Despite macroeconomic concerns, the stock market has continued to post strong gains this year thereby leaving some investors wondering if it’s time to take some chips off the table. One popular approach is owning attractive big-yield investments (6% to over 10% yields) that will continue to pay high income regardless of what happens in the broader market. In this report, we provide an overview of “frothy” market conditions (e.g. valuation metrics) and then countdown our top 10 big-yields (including BDCs, stock and bond CEFs, REITs and more). We conclude with a critical takeaway that is sadly overlooked by many.

Current “Frothy” Market Conditions

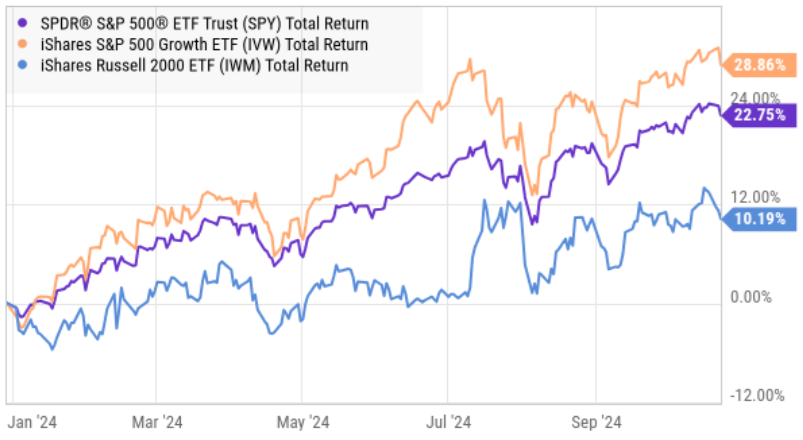

In case you haven’t noticed, the market (as measured by the S&P 500 (SPY)) has been strong this year (see chart below). And the strong returns have occurred regardless of macro and geopolitical concerns, as well as uncertainty surrounding upcoming administration changes in Washington DC.

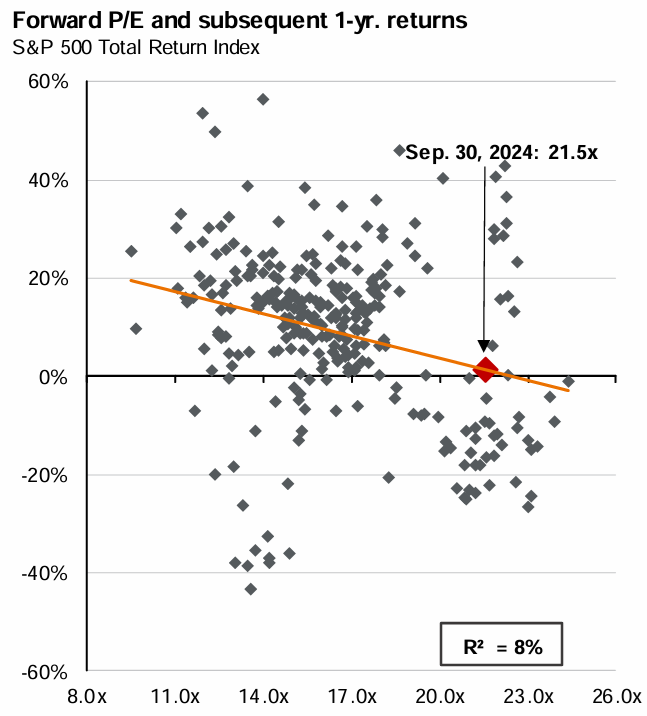

To put the gains in perspective, here is a look at the forward price-to-earnings ratio (a common valuation metric) for the S&P 500. And as you can see, we are more than 1 standad deviation aove the 30-year average (many investors consider this expensive and overvalued).

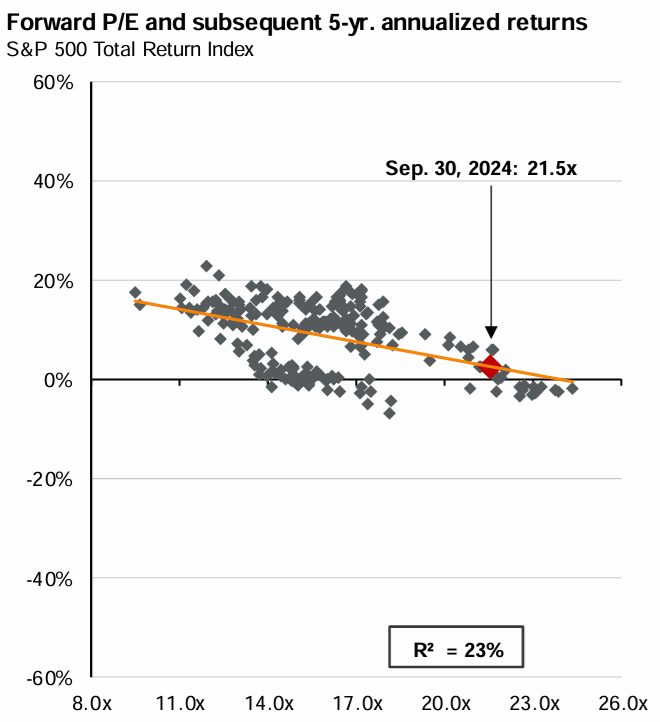

And to put the market valuation into perspective, here is a look at the subsequent 1-year and 5-year returns of the S&P500 following such a high market-wide forward price-to-earnings ratio. On average, subsequent market returns have been weaker than normal when the forward P/E ratio is as high as it is right now.

Of course, there is a wide range of variability to subsequent returns (sometimes subsequent returns have been strong, sometimes weak, but on average, below average, when market-wide valuation metrics are this high).

As always, what you do with your money should be based on your own personal situation, goals and needs, and some invetors choose to take a little risk off the table when market-wide valuations get this high.

Honorable Mentions

So with that backdrop in mind, let’s get into a couple specific “honorable mentions” on our top 10 rankings and countdown, starting with…

Schwab US Dividend Equity ETF (SCHD), Yield: 3.5%

This very popular dividend-growth ETF doesn't have a big enough yield to make it onto our official top 10 list, but it does present an attractive lower-volatility contarian opportunity (considering it owns many “value” focused stocks (instead of the growth stocks that have been dominating the market lately, as we saw in our earlier chart).

Here is a look at SCHD’s style box (from Moningstar), and as you can see it is centered around large cap “value” stocks.

And in this next chart you can see how value stocks are particularly inexpensive right now, relative to growth, in terms of 30 years of history (i.e. SCHD appears to be an increasingly attractive contrarian opportunity right now).

Of course there is no gaurantee “value” will outperform “growth” from here (many people have been calling for this for the last 6 years and it still hasn’t happened).

And for a little more perspective, here is a look at some additional “style” metrics for SCHD (as per Morningstar).

In a nutshell, SCHD is a very interesting value-oriented dividend ETF that may be due for some relative, low-volatility, outperformance as compared to the growth stocks that have dominated the market and seem a bit overvalued.

Also, we’d be remiss not to mention, SCHD focuses on qualified dividends (i.e. they’re qualified for the lower “qualified dividend” tax rate, depending on your personal income tax rate), something many other names on this list don’t necessarily do as well (so it may be especially worth considering for your taxable brokerage account (again depending on your own personal situation and relative to the other types of investments you own.

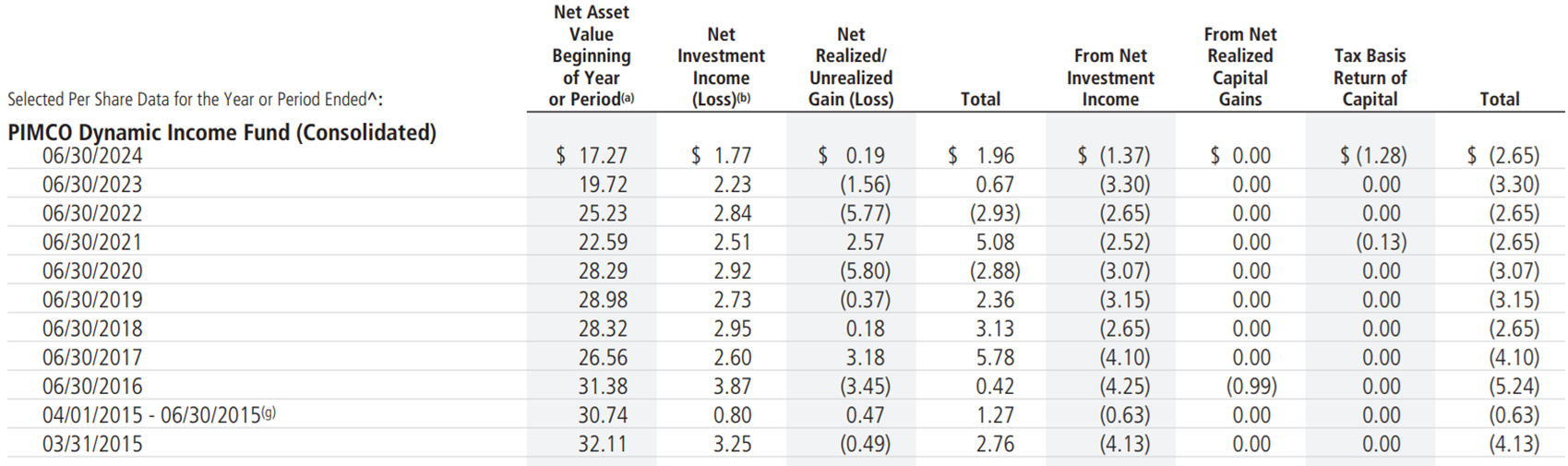

PIMCO Dynamic Income (PDI), Yield: 13.3%

This PIMCO bond-focused closed-end fund (“CEF”) is hugely popular among some investors (because of its monster yield, paid monthly). And PDI also recently experienced a large “Taxable Return of Capital (“ROC”) event, something we wrote about in great detail here:

In a nutshell, this one is in a slightly better position than it has been in recent years (despite the increasing price premium, recently over 15%) because it has gotten some taxable ROC out of the way (even though economically it has already been baked into the fund’s total return and net asset value) and because the post-pandemic interest rate volatility has subsided (and rates may even go lower from here—a good thing for this fund!). You can read our full PDI report here: PDI: The Big ROC Bath, 13.3% "Yield."

Top 10 Countdown

So with that background information, plus two honorable mentions, let’s get into the official top 10 ranking, starting with #10 and counting down to our very top ideas.

10. Blackrock Credit Allocation (BTZ): Yield: 9.2%

Although BTZ has a slightly lower yield that PDI (above), this BlackRock bond-focused CEF still offers a big yield (also paid monthly) and it currently trades at a discount of ~5.7% compared to its net asset value (contrary to PIMCO which is trading at an increasingly large premium). Investors have their opinions about PIMCO (generally considered the “premier” bond fund manager) and BlackRock (some consider it second rate, even though it also has massive resources, skill and a long history of success).

For your reference, here is a list of things we always consider before investing in any closed-end fund:

At the very least, from a diversification standpoint, BTZ is worth considering as a PIMCO alternative and/or complement. It uses 35.7% leverage, has more reasonable fees, a long track record of success, and it could also benefit from interest rate cuts (when rates fall, bond prices rise, all else equal).

9. Cohen & Steers Income Realty (RQI), Yield: 7.0%

Real Estate Investment Trusts, or REITs, are the focus of this Cohen & Steers CEF, and it’s a market sector that is up less than the overall market (S&P 500) this year, thereby arguably making it a contrarian opportunity (especially if rate cuts materialize). The fund uses a healthy dose of leverage (or borrowed money to magnify returns and income), recently 27.2%, plus it trades at a discount (~2.3%) relative to NAV (we’ll pay a premium for an attractive CEF, but always prefer to buy quality CEFs at a discount). It holds popular REITs you may be familiar with (American Tower (AMT), Welltower (WELL), Prologis (PLD) and Digital Realty (DLR), and offers a big distribution yield. If you are looking for a big-yield REIT CEF, RQI is attractive.

8. D&P Utility Infrastructure (DPG), Yield: 7.2%

This big-yield Duff & Phelps CEF focuses on utility stocks, which are known for lower-volatility safety and big dividends. And the sector has newfound growth recently related to the electricity demands of artificial intelligence programs running in data centers around the US (particularly large hubs, like Washington DC, where demand is basically insatiable at this point).

This one also offers a very attractive discount to NAV (~10.7%) following a distribution right-sizing quarters ago, and it uses a prudent amount of levereage (recently 24%) considering the lower-volatility nature of utility stocks. It also recently switched to monthly distrubutions (attractive) instead of quarterly. Said differently, DPG is an attractive big-yield contrarian opportunity.

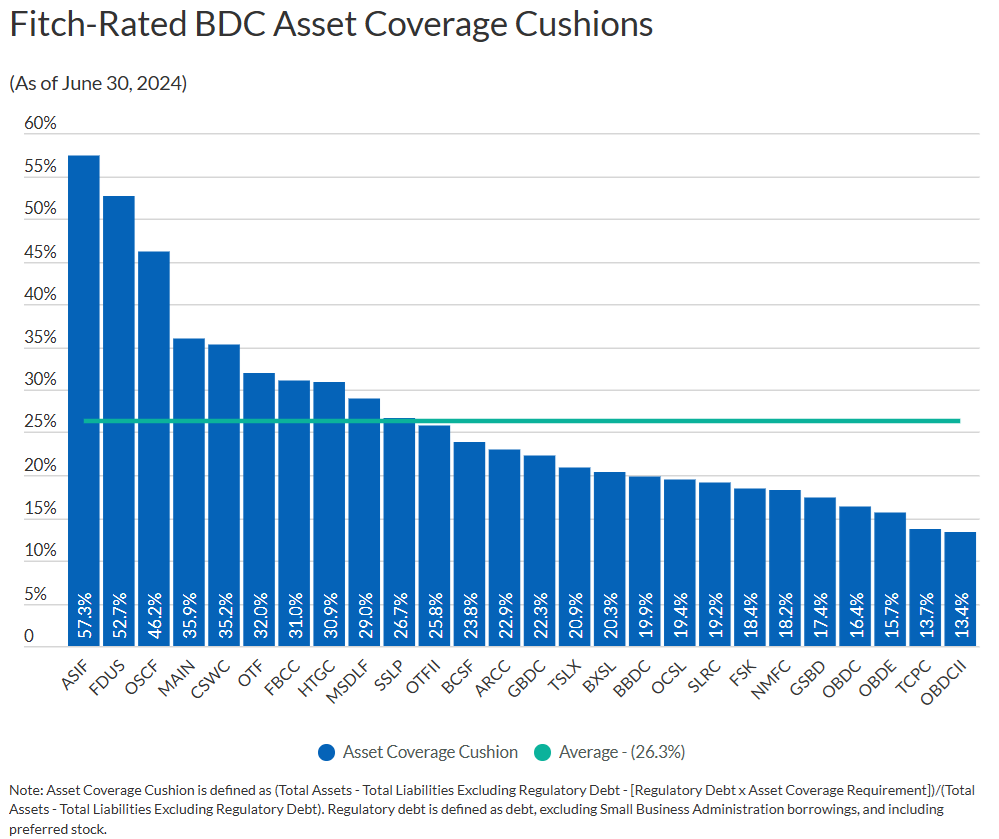

7. Blue Owl Capital (OBDC), Yield: 11.5%

This big-yield Business Development (“BDC”) has experienced share price weakness after announcing a merger with its sister BDC (OBDE). The merger does lower the net investment income (“NII”) yield a bit because OBDE holds slightly lower yield investments, but it also reduces volatility, strengthens the financials, and these dynamics are already largely reflected in the price. It sill trades at a slight discount to NAV, even though the dividend remains coverd by investment income. We recently wrote this one up in detail here:

If you are an income-focused investor, Blue Owl is absolutely worth considering for a spot in your portfolio.

6. Ares Capital (ARCC), Yield: 8.9%

Ares is the biggest publicly-traded BDC by market cap and it is leaps-and-bounds ahead of most peers in terms of existing borrower relationships and financial wherewithal. It is also well positioned to handle the dynamic economic environment while still supporting and growing its business and its dividend.

We recently wrote up Ares Capital in great detail here:

With a reasonable valuation and attractive big yield, we currently own shares of Ares in our Blue Harbinger “High Income NOW” Portfolio.

The Top 5 Big-Yields

Our top 5 big yields are reserved for members-only and they are available here. The top 5 includes an attractive mix of compelling big-yield BDCs, CEFs and more, as well as access to our complete 23-position Blue Harbinger “High Income NOW” Portfolio and our Top 10 tear sheet.

-Continue reading the full report.

(members only)

The Bottom Line

If you are an income-focused investor, there are a lot of attractive opportunities, if you know where to look (such as the names in this report). However, it is most critically important to do what is right for you based on your own individual situation. Too many investors have fallen into the trap of believing there is only one right and one wrong answer, when in reality there are as many correct answers as there are investors—each with their own individual situation and goals.

Disciplined, goal-focused, long-term investing continues to be a winning strategy. Do what is right for you.