Futures are lower this morning, as the market seems set to take a breather from its sharp move higher in recent session, especially for higher-risk growth stocks. But as we review some of the stocks that have been performing extremely well, its worth asking the question “does the fed have too much power over the stock market?”

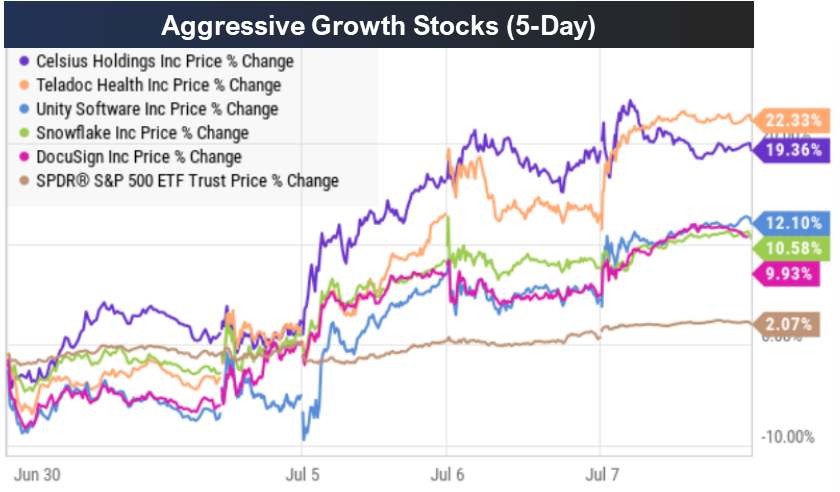

For starters, here is a look at some of the growth stocks that have been performing extremely well in recent sessions.

The common theme is that these are riskier growth stocks, which means they have the potential to generate very high earnings in the future, but they’re not there yet (because they’re still spending heavily on early growth).

The reason they’ve been volatile is basically because high-growth (and riskier assets in general) are getting whipsawed around by the Fed (and more specifically by the latest macroeconomic data releases that the Fed basis its monetary policy decisions on), and the most recent macroeconomic data suggest the inflation threat the fed has been fighting may finally be starting to come under control

But what’s scary is that the fed knows where stocks are at, and the fed uses the stock market as “dry powder” in determining just how much more aggressive they can get with their tightening monetary policies. This is not necessarily consistent with the fed’s dual mandate (low unemployment and reasonable inflation), but they still pay attention to the market, and a lot of days it can make individual investors feel like useless pawns to the fed that has different goals than individual investors. In the fed’s mind—who cares if some investors get hurt by monetary policy as long as monetary policy makes the overall economy better.

Leaving aside the notion that the fed may not even be good at improving the overall economy (considering it seems all they really do is create bubbles, then fix the bubbles, and create new bubbles in the process). Adam Smith is a famous Scottish economist known for his concept of “the invisible hand,” and a lot of days its seems the fed might be better off simply following Smith’s philosophy.

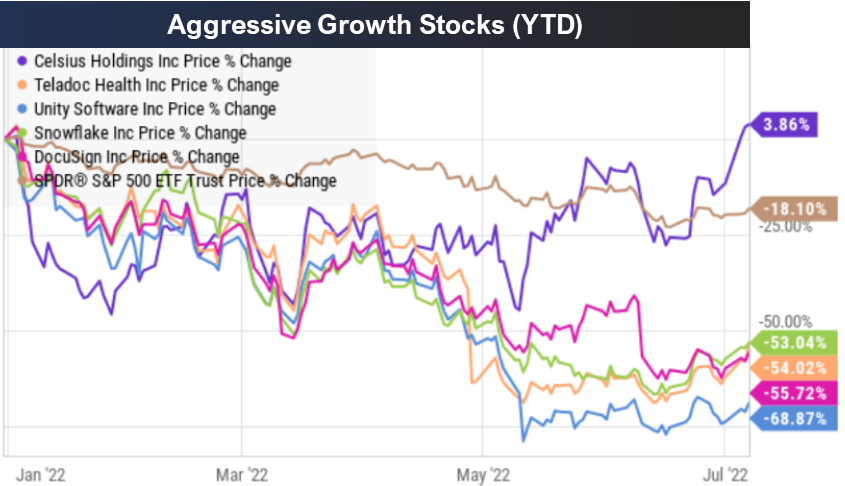

For perspective, some argue the Fed created the growth stock bubble after the pandemic started by lowering interest rates (combined with easy money fiscal policies). And now the fed has bursted that bubble this year. For example, check out the year-to-date performance of those same stocks in our earlier chart, below.

As an individual investor, all you can really do is select good investments that are consistent with your long-term goals. As Warren Buffett’s mentor Ben Graham said, the market is a voting machine in the short-run (and that’s why stocks have been whipsawed so much in the last 2.5 years), but a weighing machine (based on fundamentals) in the long-term.

In our view, all of the stocks in the charts above are attractive long-term businesses with the potential to eventually generate tremendously higher earnings than they currently do. We’d never recommend dumping your entire life savings into only one or two of them. But within a broadly diversified, goal-focused, long-term portfolio, it can make a lot of sense to own a little bit of a few of them. Again, they’re all good business, and in the long-term—the group is likely going much higher (eventually!).