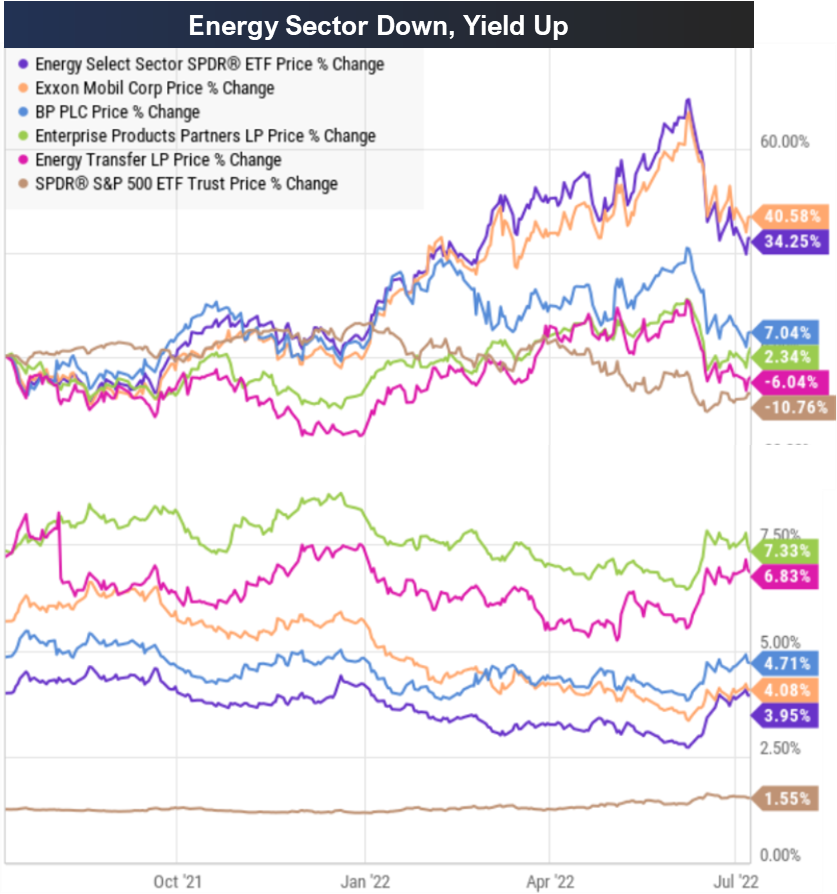

Futures are lower this morning as we head into a week of (1) new monthly inflation numbers, (2) the start of a new earnings season and (3) energy sector prices that have sold off hard over the last month.

The big month-over-month CPI numbers are to be released Wednesday morning, and this is important because inflation is the #1 thing that has been driving the fed’s aggressive interest rate hike trajectory this year which has ultimately driven markets lower. CPI is not the fed’s preferred metric, but its the one that garners all the headlines. Interesting, the fed is also expected to release their 3-year inflation projection today at 11am.

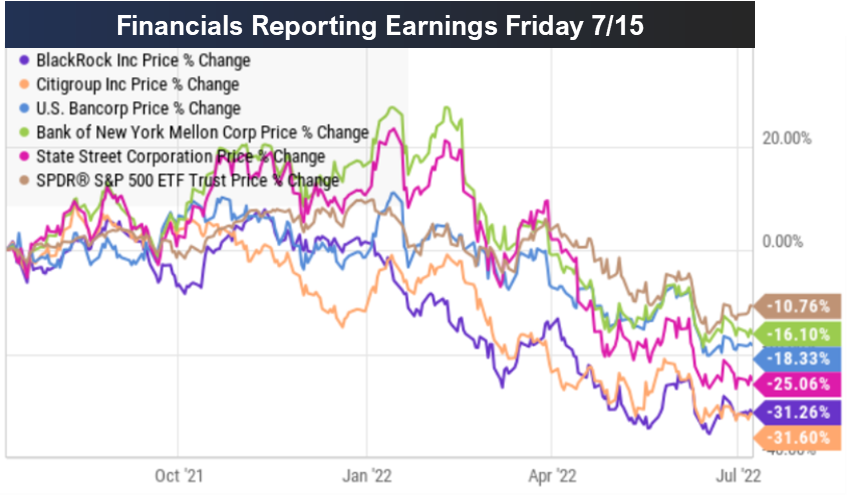

Earnings season is kicking off with financials starting on Friday (technically a few companies have released already), and this will also be consequential for markets. Earnings face another quarter of year-over-year tough comps (considering at this time last year the economy was much stronger and certain stocks were benefiting from covid bumps).

Interestingly, the large financial companies that release earnings on Friday (e.g. BlackRock, Citigroup, PNC, US Bancorp, BNY Mellon and State Street) are uniquely affected by lower equity prices, considering a large part of their business is to get paid a percentage of assets they manage (BlackRock) or custody (BNY Mellon, State Street), and with markets down they earn less. And then conversely, Citigroup and US Bancorp will arguably benefit from higher interest rates because they earn higher net interest margins on their loans.

We currently own shares of BlackRock in our Disciplined Growth portfolio, and we expect those shares to recover significantly as the market eventually does (whether the recovery comes this quarter, this year or next, the shares are set to eventually go much higher). In our Income Equity portfolio, we own State Street plus Energy companies BP and Exxon Mobil (mentioned earlier).

Takeaways:

The market has been ugly this year, but it will get better, and if you are sitting on the sideline (e.g. you sold all your stocks and now just hold cash) you are going to miss out on the eventual rebound. What’s more, the rebound is never smooth (it’s not like the market is going to go up exactly 0.04% exactly every day forever). The return will be very bumpy, and if you miss the big up days—you will regret it. And if you are putting money back into the market now, there are plenty of very interesting long-term bargains out there currently.