There is a wide variety of high income stocks, and they are not all created equally. Far too often, investors make the unfortunate mistake of blindly chasing after the highest yielding stocks without realizing many of them are simply value traps. For example, what good is it to buy a stock with a 10% yield if the price declines by 20% every year? And while many of the highest yielding stocks today are simply slowly dying businesses (e.g. value traps), there are plenty of diamonds in the rough, especially when you consider the important concepts of total return and yield on cost (i.e. dividend growth). In this article, we rank our top 10 high-income stocks, starting with #10 and counting down to our #1 top idea.

Dividend Yield Versus Total Return

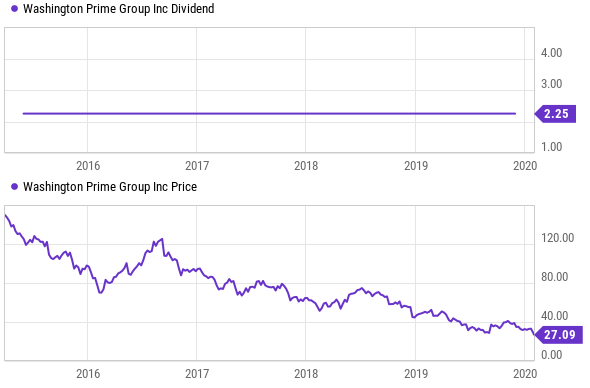

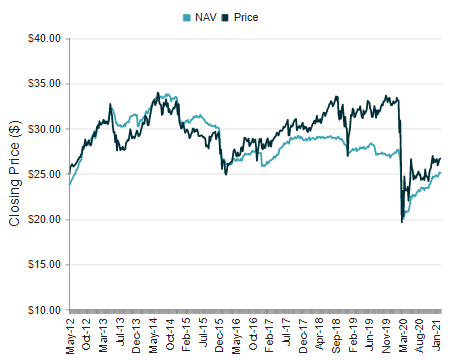

Before we get into the countdown, it’s worth reviewing the concept of total return. Total return is the combination of price gains (or losses) and income (from dividends). For perspective, here is a look at the historical big dividend and share price of once popular retail property REIT, Washington Prime Group (WPG). As you can see, WPG paid a huge $2.25 quarterly dividend that attracted many income-hungry investors for years.

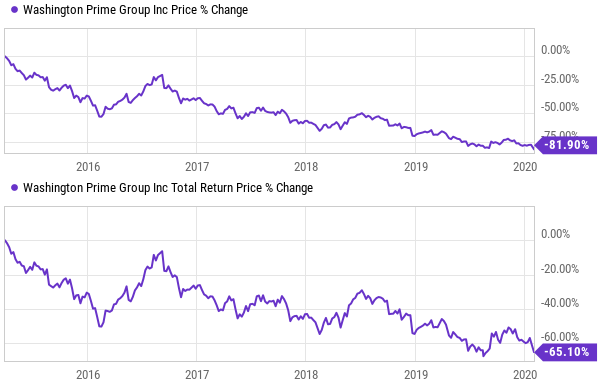

Unfortunately, as you can see in the price chart, the big dividend payments were more than offset by the ugly price decline of the shares. And in aggregate, even though WPG kept paying that big dividend for years, the “total return” (see chart below) was VERY negative over this time period.

Washington Prime Group is an example of an ugly value trap that many unfortunate investors lost a lot of money on. Further, the company eliminated its dividend altogether last year as it simply didn’t have the cash to pay it. WPG is a good example of why even income-focused investors need to be aware of total returns, instead of just blindly chasing after the highest current yields.

Dividend Growth and Yield on Cost

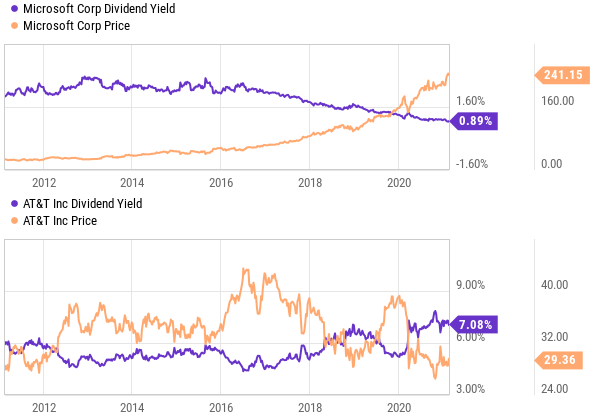

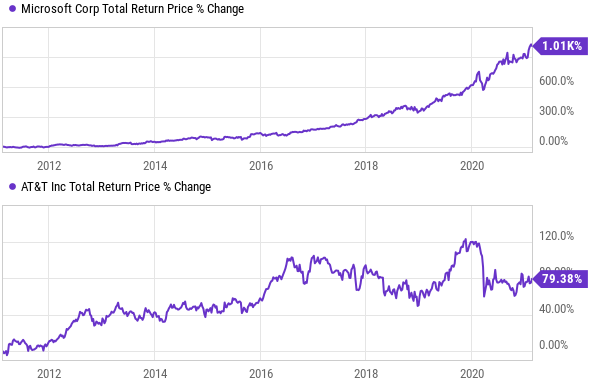

Dividend growth is another important concept for long-term income-focused investors to know because if you are not paying attention—you could overlook A LOT of income opportunities. Specifically, sometimes it is better to buy a lower dividend yield stock, if the dividend payment is growing, because in the long-term you’ll receive MORE INCOME—AND a better total return. We get into more specific examples of this later in the report, but to help you conceptualize, take a look at Microsoft (MSFT) a lower dividend yield stock versus AT&T (T) a very popular higher dividend yield stock.

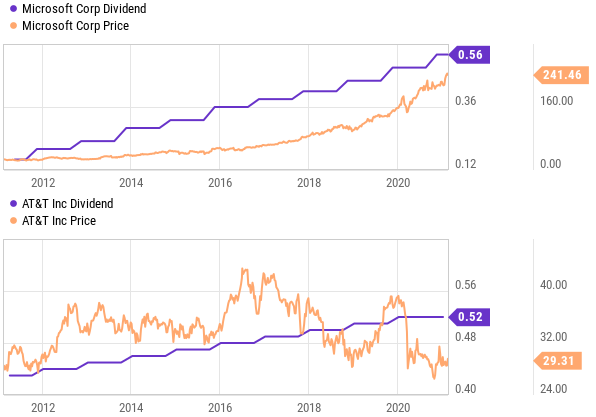

Specifically, 10 years ago, both AT&T and Microsoft traded at around $26 per share, but AT&T offered a dividend yield of around 6.0%, whereas Microsoft’s was only around 2.2%. However, as you can see in the follow chart, Microsoft’s dividend payment has grow faster, and if you purchased both stocks 10 years ago—Microsoft’s current “yield on cost” is HIGHER than AT&T’s

The point here is that investors should not overlook the massive long-term income potential of dividend growth stocks. If you chose to spend your $26 back in 2011 on a share of Microsoft instead of AT&T, you’d actually be receiving a bigger dividend payment today, and you’d also have earned a much much much bigger total return (see chart below).

You personally need to always balance your near-term and long-term needs for income with careful consideration to avoid value traps, optimize total returns and not overlook the amazing power of long-term dividend growth.

Top 10 High Income Stocks

With that backdrop in mind, let’s get into our top 10 countdown. Without further ado, here is our ranking, starting with #10 and counting down to our #1 top idea.

10. PIMCO Income Opportunity (PKO), Yield: 8.9%

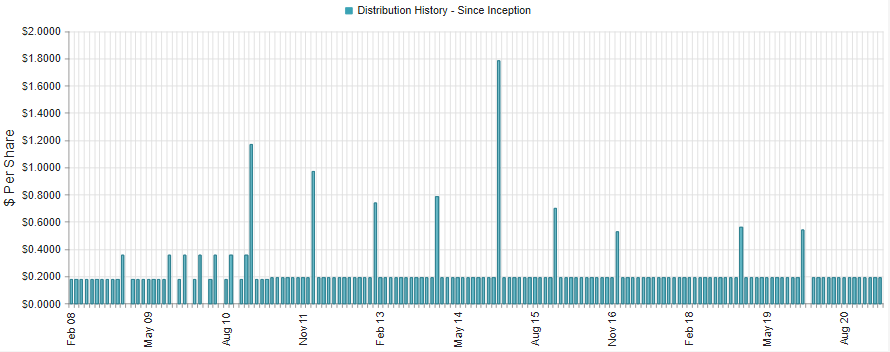

The PIMCO Income Opportunity Fund is an attractive closed-end fund considering its big monthly dividend payments, strong and experienced management team, and even its potential for some price appreciation too. It invests in a diversified portfolio of fixed income securities (mostly corporate bonds), prudently uses some leverage, and has continued to pay steady income since its inception in 2007, despite the market’s many ups and downs.

You can get all the latest data and metrics on this one at CEF Connect (here), and you can read our previous full report for our detailed thesis, here:

9. Altria (MO), Yield: 7.9%

Altria Group Inc. (MO) is one of the world’s largest manufacturer and seller of cigarettes, tobacco and related products. Altria is structured as a holding company, and operates via its subsidiaries - Philip Morris USA, U.S. Smokeless Tobacco Company, John Middleton Co., Ste. Michelle Wine Estates Ltd. and Philip Morris Capital Corporation. The company also has a 10% equity stake in Anheuser-Busch InBev (BUD), a 35% stake in e-cigarette maker JUUL (JUUL), and a 45% stake in the cannabis company Cronos Group (CRON). Some of its major brands include Marlboro, Black & Mild, Copenhagen, Skoal.

Altria has a very healthy dividend (with over 50 years of dividend increases), and the shares have significantly less volatility risk than the rest of the market (as per its 0.6, 3-year beta). Furthermore, we like the company’s aggressive share repurchase program. You can read our full write-up on Altria here:

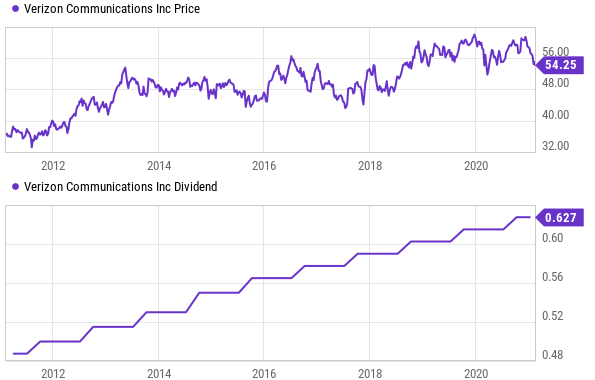

8b. Verizon (VZ), Yield: 4.6%

Verizon’s relative strength comes from the scale of its wireless business, which has positioned it on strong footing as compared to its rivals. And we believe that because of its largely resilient business model with a recurring revenue stream, the company should be able to generate robust free cash flows in the future, thereby strengthening regular dividend payouts. Also, there is plenty of room for dividend growth given that Verizon currently pays just over half of its free cash flows in dividends.

Accordingly, we believe the stock is worth considering if you are a long-term, income-focused investor. You can access our previous full report on Verizon here:

8a. Pfizer (PFE), Yield: 4.5%

The 4.3% dividend yield of mega-cap pharmaceutical company Pfizer (PFE) is worth a closer look. Specifically, its return on capital is above its cost of capital (a good thing), its margins should increase as a result of the Upjohn spinoff, its covid vaccine is in addition to an already strong core business, it’s paid 328 consecutive quarterly dividend (and has increased the dividend 11 years straight), and the share price just dipped.

If you are looking for a healthy growing big dividend, Pfizer’s is worth considering. You can access our full report on Pfizer here:

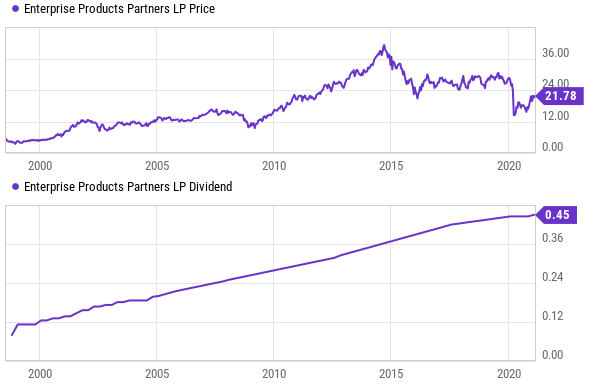

7. Enterprise Products Partners (EPD) 8.4%

If you are looking for big safe income, this midstream operator is attractive. It operates as a Master Limited Partnership (MLP), and has consistently maintained its distribution throughout the pandemic (while other midstream MLPs were cutting). Further, it’s actually increased the distribution 22 years in a row, and insiders have a large stake in the company.

You can access our new report on EPD here:

6. PIMCO Dynamic Income Fund (PDI), Yield: 9.9%

If you liked PIMCO’s Income Opportunity Fund at #10, you might like PIMCO’s Dynamic Income Fund (PDI) even more. For starters, it offers a higher yield (also paid monthly), it has the potential for more upside (the underlying bonds trade at an attractive discount to par), and the income has also remained steady and healthy throughout the market’s ups and downs. Plus this fund has a diversified basket of underlying bond holdings, including corporate bonds and asset backed securities, to name a couple. Further, it’s the premium to NAV is small by historical standards, suggesting to us there could be more upside potential to the shares.

You can read our previous write-up on PDI using the following link to get a better idea of all the things that go into our detailed review of this attractive high-income investment opportunity.

The Top 5 (Part II)

Part 2 of of this report, including the top 5 high-income stocks, is available to members here:

It includes a variety of highly attractive high-dividend stocks, and we currently own all 5 of them. If you are not already a member, you can get instant access here.

The Bottom Line:

As an income-focused investors, you need to understand your own personal goals, and then invest accordingly. Depending on how much current income you need, you might be able to better maximize long-term returns by paying careful attention to dividend growth potential, as well as total returns. And critically important, just because something offers a higher yield, that doesn’t mean it’s a better investment. Investors should do their best to avoid value traps at all costs. At the end of the day, it’s your money. Know your goals, and then stick to your plan. Disciplined long-term investing has proven to be a winning strategy over and over again throughout history. It will this time too.