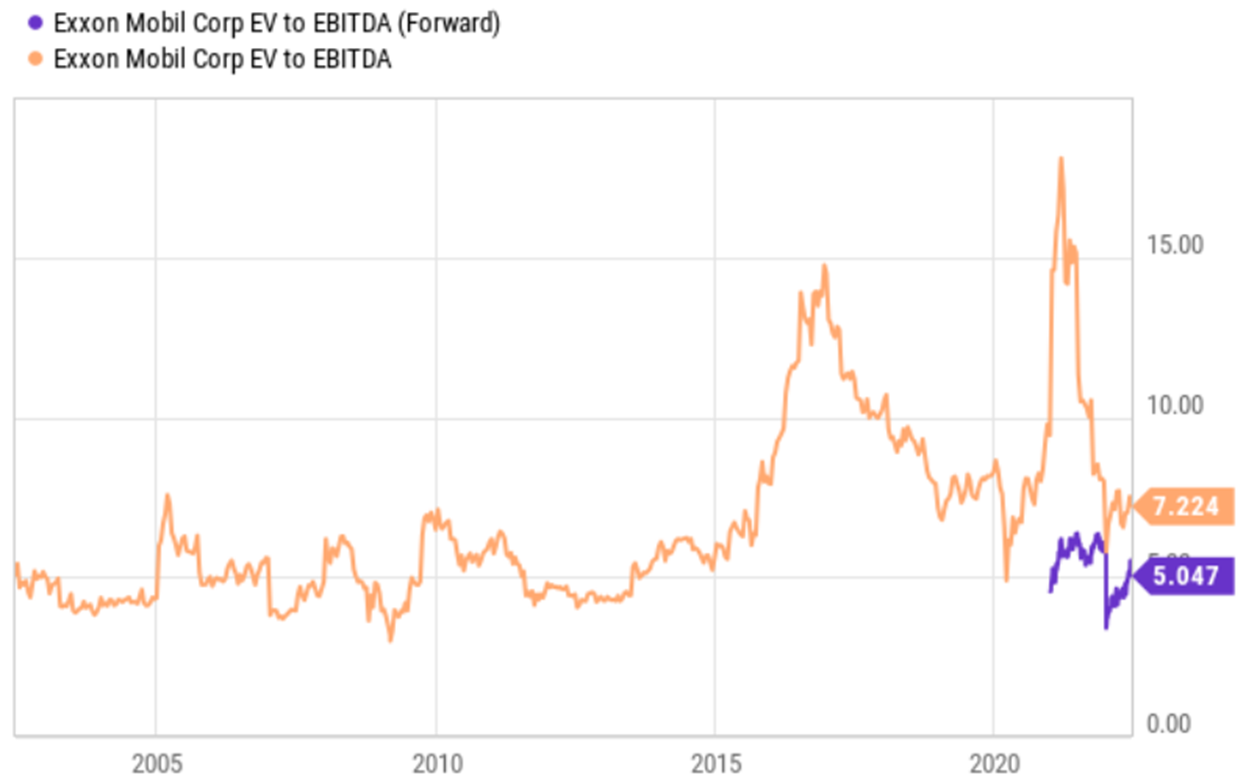

When it comes to the challenging macroeconomic environment we are in right now, whereby the Fed is raising rates to to fight inflation, but simultaneously driving us into recession by slowing growth, commodity-tied business, such as Exxon Mobil, can be extremely attractive, considering they can pass on cost to customers due the price inelasticity of oil and gas. And this attractiveness is bolstered by the horrific Russian-Ukraine conflict (which has disrupted energy-supply, thereby driving up prices) and the current US administrations disdain for domestic energy production. Energy stocks soared during the stagflation environment that existed in the 1970’s and may soon exist again in the 2020’s. Despite the strong gains already this year, energy stocks can go higher, and Exxon is a basic attractive way to play it.

While many peers have adjusted their strategies to focus more on renewables going forward, Exxon Mobil has remained committed to oil and gas—which will ultimately serve it very well in this environment. Exxon currently trades at only 5.1 times forward EV/EBITDA which leaves it plenty of room for upside, especially in this environment. We are currently long Exxon Mobil in our Income Equity Portfolio.

3. Main Street Capital (MAIN), Yield: 7.5%

BDC Main Street Capital takes debt (it makes loans) and equity (it takes partial ownership) positions in the companies it provides financing too, and it eliminates a lot of the company-specific risks by prudently diversifying and through its experienced management team.

Our basic thesis for Main Street Capital is that the price is down (and the valuation is attractive) due to the current market cycle (the fed is raising rates to slow inflation), and investors will get paid a big, healthy, monthly dividend as they wait for the shares to eventually rebound. The rebound will be driven by higher rates (similar to a traditional bank, MAIN will earn a higher net interest margin as rates rise) and the shares will also benefit as the market eventually recovers from the current slowdown (mainly a slowdown in share prices so far). We currently own shares of Main Street Capital, and you can read our recent report on this BDC here.

2. PIMCO Dynamic Income Opps (PDO), Yield: 10.3%

PDO is a bond CEF, and it has many of the same attractive qualities as PDI (mentioned earlier in this report) only better. PDO is a relatively new CEF that offers a big distribution (that has thus far consisted of no return of capital or capital gains, similar to PDI). However, better than PDI, PDO currently trades at a significant discount to NAV (as you can see in our earlier bond CEF table) and this makes for an even more attractive entry point.

Obviously, these levered bond funds face significant risks (both interest rate risk and credit risk), but the reality is that PIMCO is an exceptional bond fund manager, and the fund is positioned to survive (and keep paying big distributions) considering its current holdings and liquidity. We don’t own PDO yet, but we may purchase shares in the near future, especially if inflation starts to slow, which would be a pretty good indication that the Fed will ease up on the interest rate hikes, potentially driving PDO’s price and NAV higher, via reduced interest rate risk, reduced credit risk, and the potential for the rare price discount to revert back to a significant premium.

1. Realty Income (O), Yield: 4.6%

Rarely do you get an opportunity to purchase a blue-chip company, that is also a monthly-dividend-paying REIT, at such an attractive low price. Realty Income owns largely Internet-resistant properties in highly attractive locations, and the shares are attractively priced. Not only have they not yet fully recovered from perceived pandemic risks, but the recent selloff (as the overall market has tanked) makes for a highly compelling entry point. We currently own shares of Realty Income in our Income Equity portfolio, and we look forward to share price appreciation and continuing dividend growth (it has grown its monthly dividend for 25 years in a row).

Conclusion:

To qualify for this list, we required at least a 4% yield (Exxon Mobil squeaked in at 3.9%). But in reality, there are a lot of particularly attractive dividend stocks with yields closer to 3%, and you can view the ones we currently own in our 30-stock Income Equity Portfolio here. Not only do the holdings in this portfolio offer attractive dividend income, but many of them are growing their dividends regularly and significantly (remember the incredibly power of “yield on cost”), and they also offer price appreciation (it’s one thing to chase after a big dividend yield (like AT&T 5 years ago), but it’s something different to own an attractive growing dividend payment (think yield on cost) that also offers powerful share price appreciation). What good is a 10% dividend yield if the value of your investment declines by 12% every year (your “net” return is a loss of 2%—yuck!). At the end of the day, disciplined goal-focused long-term investing has proven to be a winning strategy throughout history, and it will this time. Be smart. Know your goals—stick to your plan.