This high-level report shares data on hundreds a big-dividend investments, sorted by categories (such as REITs, BDCs and energy stocks). We highlight a few key takeaways and leading opportunities for investors to consider.

*Data is as of Friday’s close.

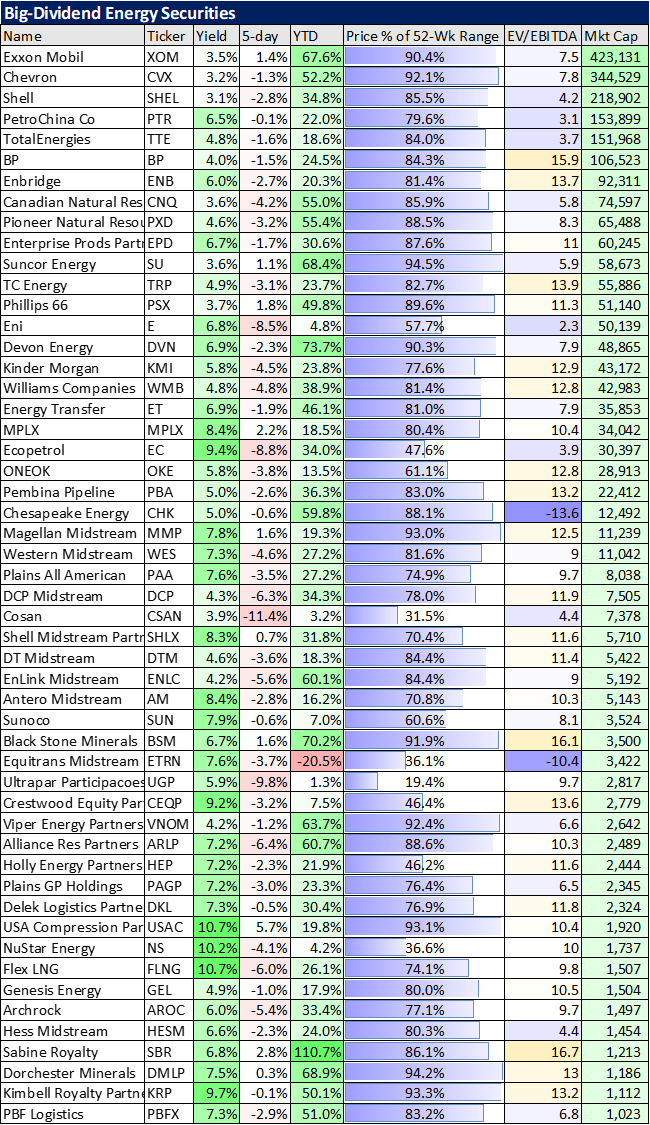

Energy Sector:

For starters, it is no secret that energy stocks have been on fire this year, posting huge gains as the combination of inflation, the Russian-Ukraine conflict and the current administration’s disdain for domestic energy production has driven energy prices dramatically higher.

Worth noting, most energy stocks were down a bit over the last 5 days (red bars), but are still up dramatically this year (orange bars):

For those of you that like to dig deeper, the following table includes a variety of big-yield energy investments for you to consider. The list is sorted by market cap. Noteworthy (but not surprising), many energy stocks sit close to the top of their 52-week price range. The red column (5-day returns) shows energy was down this week if you were waiting for even a small pullback before buying shares.

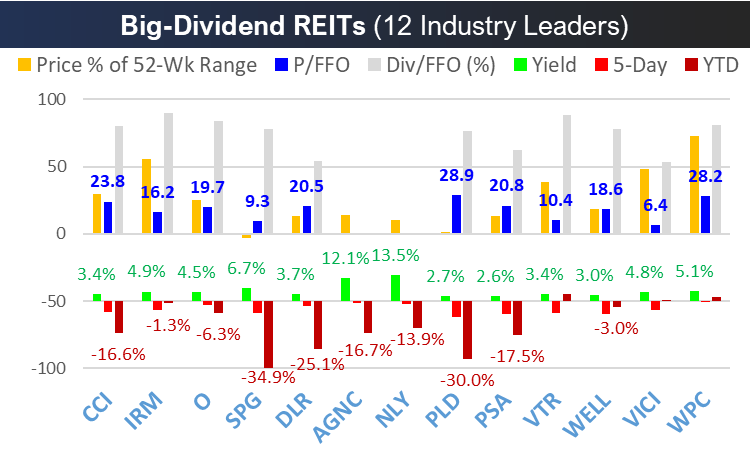

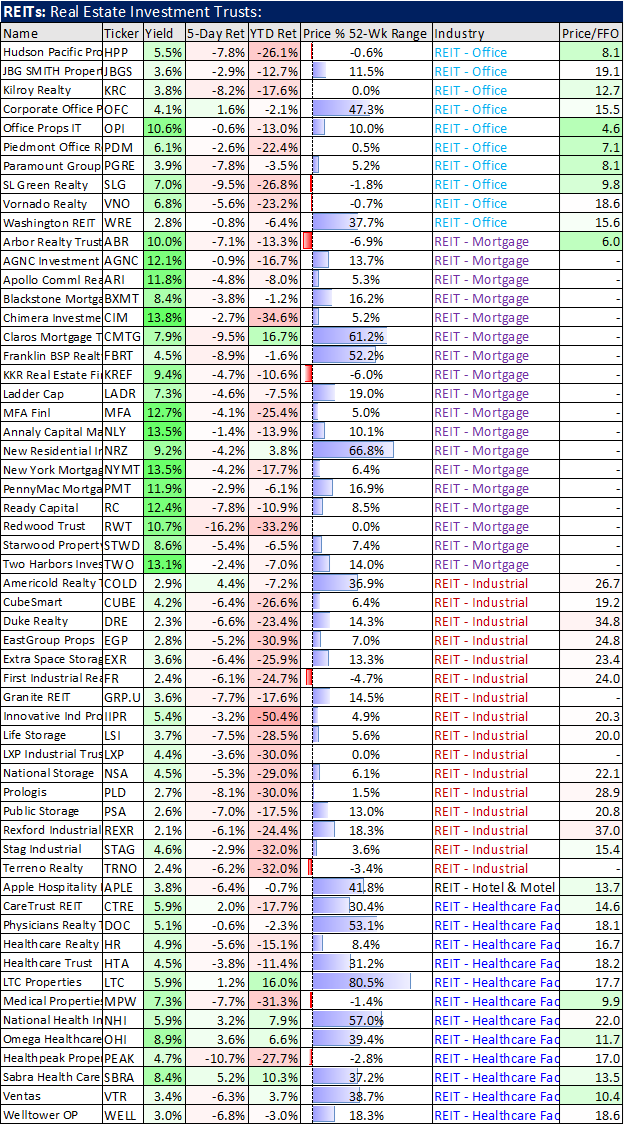

Real Estate Investment Trusts (REITs):

This next chart shows how a variety of leading REITs have been performing, and not surprisingly—they are mostly down this year (see red bars) as the broader market is down significantly. The big-yields (green bars) can make the down drafts more tolerable, and may REITs continue to cover their dividends with FFO (gray bars) and trade at somewhat more reasonable Price-to-FFO valuations—as near-term economic turmoil and interest rates weigh them down this year.

This next table sorts big-dividend REITs by industry, and as you can see in the 5-day return column—REITs just had another very rough week. Assuming the macroeconomic situation eventually calms down, now can be an attractive opportunity for long-term contrarian investors to consider adding shares.

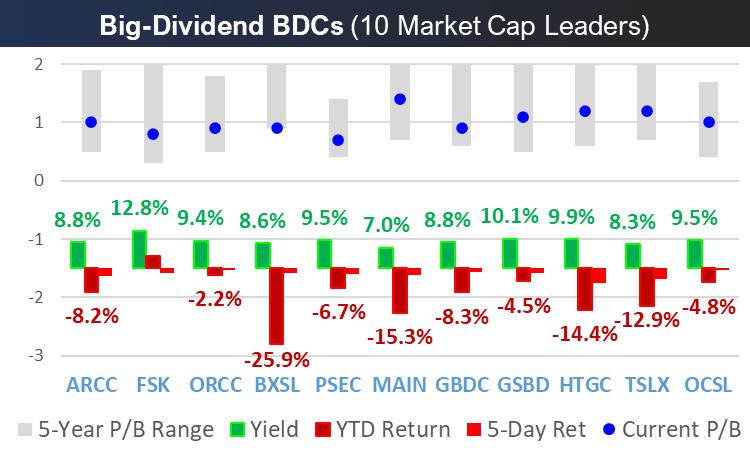

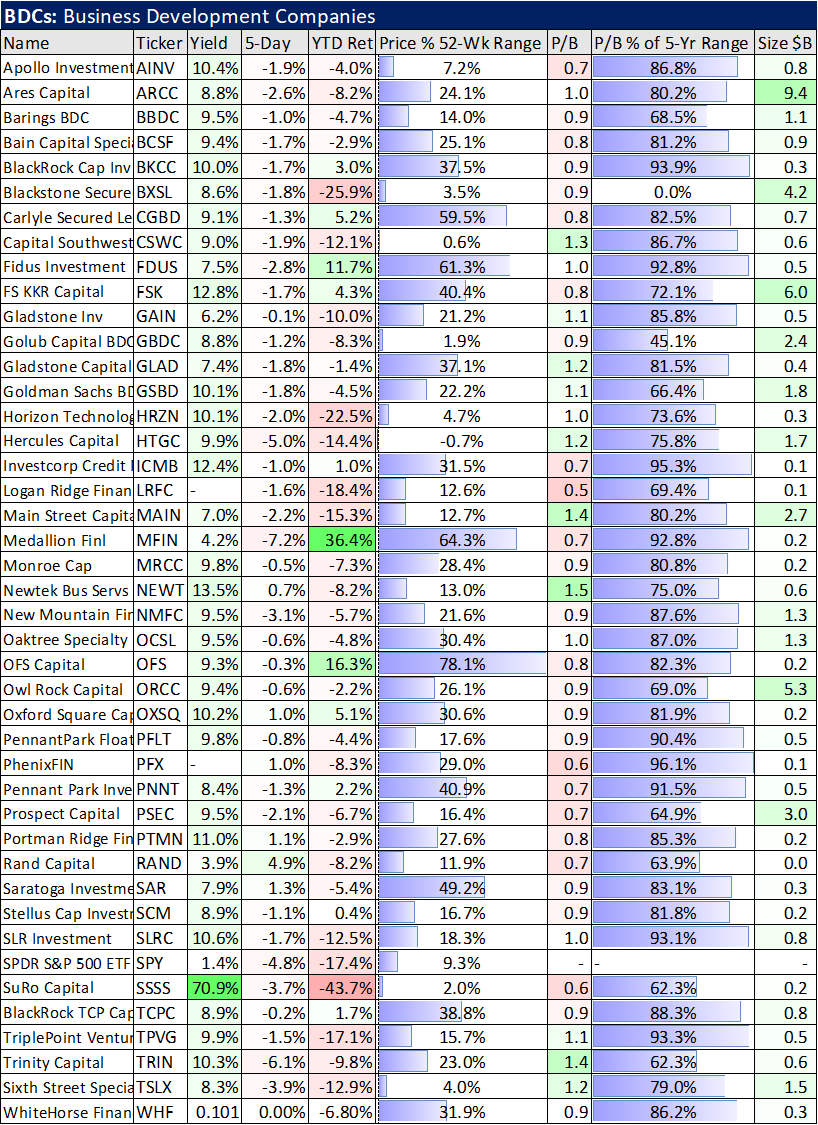

Business Development Companies (“BDCs”):

This next chart shows how some of the largest BDCs performed over the last week and year-to-date. As you can see, many sit just below a price-to-book value of one—a level some consider attractive.

Noteworthy, this next detailed table shows that despite prices being much closer to the bottom of their 52-week price range, price-to-book values are not quite as depressed—suggesting book values (reported quarterly) have fallen right along with the price this year.

Takeaway:

Markets continue to struggle mightily as inflation rages on, and the government is stuck between a rock and a hard place as they weigh the benefits of raising interest rates to fight inflation against the risks of such actions slowing the economy and driving us into recession. It’s an entirely different world now if interest rates really are set to keep rising significantly in the months ahead, considering they’ve been generally coming down for the previous 40-years. We continue to be optimistic in the long-term (this too shall pass), the question is when and how much more might the market fall before then. At the very least, the big-dividends that many of these investments pay can help soften the blow of overall market declines as the dividend income keeps rolling into your account. Disciplined, goal-focused, long-term investing has been a winning strategy repeatedly throughout history—and we believe it will be this time too.