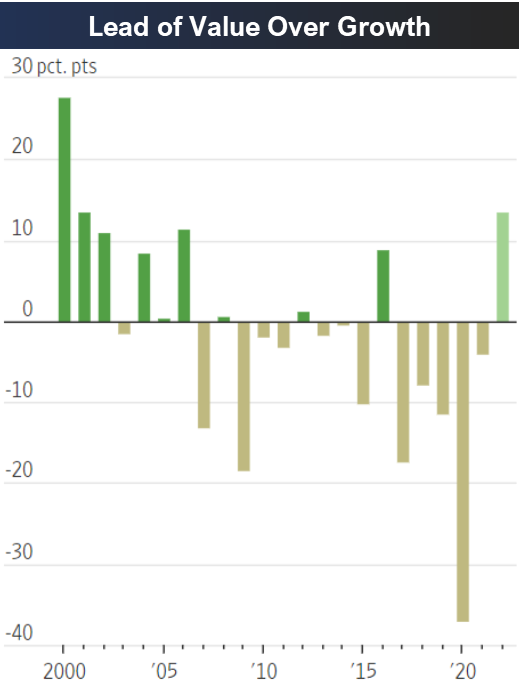

It may come as no surprise that value stocks are outperforming growth stocks this year, considering increasing interest rates and the pandemic growth bubble unwind.

source: WSJ

However, this is a trend that can continue for longer periods of time than some may realize. Interest rates came down almost unabated for 40 years straight. It seems unlikely the fed can raise them too much (because it would crush the US government under the weight of its own debt interest payments), but then again, how many people believed in the early 1980’s that the 10-year treasury could fall from over 15% to near 0%.

The best bet for investors remains to pick individual stocks (that meet your goals) instead of trying to predict the next move of the macroeconomy—which is a bit of a fool’s errand, despite any media or hedge fund stories to the contrary. Disciplined goal-focused long-term investing is a winning strategy.