The share price of steady dividend-growth stock, Verizon, is still down more than 11% following its latest earnings release. And the 5.2% dividend yield is increasingly tempting for many income-focused investors (especially in our current volatile market). But the outsized dividend doesn’t come without risks. In this report, we review Verizon’s business, its dividend safety, the current valuation and four big risks the company currently faces. We conclude with our opinion on who might want to consider investing.

Overview:

Verizon is one of the three biggest telecom companies in the US (AT&T and T-Mobile are the other two). The business basically consists of its larger wireless business (which continues to grow, and generates most of the profits) and its smaller wireline business (which continues to shrink, and generates little profit). The company basically touts its “Network-as-a-Service” strategy, as it enables the 5G economy.

Two of the main reasons many investors have historically liked Verizon is because the telecom business is considered “safe” (people are assumed to keep their phones, even when the economy gets tough), and because Verizon offers big dividend payments to investors that have increased every year for the last 18 years (i.e. it’s a dividend-growth stock).

The Dividend:

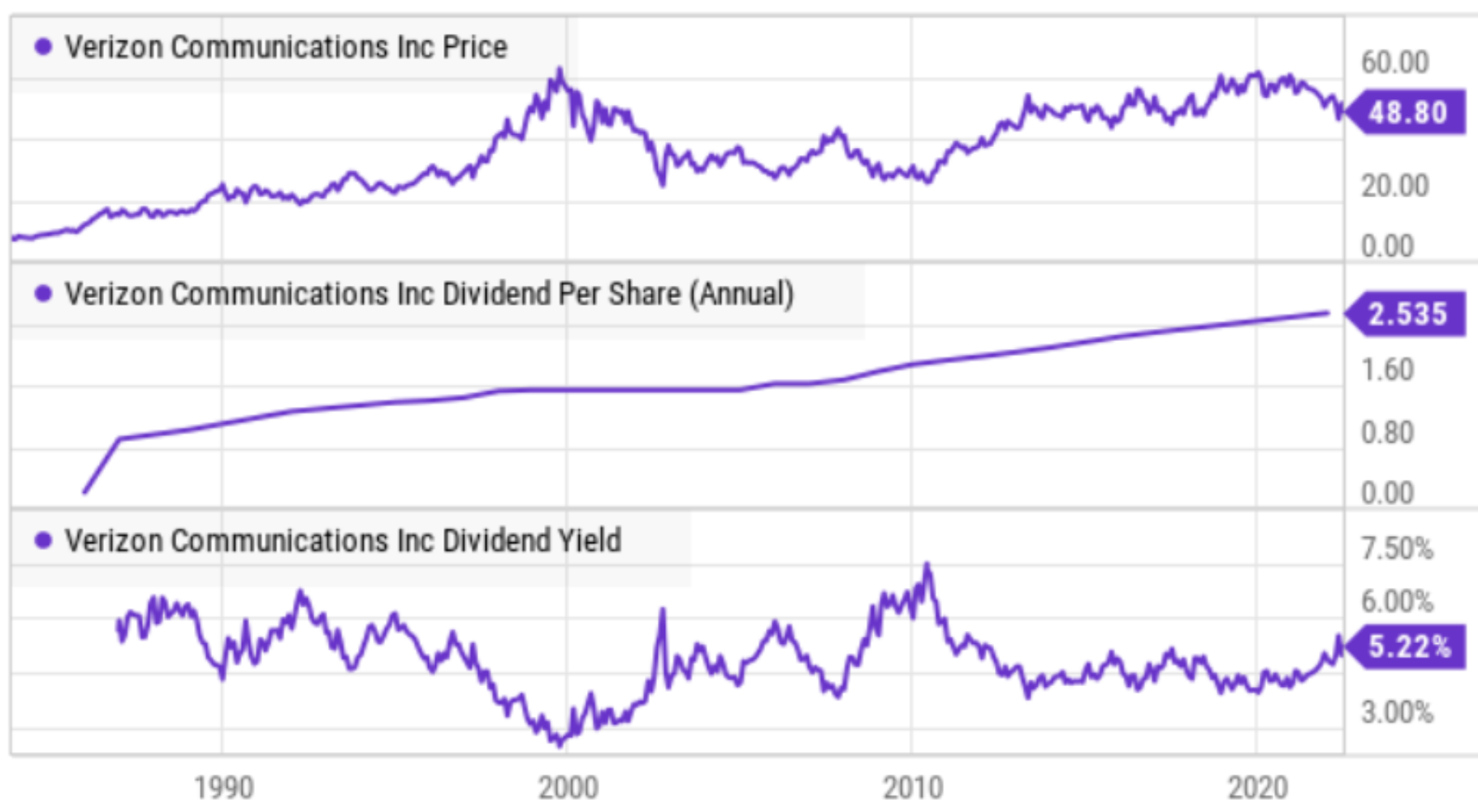

Here is a look at Verizon’s dividend, dividend yield and share price over the last ~40 years.

As you can see, the share price has increased at a reasonable clip over time (it’s had some volatility, but not nearly the same level as high-flying growth stocks), and the dividend payment has also increased steadily over time. You can see the dividend yield ebbs and flows mathematically as the share price goes up and down, but it is the steady growing dividend payments that so many investors have come to trust.

Also important to note, Verizon has an investment grade credit rating, and it generates plenty of free cash flow (cash flow from operations minus capital expenditures) to cover the dividend.

Valuation:

As mentioned, the share price of Verizon fell sharply after its most recent earnings release, and the reason is because it lowered revenue guidance, as you can see in the following chart.

However, the reduced guidance wasn’t really through any fault of its own, but rather due to Universal Service Fund reductions (a subsidy risk factor we will discuss in the risks section), and to some extent Verizon’s wireline business is still recovering from the pandemic. Verizon CFO Matt Ellis explained in the quarterly call:

“Based on our current expectations, we are updating our guidance for the year. On the revenue side, we now anticipate service and other revenue to be approximately flat to 2021, significant items affecting our service and other revenue include USF rate reductions, which are pressuring year-over-year revenue by several hundred million and softness in wireline sales.”

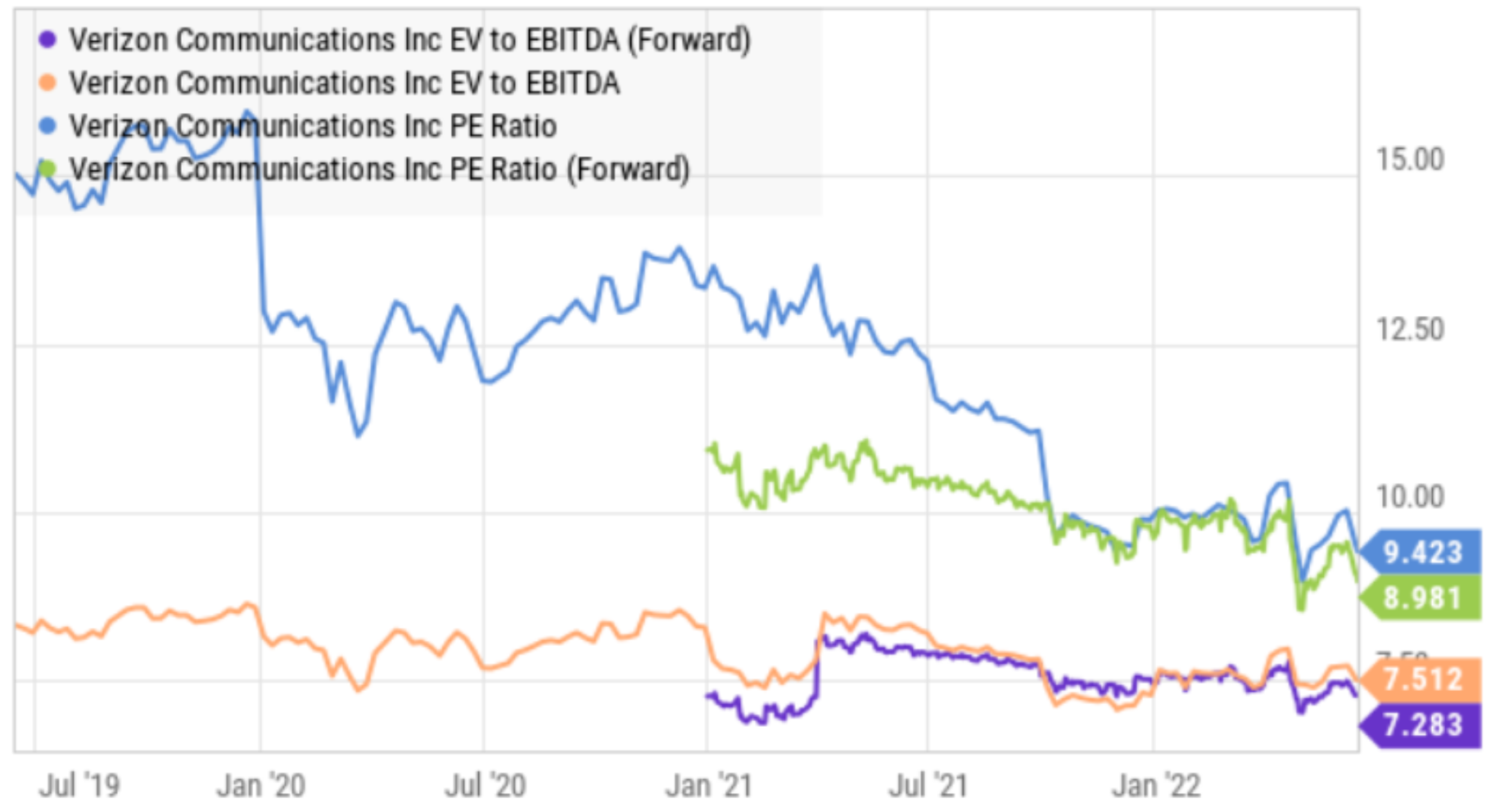

On a price multiples basis, Verizon trades at a very reasonable level as compared to its ongoing growth expectations (as shown in our earlier guidance table). For example, here is a look at recent price-to-earnings and EV-to-EBITDA for Verizon, and they sit a bit lower than historically.

According to an April 22nd note (right after the earnings release), Morningstar analyst Michael Hodel believes the shares have upside:

Our $59 fair value estimate equates to roughly 8 times our 2022 EBITDA forecast. Our valuation also implies a 6% free cash flow yield in 2022, with our free cash flow estimate down significantly versus 2021 on higher capital spending, working capital needs, and cash taxes.

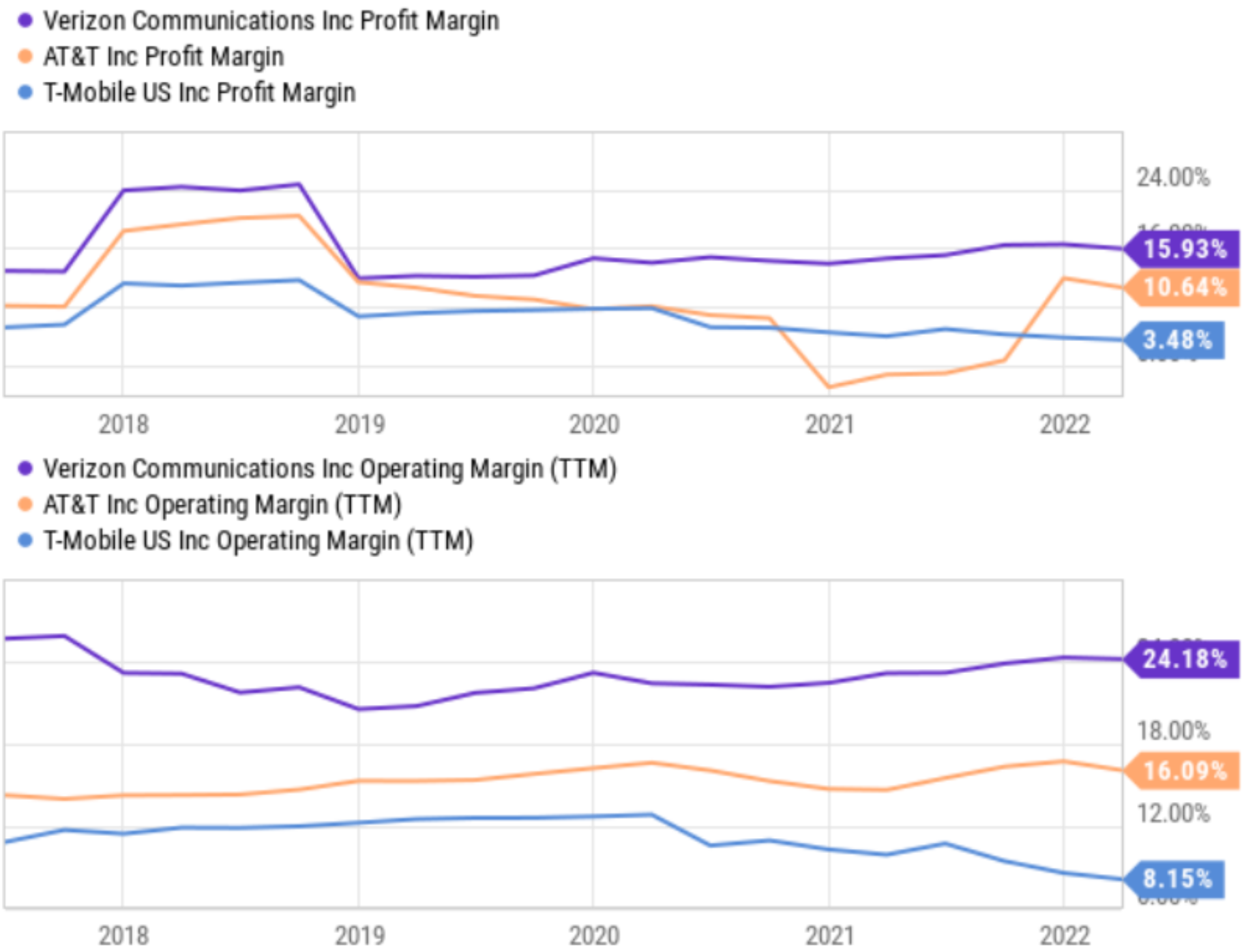

Also important to note, Verizon is profitable with relatively strong margins. For example, here is a look at Verizon’s operating and profit margins versus peers, AT&T and T-Mobile.

Not only does Verizon’s business have better margins, but this also has allowed Verizon’s business to remain largely organic, while peers are forced to look to messy acquisitions to try to improve their businesses.

Risks:

Of course Verizon also faces risks that should be considered. Here are four of them:

Slow Growth: Verizon is not a high-growth business, and as such the share price will not reach the long-term highs that many faster growing growth stocks eventually will. However, Verizon will also likely not experience anywhere near the same level of high volatility as some top growth stocks. One of the reasons many investors like Verizon is the steadiness of the business and especially the steadiness of the big growing dividend. There is likely a long-term opportunity cost to owning Verizon (because it isn’t growing as rapidly as some stocks), but to many investors—that is perfectly acceptable based on their own individual goals.

Regulation: As mentioned, Verizon faces regulatory risks. For example, one reason the company just lowered revenue guidance is because they’ll be receiving less subsidies from the Universal Service Fund (“USF”). This fund is managed by the Federal Communications Commission (“FCC”), and it’s basically a system of subsidies to increase access to telecommunications across the US.

Rising Rates and a struggling economy are another factor investors need to be aware of. Verizon has significant debt on its balance sheet, and as the Fed continues to raise rates—Verizon will eventually be forced to refinance debt at higher rates—which will increase debt expenses. Further still, as the Fed raises rates to fight inflation, it also slows economic growth and risks pushing us into an ugly recession—which would impact essentially all businesses, including Verizon. However, even in this situation, Verizon remains relatively attractive versus other “higher beta” companies that would be negatively impacted more severely in a recession (not to mention, Verizon’s big dividend helps a lot of investors psychologically weather any share price volatility).

Legacy business is dying: It’s no secret that Wireless has continued to cannibalize legacy Wireline business for telecommunications companies across the industry. And while Verizon has not been spared from this secular trend, it has remained ahead of the curve building a reputation for the strongest wireless network across the industry, while it also hangs on to a small level of profitability in the wireline business. Worth mentioning, this trend towards wireless has increased competition (because it’s now a lot less expensive to build and maintain a network) and it has also weakened Verizon’s balance sheet a bit (although it does continue to maintain a strong investment grade credit rating).

Conclusion:

So considering the busines and the risks, who should invest in Verizon? If you are an income-focused investor—you might want to consider owning the shares. Not only is the dividend big, growing and well supported by the business, but the share price is attractive relative to the long-term value of the business (i.e. the shares have upside potential from here). And while Verizon will likely never ever achieve the ultra-high growth that some younger and more innovative/disruptive companies will, that is totally fine with a lot of long-term Verizon shareholders seeking a little long-term price appreciation with a lot less volatility, plus some big, steady, growing dividend income. We are currently long shares of Verizon in our Income Equity portfolio.