The semiconductor industry has sold off very hard this year, yet it still has a massive long-term runway for growth. Here is a look at 25+ top chip stocks, sorted by profit margins. As you can see, these stocks have widely different expected growth rates, and that’s…

200+ Big-Dividend Preferred Stocks for You to Consider

If you don’t know, preferred stocks can work a lot like bonds when interest rates rise (that’s why many prices are down and yields are up this year), but they are distinct in that they’re lower than bonds in the capital structure (but still higher than common shares), and preferred shareholders can basically get screwed in a bankruptcy (preferreds are not a loan, they are a form of equity). This report offers more details, including current data (yields, prices, recent performance, industries) on over 200 preferred shares for you to consider.

Contrarian Warning Signs

The S&P 500 is down 18.5% year-to-date and performance has been wide ranging. It’s highly unusual for a large swath of the index to be down over 40% and another group to be up more than 20%. But a look under the hood reveals many of the top performers have been “safety plays” such as lower beta utilities and pharmaceutical companies, and many of the worst performers are great companies now trading at very attractive valuations. Those who chased high growth at the end of 2021 got burned. Will those now flocking to high-flying energy and low-beta utilities stocks soon get burned too?

Resistance at the 50-Day Moving Average, Again?

The Week Ahead: Inflation, Earnings and Energy

Is The Fed Too Powerful?

Futures are lower this morning, as the market seems set to take a breather from its sharp move higher in recent session, especially for higher-risk growth stocks. But as we review some of the stocks that have been performing extremely well, its worth asking the question “does the fed have too much power over the stock market?”

Is This Dead Cat Bounce Different?

With futures pointing higher, the market is set to rise for a third day in a row. And some investors are starting to think these gains are different than the dead cat bounces we’ve repeatedly experienced this year because this time commodity prices are down, the dollar is strengthening and the fed may finally be ahead of inflation.

The Fed Is Fearful, Time to Get Greedy?

The minutes from the Fed’s June meeting were released today, and they show a continued laser-focus on inflation (i.e. the fed is scared). Yet interestingly, Energy stocks and 10-year treasury rates keep declining in what may be a case of the market being a few steps ahead of the minutes from a meeting that took place in the past. For example, here is a look at the one month performance of energy stocks, and it has been ugly!

Signs of Slowing Inflation

S&P futures are hovering around flat to slightly negative so far this morning, as we head into a day where the upcoming release of last week’s fed meeting minutes may already be outdated. Both treasuries and commodity prices have been trending lower, a sign that the fed’s inflation fight may be less dire than last week’s minutes convey. Markets tend to recover long before recessions end. This report shares data on past recessions, chip stock valuations (e.g. Nvidia, AMD, Micron and Intel) and an update on the market’s technical position.

Positve Signals: Growth Stocks Up, Commodities Down

BH THINKER: The Worst First Half for Stocks in 50 Years

10-Day Market Reversal

Lead of Value Over Growth

10-Year Treasury vs Growth Stocks

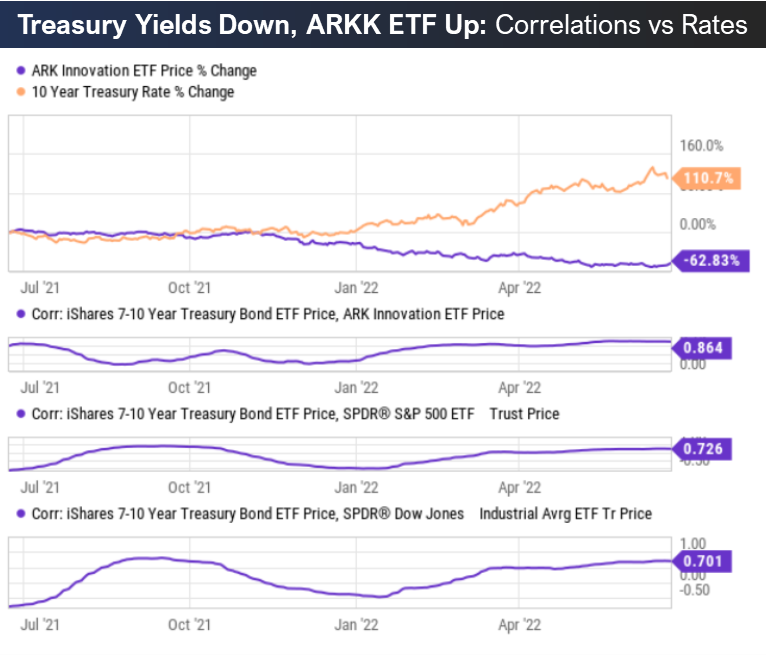

As you can see in the following chart, there has been a high correlation between high-growth stocks (as measured by the Ark Innovation ETF (ARKK)) and the 10-year treasury rate. More so than for the S&P 500 or the Dow.

The reason is because as the fed raises rates to fight inflation, they slow down the economy as a side affect, and the most growth-oriented names are the most negatively affected.

Considering we just had the largest drop in 10-year treasury rates this week since Covid, it was off-to-the-races for ARKK and high-growth stocks in general.