Understandably, many investors are not excited about traditional fixed income investments because interest rates are so low and rising (as rates go up, bond prices go down). Also understandably, many investors are not excited about high-yield stocks because they usually involve much more volatility and risk than bonds. However, healthcare REITs is one corner of the market that risk-averse income-focused investors may want to consider. In fact, prices are cheap, the growth outlook is compelling (demographics make the space compelling over the long-term), and the yields are high and generally stable. This article highlight 7 attractive healthcare REITs that we believe are worth considering. Without further ado, here is the list.

7. Physicians Realty (DOC), Yield: 4.4%

Physicians Realty Trust (DOC) is a medical office building REIT that offers an attractive 4.4% dividend yield. It has been growing rapidly, and management expects continued high growth going forward. Concerns regarding healthcare reform and rising interest rates have caused healthcare real estate to underperform, and that includes Physicians Realty Trust. However, DOC’s financials are healthy, its valuation is reasonable, it is differentiated from other healthcare REITs, it’s a contrarian opportunity, and we like its stable dividend yield.

You can read our full write-up on Physicians Realty here...

6. MedEquities Realty Trust (MRT), Yield: 7.2%

MedEquities Realty Trust (MRT) is an attractive healthcare REIT that offers a big 7.2% dividend yield. It is growing rapidly, and it trades at compelling price-to-book and price-to-forward-AFFO ratios. And apparently, hedge funds like it too. This article provides an overview of the bull case for MedEquities, highlights some of the significant risks, and then offers an idea about how to invest in this potentially big opportunity.

You can read our full write-up on Med Equities here...

5. New Senior Investment Group (SNR), Yield: 10%

New Senior is a small equity REIT, operating in the highly-fragmented, but very large and rapidly growing senior housing space. New Senior is struggling with a heavy debt load (they’re trying to sell more assets to pay down debt), and they’re also struggling with a small handful of troubled operators. It seems if New Senior can get through near-term challenges then there are plenty of healthy profits (and dividend payments) ahead.

You can read our recent full write-up on New Senior here...

4. Welltower (HCN), Yield: 4.7%

Welltower is one of the more blue-chip opportunities in the healthcare REIT space, and its price is still trading considerably lower than it was last summer (and its valuation is attractive, in our view).

Besides being the largest healthcare REIT, it pays a big, growing dividend. It's also well diversified across senior housing (triple-net and operating), outpatient medical, and long-term post-acute. The "post-acute" is somewhat risky considering other healthcare REITs (such as HCP (HCP) and Ventas (VTR) have been shedding "skilled nursing" exposure because they don't want to deal with the regulatory reimbursement risks. However, we like that Welltower has some exposure to the upside in that segment.

We don't currently own shares of Welltower, but it remains on our watch list (we wrote about Welltower last August (See: Welltower's Big Dividend: Weighing the Risks Ahead). Since that time, its business has remained strong, and its price to FFO ratio has dropped to a compelling level. We also like that Welltower rents properties under group leases rather than separate per property leases, because this makes it harder for tenants to drop underperforming properties.

Worth noting, of Welltower's 1,414 total healthcare properties, 96 facilities are located in the UK, and 145 in are in Canada. This introduces diversification benefits and additional growth opportunities, but it also introduces additional operational risks for the company.

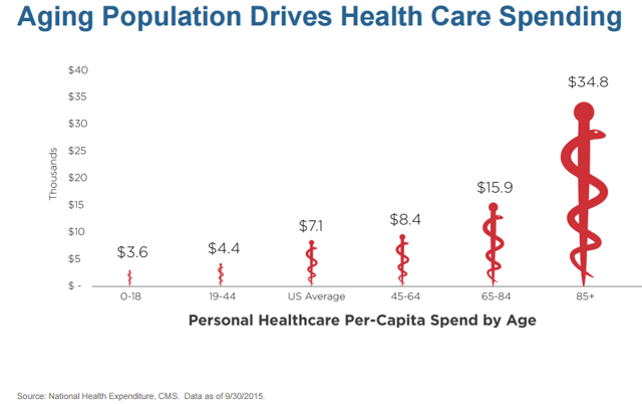

Additionally, we'd be remiss not to point out the strong demographic tailwinds Welltower has at its back, as shown in the following two charts about the growing healthcare demands of the aging population.

In our view, Welltower is a very high-quality REIT that pays a big dividend and is currently on sale. If you are an income-focused value investor, Welltower is worth considering.

High-Yield Healthcare REITs...

Our top 3 high-yield healthcare REITs worth considering are reserved for members-only...

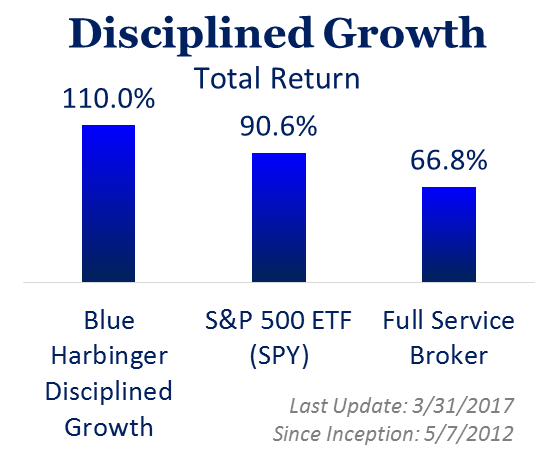

Want access to Blue Harbinger's current holdings and 100% of our members-only content?

Consider a subscription...