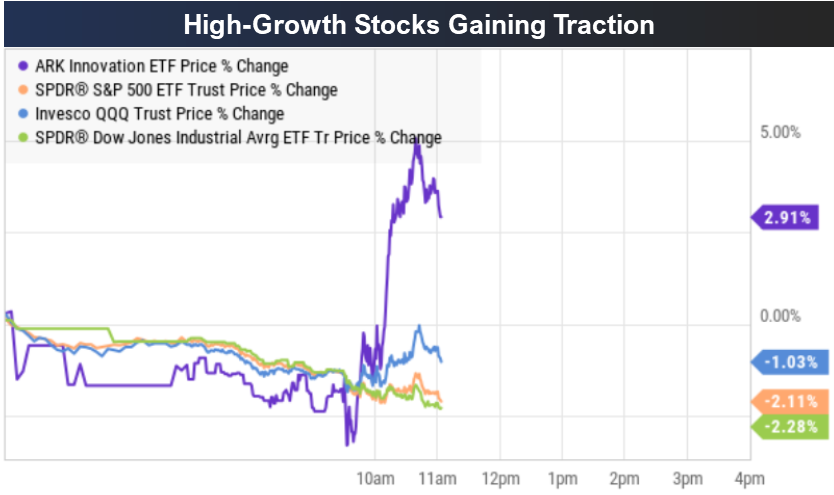

You many not notice it with all three of the major indexes downs so far today, but we are seeing some positive signals from the highest growth stocks and from commodities.

For example, the Ark Innovation ETF (ARKK) is up big so far today as many of its ultra-high-growth stocks are climbing fairly significantly. These high growth stocks are often a leading economic indicators (as apparently the “smart money” has been producing a big inflow of money into the ARKK ETF).

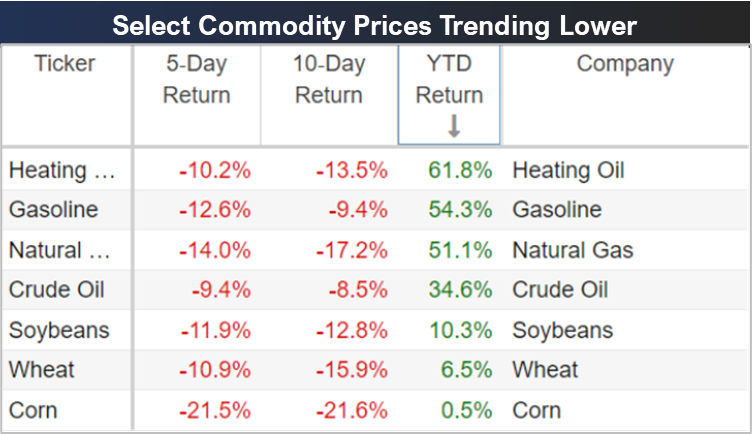

Similarly, commodity prices are down in recent trading sessions. And this is a very good sign because it is perhaps an indication that inflation is slowing.

And if inflation is slowing then perhaps the fed will lighted up on its hawkish interest rate hike trajectory, considering the hikes were intended the fight high inflation in the first place. And if the fed stops being so aggressive, stocks should stop falling so hard (as they have been this year).

Individual Stocks

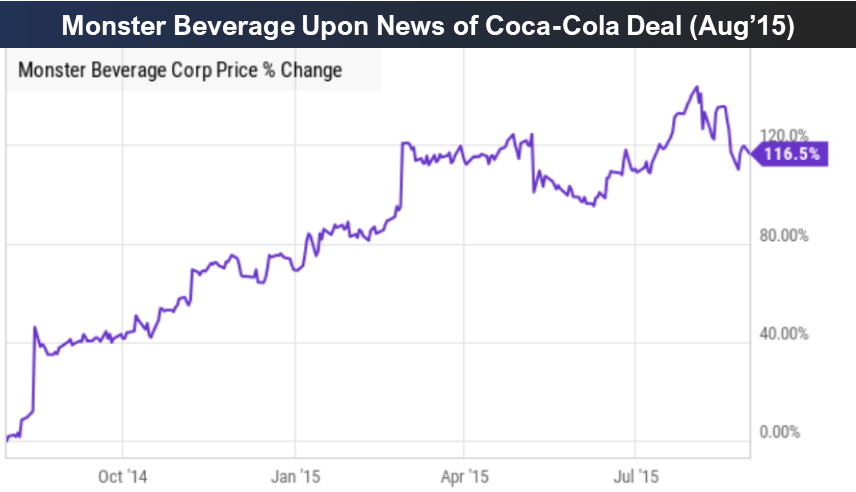

Celsius Holdings (CELH): You may have notices that Disciplined Growth Portfolio holdings, Celsius Holdings, is up around 8% as of midday today. Celsius offers “functional” energy drinks, and there are growing rumors of a potential investment from Pepsi (PEP). This type of deal would make sense because it would give Celsius access to Pepsi’s distribution channel (they can help make Celsius drinks available everywhere Pepsis is available). This type of deal is not unusual. For example Coca-cola (KO) acquired a 16.7% stake in energy drink Monster Beverage (MNST) back in 2015, and it proved to be a very good acquisition for both companies. Here is a look at what happened to MNST shares after the deal was announced with Coke.

We share this data because a CELH deal with PEP could result in equally positive share price gains for CELH.

Enphase (ENPH): Shares of Disciplined Growth Portfolio holding, Enphase Energy, are down around 8% as of midday. It seems the entire energy sector (XLE) is down significantly today, and it is dragging Enphase with it. The decline in energy prices is a good think for the market because it could cause the fed to lighten up on its interest rate hikes which were designed to fight inflation, but also have been dragging all stocks lower. With regards to Enphase in particular, it makes microinverters for solar-powered home energy solutions. As such, it’s not a traditional energy stock and its not a commodity. It’s a business we continue to believe in and continue to own (despite the high noise in the energy sector today).

Disciplined Growth Portfolio:

Also worth mentioning, the Disciplined Growth Portfolio is up significantly so far today, despite the broader market being off. This is consistent with the gains we’re seeing across the market for high-growth stocks today, and perhaps (hopefully) a leading indicator that inflation is slowing—in which case high-growth stocks may be set to rebound very hard in the weeks and quarters ahead.

Be sure to also check out our growth stock watchlist to see how other high-growth stocks are moving throughout the day: