MedEquities Realty Trust (MRT) is an attractive healthcare REIT that offers a big 7.2% dividend yield. It is growing rapidly, and it trades at compelling price-to-book and price-to-forward-AFFO ratios. And apparently, hedge funds like it too. This article provides an overview of the bull case for MedEquities, highlights some of the significant risks, and then offers an idea about how to invest in this potentially big opportunity. We have ranked MedEquities #6 on our list of Top 7 high-yield healthcare REITs worth considering.

Overview

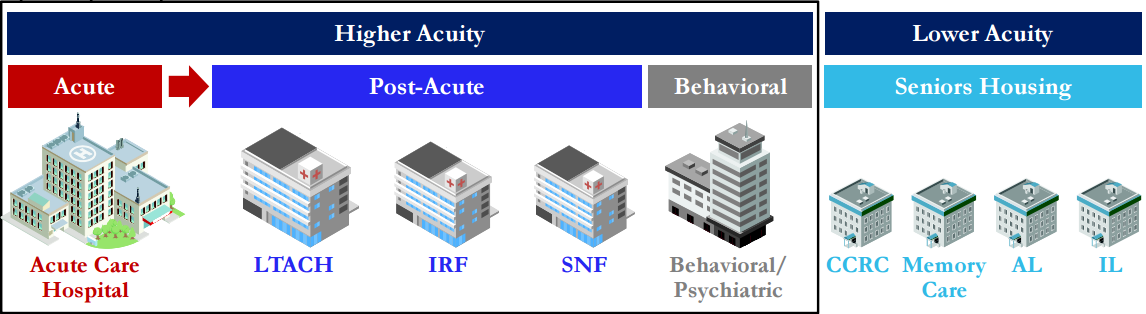

Founded in 2014, MedEquities completed its initial public offering (“IPO”) in October of 2016, right before the US presidential election and a hawkish US Fed laid the hammer down on the REIT sector in general (more on this later). The company invests mainly in skilled nursing facilities (“SNF”) and acute care hospitals (“ACH”), as shown in the “Asset type breakdown” section of the following graphic.

And as the title of the above graphic suggests, MRT isn’t dealing with many of the “legacy” assets that trouble other higher acuity healthcare REITs. Specifically, because MRT is so new, it isn’t dealing with challenges caused by more stringent healthcare reimbursement policies that continue to plague some of the more seasoned REITs in the space (more on healthcare regulatory reforms later).

This next graphic shows more of the positive attributes of MRT, including its well-covered dividend, its conservative leverage, and its substantial liquidity.

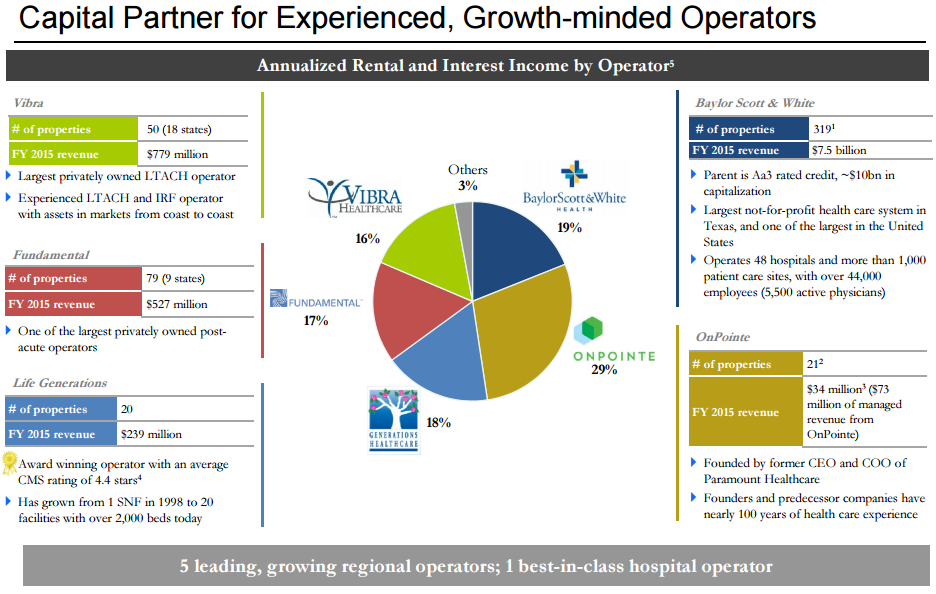

And for more color, this next chart provides more details o MedEquities five operators.

Very importantly, as this next chart shows, MedEquities operates in a space that is poised to benefit from significant long-term demographic growth.

And MedEquities plans to capitalize on this growth opportunity through more acquisitions, particularly in the hospital and skilled nursing segments of the market (areas where other REITs have demonstrated aversion) as shown in this next chart.

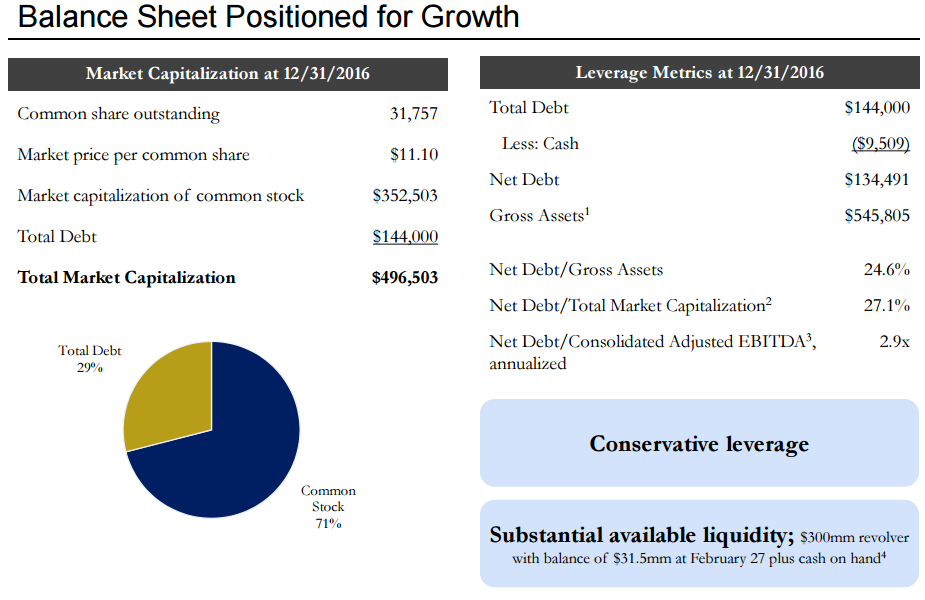

One key consideration of the above chart is the $600+ billion of institutional quality healthcare real estate. Relative to other real estate sectors (e.g. office, commercial, industrial) healthcare is very un-saturated, which means there is a lot of space for healthcare REITs to grow. And as shown in this next chart, MedEquities has the balance sheet (i.e. financial wherewithal) to support significant growth.

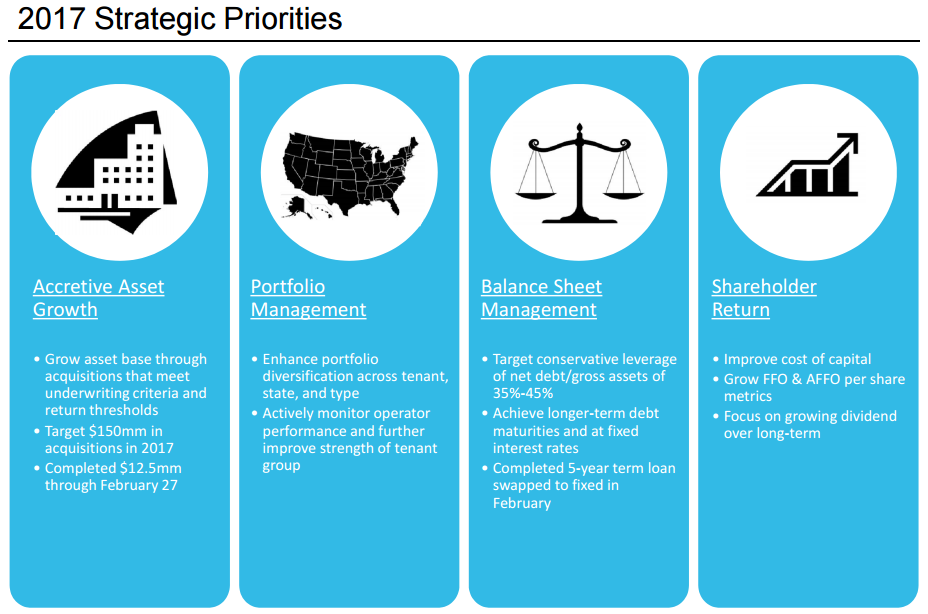

For more perspective, this next chart shows MRT’s strategic priorities (including growth, prudent asset management, balance sheet management, and shareholder returns.

Valuation

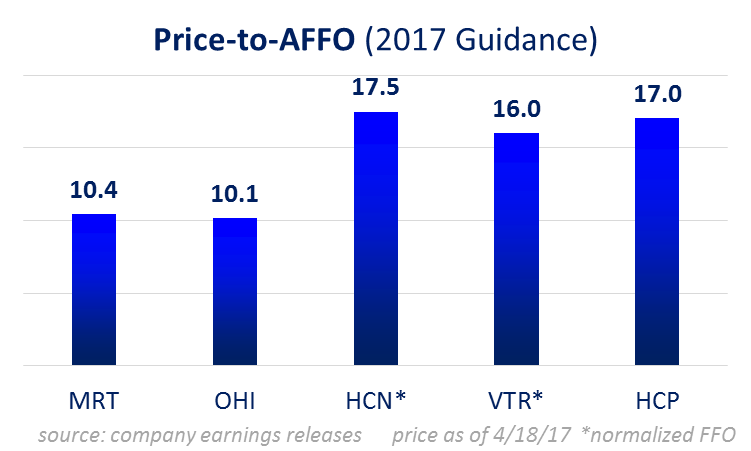

We like the MedEquities growth story, but we’re keen on its valuation too. For perspective, this table shows MRT’s price-to-forward-AFFO (Adjusted Funds From Operations) ratio versus other healthcare REITs, and it is attractive, in our view.

The companies in the chart are all healthcare REITs, but they have varying exposures across the acuity spectrum.

The market has generally been perceiving higher risk (related to healthcare reform) and assigning lower valuations, to skilled nursing facilities operators such as Omega Healthcare Investors (OHI) and MRT (more on this risk later). However, MRT has less legacy assets considering it was formed in 2014 (and IPO’d in late 2016) which means they own more high quality healthcare real estate, as described in our earlier chart. However, trading just over 10 times 2017 AFFO is very cheap in our view

Remember, REITs in general have been trading significantly lower following the November US election, and higher interest rate expectations from the Fed, as shown in the following chart.

We believe the fears of higher interest rates (REITs rely heavily on borrowing) are already baked into REIT prices. And the strong rally in growth (and non-dividend stocks), aka the “Trump Rally,” is starting to slow, and now is an attractive time to invest in REITs in general.

For further perspective, the following table shows the price-to-book-value of MRT versus other healthcare REIT peers, and again it is attractive, trading at just over one times its book value.

Hedge Funds

Apparently, hedge funds like MRT too. According to this article by Insider Monkey, 14 hedge funds recently had positions in MRT, including some large well know names like Tudor Investments and Millennium Management. However, more recently, BlueMountain Capital Management took a very large position (around 8.2% of shares outstanding) and holds two board seats at MRT.

Generally speaking, we’re not overly impressed when our holdings overlap with hedge funds, however it is something to keep on your radar. We’re encouraged to know our interests seem aligned with the money at BlueMountain, but it also presents a risk as described below.

Risks

We’d be remiss not to review some of the more significant risks facing MRT. For example, BlueMountain’s position in MRT is a risk as described by MRT in its recent annual report:

BlueMountain has the ability to exercise substantial influence over us, including the approval of certain acquisitions.

As of February 22, 2017, BlueMountain Capital Management, LLC (“BlueMountain”) owned approximately 8.2% of the outstanding shares of our common stock. BlueMountain has designated two of the members of our board of directors and will have a continuing right to designate one or two of our directors, who will serve on our investment committee. BlueMountain and its two board designees have substantial influence over us, including the ability to veto certain of our acquisitions as members of the investment committee and any changes to the size of our board of directors, and the concentration of ownership by BlueMountain in us may influence the outcome of any matters submitted to our stockholders for approval.

For the time being, it appears BlueMountain’s intentions are good (they want the stock price to go up), considering their 13-F filing doesn’t appear to show any larger REITs that they might try to sell MRT to at a discount price. However, this may change, and it’s important to monitor the intentions of BlueMountain (they could turn against shareholders if the right opportunity arises).

Another risk is that MRT’s portfolio is concentrated in areas that could be negatively impacted by efforts to “repeal and replace” the affordable care act. MRT describes this risk in their annual report as follows.

We are unable to predict the impact of the Affordable Care Act or the results of any efforts to repeal and/or replace it.

The Affordable Care Act has changed how healthcare services are covered, delivered and reimbursed through expanded coverage of uninsured individuals, reduced growth in Medicare program spending, reductions in Medicare and Medicaid Disproportionate Share Hospital (“DSH”) payments, and expanding efforts to tie reimbursement to quality and efficiency.

And more generally, the company explains:

Changes in the reimbursement rates or methods of payment from third-party payors, including the Medicare and Medicaid programs, could have a material adverse effect on our tenants and operators and on us.

As we mentioned earlier, higher interest rates also present a risk. The company describes this risk in its annual report as follows;

Higher interest rates could increase our interest expense and may make it more difficult for us to finance acquisitions or refinance existing debt, which could reduce the number of properties we can acquire or require us to sell properties on terms that are not advantageous to us, which could materially adversely affect our business, financial condition and results of operations and our ability to make distributions to our stockholders.

In our view, this risk is largely already baked into the price as the market is already factoring in higher interest rate expectations. Also worth considering, the company goes on to explain:

Increases in market interest rates may reduce demand for our common stock and result in a decline in the market price of our common stock.

The market price of our common stock may be influenced by the distribution yield on our common stock (i.e., the amount of our annual distributions as a percentage of the market price of our common stock) relative to market interest rates. An increase in market interest rates, which are currently low compared to historical levels, may lead prospective purchasers of our common stock to expect a higher distribution yield, which we may not be able, or may choose not, to provide. Higher interest rates would also likely increase our borrowing costs and decrease our operating results and cash available for distribution. Thus, higher market interest rates could cause the market price of our common stock to decline.

MRT’s dividend yield (versus market interest rates) will remain attractive for years in our view, considering rates are still very low to begin with.

Another risk is simply that MRT won’t be able to keep up with the rapid growth it is experiencing. According to the company:

We have experienced and expect to continue to experience rapid growth and may not be able to adapt our management and operational systems to respond to the integration of the healthcare properties we expect to acquire without unanticipated disruption or expense, which could have a material adverse effect on our business, financial condition, results of operations and ability to make distributions to our stockholders.

In our view, this is a real risk, but it’s also a reminder of the attractive high-growth opportunity that MRT presents.

Conclusion

Overall, we believe MedEquities Realty Trust presents a compelling, high-yield, growth opportunity, especially considering the low valuation multiples currently assigned by the market. In fact, we like it so much that we ranked it #6 on our list of Top 7 High-Yield Healthcare REITs. We understand there are clear risks to investing in MRT (as described in this article), but the powerful growth opportunities and attractive valuation make MRT a compelling opportunity nonetheless.

In our view, income-focused investors may want to consider initiating a small position in their diversified portfolio now (assuming they’re comfortable with the risks). However, more likely than not, Affordable Care Act “repeal and replace” efforts will flare up in Washington DC and the media again soon, and this will likely cause the price to pullback temporarily. We are keeping MedEquities near the top of our watch list for now (especially considering we already have exposure to healthcare real estate via our position on Omega Healthcare).