Since the depths of the initial coronavirus selloff in 2020, the market has climbed dramatically higher, and the ascent has been even more dramatic for top growth stocks. In light of these dramatic price gains, many investors are getting nervous and wondering if they should dump their high growth stocks altogether in order to avoid a potential market selloff that media fear mongers warn us of daily. Of course, what you do with your own investment dollars is up to you entirely. We’d never advocate for blindly buying all growth stocks in general, but we do believe their continues to be an ample supply of individual high growth businesses that are worth investing in regardless of what happens to the overall market indexes. And in this report, we countdown our top 10 high growth stocks, starting with #10 and finishing with our #1 top idea.

Market Overview:

Before getting into the countdown, it is worth reviewing some high level data to provide a backdrop for our rankings.

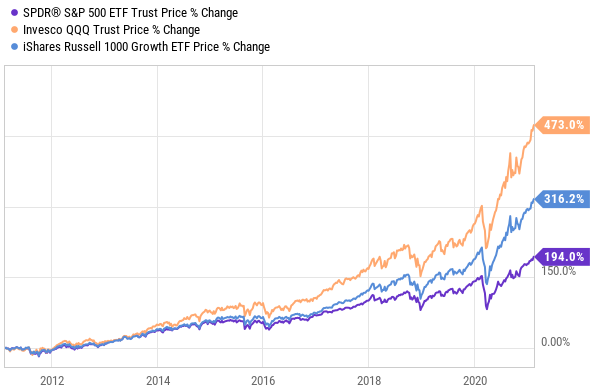

First, here is a look at the performance of the S&P 500 as well as the Russell 1000 large cap Growth index and the tech-heavy Nasdaq 100. Clearly overall performance has been very strong since the initial pandemic selloff in early 2020. And the strong performance has been even more pronounced for “growth-ier” stocks.

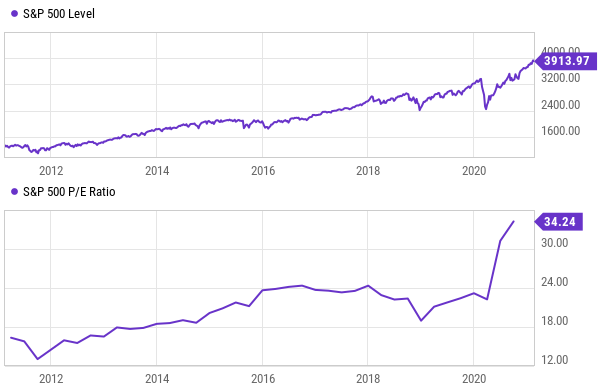

Next, here is a look at the performance of the S&P 500 versus its P/E ratio. While performance continues to be strong, valuations (as measured by price-to-earnings) is getting relatively expensive (an indication to some investors that the market is getting expensive).

source: YCharts, as of 2/18/2021

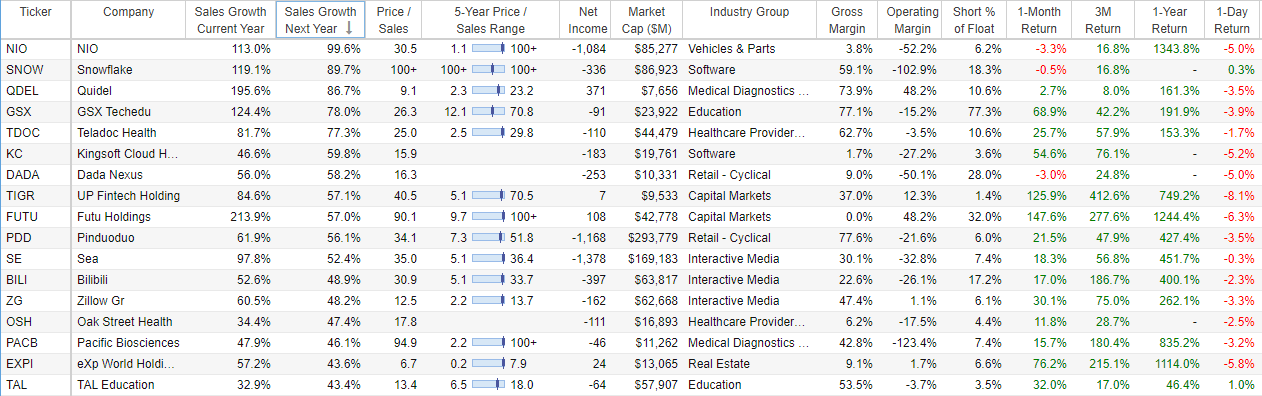

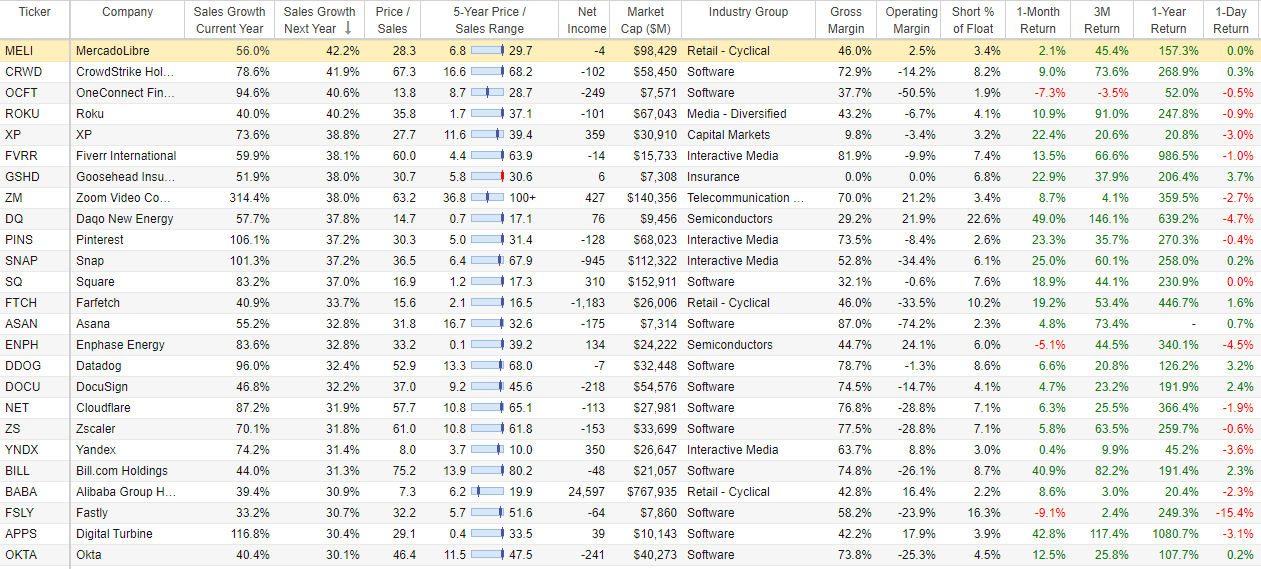

However, not all stocks are created equally, and it would be a great disservice to value everything on P/E ratio alone. For example, top growth stocks often have very little earnings (by design) because they are spending heavily on growth (which is often the right thing to do to take advantage of market opportunities and to maximize long-term value). Rather, price-to-sales ratio can be a more prudent valuation metric in these growth stock cases. To put this in perspective, here is a look at the recent performance and price to sales ratios of growth stocks with the highest revenue growth trajectories.

(image source: StockRover, as of 2/18/2021)

As the table above shows, many of these top growth stocks (with very strong 1-year price performance and very high expected revenue growth), look “beyond-absurd” on a P/E basis (because most of them have negative earnings), but are at least somewhat rational and comparable on a price-to-sales ratio basis. To conceptualize the price-to-sales valuation metric, it can be helpful to consider the ratio in relation to sales growth rates because a high sales growth rate can quickly bring a higher price-to-sale ratio considerably lower (to a more reasonable level) in a matter of quarters or years.

And it is critically important to note, unlike the “Tech Bubble” of the late 1990’s and early 2000, many top growth stocks today have very real revenues that are growing very rapidly and have very long runways for continued high growth. These are real businesses and the stocks can make you a lot of money if you select them right.

Top 10 High Growth Stocks

With that backdrop in mind, and without further ado, here is our ranking of Top 10 high growth stocks, starting with #10 and counting down to our #1 top idea.

10. Unity Software (U)

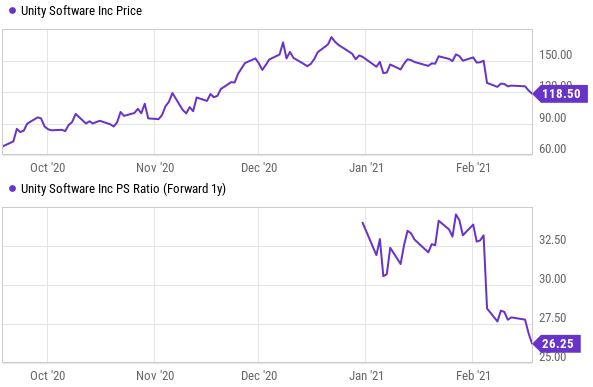

Unity Software provides tools to videogame developers. The company completed its initial public offering in September, and the share price had been strong. However, the shares sold off significantly following the company’s recent earnings announcement at the start of this month. Specifically, Unity beat earnings (and revenue) expectations, but provided lower than expected forward guidance causing the market to react negatively.

source: YCharts, data as of 2/18/2021

Unity’s forward growth expectations still remain high (26.8% per StockRover) and the total addressable market is large (which means the company has a long runway for years of high growth ahead). The shares trade at around 26.25x forward sales (see chart above), and the recent selloff has created an attractive entry point in our view. If you are looking to buy high growth after a short-term pullback, Unity is worth considering. You can read our previous full write-up on Unity here:

9. Alibaba (BABA)

Shares of this Chinese internet juggernaut (sometimes referred to as the Amazon (AMZN) of China) have gotten slammed in recent months as the company is reported to have fallen out of favor with the Chinese government, and the much anticipated IPO of its fintech holdings (Ant Group) was sacked. However, Alibaba remains an incredibly undervalued massive money printing machine, especially as its impressive cloud business continues to grow rapidly.

For a little perspective, here is a look at the recent share price performance (solid black line) as compared to the analyst ratings (93% “Buy” ratings by the 57 analysts reporting to Factset) and aggregate price target ($328.88, dotted line) suggesting the shares are more than 22% undervalued.

However, Alibaba has significantly more long-term upside than these conservative near-term analyst price targets suggest. At only 7.4 times sales, these shares are simply trading way too inexpensively, even for a Chinese business. You can read our previous full report on Alibaba (for the details of our long-term thesis) here:

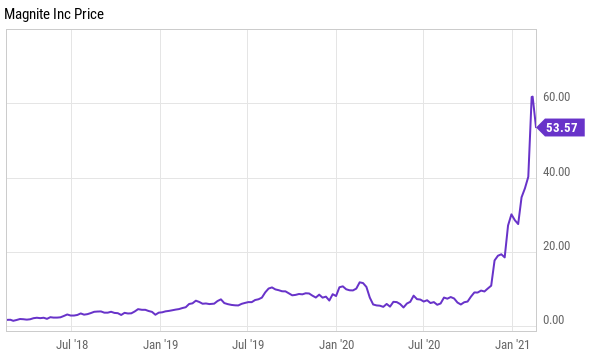

8. Magnite (MGNI)

Magnite is already a “five-bagger” for us in 5 months, as the shares of this digital advertising sell-side platform have soared in the wake of the market’s rightful love affair with the future possibilities of connected TV advertising.

source: YCharts, data as of 2/18/2021

Without a doubt, these shares are highly volatile and risky, but incredibly—they’re still relatively cheap on a price-to-sales ratio basis (as compared to growth) if the company can actually deliver on all the hype (the company is expected to announce earnings on Wednesday 2/24). MGNI’s recent acquisition of SpotX is a step in the right direction. We’ve already taken significant Magnite profits (at around $60) as the shares quickly grew to an oversized position in our Disciplined Growth Portfolio, but we remain long some shares, and are expecting a very volatile long-term ride that skews sharply higher. You can read our recent Magnite full report, about this massive opportunity, here:

7. Palantir (PLTR)

Palantir is a data analytics software company that has only traded publicly for about six months. However, it’s already a highly seasoned veteran business considering its very “hard to get” long-term highly-secretive contracts with the US government. Palantir’s 22.6x price-to-sales ratio is lofty, but not when you compare it to its 28.7% expected sales growth rate over the next year and combined with its massive long-term total addressable market.

source: YCharts, data as of 2/18/2021

We are long shares of Palantir at a lower average price, but the shares have again become attractive following the recent post-earnings announcement sell off. Specifically, the markets expectations were brought back down to earth by the very strong (but not as strong as some people hoped) earnings announcement. And in fact, Wall Street analysts actually raised their price targets after earnings (even though the share price sold off). If you want to get a better understanding of what this business actually does, you can access our previous very detailed full report here:

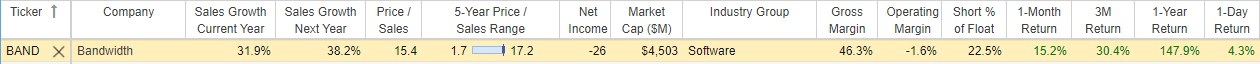

6. Bandwidth (BAND)

An attractive high-growth business trading at a compelling valuation, Bandwidth is a CPaaS (Communication Platform as a Service) solutions provider that offers a suite of software APIs (to support the mission-critical communications needs of a diverse and impressive set of enterprise-grade customers that includes the likes of Google (GOOGL), Microsoft (MSFT), Zoom (ZM), Arlo (ARLO), and RingCentral (RNG), to name a few). Not to mention Bandwidth’s owned IP network provides scalability, reliability, major cost savings and uniquely positions it for success.

(image source: StockRover, data as of 2/18/2021)

Specifically, Bandwidth is well-positioned to take advantage of the large secular growth opportunities ahead. To get a better understanding of this business, members can read our previous full report and investment thesis here.

The Top 5 (Part II)

Part 2 of this report, including the top 5 growth stocks, is available to members here:

The 5 includes a variety of highly attractive growth stocks, and we currently own 4 of the top 5 in our Disciplined Growth Portfolio (and the 5th one is high on our watchlist). If you are not already a member, you can get instant access here.

The Bottom Line

If you are a long-term growth investor, there remains plenty of opportunities to make a lot of money in the years ahead. Despite the constant chorus of market bubble fear-mongers, the opportunities are attractive. Many investors simply do not understand that it is a very good thing for a lot of high growth businesses to have zero net income because it means they are focused on growth and long-term value maximization. Our Blue Harbinger Disciplined Growth Portfolio continues to put up strong market-beating returns, and you can view the current holdings here.