This report is a continuation of our free public report titled "Top 7 High-Yield Healthcare REITs Worth Considering." However, this members-only report contains the top 3...

3. Global Medical REIT (GMRE), Yield: 8.8%

Global Medical REIT (GMRE) is a small cap healthcare REIT that offers a big dividend yield (8.8%). The shares initial public offering ("IPO") was in July of 2016. The company faces a variety of risks that have kept the share price low and the dividend yield high, such as rising interest rates, single tenant properties, external management and uncertainty regarding healthcare reform. However, despite the risks, we have highlighted seven reasons why this REIT is worth considering if you are an income-focused value investor. You can read that member-only article here:

2. Ventas (VTR), Yield: 4.7%

If you like the healthcare demographics story and the big-dividend yield offered by Welltower, but you don't like the Affordable Care Act risks associated with skilled nursing facilities, consider Ventas. Ventas is a healthcare REIT that offers the same dividend yield (5.2%), but spun off most of its risky skilled nursing facilities business into a separate REIT (Care Capital Properties (CCP)) in 2015.

And despite the arguably lower-risk business, Ventas trades at a similar price-to-FFO ratio as Welltower (Ventas is slightly more attractive at 14.8x).

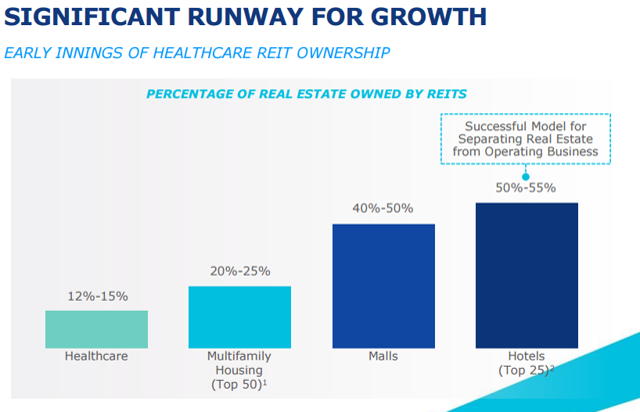

Worth noting, Ventas believes it has significant room for growth as shown in the following chart (realistically, this industry-wide opportunity may bode well for all healthcare REITs, not just Ventas).

Also worth noting, analyst have a higher 5-year EPS growth rate for Ventas (+6.9%) than Welltower (+2.9%). And as the following chart shows, analysts have been increasing EPS estimates upward.

Overall, if you're into big safe dividends trading at attractive prices, Ventas may be worth considering for a position within your diversified long-term, income-focused, investment portfolio.

1. Omega Healthcare Investors (OHI), Yield: 7.2%

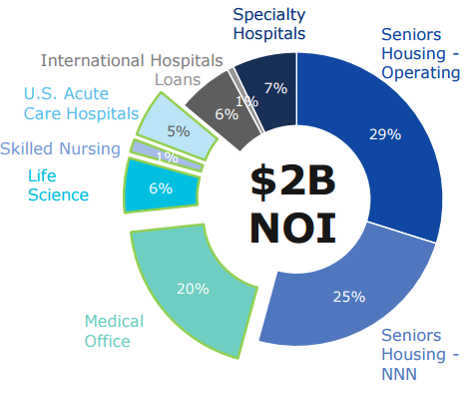

Whereas Ventas shed risky skilled-nursing facilities, and Welltower invests in some skilled-nursing facilities (a small portion of its overall portfolio), Omega is focused almost exclusively on skilled-nursing facilities. And in this case, we believe it is a risk worth considering.

In our view, Omega is an exceptionally attractive, undervalued, big-dividend healthcare REIT. It's currently on sale due to uncertainty surrounding Congressional efforts to repeal/replace the Affordable Care Act. Simply put, investors are afraid. Omega's price has also been dragged lower as the entire REIT sector is down due to rising interest rates fears. In our view, both of these fears are baked-in and overblown, and Omega currently represents an exceptional contrarian opportunity to invest in a big safe dividend.

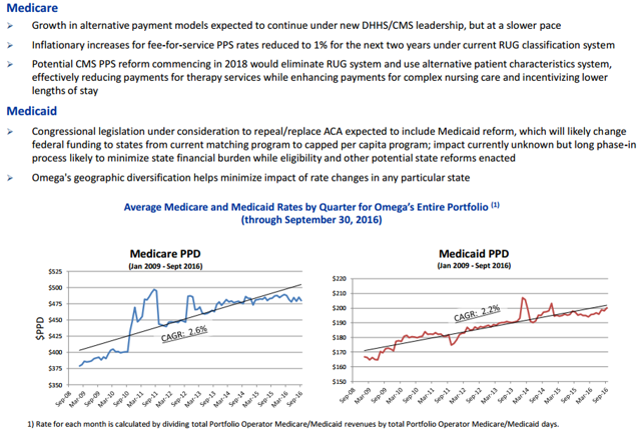

With regards to healthcare reform, here is what Omega had to say in its most recent investor presentation.

Specifically, Omega believes the healthcare reform fears are overblown because alternative payment models will expand under Medicare. And regarding Medicaid, the phase-in process will be long thereby allowing states to offset the burden, and Omega's geographic diversification will help minimize the impact of rate changes in any one state.

On a comparative basis, skilled-nursing facilities REITs (like Omega) have lagged the overall healthcare REIT space because of the regulatory reform uncertainty. Yet these REITs still have some of the highest short interest as fearful investors continue to place their bets. Worth noting, despite the high short-interest, Omega has a relatively high expected annual earnings growth rate of 15.8% over the next five years (largely because the demographics of a growing aging population with increasing healthcare needs are strongly on Omega's side).

Also, as we mentioned previously, the entire REIT group has sold off because investors are afraid that rising rates will negatively impact these highly levered companies (i.e. they use a healthy amount of debt to run their businesses). However, this fear is already significantly baked in (the prices are down), and Omega has the strong ability to continue to generate FFO to cover and grow its dividend. In fact, Omega just raised its dividend (again) and announced that their earnings expectations continue to rise.

Overall, we recognize Omega faces unique regulatory reform risks, but we believe it is a risk worth taking. If you are an income-focused value investor, Omega is absolutely worth considering.

Conclusion

If you are an income-focused investor, high-yield healthcare REITs are worth considering. They are out of favor, and in our view undervalued as the market is overly fearful about the impacts of rising interest rates and regulatory reform. Depending on you personal preference, the space offers a variety of attractive opportunities. We continue to own Omega Healthcare Investors (OHI). You can view all of our current here.