The S&P 500 is down 18.5% year-to-date and performance has been wide ranging. It’s highly unusual for a large swath of the index to be down over 40% and another group to be up more than 20%. But a look under the hood reveals many of the top performers have been “safety plays” such as lower beta utilities and pharmaceutical companies, and many of the worst performers are great companies now trading at very attractive valuations. Those who chased high growth at the end of 2021 got burned. Will those now flocking to high-flying energy and low-beta utilities stocks soon get burned too?

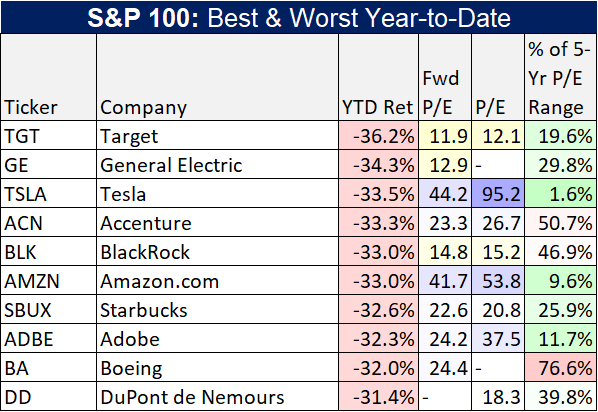

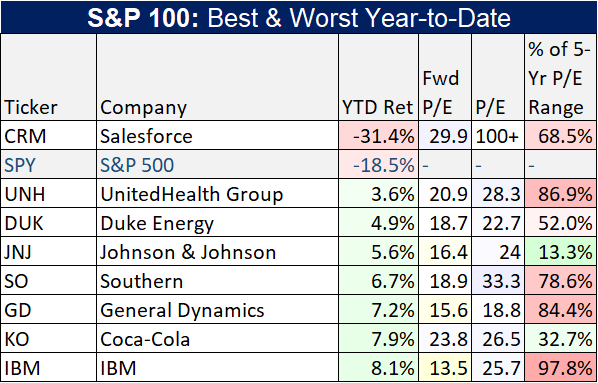

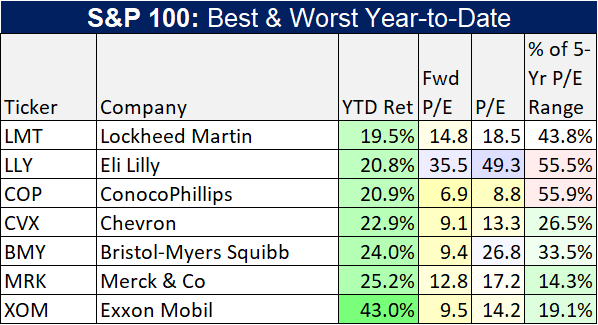

For starters, here is a look at the 20-best and 20-worst performers in the S&P 100 so far this year.

As you can see, many of the worst performers are quality company with high-growth (because anything with high future growth has sold off hard as interest rates rise). But many of these are very good businesses, and once the federal reserve gets interest rates under control (hopefully soon) some of these business will post very strong returns.

The “% of 5-Year P/E Range” column shows many top blue-chip stocks (like Meta Platforms, Amazon, Starbucks and Adobe) now trade near the lower end of their 5-year P/E range, and this is attractive considering the businesses are still growing and posting strong earnings numbers. For example, we own several of them, including Adobe, and 5-years from now we expect them all to be trading significantly (perhaps dramatically) higher! From a contrarian standpoint, there are growing attractive opportunities in the market for disciplined long-term investors.

On the other end of the spectrum, low-beta, low-volatility stocks like pharmaceutical company Eli Lilly and utilities stocks like Duke Energy, Southern Company and Exelon, now trade at high valuations relative to their historical ranges as investors have flocked to them in the short-term as a safe-haven play against falling markets.

The reality is that buying many of these highly-valued top performers is like buying insurance AFTER the hurricane. From a contrarian standpoint, many of the quality stocks that have sold off hard are now the most attractive. It can be counterintuitive, but buying high-quality businesses at lower prices can prove to be highly lucrative from a long-term standpoint.

Disciplined, long-term investing can be somewhat painful in the short term (when the market is down), but in the long-term it is consistently a winning strategy.