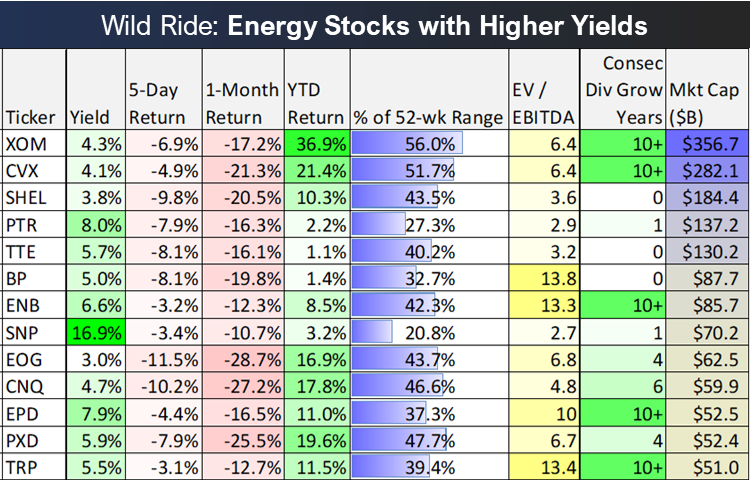

The minutes from the Fed’s June meeting were released today, and they show a continued laser-focus on inflation (i.e. the fed is scared). Yet interestingly, Energy stocks and 10-year treasury rates keep declining in what may be a case of the market being a few steps ahead of the minutes from a meeting that took place in the past. For example, here is a look at the one month performance of energy stocks, and it has been ugly!

According to the fed meeting summary,

“Participants recognized that policy firming could slow the pace of economic growth for a time, but they saw the return of inflation to 2 percent as critical to achieving maximum employment on a sustained basis.”

Perhaps confirming the fed’s comment on slowing the pace of recovery, and perhaps an indication that demand is slowing, energy prices are down significantly over the last month (yet have very strong ytd performance). Although there are clearly are other factors at play such as lingering re-opening hiccups from the pandemic, the Russia-Ukraine war and the current administration’s disdain for domestic energy.

However, perhaps corroborating the notion of slowing inflation, other commodity prices are also down, and so too is the 10-year treasury rate.

Of course predicting the next move in treasury rates or oil prices is a bit of a fool’s errand, but the market is certainly lower than it was at the start of the year, and that makes now a better time to buy than the start of the year (assuming you believe the market is eventually going up—which it will—eventually!).

Regarding energy stocks, BP and Exxon Mobil, both are down significantly over the last month, and they both pay big dividends (Exxon’s has increased annually for over 10-years straight), and they are both currently included in the Blue Harbinger Income Equity portfolio. These were healthy companies before energy prices shot up this year (and they’re still up even after the 1-month price declines), and they’ve now stuffed their coffers to help them weather years more of future market cycles.

Bottom Line

The market will get better. In fact, it may already be improving considering stocks are off their lows and leading inflation indicators are down (energy prices, treasury rates). However we cannot know for sure in the short-term. In the long-term, however, disciplined goal-focused investing will very likely continue to be a winning strategy, and stocks are a lot cheaper now than they were to start the year thereby making for an even better long-term entry point.