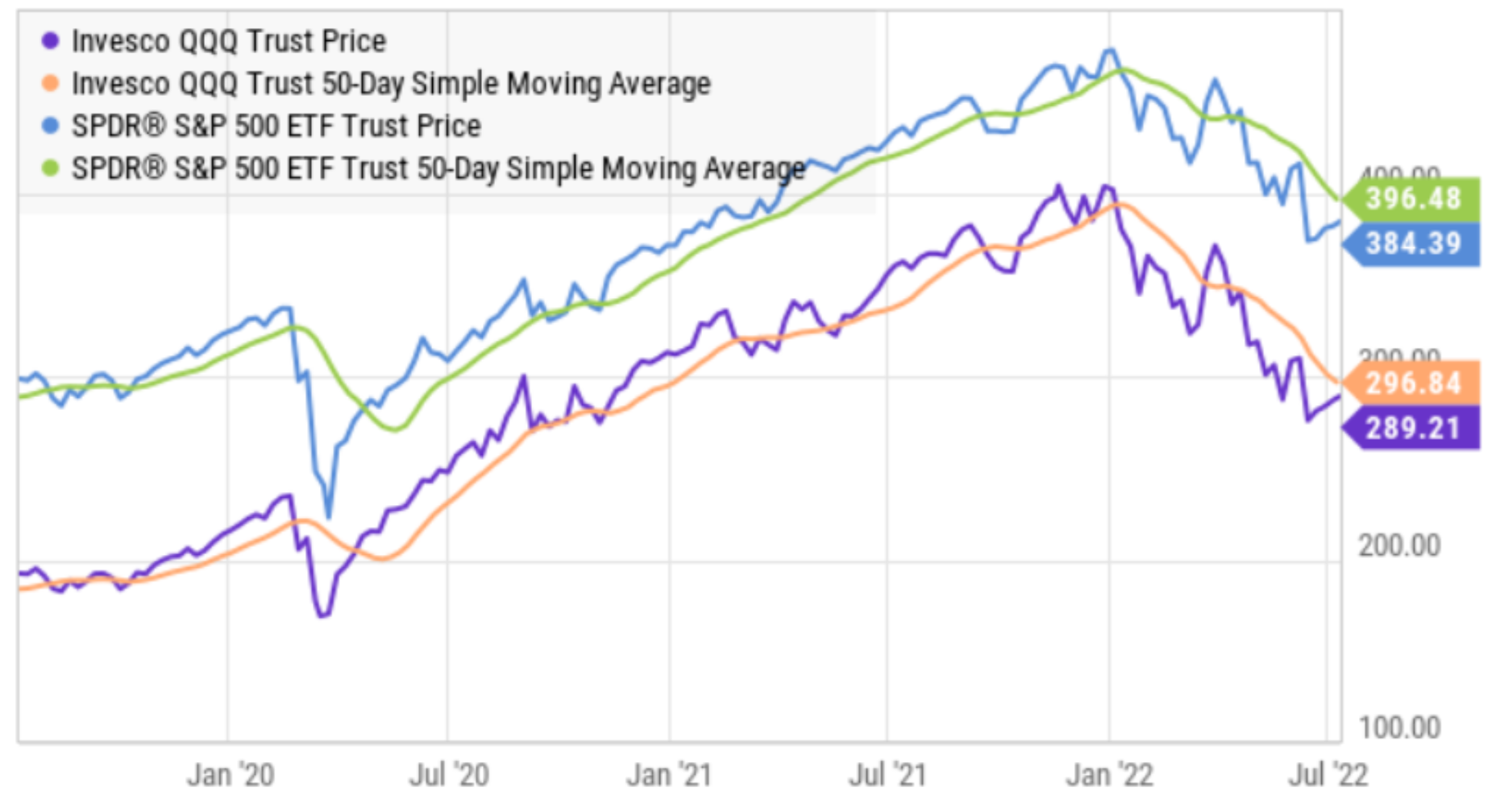

The market has been in a downtrend this year, and after another brief uptrend, it is resuming its move lower again today. While these types of patterns may indicate appealing predictable short-term trading opportunities to some, take caution in “resisting” the urge to ditch your long-term strategy.

For example, these type of patterns seem to work, until all of a sudden—they don’t. And that’s when investors lose the most money. For example, a lot of investors got very aggressive with the almost 2-year uptrend in 2020 and 2021, until all of a sudden it stopped working this year. Investors that piled into speculative growth stocks (and even borrowed money to do so) got crushed as the market turned this year.

And the market can turn again on a dime. With earnings starting this week, and the monthly headline CPI reading on Wednesday, any signs of positivity can quickly reverse the market and start a new long term uptrend. And if you are betting against the market with a short-term trade (or even sitting on the sidelines with cash) you could miss out when the market turns up. Remember, the market’s historical returns don’t come in even small increments, they come in big spurts, and if you miss a few of the biggest up-days during a year, that can ruin your total returns.

To the contrary, if you are a long-term investor, and you have extra cash, now is a much better time to invest than the start of the year (the saying is “buy low” not buy high). For example, here are a few semiconductor stocks we just wrote up that are currently trading at depressed prices, but still have very attractive long-term prospects (and attractive valuations):

While share prices are currently “ugly,” that often represents the best time for long-term investors to buy!