If you are looking for big safe income, this midstream operator is attractive. It operates as a Master Limited Partnership (MLP), and has consistently maintained its distribution throughout the pandemic (while other midstream MLPs were cutting). Further, it’s actually increased the distribution 22 years in a row, and insiders have a large stake in the company. This article reviews the health of the business, distribution safety, valuation, risks and concludes with our opinion on investing.

Overview: Enterprise Products Partners (EPD)

EPD Price:

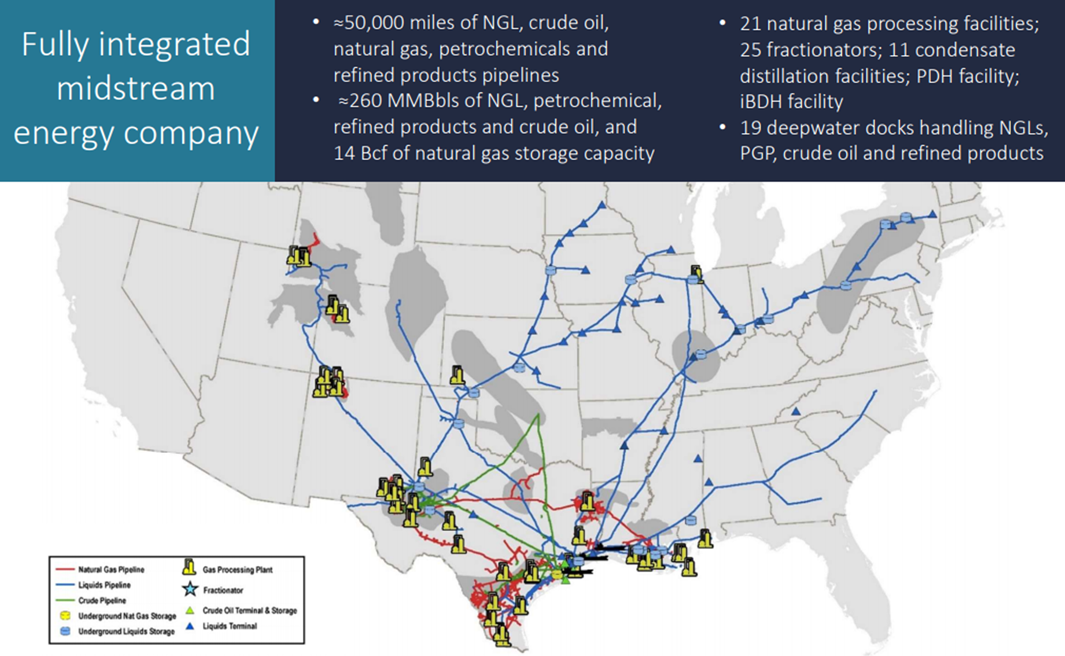

Enterprise Products Partners L.P. (EPD) operates one of the largest integrated networks of midstream infrastructure for natural gas, natural gas liquids (NGL), crude oil, petrochemical and refined products in the US. The company generated $27 billion in revenues in 2020 and conducts its operations via four business segments:

NGL Pipelines & Services (~40% of revenues): includes 22 natural gas processing facilities; 19,900 miles of NGL pipelines; NGL and related product storage facilities; 16 NGL fractionators; related NGL marketing activities; and LPG and ethane export terminals and related operations.

Crude Oil Pipelines & Services (~25% of revenues): includes ~5,300 miles of onshore crude oil pipelines, storage, terminals and crude oil marketing activities.

Natural Gas Pipelines & Services (~9% of revenues): includes gathering, treatment and transportation of natural gas through over 19,000 miles of natural gas pipeline system, and related natural gas marketing activities.

Petrochemical & Refined Products Service (~26% of revenues): includes production facilities, fractionation units, pipelines and marketing activities for various kinds of petrochemicals and refined products, as well as a marine transportation business.

From an economic stand point, EPD operates as a publicly traded master limited partnership (MLP), that does not pay income taxes at the corporate level and is required to distribute 90% of its taxable earnings to its partners/investors. However, investors receive a Schedule K-1 from the company to file with their income taxes (which adds a step to their income tax reporting). Most retirement accounts do not allow a significant amount of MLPs because of the complicated tax reporting. However, the regular stream of income that EPD provides is a compelling reason for investors to consider investing.

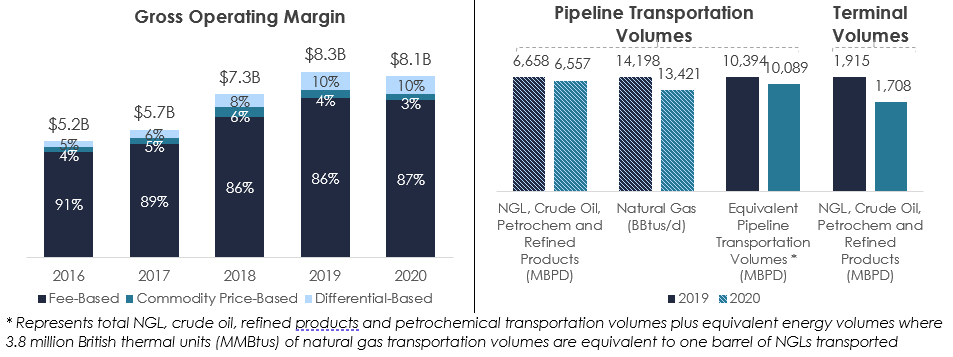

Resilient Model Backed by Fee-Based Income from a Broad Range of Business Lines

As is typical with most oil and gas midstream companies, EPD’s business is less susceptible to volatility in energy commodity prices compared to other energy companies, as a large majority of its income is fee-based. An added advantage is that EPD leverages its highly diversified asset portfolio to generate stable operating income from its broad range of business lines. As a result, the business has remained largely resilient to the unprecedented COVID-19 led market turmoil that was seen in most of 2020. This is substantiated by the more or less consistent gross operating income it generated in 2020 vis-a-vis 2019, despite the significant volume declines in its pipeline transportation, as well as in marine terminals.

Source: 4Q20 Earnings Release and 4Q20 Presentation

The steep decline in the prices of crude oil as a result of the COVID-19 pandemic and the resultant lockdowns led many upstream oil producers to cut down on their production capital expenditure, which resulted in lower transportation volumes for midstream companies. However, this increased the need for storage and EPD successfully leveraged its storage operations to offset a large portion of the loss of operating income from lower pipeline transportation and terminal volumes in 2020. As a matter of fact, EPD charges fees based on the stored quantity of resources, and this was one of the key factors that helped it protect itself from the significant changes in commodity prices over the course of 2020.

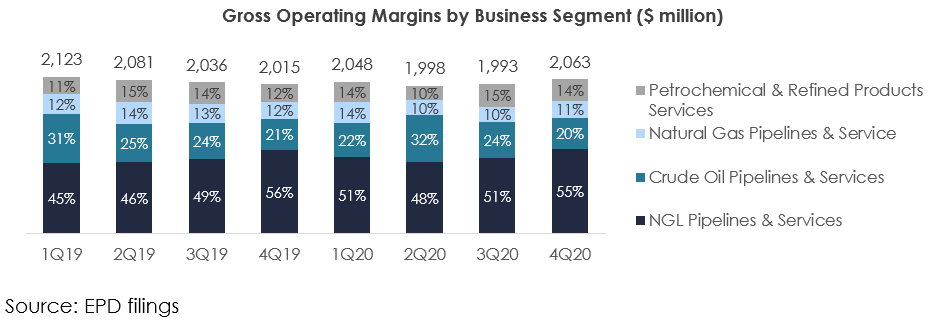

From a business segment perspective, NGL Pipelines & Services brings in over half of the total gross operating margins (GOMs). The demand for NGL has been experiencing strong recovery from the shocks of the pandemic and is expected to remain robust in 2021. Being the largest business segment of EPD, we believe the growing demand for NGL will help the company generate incremental operating income, going forward. The company’s other segments have continued to generate stable GOMs.

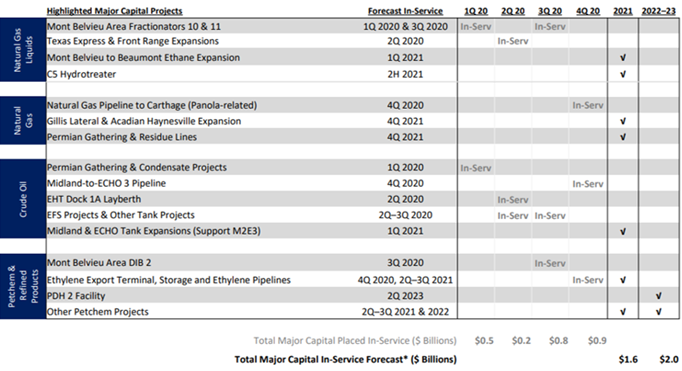

Additionally, some of the new construction projects that EPD commenced in 2020 benefited its operating income for the year. Going forward, the company remains committed to long-term growth as evidenced by ~$3.6 billion worth of new construction/expansion projects it plans to start between 2021 and 2023. Specifically, based on its sanctioned projects, EPD is forecasting growth capital expenditure to be $1.6 billion for 2021 and $800 million for 2022. Encouragingly, some of its customers, a large majority of which are “Investment Grade” rated, have already committed to use the new infrastructure for the long-term. This essentially implies that EPD will start to generate income from these new construction/expansion projects as soon as they become operational, thus assuring of continuing growth.

Source: 4Q20 Presentation

22 Consecutive Years of Distribution Growth

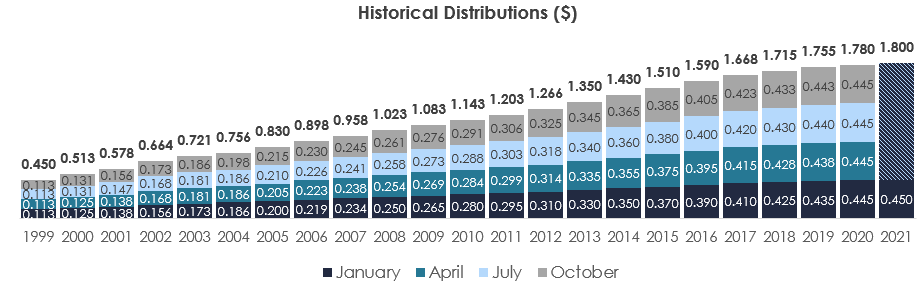

Unlike some midstream companies that cut their distributions due to the COVID-19 induced financial turmoil, EPD had maintained its quarterly distributions throughout 2020. In January 2021, the company announced an increase to its distribution, marking the 22nd consecutive year of distribution growth.

Source: EPD website

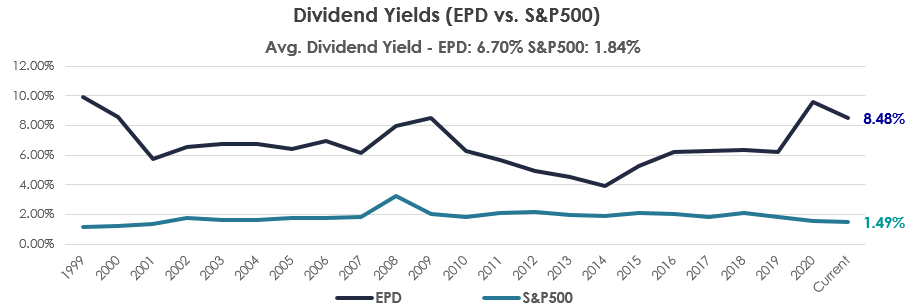

EPD’s distributions have historically yielded higher than the broader S&P500 index. In fact, the most recent distribution of $0.45 per share, which results in an annualized yield of 8.3%, is well above the S&P500's ~1.5% dividend yields, and also above the midstream sector’s ~7.6% yield.

Source: Multpl, EPD and Blue Harbinger Research

Strong Balance Sheet and Solid Cash Flows Strengthen Distribution Safety

Supporting the solid distributions are the company’s balance sheet (which remains one of the strongest among midstream companies) and its ability to generate large amounts of cash flows from the business. EPD’s balance sheet strength can be gauged from its strong liquidity position, which stood at $6.1 billion as of 31 Dec, 2020, and consisted of $5.0 billion of available credit capacity and $1.1 billion of unrestricted cash on hand. Moreover, EPD’s high credit ratings of BBB+/Baa1 allows it the ability to raise debt at the lowest cost and the most favorable terms in the oil & gas midstream industry. This further enhances the company’s ability to maintain strong liquidity to fund its growth projects.

As is typical with midstream players, EPD does have a high debt load of ~$30 billion, but is covered well enough by EBITDA generation of ~$8 billion for a 3.5x leverage as of 31 Dec, 2020. This incidentally is also the company’s targeted long-term leverage ratio. We note that high leverage is an issue that has been crippling most midstream players, but it has not been much of a concern with EPD so far. Going forward, we believe EPD will be able to maintain the leverage ratio within its target range, while also maintaining its distributions, given that it is able to self-fund the majority of its growth capital expenditures from the large amounts of cash flows it generates from operations.

The company generated $5.9 billion in cash flow from operation (CFFO) in 2020, which was understandably lower compared to CFFO of $6.5 billion in 2019, given the economic uncertainties. Importantly, it was very prudent in cutting down on some of its capital expenditures during 2020, and this resulted in improved free cash flows (FCF), which increased 8% y/y to $2.7 billion in 2020. Its distributable cash flow (DCF), a non-GAAP proxy to CFFO which a publicly traded partnership can distribute to its partners, stood at $6.4 billion for 2020, just about 3% shy of $6.6 billion for 2019, of which it returned 70% back to investors via $3.9 billion in cash distributions and $200 million in share buybacks. What is worth noting is the 1.6 times coverage for distributions, which we believe provides an added margin of safety and sustainability for distributions. Moreover, EPD expects to generate discretionary free cash flow (cash flow minus capital expenditures and distributions) and be net free cash flow positive beginning the second half of 2021. According to the company’s Co-CEO and CFO, Randall Fowler, during the Q4 earnings call:

“We do expect to start generating discretionary free cash flow in the second half of the year. A good bit of our CapEx is skewed more towards the beginning of the year. And - but we think we'll be discretionary free cash flow positive.”

We think the 70% payout in 2020 was highly conservative and rightly so as the reinvestment of DCF within the company provided it with additional financial flexibility in the most uncertain times. And with the encouraging early signs of a rebound in economy and the expectation of being net free cash flow positive in 2H21, we believe the company will continue to grow its distributions in the future. However, the company has not provided any distribution growth and buyback guidance, but has said that the payout will be lofty. According to Randall Fowler:

“At this point in time, we really don't want to provide any guidance on payout or I mean payout is still going to be pretty lofty. I mean, just given where our distribution is, since the distribution makes up a substantial amount of the cash that we returned to our investors. So it's still going to be fairly high just based on that.”

Solid Management Team

It is often said that no discussion on EPD is complete without a mention of the company’s late founder Dan Duncan’s family. The Duncan family has about one-third ownership in the company and continues to exercise a significant amount of control over the company’s decision making. They bought large quantities of EPD’s shares when the stock was beaten down in the pandemic. This goes to show the potential they see in the company’s future.

Randa Duncan Williams, daughter of the company’s founder, is the Chairman of the company’s Board of Directors. Reporting to her is a highly qualified and experienced management team that is led by CO-CEOs Randall Fowler and A. J. Teague. Mr. Flower has been with the company since 1999 and has served it in a number of executive level positions. Presently, he also serves as EPD’s CFO. Mr. Teague joined EPD in connection with its purchase of certain midstream energy assets from affiliates of Shell Oil Company in 1999, and since then has successfully served EPD in various positions of higher responsibility.

Valuation

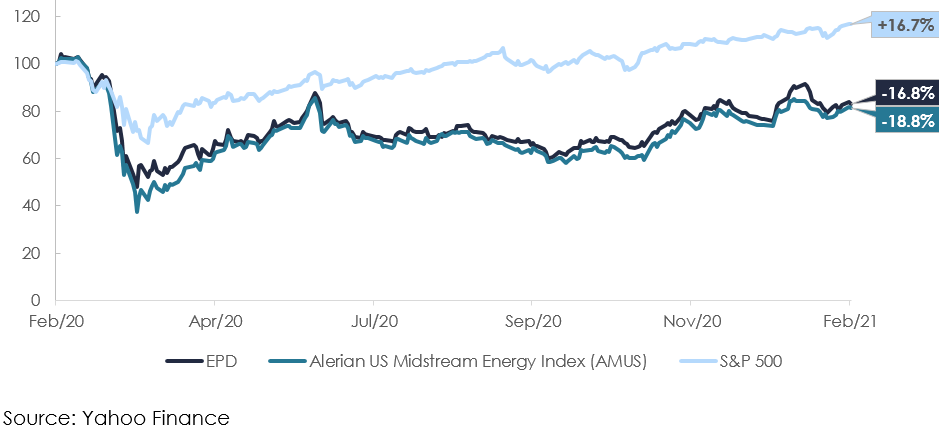

EPD’s shares were beaten down significantly along with a lot of other midstream companies during the initial COVID-19 market turmoil. The share price has strongly recovered since the lows of March 2020, but has significantly lagged behind the S&P500 index. However, it has marginally outperformed the US midstream energy sector (as measured by Alerian US Midstream Energy Index) by about 2% in the past one year.

From a valuation perspective, the stock trades at an EV/EBITDA multiple of 9.6x, which is at the lower end of its own historical range of 6.5x-19.0x. It is also at a steep discount to the midstream sector average of 16.0x. We believe the current trading multiples do not adequately reflect the strength of the company that comes from its vast and diversified asset base, high cash flow generation capability, sustainable operational profits and appropriately managed leverage on the balance sheet. Moreover, insiders bought large quantities of the stock when it was beaten down by the market turmoil, and this reflects the overall possibility of expansion of the valuation multiples, going forward.

Risks

Political Risks: EPD’s biggest risk is the political opposition to fossil fuels due to their hydrocarbon impact on the environment. The newly elected Biden administration has promised a clean energy revolution and any stringent environmental regulations can possibly have a negative impact of companies operating in the oil and gas sector.

Fluctuations in Oil, Natural Gas and NGL Prices: Although EPD is less susceptible to fluctuations in the prices of oil, natural gas and NGLs because of its diversified and majorly fee-based business model, the fluctuations still pose a risk as continued downward prices might lead upstream producers to significantly cut down on their production, which can result in lower transportation volumes for midstream companies such as EPD.

Change in MLP Regulatory Status: Since EPD operates as an MLP, it is not required to pay taxes at the corporate level, and is one of the key reasons why it pays the big distributions to investors. In case there are any changes in tax laws that are detrimental to MLPs or if there is a change in the regulatory status of MLPs, EPD might find it difficult to sustain its big distributions.

Conclusion:

EPD successfully leverages one of the largest and most diversified midstream asset portfolios, and uses a primarily fee-based business model to drive strong cash flow generation even during the most uncertain economic scenarios. Its balance sheet strength is unmatched in the midstream space, which it efficiently leverages to invest in long-term growth. Moreover, it regularly pays out big distributions. We believe EPDs distributions are the safest among midstream companies and expect the company to continue to grow them. We also believe the shares are priced inappropriately low at this time and there is a significant potential for price appreciation. Accordingly, we find EPD to be highly attractive from the perspective of a long-term income-focused investor. We do not currently own shares, but EPD is high on our income-focused watchlist.