As you can see in the 10-day return column (below), Artificial Intelligence (“AI”) stocks have been particularly volatile. Much of this volatility is fear-driven and has thereby created select attractive opportunities, as the AI megatrend is still fully intact (i.e. it’s in its early innings). In this report, I share my top 10 AI growth stock rankings, starting with #10 and counting down to my very top ideas.

The AI Megatrend

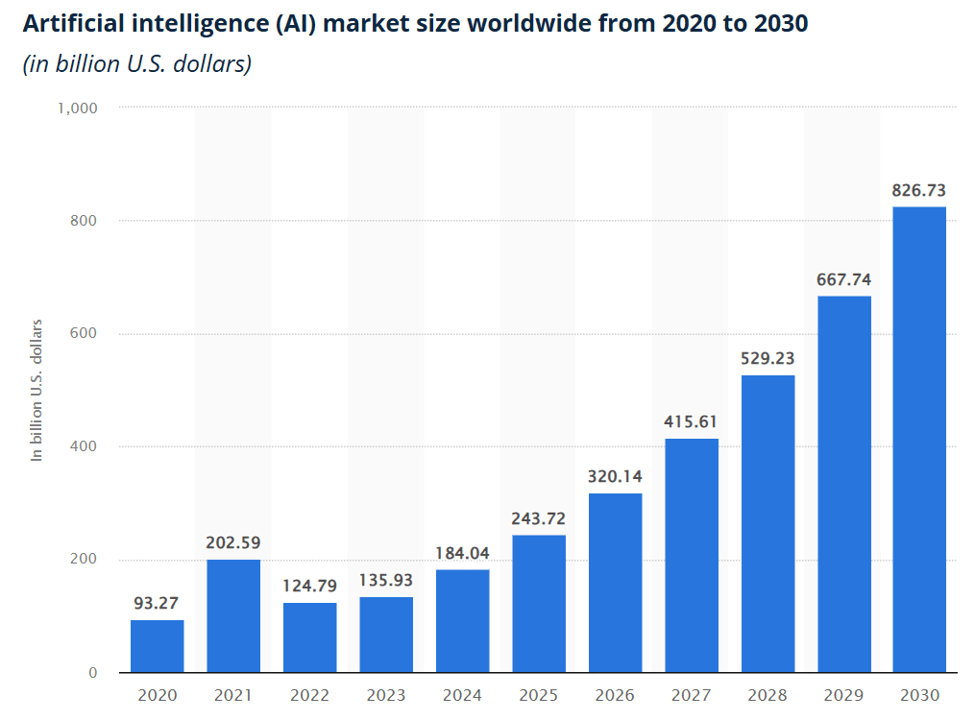

Before getting into the top 10 rankings, it’s worth first reviewing the AI megatrend. In particular, it’s important to realize that just because the megatrend is in its early innings, that doesn’t mean all AI stocks will be successful.

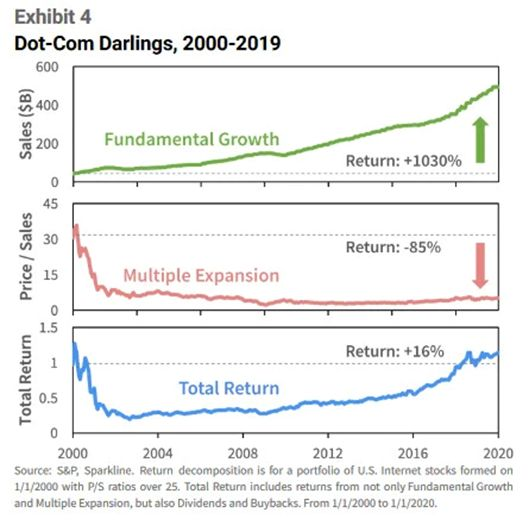

Take for example, the Internet megatrend at the start of this century; many stocks were overhyped, overvalued, share prices eventually crashed, and it took many years for a lot of investors to recover (see graph below).

There were ultimately big Internet winners (such as Google, Meta and even Netflix), but there were a lot of big losers that never recovered too.

Recent AI Volatility:

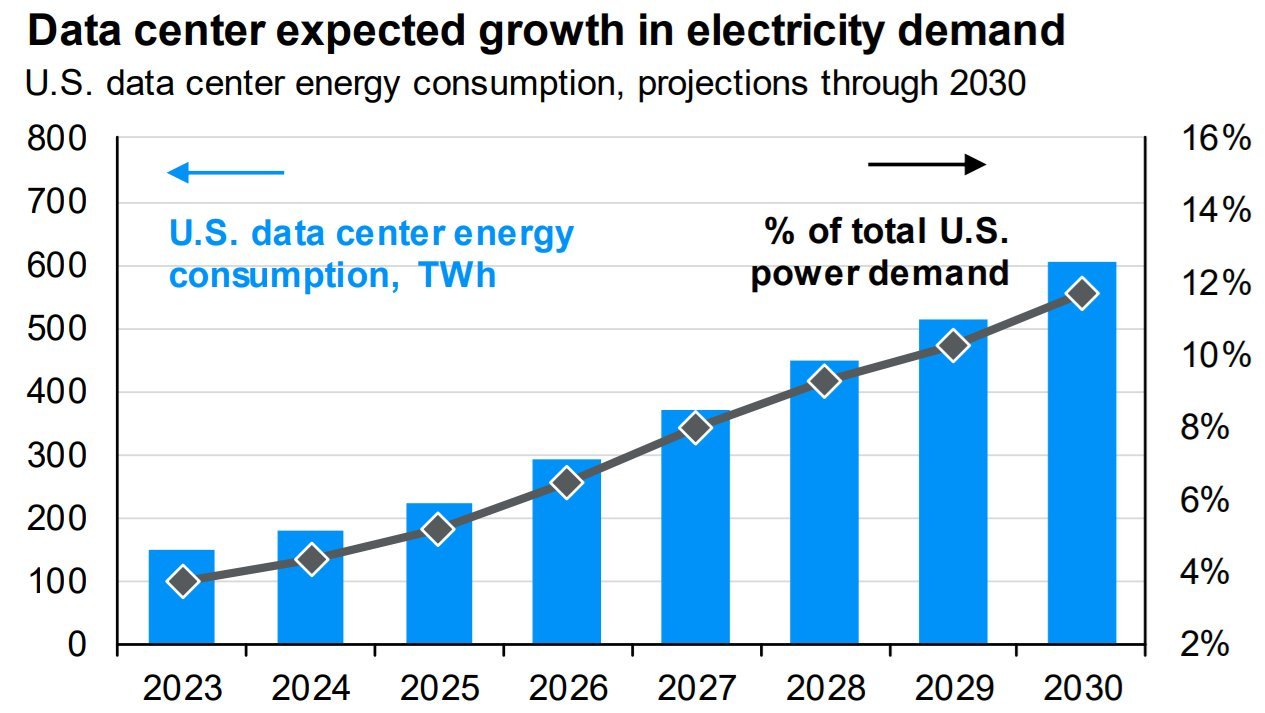

Fast forward to the AI megatrend of today. There will be big winners and losers, and the market’s volatility over the last few weeks has created some additional margin of safety for would-be buyers, especially as the AI megatrend beings to shift from phase 1 (capital expenditures) to phase two (software implementation and related infrastructure demands—such as astronomical datacenter energy requirements).

*Honorable Mention:

Palantir (PLTR)

Before getting into the official top 10 rankings and countdown, it’s worth considering a truly impressive AI software company, Palantir (and my “honorable mention” in this report).

Palantir’s business has been growing like wildfire, and it has enormous amounts of continuing growth ahead. Plus, the shares have just recently sold off hard, thereby creating a more attractive price for potential buyers.

The problem with Palantir, however, is not it’s business (business is great!), it’s Palantir’s valuation. Much like the earlier green-red-and-blue graph of “Dot Com Darlings,” Palantir is so loved by many investors that its valuation has already reached incredible levels. For example, it’s recent price-to-sales ratio is over 75x (dramatically higher than just about every other opportunity in the table).

I have a high degree of confidence CEO, Alex Karp, will lead this business through incredible growth over the next decade (as the AI megatrend continues to unfold). However, I recently sold 100% of my Palantir shares at $101.00 per share (my average purchase price was in the $20’s) because it was being valued like the next 10 years already happened. I’ll look to add back shares of Palantir in the future (they’re already trading at a much more attractive price following recent market volatility, and we may get a shot in the coming months to buy back even lower).

Top 10 AI Growth Stocks:

So with that backdrop in mind, and considering recent market volatility (fear creates opportunity) let’s get into the top 10 AI growth stock rankings and countdown.

10: Snowflake (SNOW)

Snowflake is a cloud-based, big-data (structured and unstructured), AI company with incredible revenue growth and a truly massive total addressable market size/opportunity. The company’s platform allows businesses to consolidate disparate data into a single source to derive insights, build data-driven applications, and share securely with other teams and even other companies (impressive!). It also integrates with the big cloud platforms, including Amazon Web Services, Microsoft Azure, and Google Cloud (this is a big deal).

And Snowflake’s latest quarterly earnings announcement (released this past week) was also impressive. For example, revenue was $986.8 million (ahead of a $957 million estimate) and represented 28% year-over-year growth. Also impressive, the company’s net revenue retention rate was 126% (land-and-expand).

From a valuation standpoint, Snowflake is one of the more expensive names on the list, but this is to be expected as it is younger and it is turning the corner to more profitability. Additionally, its price-to-sales ratio has come down dramatically since the heights of the pandemic bubble, and the company’s relatively new CEO appears to be pivoting and accelerating the company in the right direction.

Given the truly massive AI market opportunities ahead, Snowflake presents an attractive long-term growth opportunity.

*(long Snowflake).

9. Constellation Energy (CEG)

Constellation Energy is the largest producer of carbon-free energy in the US, and it is positioned to benefit dramatically from the growing energy demands of AI datacenters. Specifically, CEG is focused on generating and supplying clean power through its extensive fleet of nuclear plants (along with hydro, wind, and solar facilities).

It serves a wide range of customers, including businesses, homes, and public sector entities, while also providing energy products and services tailored to meet the growing electricity demands of industries like AI and data centers.

The company surpassed expectation in its latest earnings release, and also increased its dividend by 25% (an indication of strength, especially for a utility sector stock). CEG’s 5-year earnings per share growth estimate is impressive (15%), especially considering the relatively low-beta nature of the utility sector combined with CEG’s ongoing benefits from big AI data center energy demand. This one has a lot of impressive upside potential in the years ahead.

8: Salesforce (CRM)

Salesforce is the leading cloud-based, customer relationship management (CRM) software, and it’s set to benefit from AI (particularly, “Agentforce,” Salesforce’s suite of autonomous AI agents).

Unlike some of the more aggressive AI growth stocks on this list, Salesforce is emerging as a “growth at a reasonable price” or “GARP” stock, considering the steady double-digit revenue growth combined with the compelling valuation, especially as the share price has pulled back recently. Trading at 1.7x sales, with 16% net margins and a 17.4% 5-year expected EPS growth rate, the Salesforce shares are compelling.

While the company’s fiscal 2026 revenue guidance ($40.5 billion to $40.9 billion) falls short (of the $41.46 billion expected by the street), Salesforce’s 34% operating margin forecast and steady profitability signal strength and attractiveness as a compelling GARP play (especially considering the company boosted its share repurchase program, thereby complementing its sturdy cash flow generation).

*(long Salesforce).

7. Nvidia (NVDA)

Nvidia is ground zero for the AI megatrend, as the semiconductor computer chips they make (graphical processing units, or GPUs) are the absolute dominant choice for AI users (and Nvidia’s CUDA programming platform is training developers to never switch to any competitor chips). Nvidia’s revenue growth over the last two years has been nothing short of spectacular.

And Amazingly, despite Nvidia’s incredible gains (see table above) it’s valuation is attractive. For example, check out its very low PEG ratio (price/earnings to growth) as compared to competitors (attractive!).

Just know that even though Nvidia is so extremely attractive, that doesn’t mean the shares cannot be volatile (they can be!), but based on the fundamentals, CUDA moat, high demand and ongoing megatrend trajectory, Nvidia is absolutely worth considering for a significant allocation in your long-term growth focused portfolio.

In fact, Nvidia is so large that it has become a huge portion of the S&P 500 (bigger than several entire market sectors and many countries), and if it continues to perform well you may certainly underperform the S&P 500 in the years ahead if you do NOT have a healthy allocation to Nvidia shares.

Also worth highlighting, Nvidia’s earnings announcement this past week exceeded analyst expectations with the company reporting record-breaking Q4 revenue of $39.3 billion, a 78% increase year-over-year (fueled in large part by datacenter growth). Also, the company’s ramp up of its cutting-edge Blackwell platform is expected to improve gross margins further in the years ahead.

*(long Nvidia).

6. GE Vernova (GEV)

GE Vernova is a global energy company (that spun out of General Electric), and it provides energy via gas turbines, wind energy (both onshore and offshore), hydropower, and electrification solutions (such as grid systems and power conversion). The company plays a key role in advancing sustainable energy infrastructure, thereby making it a critical player in the AI megatrend.

For example, the surge in AI data center adoption is driving unprecedented demand for reliable, efficient, and scalable power sources (see our earlier graph)—areas where GE Vernova excels). It also has a strong order pipeline, improving margins, and management thereby confidently initiated a new $6 billion share repurchase program (a good thing).

From a valuation standpoint, GE Vernova has an incredible (especially for a utility sector stock) 81% 5-year EPS growth estimate, and an impressive 0.8x forward PEG ratio. This is an compelling opportunity (especially following recent market volatility and the share price pullback).

5: Super Micro Computer (SMCI)

The volatility for this server and digital storage company has been extraordinary over the last 18 month, and the last 18 days. But one thing has remained constant—massive revenue growth related to the AI megatrend.

Super Micro shares skyrocketed in 2024 related to its benefits from AI and its relationship with AI chip leader Nvidia. However, the shares then sold off hard following skepticism about growth and the company’s financials (following a short-seller report and the resignation of its auditor, Ernst & Young).

The company finally filed its audited financials this past week, removing a big uncertainty, but the new auditor (BDO USA) noted material weaknesses in internal controls (e.g. IT deficiencies, inadequate documentation, and potential litigation and reputational damage from delayed filings).

The best investments are rarely without warts, and Super Micro trades at an incredibly attractive valuation if you can get past the drama. For example, SMCI has above 40% revenue growth, a 55% expected 5-year EPS growth rate, and trades at an incredibly low forward PEG ratio of ~0.1x (attractive!).

*(long SMCI)

The Top 4 AI Growth Stocks

The top 4 AI growth stocks are available to members only, and they can be accessed here. They include very top ideas for you to consider.

The Bottom Line

Just because shares have sold off in recent weeks, the AI megatrend is not over. In fact, it is still in its early innings and the recent share price pullback creates some additional margin of safety for long-term growth investors to buy.

The names highlighted in this report are particularly compelling, and hopefully provide some timely ideas worth considering as you manage your own investment portfolio.

And remember, near-term price volatility is often the price you pay for the best long-term returns. Long-term compound growth remains the 8th wonder of the world. And disciplined, goal-focused, long-term investing remains a winning strategy.