Nvidia is ground zero for the Artificial Intelligence (“AI”) megatrend and Trump’s draconian trade war tariffs. The shares are now down nearly 40%, but this whole mess is far from over. In this report, I review the US trade imbalance and the AI megatrend through the lens of Nvidia’s massive business growth, current valuation and risks. I conclude with my strong opinion on investing.

US Trade Imbalance and The AI Megatrend

To give some perspective on the massive scale of both the trade war and Nvidia, let first consider a few charts.

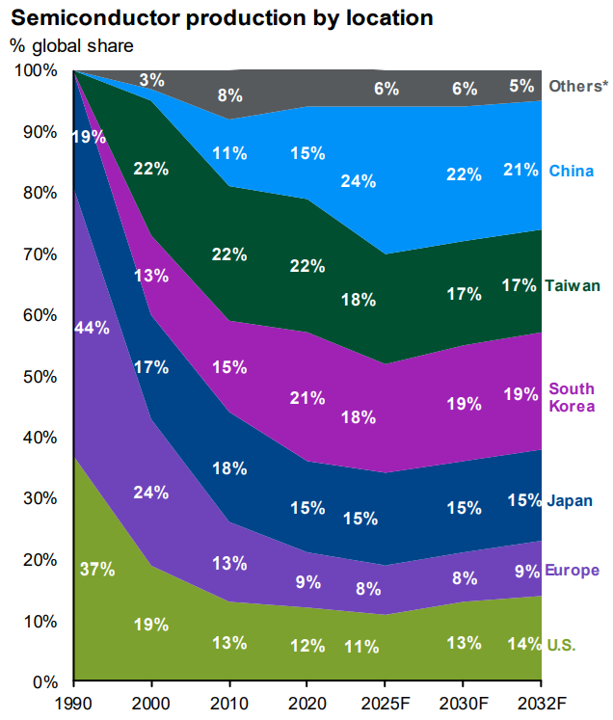

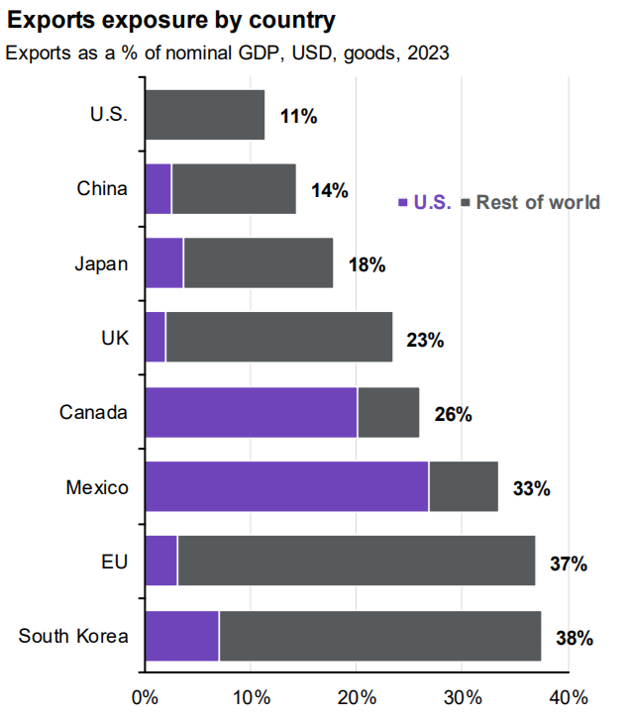

This first chart shows just how much semiconductor chip production has shifted away from the US, and towards China (and Taiwan), over the last 35 years. This really irritates President Trump, and it’s essentially the main reason Trump announced the new draconian tariffs that sent the market into a tizzy (i.e. Trump thinks foreign countries are ripping off the US, and it’s only going to get worse with the AI megatrend still in its early innings).

Of course Nvidia (the leading semiconductor company worldwide) is a US company, but the majority of its chips (e.g. Blackwell) are produced by Taiwan Semiconductor in Taiwan (which complicates tariff considerations, especially because of ongoing disputes about Taiwan’s independence from China, i.e. China thinks they own Taiwan, Taiwan and the US disagree).

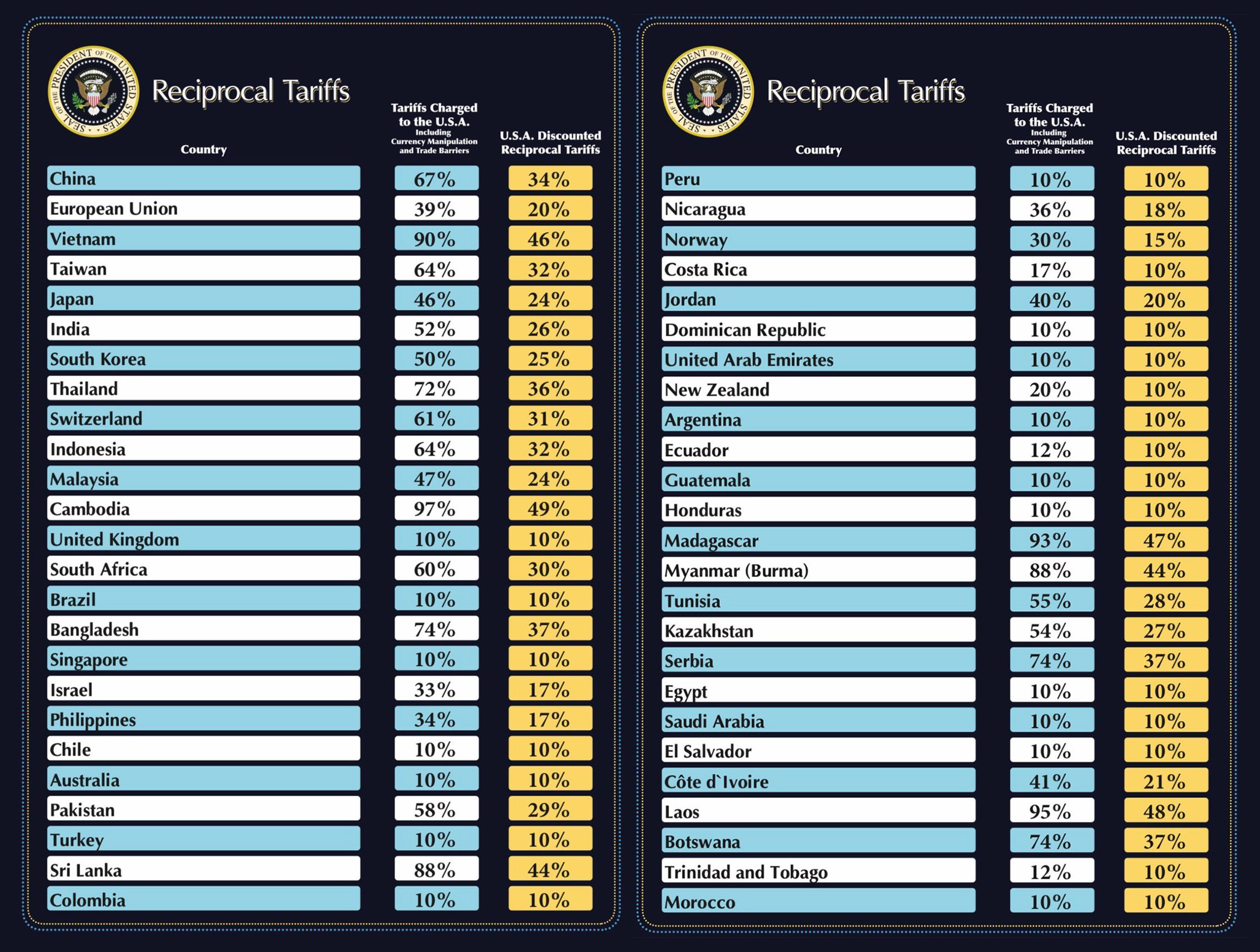

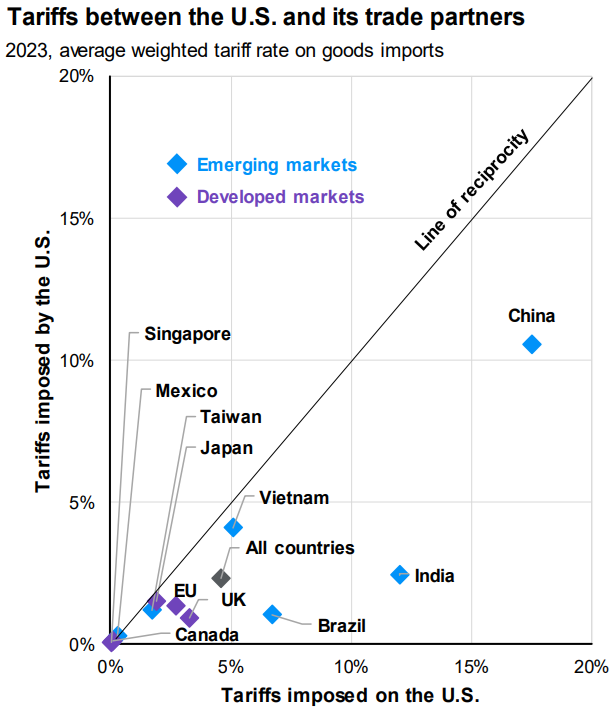

And for more color, this next chart shows just how big tariffs imposed by China (and others) are compared to tariffs imposed by the US (i.e. the imbalance).

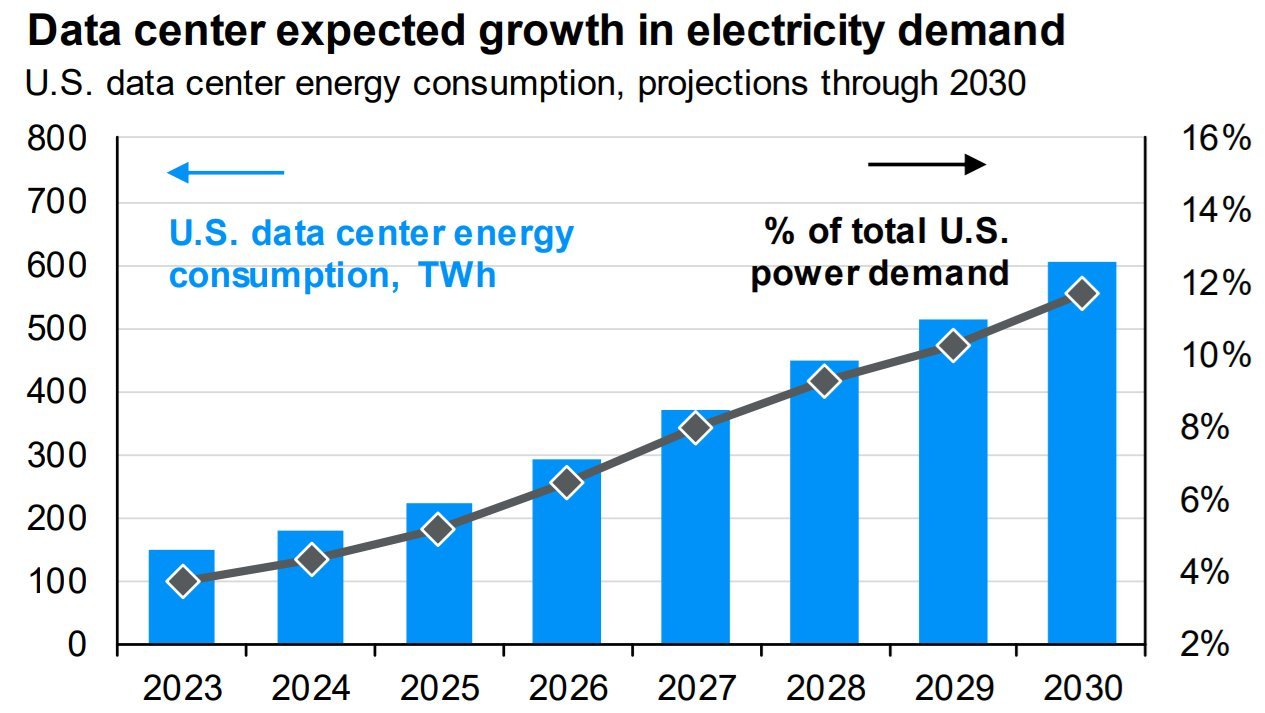

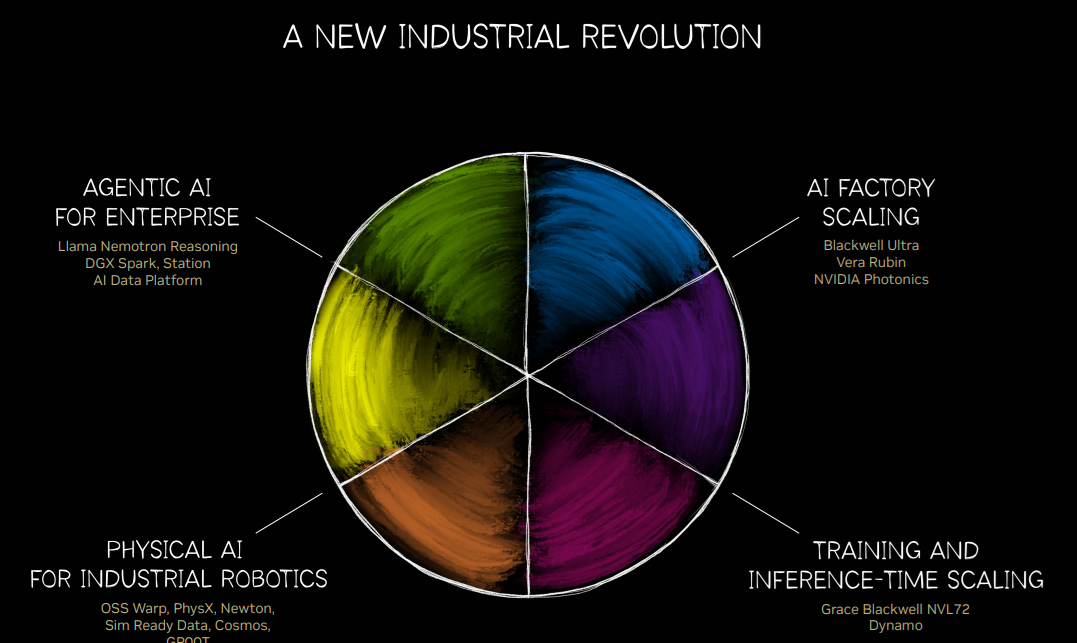

And of course the AI megatrend is huge and growing fast (i.e. it’s still in its early innings).

For example, while the above chart suggest the global AI industry could be worth over $1 trillion by 2030, a report from PwC projects AI could contribute as much as $15.7 trillion to the global economy by 2030 (driven by productivity gains and consumer demand). That’s bigger than the current GDP of most countries. And it’s expected to grow at a compound annual growth rate (CAGR) of 35-40% over the next few years, according to Grand View Research and McKinsey.

And for more current perspective, just this past week, Microsoft (MSFT) AI CEO, Mustafa Suleyman, said "We are going to need many, many, many more times" the amount of AI accelerators and data centers compared to what they currently have (i.e. AI growth is till just getting started).

And remember, in the data center GPU market (which is basically where AI actually happens), Nvidia has captured around 90%+ market share.

About Nvidia: AI Ground Zero

NVIDIA is best known for designing GPUs, which were initially developed for gaming but have since expanded into diverse applications, particularly related to the cloud (data centers) and the AI megatrend.

Specifically, Nvidia GPUs are critical for parallel processing, making them ideal for AI workloads. And its CUDA software platform enhances GPU programmability and gives the company a competitive advantage (i.e. a wide moat as the currently undisputed AI leader). Basically, datacenters are required for AI, and (as mentioned) Nvidia has captured over 90% of the market shares, and with a wide moat competitive advantage (i.e. it will be very hard for any competitor to dethrone Nvidia at this point).

Nvidia Growth

Given earlier AI industry growth projections, and considering Nvidia is already the wide-moat industry leader, it reasonable to believe Nvidia is growing rapidly. And for more perspective, here is a look at its previous (and future projections of) annual revenue growth.

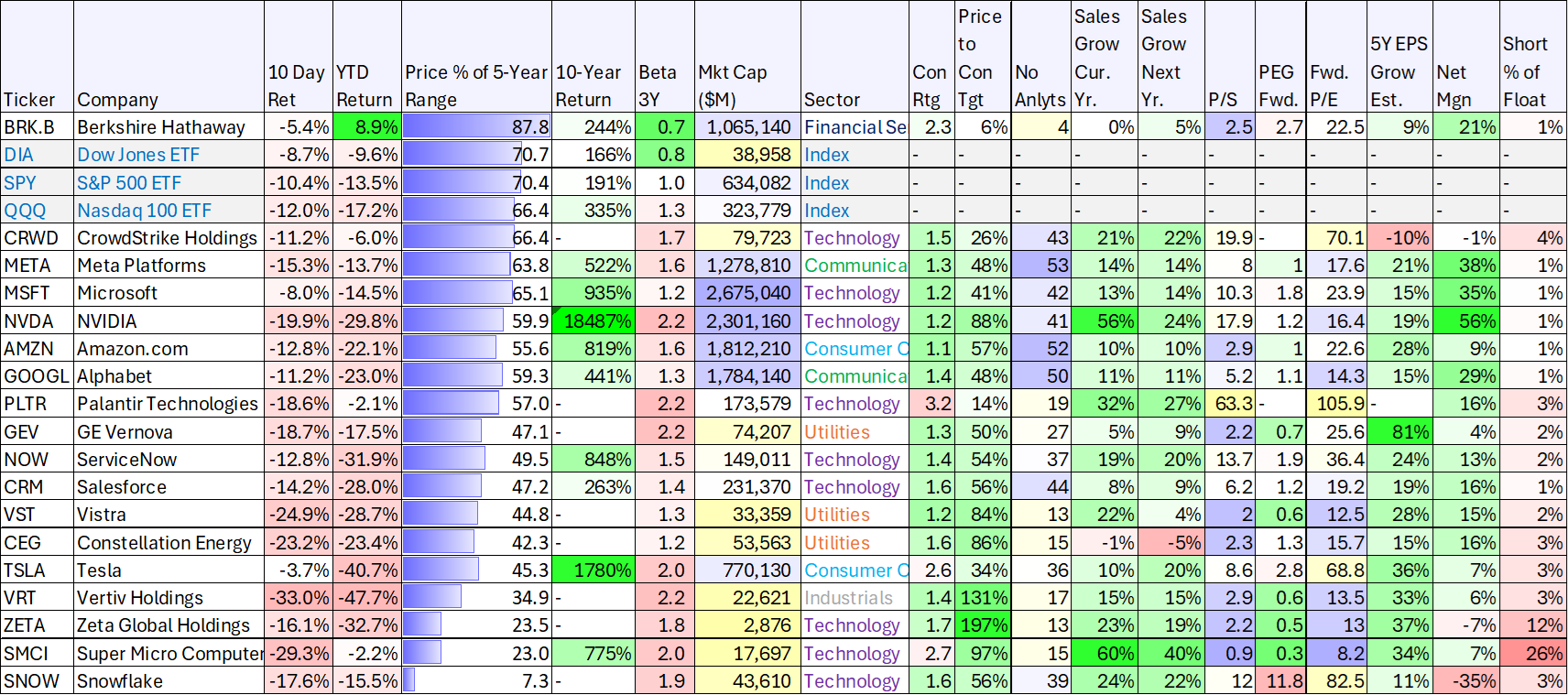

You can also see in the table below more specific Wall Street projections of Nvidia revenue growth for this year and next.

Nvidia Valuation

If you liked Nvidia at the start of this year, you’re probably thinking a lot has changed since then. For example, Trump unleashed a can of head-scratching tariffs that dragged stocks, especially Nvidia, dramatically lower (it’s now down more than 40% from its all-time high).

However, as you can see in the table below, Nvidia now trades at a compelling 16.4x forward price-to-earnings ratio. This is very attractive compared to peers, and on a standalone absolute basis (especially considering Nvidia’s high expected sales growth, high margins, low PEG ratio and impressive 5-year earnings-per-share (EPS) growth estimate).

*data as of Friday’s close (April 4, 2025).

However, a lot of Nvidia’s valuation is based on forward estimates (i.e. “guesses” about what will happen in the future) and with Trump Tariffs expected to ramp up soon—there is a lot of uncertainty in the market (and the market hates uncertainty!).

3 Phases of Trump’s Trade War

Considering the give-and-take between the massive AI megatrend and Trump’s massive head-scratching tariffs, it’s worth considering three (likely) phases of the trade war.

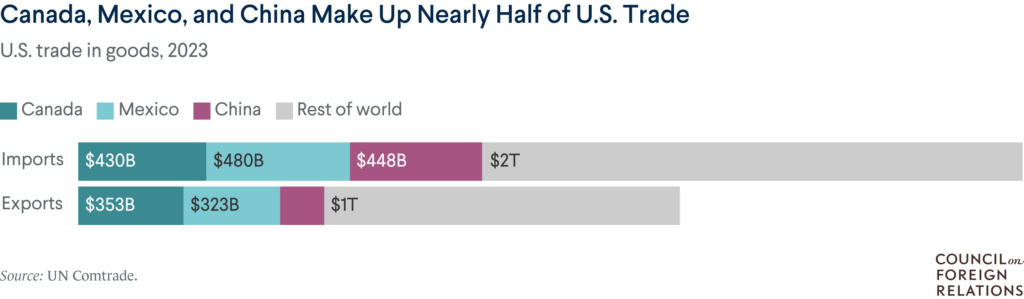

Phase 1: Liberation Day: Phase 1 of this trade war is President Trump announcing massive tariffs against international trading partners (most of whom which the US has a trade deficit). And of course, the hideous market selloff that just accelerated to frightening speed over the last few trading sessions. A case can be made that phase 1 has been going on for decades as foreign countries take advantage of US wealth, but no one can dispute Trump just whipped the trade war into high gear with his newly announced tariffs.

Phase 2: Concessions and Economic Damage: Phase 2 of the trade war will be the concessions and economic-destruction period. This will include a wide range of concessions and timeframes as the US renegotiates trading terms (tariffs) with foreign countries. Real economic damage will likely occur during this phase, as costs rise for US consumers, economic growth slows, and the declines we have experienced in the stock market so far likely reflect true value destruction that will occur as a result of the tariffs.

Regarding concessions, some will occur quickly, and be mostly meaningless, but the US President will most certainly tout them as big wins. Some concessions will happen slowly, and the value of the changes will be economically ambiguous (but again, there will be a lot of “victory lapping” from the US President).

The most important parts of phase 2 will be trade negotiations with large trading partners like China, Canada and Mexico. Mexico will likely be the quickest and most reasonable (because they are the most reasonable). Canada will likely be a lot friendlier (especially in their rhetoric) following their upcoming election at the end of April. China will be the least reasonable, simply because they are the most culturally different (i.e. they are communist, and they don’t really believe in things like “property rights” or “the American Dream”).

At the end of phase 2 (when most of the so called “concessions” have been made), real near-term economic damage will have been done, the long-term economics may actually be slightly improved for the US (in terms of trade deficits), and the US President will proclaim huge victory.

Phase 3: Relapse: Over time, less wealthy countries will creep back into taking economic advantage of the US, especially China (a country the doesn’t believe in property rights or Western values). However, phase 3 will also bring less uncertainty, less market volatility and healthy stock market gains (building off a new, albeit lower, base).

Whether we are closer to the beginning or end of the tariff selloff is uncertain, but stocks are certainly trading a lot lower than they were. And over the long-term they will likely be trading a lot higher than they are now.

Nvidia Risks:

Nvidia is a very volatile and cyclical stock to begin with (that is the nature of the semiconductor industry), but the newly announced tariffs and trade war bring an entirely new level of risks that investors need to consider. For example:

Increased Production Costs: As described earlier, Nvidia relies heavily on a global supply chain (i.e. its chips are manufactured in Asia (e.g. Taiwan Semiconductor). So any tariffs on imported raw materials could raise production costs and decrease profits for Nvidia (i.e. bad for shareholders).

Reduced Demand in Some Markets: If tariffs are implemented in certain markets (countries) this will most directly increase the price of Nvidia chips to the consumer, and possibly decrease demand. Arguably, Nvidia’s gaming segment is more sensitive to prices, but data center demand could also drop as a result of higher prices.

Supply Chain Disruption: If tariffs are aimed at bringing more production back to the US (as per the earlier chart shared), this could take time and disrupt the supply chain and thereby lead to lower supply and higher costs—and the inability to meet demand in some markets but not others. Basically, supply chain disruption will decrease efficiency across the industry and for Nvidia especially (i.e. ground zero of the global AI megatrend).

Macroeconomic Ripple Effects: The reality is, it’s all just one global economy, and any inefficiency and slowdown for Nvidia will carry over to the rest of the economy (i.e. a globally economic slowdown). Further, tariffs may likely increase inflation, an issue the US fed is already working to combat. Potential inflationary pressures are a double edge sword as the fed raises rates (or keeps rates high) to slow inflation which also further slows the economy.

The Bottom Line

Sir John Templeton famously said the four most dangerous words in the stock market are “this time it's different.” He basically meant investors should be careful not to throw traditional investing rules out the window every time a new market crisis hits (e.g. even Trump’s head-scratching tariffs).

With that in mind, and despite the current high level of uncertainty and stock market volatility, the AI megatrend is still a massive long-term opportunity, and Nvidia has already secured its position as a wide-moat market leader (i.e. GPU competitors have simply been unsuccessful in building competitive AI chips, and Nvidia’s CUDA platform has widened that moat).

From a valuation standpoint, Nvidia is now less expensive and more attractive because its leadership position and trajectory in the long-term AI megatrend remains intact. To quote Sir John Templeton’s early contemporary, Baron Rothschild, “Buy when there is blood in the streets.” I am long Nvidia.