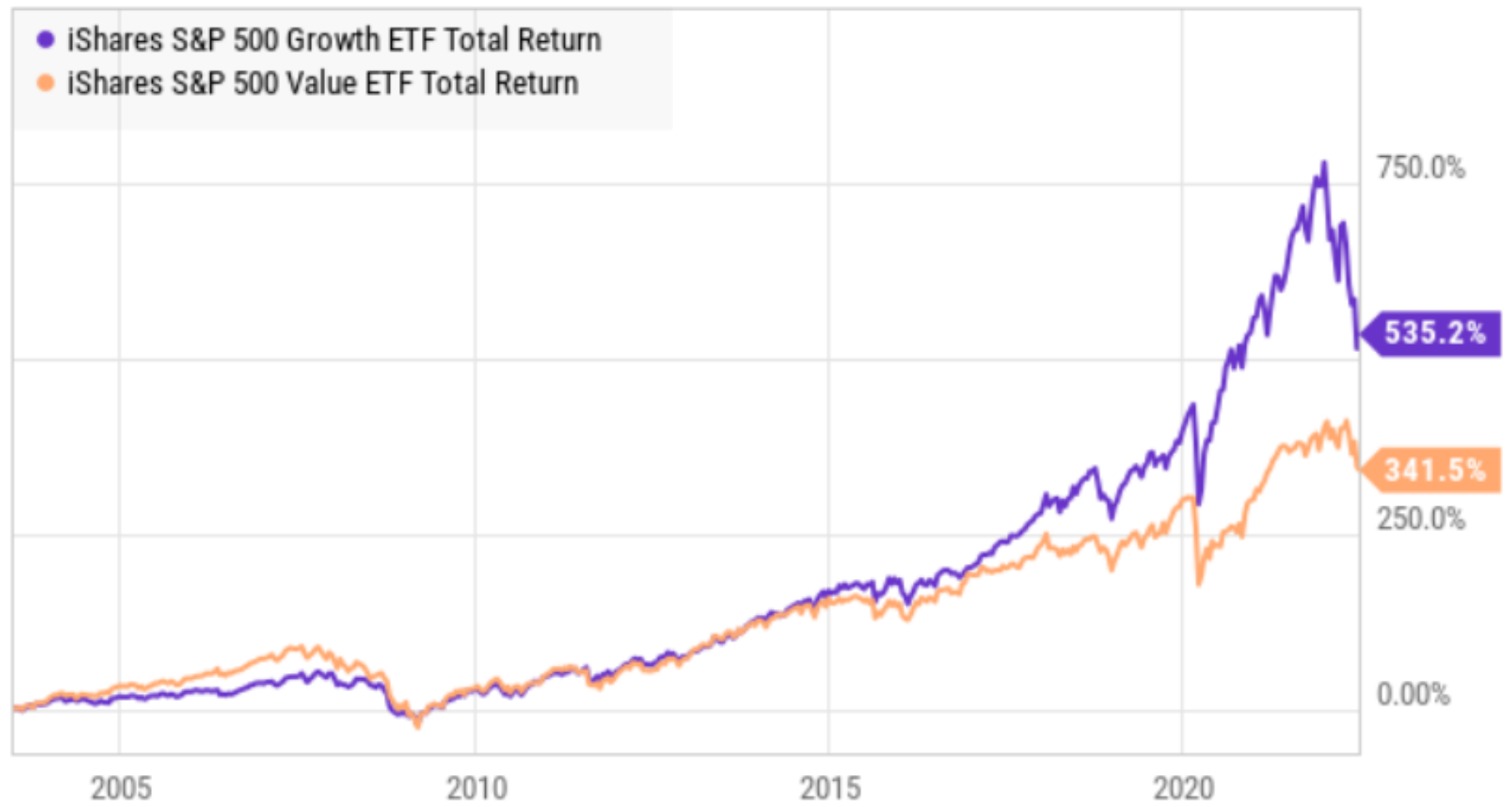

In the “olden days,” it was widely accepted that value stocks outperform growth stocks over the long-term. But as central bankers have gotten increasingly involved in the last few batches of market cycles, growth stocks (supported by easy money) have been dominating—until this year. And if the US Fed’s now increasing interest rate trajectory is any indication, value stocks may again return to extended periods of outperformance. Shares of diversified industrial company, Honeywell (HON), fall into the value stock category, and may be worth considering. This report reviews Honeywell’s business, its valuation and risks, and then concludes with our opinion on investing.

Growth Versus Value Debate:

Before diving into Honeywell, here is a quick look at the recent performance of value stocks versus growth stocks. Even after this year’s terrible performance (so far) for growth stocks, they’re still way ahead of value over the last decade, and still could have quit a bit of room to fall further, relative to value.

For example, the empirical data for value over growth is explained in the link above, but from a psychological standpoint, one explanation is that people get over-excited by growth stocks and over-averse to value stocks in the short-term, and then in the long-term the fundamentals erase these short-term psychological biases.

However, with the Fed now increasingly hawkish, semi-famous value investor, Cliff Asness says value stocks remain very attractive (and set to outperform growth) And as an interesting side note, Asness likes both Amazon (AMZN) and Facebook (META) from a value stock standpoint. He also stress the importance of relative value within market sectors, meaning he likes to find value opportunities in each sector (instead of betting on one sector versus another). We view Honeywell as an attractive industrials value stock, so let’s get into the details.

About Honeywell:

Based in Charlotte, NC, Honeywell is a diversified industrials company that offers a wide range of products, such as these.

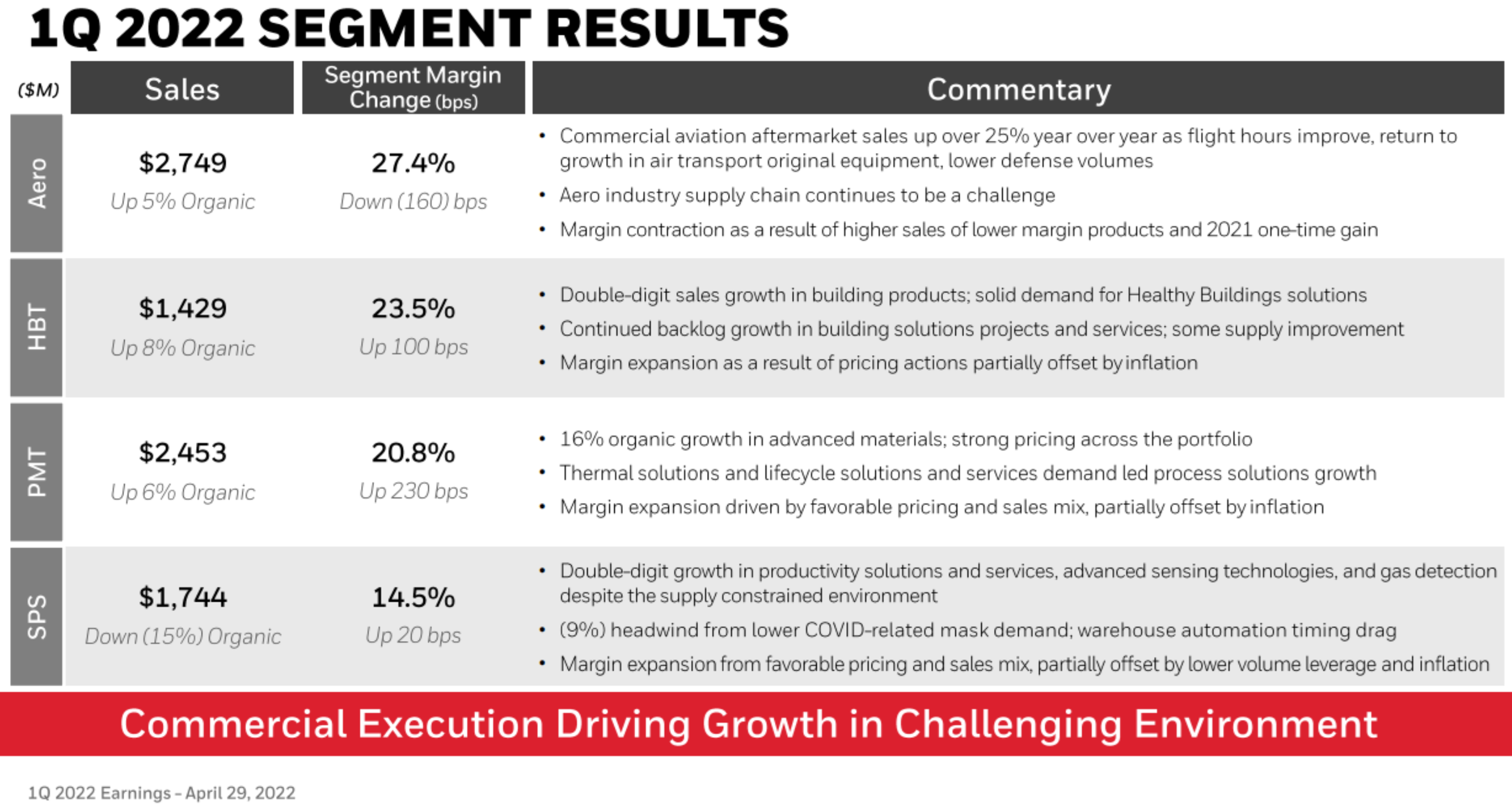

And Honeywell divides its business into four main segments: Aerospace, Building Technologies, Performance Materials and Safety/Productivity Solutions. Each segment has healthy high margins, as you can see in the following table.

And the fact that margins have remained strong in our current challenging macroeconomic environment—is a tribute to the company’s pricing power, stemming from high switching costs for customers and Honeywell’s already competitive pricing due to its economies of scale.

Additionally, Honeywell is staying at the front of (and benefiting significantly from) the ESG and sustainability secular trend (as companies upgrade their equipment), in particular with regards to energy transition solutions. For perspective, according to CFO Greg Lewis:

“about 60% of both our R&D and our sales are in ESG-related solutions. And so that's helping both ourselves and customers.”

And according to a May 1st note from Morningstar analyst, Joshua Aguilar:

“Honeywell is one of the strongest multi-industry firms in operation today. We think the firm has successfully pivoted to capture multiple ESG trends, including the need to drive energy efficiency, reduce emissions, and e-commerce, among others. We predicate our thesis mostly on a) increased demand for warehouse automation solutions; b) new digital offerings that promote data analytics in powerplants, as well as remote security management, and energy savings in building solutions; c) an increasingly automated world in mission critical end-markets like life sciences. Over the next five years, we think Honeywell is capable of mid-single-digit-plus top-line growth, incremental operating margins in the low-30s, low-double-digit adjusted earnings per share growth, and free cash flow margins in the midteens.”

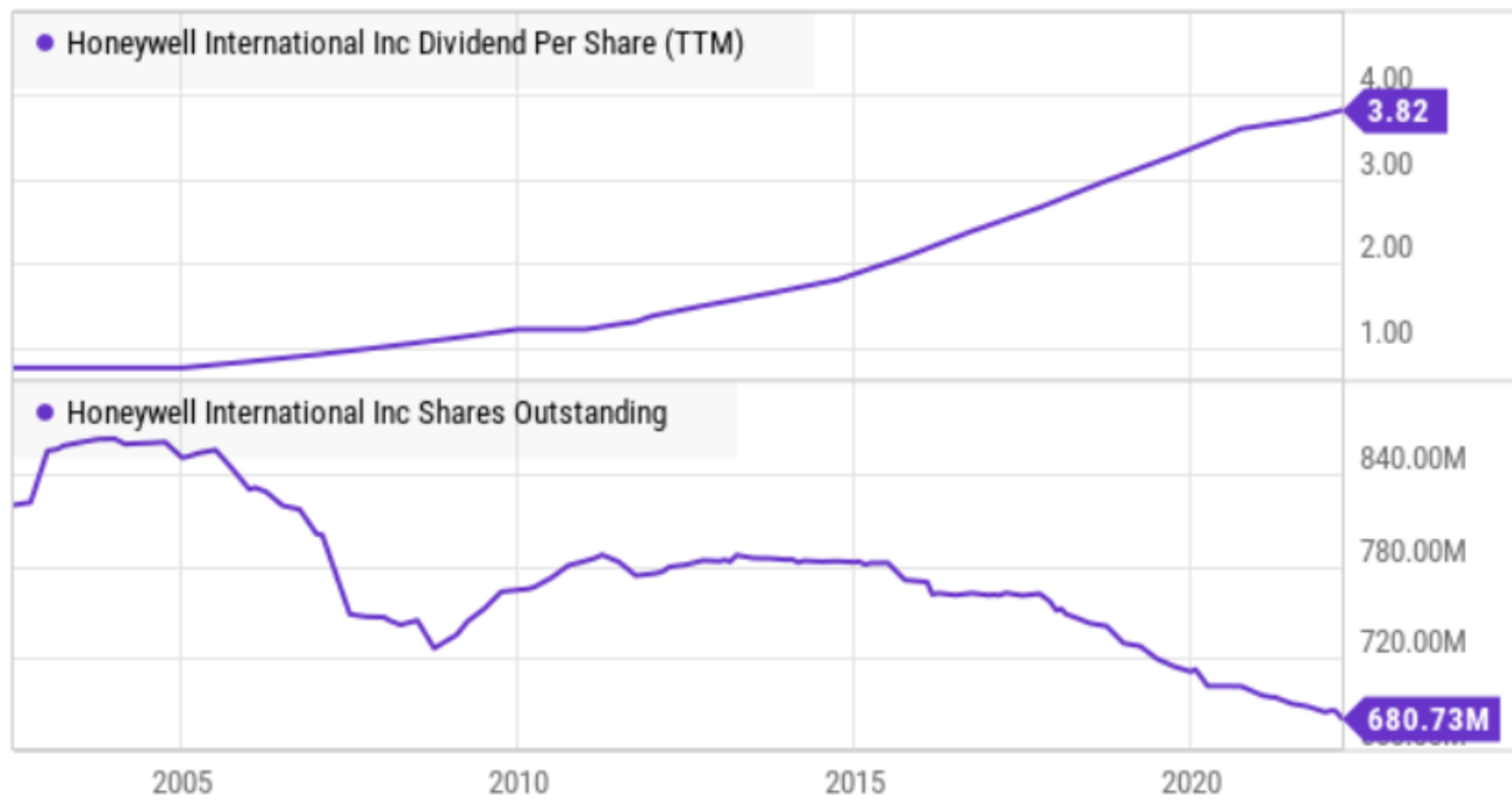

Dividend (2.3% Yield), Share Repurchases:

Honeywell has paid a dividend for 22 years straight, and it has increased that dividend every year for the last 18. Further, Honeywell continues to have enough excess free cash flow (after reinvesting in its own business) to reduce the number of shares outstanding (which is another attractive way to return cash to shareholders.

Cash Flow and Valuation

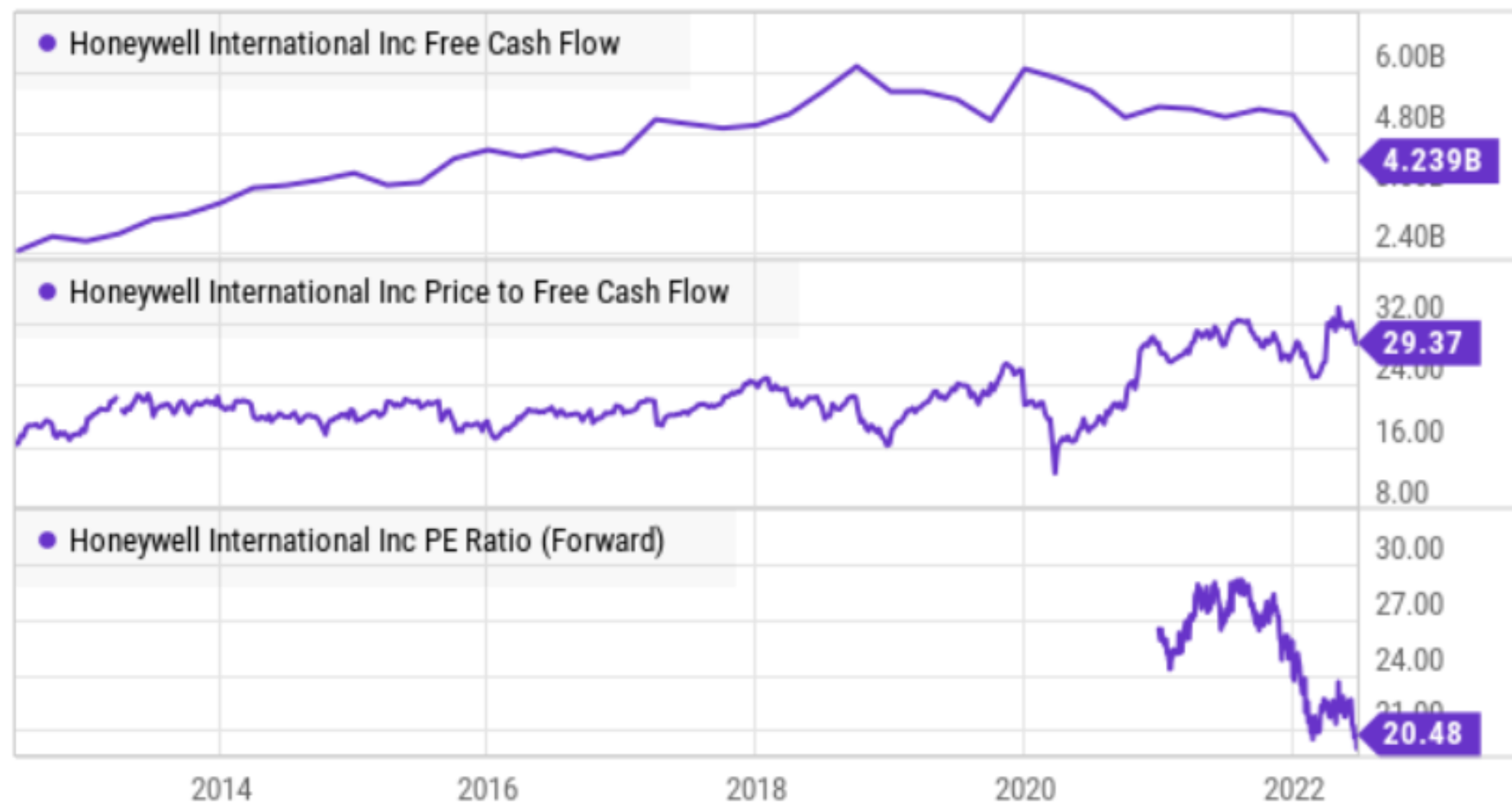

With regards to free cash flow, Honeywell continues to generate a lot of it. Here is a look at the company’s growing free cash flow (basically cash from operations minus capex), which has fallen off slightly since the pandemic hit, but is expected to continue rebounding.

For perspective, even though the price versus free-cash-flow looks a little high relative to history, it has fallen off a bit this year, and it would have fallen off more if it weren’t for the high expected future rebound for the business as the pandemic falls off (knock and wood) and as the business continues to strengthen and grow. Furthermore, Honeywell’s margins have strengthened over the years (as shown earlier) thereby warranting a higher valuation. Also, on a forward price-to-earnings basis, Honeywell’s valuation has come down more, thereby making it an increasingly attractive value stock opportunity, in our view.

Honeywell won’t have the explosive growth you may get from some popular meme stocks, but it does offer a healthy business, a powerful growing dividend and the potential for strong share price appreciation.

Risks:

As a strong leader benefiting from economies of scale and pricing power (stemming from high switching costs for customers) Honeywell does still face risks. Perhaps the biggest risk is simply the overall economy. If we do head further into an ugly recession (as some pundits expect) Honeywell’s busines and share price could fall further. As a specific example, a large portion of Honeywell’s business (~40%) comes from aerospace and oil & gas. These are economically sensitive sectors (as a lot post-pandemic demand for aerospace has not yet returned, and work-from-home persists in many cases, thereby impacting travel).

Also, as the company continues to innovate, it takes significant risks on large projects that may not be as successful as hoped. For example, Honeywell has recently made significant software investments that could ultimately prove obsolete depending on competitive forces and technology innovation.

Conclusion:

Honeywell is an example of an attractive value stock that could benefit if the growth-versus-value factor continues to unwind (i.e. if growth’s multi-cycle outperformance versus value continues to reverse—especially as the Fed raises rates significantly). Further, Honeywell’s business remains extremely healthy from a cash flow standpoint as it continues to weather the macroeconomic environment better than many. In the long-term, Honeywell has attractive earnings growth potential and room for additional price appreciation from multiple expansion. We do not currently own shares of Honeywell, but we like it, and it remains high on our watchlist.