If you don’t know, preferred stocks can work a lot like bonds when interest rates rise (that’s why many prices are down and yields are up this year), but they are distinct in that they’re lower than bonds in the capital structure (but still higher than common shares), and preferred shareholders can basically get screwed in a bankruptcy (preferreds are not a loan, they are a form of equity). This report offers more details, including current data (yields, prices, recent performance, industries) on over 200 preferred shares for you to consider.

There are lots of nuances to every issue of preferred shares, but one characteristic to many is a redemption price of $25. For example, the companies that issue preferred shares often include a clause about retiring the preferred shares at a price of $25. This can help reduce some of the interest rate risk when interest rates are rising (like now), and it makes bonds trading under $25 more interesting, in some cases.

Bonds are often an income-focused investor favorite because they can offer big steady dividend payments (the ones in our table below, all yield at least 5%). But investor should also be aware that prices don’t generally rise much above $25 (if that’s the redemption price) so preferred shares generally offer less upside than common stock.

Quantum Online is a great resource for more of the specific details of each individual bond issue, and you can access that data here.

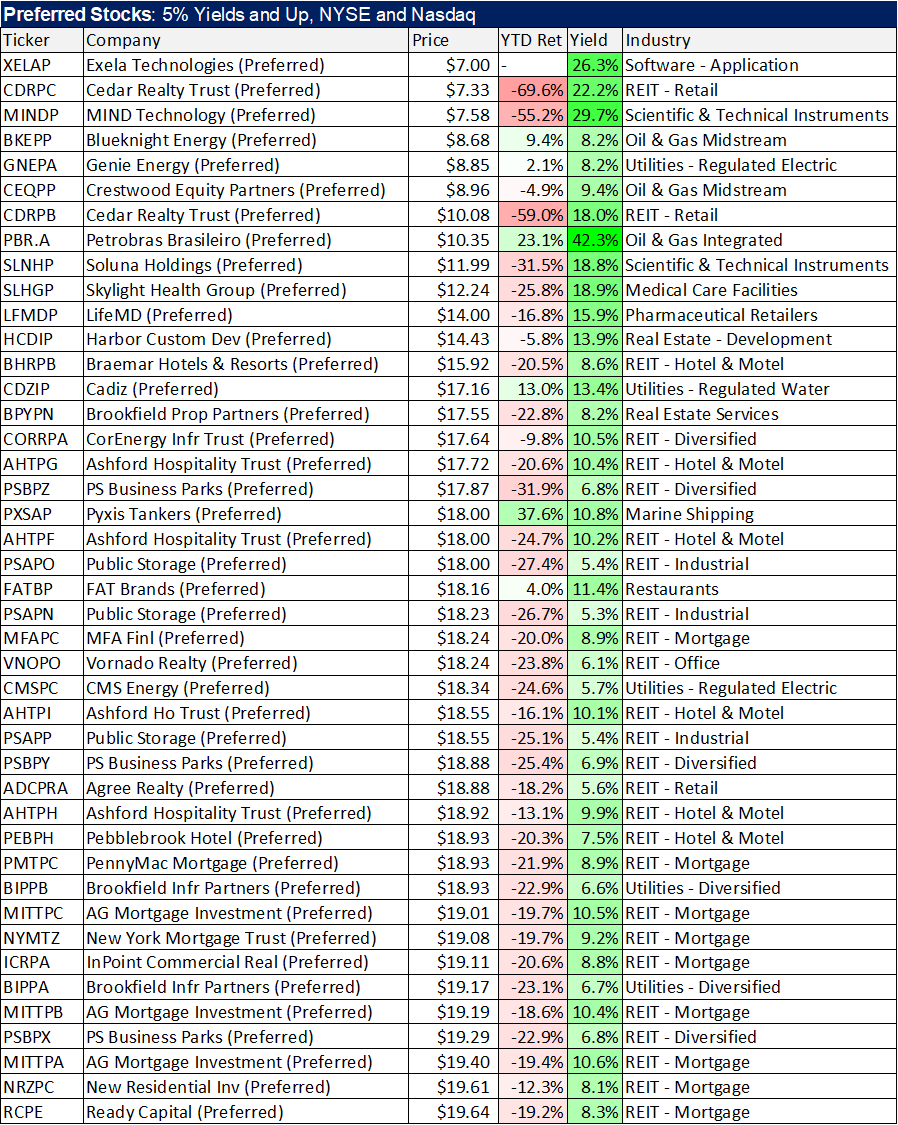

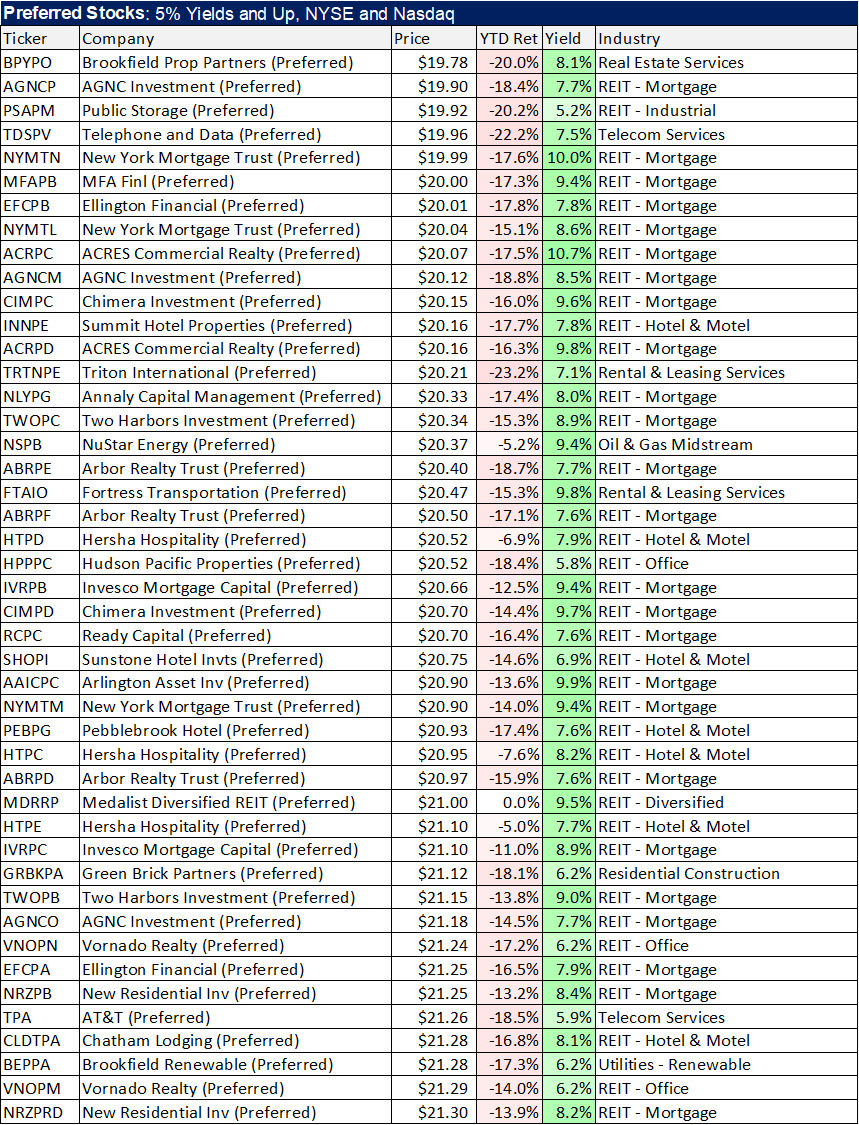

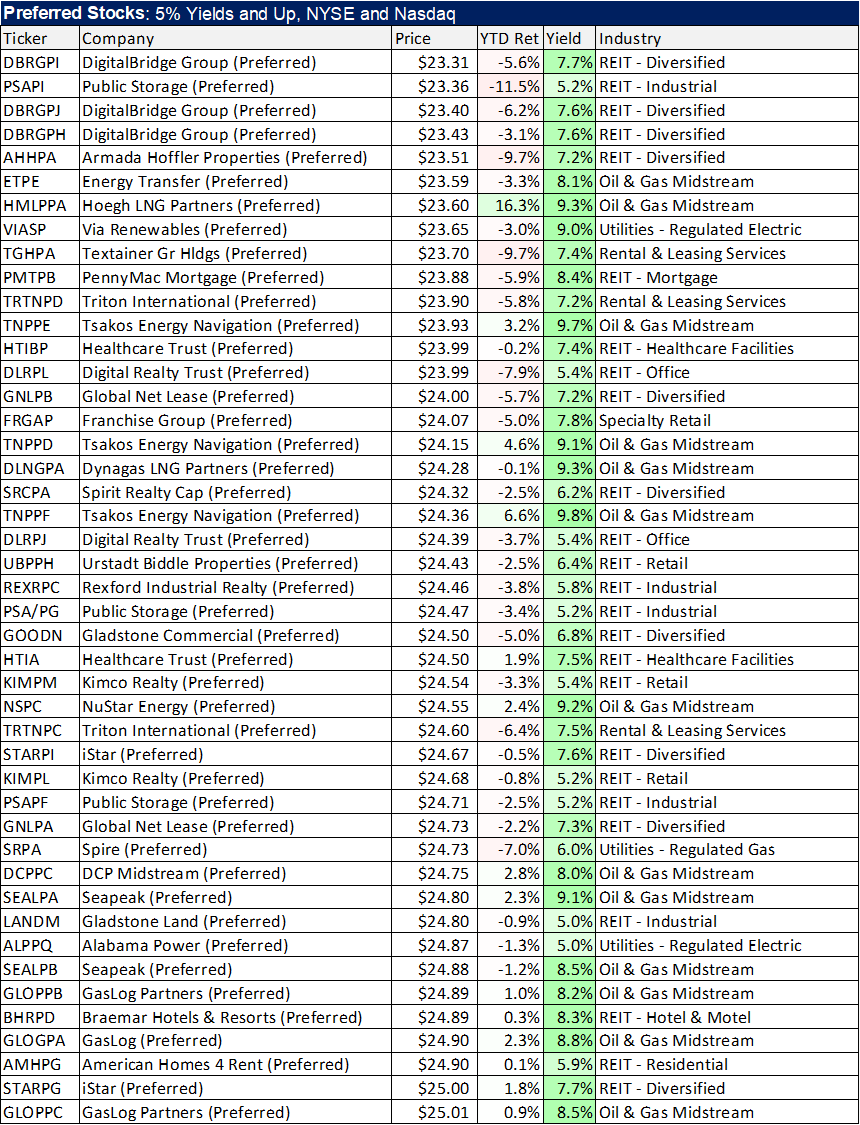

Also, for your consideration, here is more information on over 200 preferred stocks for you to consider (the table is sorted by price).

As another interesting nugget of information, preferreds have historically offered relatively low risk of default. According to PIMCO:

Lower Default Risk: A significant proportion of preferreds are issued by banks and the banking sector historically has a lower default rate than other sectors. From 1983 to 2016 the default rate of the banking sector averaged 0.5% while all other sectors averaged 2.3% (Source: Moody’s).

The Bottom Line:

If you are an income-focused investor, preferred shares can be attractive for the big steady dividend payments. Just be aware they are considered safer than ordinary common stock shares, but preferred shares also generally offer less long-term price appreciation potential (because the share prices are often tied to a $25 redemption price, for example). We hope to have more information for you on specific attractive preferred share opportunities in the coming weeks, and we hope the table of information (above) has been helpful.