This week’s Weekly provides a brief review of every Blue Harbinger holding, including year-to-date price returns and total returns (dividends plus price appreciation). We also share market-wide data on what has been working, and what we expect will work going forward.

Blue Harbinger Holdings (across strategies)

For starters, the following table shows all of our current holdings across strategies, including year-to-date price returns and total returns (dividends plus price appreciation).

What Has Been Working...

This next table shows what has been working. Specifically it shows ETF performance across style and sectors, and you’ll notice growth stocks continue to lead the way higher.

Specifically large growth, small growth and the tech-heavy Nasdaq all outperformed again in April to extend the continuing “Trump Rally.”

What Will Work Going Forward...

However, were starting to see some cracks in the armor of growth stocks (i.e. the data shows the rally is slowing). For example, here is the yield on the 10-year treasuries since President Trump was elected.

The strong uptick was based on the expectation that Trump’s pro-growth policies would improve the economy thereby enabling the Fed to keep raising rates. Additionally, treasuries are a safe have investment, and the rising rate is an indication that investors were dumping safe haven treasuries because they felt more confident growth was coming. However, as the above chart shows, that rally is slowing. Specifically, treasury yields have leveled off (and they’re actually starting to fall) an indication that investors have waning confidence in the Trump Rally.

Further, the gap between short-term and long-term treasury yields is recently narrowing, in this case because investors appear to have less confidence in the pace and magnitude of growth, as shown in this next chart.

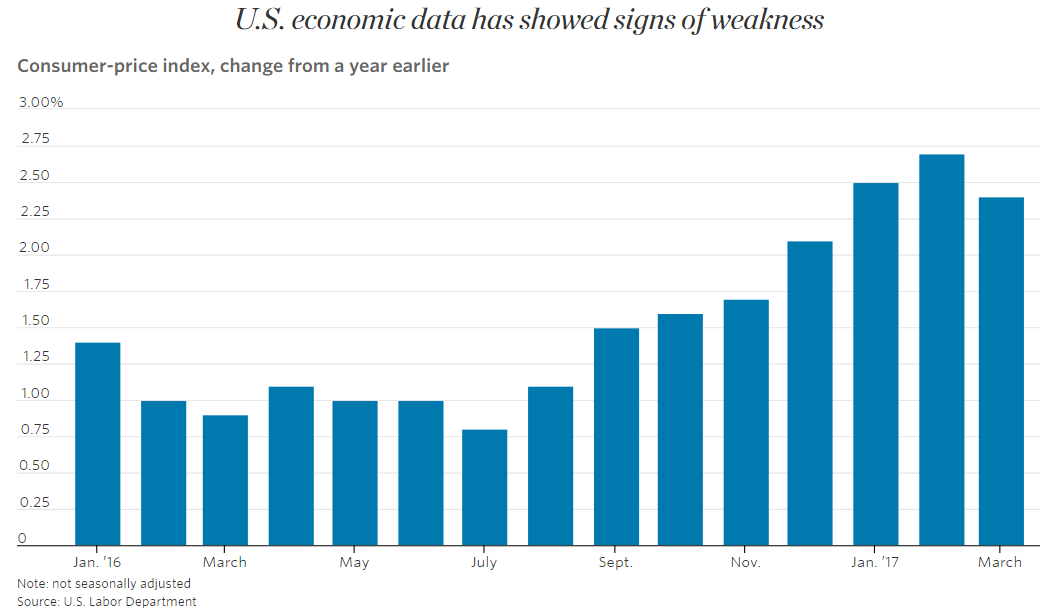

Further still, this next chart suggests consumer confidence is slowing.

In particular, the consumer price index (CPI) increased significantly after the election, but most recently has started to fall, perhaps foreboding less growth ahead that the stock market is pricing in.

And further still, bets on higher inflation are waning.

And from a sector specific standpoint, bank stocks are starting to slip (particularly in April) as safe-haven utilities are showing strength (another indication that the Trump Rally is slowing).

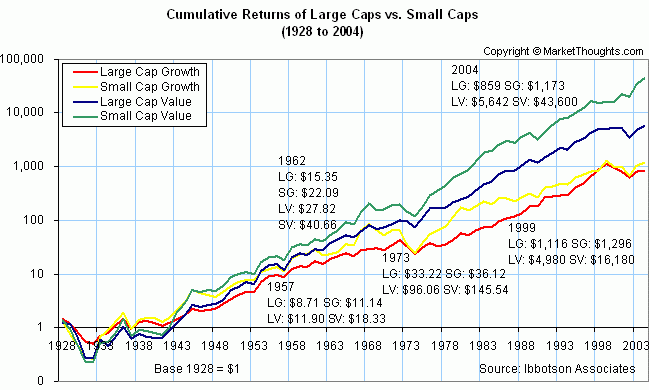

In our view, all of this data is an indication that now is an increasingly attractive time to own Value Stocks. As we often point out, value stocks have a very long-history of outperforming growth stocks over the long-term. And in periods where growth is beating value (i.e. this year so far) we consider Value Stocks even more attractive than usual.

For example, our recent article explains why we believe growth oriented Business Development Companies (“BDCs”) seem particularly expensive right now, and high-yield REITs are compelling.

3 Overcrowded High-Yield BDCs: Prospect, Main Street And Fidus

And as a reminder, here are a couple charts showing the long-term dominance of value stocks over growth stocks…

And more recently...

In a nutshell, we like value stocks even more now than we did just last month.

However, bear in mind we like value stocks on a relative valuation basis (relative to growth). For perspective, one popular nobel-prize winning pundit, Robert Shiller, believes stocks are expensive in absolute terms based on his Shiller PE ratio as shown in the following chart.

We share the Shiller PE ratio not because we are huge Robert Shiller fans (we are not), but just to play “devil’s advocate,” and to provide a different viewpoint. In our view, value stocks are always a good investments (see our long-term value graphs provided earlier), and in particular we like picking attractive individual value stocks, as shown in our holdings table at the beginning of this article.

Blue Harbinger Holdings by Strategy...

As a reminder, All three Blue Harbinger strategies outperformed in April, and continue their long-term, since-inception, track records of outperformance. For your reference, you can view all of our holdings by weight and Blue Harbinger strategy by clicking here.