This week's Blue Harbinger Weekly covers a new dividend idea. Because of its size and nature, it's often overlooked. However, given its opportunity pipeline and out-sized income, we believe this one is worth considering.

Global Medical REIT (GMRE) is a small cap healthcare REIT that offers a big dividend yield (8.8%). The shares initial public offering (“IPO”) was in July of 2016. The company faces a variety of risks that have kept the share price low and the dividend yield high, such as rising interest rates, single tenant properties, external management and uncertain healthcare law changes. However, despite the risks, we have highlighted seven reasons why we believe this REIT is worth considering if you are an income-focused value investor.

1. The Big Dividend

The first reason many investors may want to consider owning GMRE is its big dividend yield (8.8%). The company currently pays a $0.20 quarterly dividend, and we believe this is a strong signal from management. As a newly IPO’s company, management set the dividend at a level they believe the company could support. They were not dealing with a legacy dividend amount that they were forced to direct all their resources to support, as is the case for many seasoned companies that are just trying to avoid a dividend cut. Instead, GMRE had the freedom to set the dividend wherever they wanted, and they picked $0.20 because they’re confident they can support this amount going forward. And considering an 8.8% yield is higher than most healthcare REITs, it’s also a signal that management believes the share price should be higher (as the share price rises, the dividend yield will come down to a more normal percentage relative to peers).

2. Big Growth Potential

Aside from the dividend, another reason we believe GMRE is worth considering is because it has big growth potential. For example, here is a look at the new acquisitions the company has already completed since the end of 2016.

And here are the additional acquisitions that were recently pending.

GMRE is growing by acquiring new properties (as a REIT, GMRE owns properties and leases them (triple net leases) to healthcare operators (more on this later)). And what is encouraging is that the company still has a relatively low amount of debt relative to its assets (as shown in the following chart), plus it has lots of dry powder for more acquisitions.

For example, regarding dry powder, on December 5, 2016, the Company announced an initial agreement with BMO Harris Bank N.A. and syndicate members for a $75 million secured credit facility plus a $125 million accordion feature for a total commitment of $200 million. And then on March 6, 2017, the Company announced that it had entered into an amended secured credit facility agreement with an increased base commitment amount of up to $200 million plus an accordion feature of up to $50 million, bringing the total commitment under the secured credit facility to $250 million.

Having access to financing described above will help GMRE meet its growth goals. Specifically, one of the company’s goals is to reach $500 million is stockholder’s equity (they were at $155 million at year-end, and growing fast). And upon reaching $500 million they company is committed to considering bringing its external management team internal (more on management later).

For reference, here is more information on the company’s pipeline.

Another indication of big growth potential is the industry demographics. As the following graphic shows, the aging US population and changing consumer preferences both contribute to GMRE’s large and growing opportunity.

Also worth noting, GMRE won’t face the same level of rising interest rate challenges as some other REITs because GMRE is just deploying capital now (rates have already started too rise), and they can do so in a prudent fashion without risky legacy assets that need to be refinanced soon.

3. GMRE’s High Quality Portfolio

GMRE’s high qulity portfolio of healthcare properties is another reason why this REIT is attractive. For example, as we mentioned earlier, GMRE’s assets are newer (lower asset age) than many of its peers as shown in the following graphic.

Also, GMRE leases its properties on a triple net lease basis, meaning the tenants are responsible for the majority of the expenses related to the properties (and that’s in addition to the rent they pay). Additionally, the properties are diversified geographically across the US as shown in the following map

The following graphic describes some of the attractive characteristics of the propriety property deals that GMRE structures.

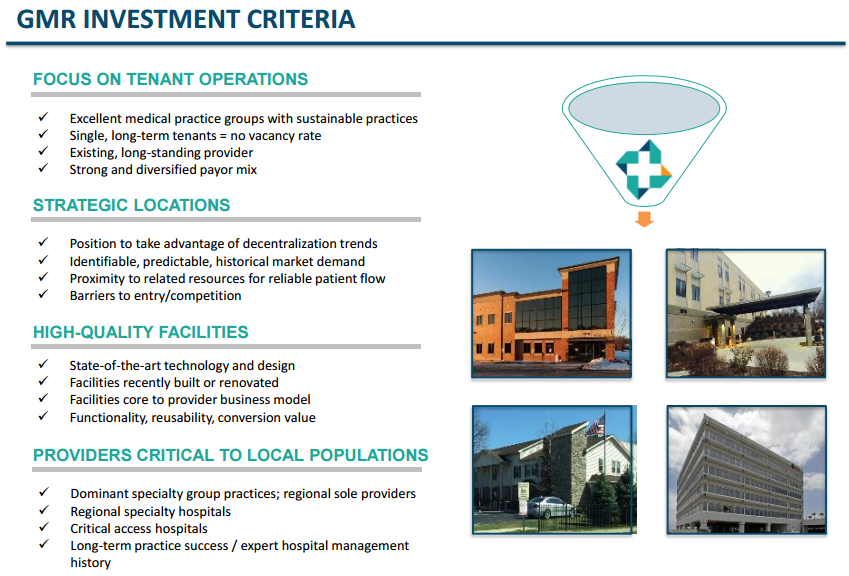

For reference, here are some of the company’s investment criteria.

And also for reference here is a list of GMRE’s property portfolio as of year-end.

4. GMRE has a high quality management team

As the following graphic shows, GMRE has a highly experienced leadership team.

Importantly, the team is externally managed, but is committed to considering moving the team internal when shareholders equity reaches $500 million.

Important to note, insiders currently own 14.2% of the shares outstanding. This is a significant amount, and it’s important because it helps align the interests of shareholders and management. Also important, as the company continues to grow it will achieve more economies of scale to spread out costs and reduce costs as a percentage of income.

5. A compelling investment strategy

GMRE’s principal business objective is to provide attractive risk-adjusted returns to stockholders through a combination of sustainable and increasing rental income that allows the company to pay reliable, dividends, and potential long-term appreciation in the value of its healthcare facilities and common stock.

To achieve this objective, the company is engaged primarily in the acquisition of licensed, state-of-the-art, purpose-built healthcare facilities and the leasing of these facilities to leading clinical operators with dominant market share. GMRE intends to produce increasing, reliable rental revenue by leasing each of its healthcare facilities to a single market-leading operator under a long-term triple-net lease.

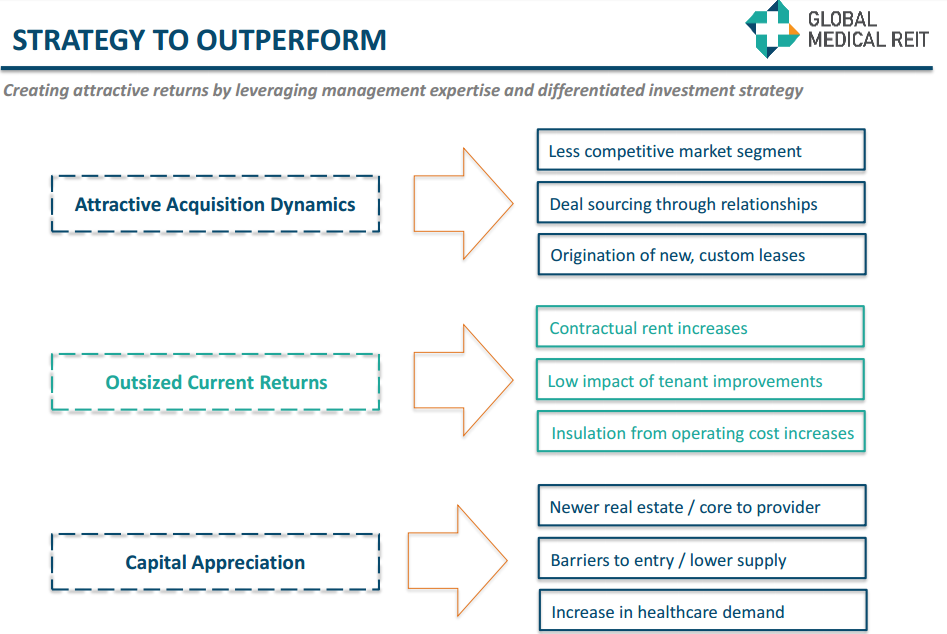

The company’s strategy to outperform is described in the following table

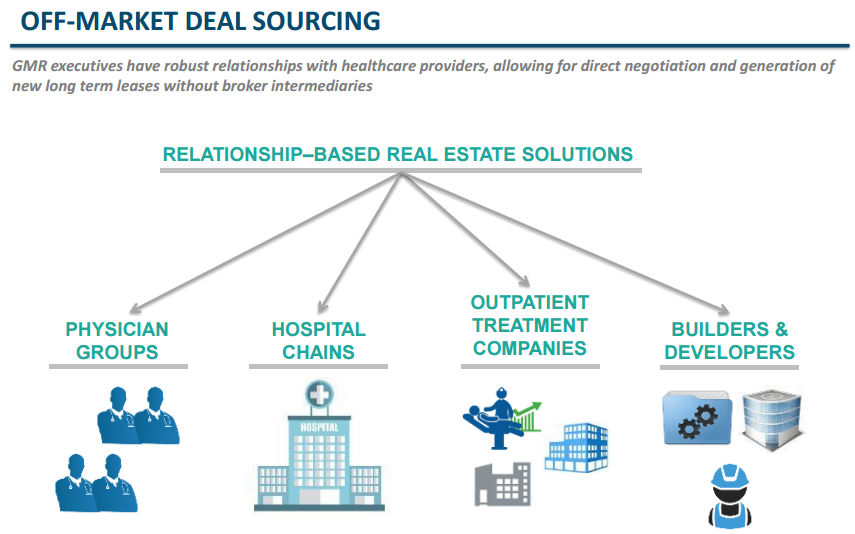

Also, the company has the ability to source off-market deals which helps minimize costs and gain access to attractive opportunities.

And as mentioned previously, the company operates in an industry with very positive demographics (i.e. an aging US population, and a growing demand for healthcare solutions to meet their needs).

6. GMRE’s Valuation is Attractive

Don’t be misled by GMRE’s negative Adjusted Funds from Operations (“AFFO”). AFFO is often the first thing REIT investors hone in on when valuing a REIT and determining if it can support its dividend payments. However in the case of GMRE, AFFO is misleading. In particular it was negative (-0.03 per share) for the full year 2016, as shown in the following table.

However, as the table also shows, AFFO has improved significantly since 2015, and actually turned positive in the fourth quarter of 2016.

Also, we believe stockholders equity is a more appropriate valuation metric for GMRE given the company’s aggressive growth. Stockholder’s equity is the valuation left over for shareholders after adjusting a company’s assets by all of its liabilities. And in the case of GMRE, its market price is very low relative to its stockholders equity, as shown in the following table comparing GMRE’s “price-to-book” value relative to its healthcare REIT peers.

Part of the reason for the low price-to-book value is risk (as we have alluded to previously, and will cover more later). However, GMRE’s assets to have value, and the market is currently not assigning those assets nearly the value we think they deserve (i.e. they are high quality, income-producing, assets). Also, as we mentioned previously, as the company continues to grow, economies of scale will make it more profitable.

7. Not on the radar.

Another reason we like GMRE is simply because it’s not on the radar for many investors. It’s a small cap stock (market cap is only $161 million), it just IPO’d last year, and some of its valuation metrics cause investors to overlook it (e.g. AFFO was negative in 2016). As contrarian investors, we find all of these things attractive. And the high dividend yield and significant growth potential make GMRE that much more attractive, in our view.

Risks:

We’d be remiss not to mention some of the significant risks that GMRE faces. For example, the company has single tenants with no vacancies. This is a good thing for now becauase everything is leased and providing income. However, if one of the tenants stops paying this creates significant challenges for GMRE. Also, GMRE currently has only 31 facilities and 14 tenants. This provides some diversification, but these are not huge numbers.

Another risk is interest rates. Considering REITs rely heavily on borrowing to finance growth, and interest rates are expected to keep rising, this creates a challenge for the industry as a whole. However, REITs have significantly underperformed the rest of the market over the last six months, and we believe interest rate risks are already baked into the prices thereby creating an attractive contrarian opportunity.

Healthcare reform is another risk. Given the recently aligned executive and legislative branches of the federal government, combined with aspirations for healthcare reform, the industry (including GMRE) faces uncertainty risks. GMRE describes these risks in its annual report as follow:

At this time, it is difficult to predict the full effects of the Affordable Care Act and its impact on our business, our revenues and financial condition and those of our tenant-operators due to the law’s complexity, lack of implementing regulations or interpretive guidance, gradual implementation and possible amendment. The Affordable Care Act could adversely affect the reimbursement rates received by our tenant-operators, the financial success of our tenant-operators and strategic partners and consequently us.

External management is another risk. As we described earlier, an external management team is often expensive and can create conflicts of interest for shareholders. However, in the case of GMRE we take some comfort in knowing management also owns a significant amount of shares (14.2% of shares outstanding), and this will help reduce potential conflicts of interest. Also, because of the company’s rapid growth, the impacts of management and administrative expenses are being reduced through economies of scale. Plus, management is committed to considering internalizing itself once the $500 million shareholder equity threshold is reached, a level the company is driving toward s through growth (they were at $155 million at year end, and growing rapidly).

Conclusion

Despite the risks, we believe GMRE presents an attractive investment opportunity. Specifically, we like the big dividend, big growth opportunities, high quality portfolio, strong management team, compelling strategy, attractive price-to-book, and the fact that many investors overlook this opportunity. If you are a diversified income-focused investor, GMRE is worth considering.