Sir John Templeton famously described the danger when over-exuberant investors start believing “this time it’s different.” And with the incredibly strong performance of a certain subset of leading growth stocks (i.e. the ones with very high revenue growth trajectories but essentially zero net income), a growing chorus of investors is warning of a massive bubble. In this report, we review the data behind “the bubble,” discuss what is actually happening, review volatility, investor goals, five stocks worth considering for purchase right now, and then conclude with a few critically important takeaways.

The Growth Stock Bubble

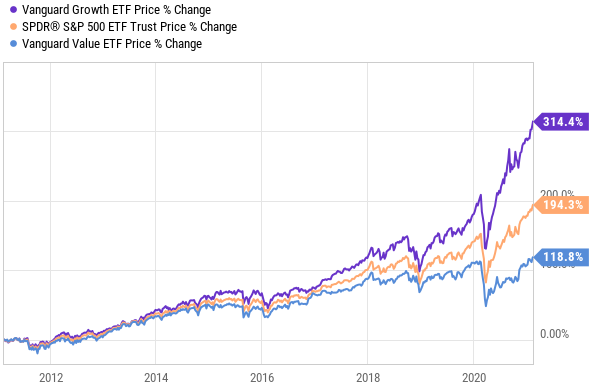

For starters, here is a look at the recent performance of the S&P 500 (SPY) versus value stocks (VTV) and growth stocks (VUG).

source: YCharts

Obviously, growth stocks have been outperforming by a lot over the last 10 years, but the story is much more nuanced than that. Of course many investors quickly attribute the outperformance to the strength of FAAMG stocks (Facebook (FB), Amazon (AMZN), Apple (AAPL), Microsoft (MSFT) and Google (GOOGL), but there is more to this story than that.

source: YCharts

Importantly, there is a “new breed” of growth stock leaders that some investors believe is making the so called “growth bubble” much worse. This new breed includes companies (often in the tech sector) with very high revenue growth trajectories (often based on a recurring subscription revenue model), but with essentially zero (or negative) net income. The argument being made by exuberant investors claiming “this time it’s different” is that this new breed of stocks is foregoing earnings now in order to maximize earnings later. It’s essentially an arms race whereby the companies with the highest revenues (and revenue growth potential) are being assigned the highest valuations regardless of the fact that they often have zero (or negative) current earnings.

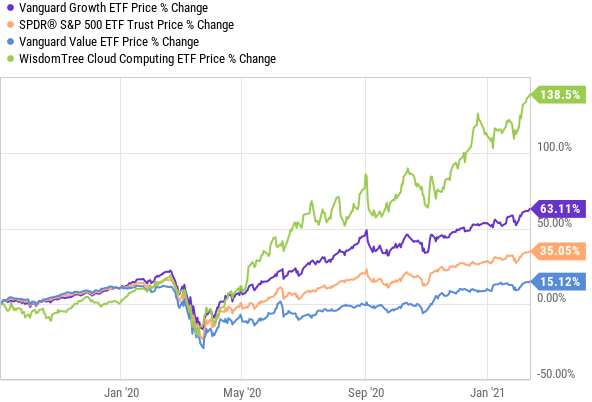

To help conceptualize this new breed of growth stock leaders, take for example the WisdomTree Cloud Computing ETF (WCLD) where many examples of these new breed stocks are concentrated. Before getting into its holdings, here is a look at its performance in recent quarters (as compared to the S&P 500, growth stocks and value stocks). WCLD has been delivering extremely high returns.

source: YCharts

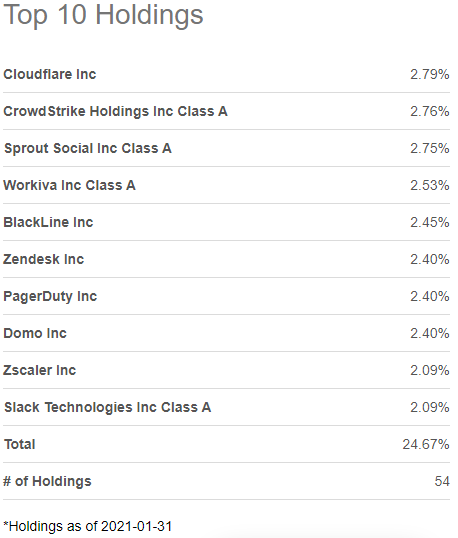

And if you look under the hood of this ETF, you’ll see its holdings are highly concentrated in the new breed of growth stock leaders. Specifically, it holds companies with very high revenue growth trajectories but very little net income. For example, here are the top 10 holdings and sector concentrations.

WisdomTree Cloud Computing ETF (WCLD) Holdings:

image source: Seeking Alpha

And aside from the huge technology bias (see holdings breakdown above), here is a data table (below) to corroborate our narrative about this new breed of companies having high sales growth trajectories but very little net income. For example, Cloudflare (NET), Crowdstrike (CRWD), Zscaler (ZS), Zendesk (ZEN) and Slack (WORK) are particularly expensive on a Price-to-Sales basis, despite negative net income.

source: StockRover

Specifically, all of these stocks have very high expected sales growth rates (this year and next), but negative net income. And as you can also see, all of these stocks have posted extremely impressive 1-year returns. Also worth noting, they all have very high price-to-sales ratios (a valuation metric that is often used to value high growth stocks with no actual earnings), and these ratios are closer to their 5-year highs than their 5-year lows.

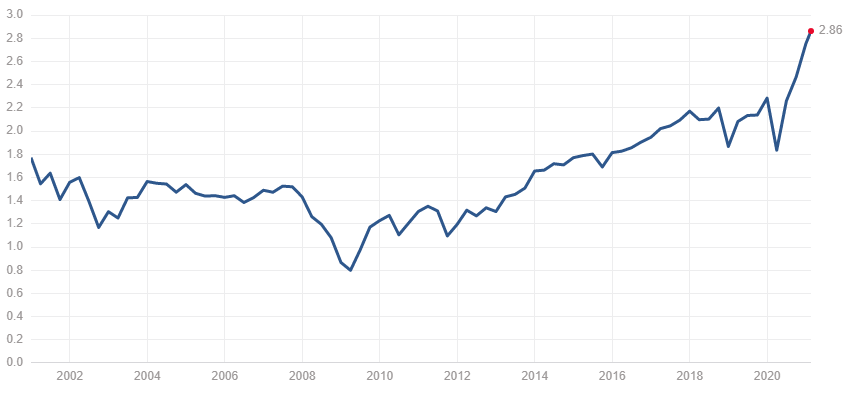

And for a little more perspective on just how expensive these stocks are relative to the rest of the market, here is a look at the historical price-to-sales ratio of the S&P 500 (SPY); it’s just a tiny fraction of the high multiples assigned to the new breed of growth stock leaders.

S&P 500 Price to Sales Ratio:

Source: multpl

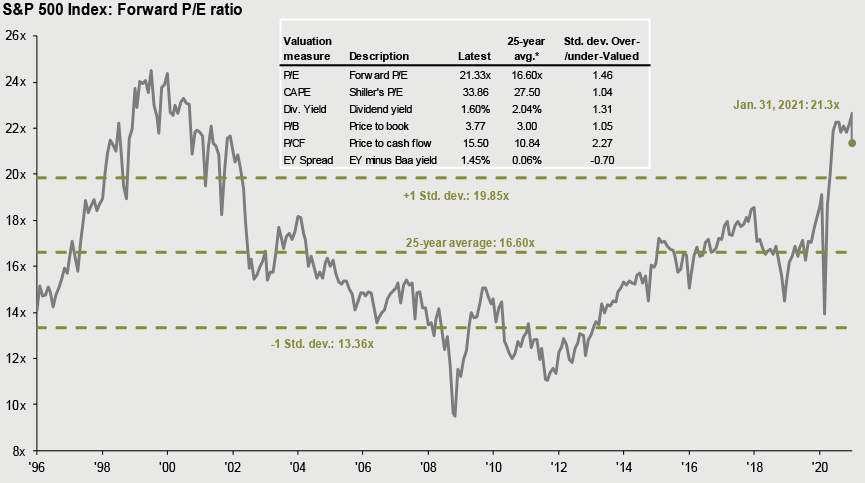

And for more perspective, here is a look at the forward price-to-earnings ratio of the S&P 500, to give you some historical perspective on current market valuations.

source: JP Morgan

Further still, this next chart shows you that the range of valuations (on a P/E basis) is significantly wider than normal. Note this is current P/E (instead of forward P/E) which explains why the number is on par with the “tech bubble” of the late 1990’s, but below the “tech bubble” on a forward p/e basis as seen earlier (i.e. because current earnings growth expectations are higher).

source: JP Morgan

What is Actually Happening?

Unlike the “tech bubble” of the late 1990’s (that famously burst in the early 2000’s) the top growth stocks today actually do have very real revenues (that is growing rapidly), and a very strong argument can be made that by forgoing current earnings (to instead focus on maximizing long-term revenue growth) these companies are in fact maximizing their long-term value. Specifically (and as shown in the table earlier) these stocks have very high gross margins (indicating their core businesses can one day be very profitable), but their operating margins are negative (because they’re spending heavily to grow their businesses before some competitor seizes the large market opportunity before them).

To help you better understand what is happening, here is a fantastic video from famous investors Howard Marks and Joel Greenblatt. I particularly like the conversation between 7:38 and 9:06 where Marks starts out by saying “never before has it been more acceptable to be unprofitable,” and then Greenblatt follows it up by explaining that if it costs $2 today to get a customer that will pay a company $1 a year for 8 years, then the company looks unprofitable in year 1, but it can actually be very profitable over the 8 years. Basically, some investors are having a hard time assigning a current valuation to this type of investment (i.e. the new breed of growth stocks, such as the ones held by WCLD).

source: RealVision

The bottom line here, in our opinion, is simply that the “growth stock bubble” of today, may not be very much of a bubble at all, considering (unlike the Tech Bubble of the late 1990’s) today’s leaders are real businesses, with extremely real cash flows that are growing rapidly and can keep growing rapidly for a lot of years to come considering the attractive business models and very large total addressable markets. The real question is not whether this is a bubble, but rather “is this new breed of growth stock leaders right for you?” (more on this in a moment).

There Will be Volatility

The so-called “risk-reward” tradeoff is an investing adage whereby the more risk (volatility) you take—the more potential reward (return) you will receive. While that is a useful analogy (and there may be some truth to it) many lazy professional investor take this analogy too far instead of rolling up their sleeves and doing the fundamental research (i.e. they’re all just closet indexers as per some convenient interpretation of the modern portfolio theory they all learned at their expensive universities). Specifically, if you are willing to do work, there are a lot of individual “new breed” growth stocks that are extremely attractive today (despite their recent strong performance), and we give specific examples of specific companies later in this report. But the question is, “are they right for you and your own personal portfolio?” When you select investments, you need to know your goals and know your risk tolerance. For example:

Will you hit the panic button and sell everything you own after a 15% market selloff, or will you acknowledge that volatility is one potential price you pay in exchange for earning powerful long-term price appreciation?

Similarly:

If you are at a point in your life where your goal is to generate steady high income, do you really want to own 100% high growth stocks, or will you be better served by owning some steady high dividend stocks instead?

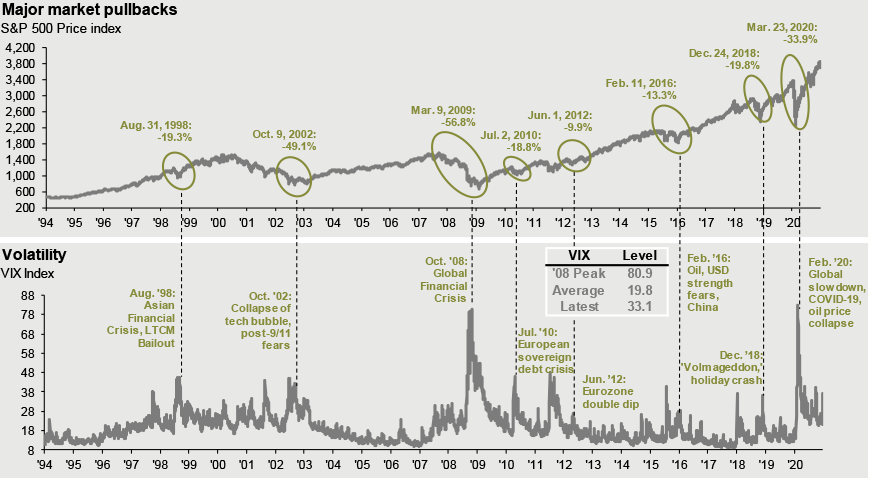

For example, significant market pullbacks are circled in the chart below. Can you handle one of these pullbacks? Are you confident you would react prudently?

source: JP Morgan

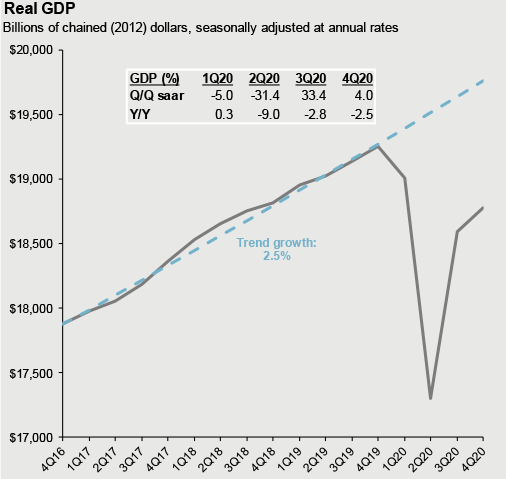

As another data point, you might want to keep in mind that despite our incredible market rally since the onset of the pandemic, US Real GDP is still recovering (per the chart below). The market is forward looking, but at times it can get ahead of itself.

source: JP Morgan

The Point: Know Your Goals

It cannot be said enough, as an investor it is critically important to know your goals and then stick to your plan. Disciplined, goal-focused long-term investing has proven to be a winning strategy over and over again throughout history, and it will this time too. In the next section, we describe 5 extremely attractive stocks to buy right now, depending on your own personal investment goals and situation.

5 Stocks to Buy Right Now

Depending on your situation, here is a list (below) of five stocks that are worth considering for purchase right now. The list is broken down into two groups: (1) attractive high-income stocks and (2) powerful long-term high-growth stocks. These are extremely different types of investments, but both offer very attractive investment opportunities right now. We first start with a high-income stock that can be an outstanding place to temporarily park some of your cash (if you don’t want it all sitting in zero-dividend high-growth stocks). But then we get into specific attractive high-growth stocks, selected from our current high growth stock watchlist.

1. PIMCO Dynamic Income Fund (PDI), Yield: 9.9%

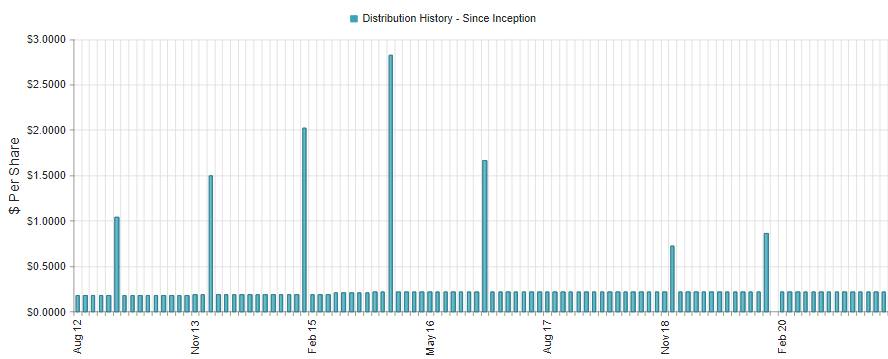

The PIMCO Dynamic Income fund is an attractive closed-end fund that will likely keep paying its big steady monthly income payments, even if the overall market sells off dramatically. This fund’s primary objective is current income, and as you can see in the following chart, it has paid a steady (and sometimes increasing, but never decreasing) monthly distribution (plus an occasional special dividend) to investors since its inception in 2012.

source: CEF Connect

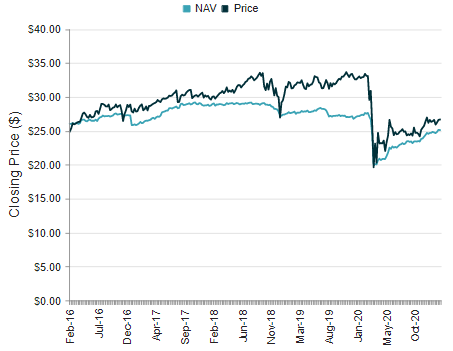

The fund holds a diversified mix of mostly bonds / fixed income instruments, and it’s important to note the monthly income payments have remained steady throughout historical market volatility. Price appreciation is the secondary objective on this fund, and it currently trades at an attractive price as its underlying bond holdings trade at a discount to par, its price trades at a relatively small premium to its net asset value on a historical basis (especially for a well-managed PIMCO fund), and the fed has demonstrated an extraordinarily strong desire to back the fixed income markets since the global pandemic began. Said differently, we believe the shares have upside price appreciation potential, in addition to the big steady monthly dividend payments to investors.

PDI Price versus Net Asset Value:

source: CEF Connect

These shares won’t ever achieve the extreme long-term upside price appreciation potential of some high growth stocks, but if you are simply looking for steady income payments—PDI is attractive and worth considering.

2. Palantir (PLTR): Massive Total Addressable Market

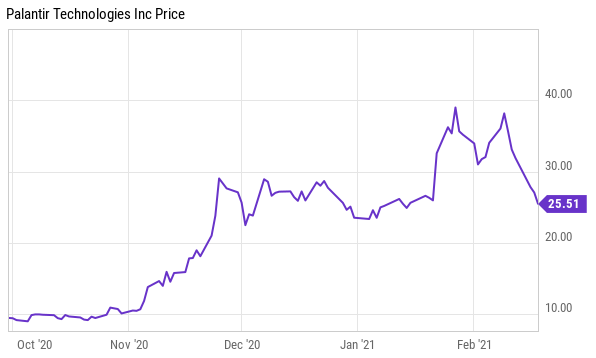

Polar opposite to PDI, Palantir is a zero-dividend stock with incredible long-term price appreciation potential, and the recent share price pullback (following earnings) makes for an increasingly attractive entry point for disciplined, long-term, high-growth investors.

Palantir Share Price:

source: YCharts

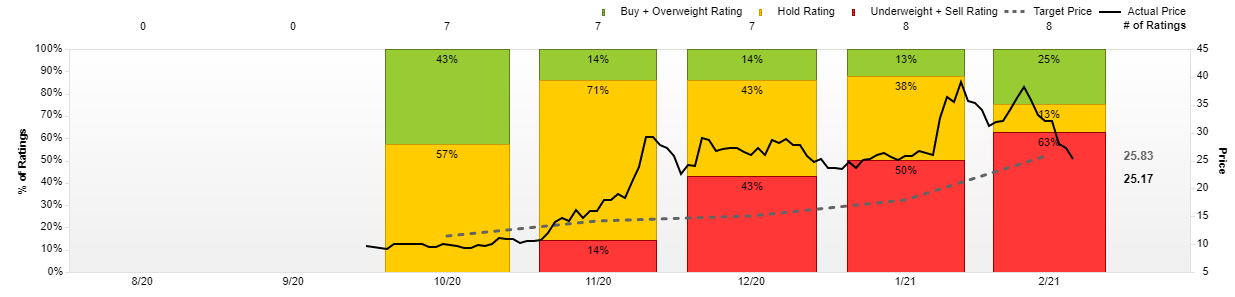

Palantir is a market leading data analytics software company (that began trading publicly in 2020), and it is one of the new breed growth stocks that has an incredibly strong revenue growth rate (estimated at 32.1% next year, per Stock Rover) and a very large total addressable market (recently valued at $119 billion per its S-1 filing), but net income is currently negative. The company is basically being valued on its immense future potential. And despite the currently high 49.5x price-to-sales ratio (as per Stock Rover), these shares can go much higher in the years ahead if it is able to capitalize on the large market opportunity, which many investors believe it will. And even though the shares sold off after earnings, Wall Street analysts raised their price targets (dotted line below) following the announcement as they only just beginning to appreciate the massive long-term growth potential of Palantir and it's market-leading business model.

source: Factset

Regardless of what happens to the overall market, if you are a disciplined, long-term, high-growth investor, Palantir shares are worth considering, especially after the recent share price sell off.

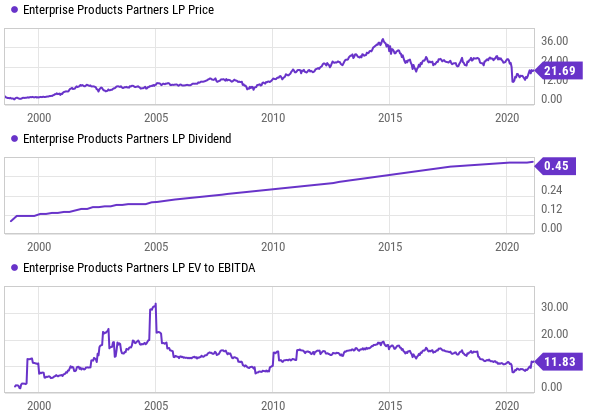

3. Enterprise Products Partners (EPD), Yield 8.2%

Returning to our high income theme, EPD is a Master Limited Partnership (“MLP”) that has delivered strong high income despite the market’s up and downs, and it is positioned to continue doing so going forward.

source: YCharts

EPD successfully leverages one of the largest and most diversified midstream asset portfolios, and uses a primarily fee-based business model to drive strong cash flow generation even during the most uncertain economic scenarios. Its balance sheet strength is unmatched in the midstream space, which it efficiently leverages to invest in long-term growth. Moreover, it regularly pays out big distributions. We believe EPDs distributions are among the safest of midstream companies and expect the company to continue to grow them. We also believe the shares are priced inappropriately low at this time and there is a significant potential for price appreciation. For example, EPD’s EV/EBITDA multiple is ~11.8x, which is near the lower end of its historical range of 6.5x-19.0x, and it’s also trading at a steep discount to the midstream sector average of ~16.0x. If you are looking for steady income, Enterprise Products Partners is worth considering, regardless of the ups and downs of the overall market indexes.

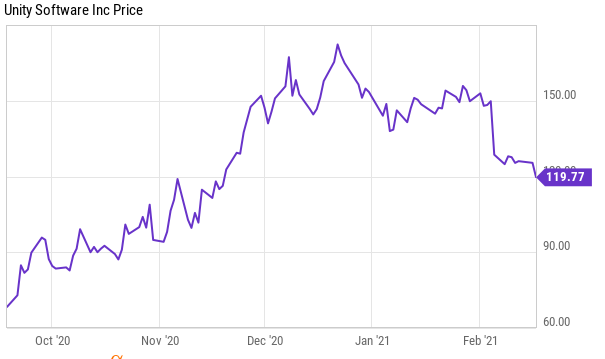

4. Unity Software (U): Significant Long-Term Upside

Unity Software provides tools to videogame developers, and is has big upside potential. It’s a new breed growth stock (it recently completed its initial public offering in September) with a very high revenue growth trajectory (51.1% growth this year, 27.1% next year, as per StockRover), a very large total addressable market ($29 billion), but net income is currently still negative.

Furthermore, the recent post-earnings share price pullback has created an increasingly compelling entry point for long-term investors.

source: YCharts

This is a stock, that despite what happens to the overall market, has powerful long-term price appreciation potential.

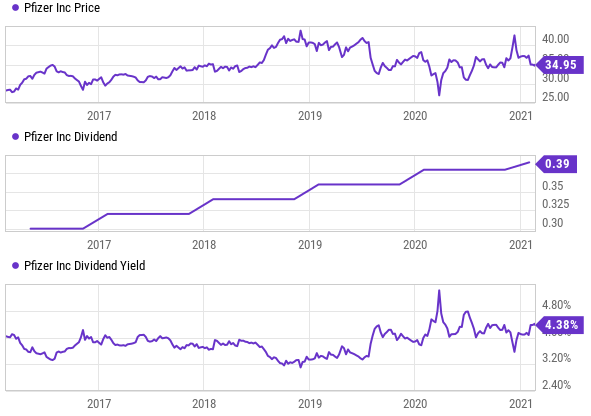

5. Pfizer (PFE): Steady Dividend Growth

Sometimes it can be better to avoid the highest dividend yields, and instead invest in a steady growing blue chip dividend payer. For example, the 4.5% dividend yield of mega-cap pharmaceutical company Pfizer is worth considering because its return on capital is above its cost of capital (a good thing), its margins should increase as a result of the Upjohn spinoff, its covid vaccine is in addition to an already strong core business, it’s paid 328 consecutive quarterly dividend (and has increased the dividend 11 years straight), and the share price just dipped.

source: YCharts

If you are looking for a dividend that will remain healthy (and likely continue to grow), regardless of what happens with the overall market, Pfizer shares are worth considering.

Conclusion:

Is there a bubble? To answer that question, overall market valuation metrics (in some areas especially) are a little expensive. But is it going to burst? To answer that question, It could burst now or 10 years from now, but no one actually knows exactly when. And as Peter Lynch once famously said: “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

A better question to ask is “what are your own individual goals?” and then to invest accordingly. For example, not all stocks are created equally, and we have presented multiple attractive ideas that we believe can be successful regardless of what happens to the overall market indexes. Further, there are more details (including full reports) on each of the ideas we’ve presented (plus a handful of additional ideas) in our new reports titled Top 10 High-Growth Stocks and Top 10 High-Income Stocks. But at the end of the day, you need to know your personal investment goals, and stick to your plan. Disciplined, goal-focused, long-term investing has proven to be a winning strategy over and over again throughout history. It will this time too.