Physicians Realty Trust (DOC) is a medical office building REIT that offers an attractive 4.4% dividend yield. It has been growing rapidly, and management expects continued high growth going forward. Concerns regarding healthcare reform and rising interest rates have caused healthcare real estate to underperform, and that includes Physicians Realty Trust. However, DOC’s financials are healthy, its valuation is reasonable, it is differentiated from other healthcare REITs, it’s a contrarian opportunity, and we like its stable dividend yield. We have ranked Physicians Realty #7 on our list of Top 7 High-Yield Healthcare REITs Worth Considering.

Overview

Physicians Realty is an internally managed healthcare REIT with a focus on acquiring and managing medical office buildings (“MOB”s). The company’s corporate strategy focuses on leveraging its physician and hospital relationships nationwide to invest in off-market assets that maximize risk-adjusted returns to shareholders.

As of December 31, 2016, the company's portfolio consisted of 246 properties located in 29 states with approximately 10,883,601 net leasable square feet. The properties are diversified across the US, and the number of properties has continued to grow this year as shown in the following map.

And according to Physician Realty’s annual report “We believe we have established the preeminent pure play medical office investment and asset management platform in the United States.”

Growth Story

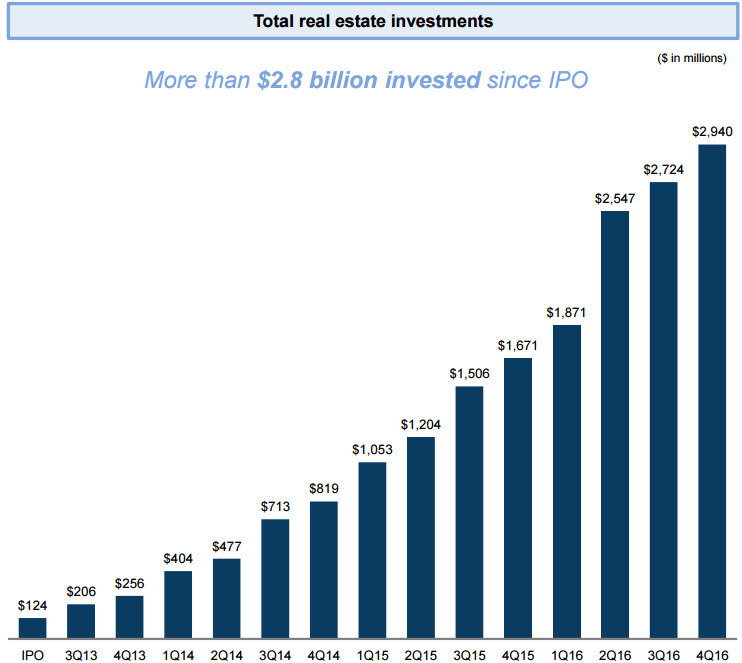

Physicians Realty has been growing rapidly, but there remains enormous opportunity for continued rapid growth ahead. For starters, Physician’s Realty has been growing rapidly as the following chart shows the company’s total real estate investments since its initial public offering (“IPO”) in 2013.

More recently, DOC completed $1.3 billion of investments in 2016. Further, the company expects to close between $800 million and $1 billion of total real estate investments in 2017, subject to favorable capital market conditions (this is per the company’s most recent quarterly earnings release).

Further, according to DOC’s recent annual report, there exists as much a $200 billion worth of medical office facilities that are owned by hospitals, physicians, and healthcare systems. This creates a huge runway for growth for DOC to provide capital for improvements, growth, and other services and solution.

Also, the growth opportunity continues to be fueled by strong industry growth demographics. For example, per the following graphic, US healthcare expenditures are expected to continue growing, particularly as the population ages.

Also very important to Physicians Realty’s future growth, the company has strong liquidity and access to a variety of capital, as shown in the following graphic.

Also important, DOC has low leverage, particularly relative to many of its peers, as we will see in more detail in the next sections of this report.

Valuation

Price-to-FFO (funds from operations) is one of the most common REIT valuation metrics, and we believe Physicians Realty’s valuation is attractive, despite its relatively higher price-to-FFO. For starters, the following table shows DOC’s P/FFO ratio (and a variety of other metrics) compare to other healthcare REIT.

At first glance, DOC’s 22.8 P/FFO looks expensive. However, bear in mind that FFO is backward-looking, and DOC continues to grow rapidly. For example, the following table shows the growth in FFO from 2015 to 2016 (it was up significantly in absolute terms and on a per share basis).

Further, DOC has already provided guidance for closing between $800 million and $1 billion of new real estate investments in 2017. This will dramatically increase DOC’s investments for a second year in a row. Also, these new investments will help grow future FFO to support DOC’s big dividend payments.

Also, don’t be misled by Physician Realty’s high dividend payout ratio. For example, DOC pays a $0.225 quarterly dividend, and generated only $0.88 in FFO last year. Normally, this would be concerning (paying out more in dividends than they are generating in FFO). However, DOC is growing rapidly, and this grow will continue to grow FFO. For perspective, the following chart shows DOC’s historical quarterly FFO per share growth, and we expect this upward trend to continue.

Also important, Physicians Realty has a lower amount of leverage than many other healthcare REITs. For example, DOC’s debt/equity (0.57) and long-term debt to total capital (0.4) are both relatively low. Not only will this help DOC fund future growth (because they can borrow more, considering their investment grade rating), but it also gives them relatively lower exposure to the risks of rising rates (because they have less debt relative to many peers).

Also, on a price-to-book basis, DOC is cheap at 1.8 times. These means the market is not giving Physicians Realty as much credit for its assets relative to peers.

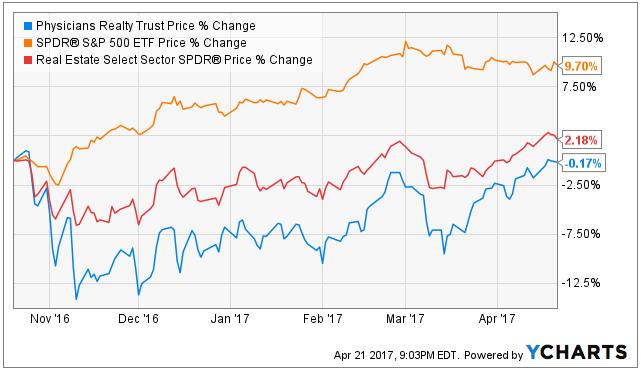

Finally, Physicians Realty’s price has underperformed the rest of the market recently as president Trump’s pro-growth agenda and the Fed’s increasing interest rate expectations have caused real estate securities to sell-off somewhat indiscriminately, as shown in the following chart.

Risks

Physicians Realty faces a variety of risks that are worth considering. For starters, the company may simply not be able to maintain its high level of growth. The company describes thisi risk in its recent annual report, as follows:

“We may not be able to sustain our growth rate level. Since our inception in 2013 through December 31, 2016, our compounded annual growth rate was 150.0%. This growth rate has contributed significantly to our growth in revenue. We may not be able to sustain this level of growth and over time we may experience a decline in our growth rate as a result of various factors, including changes in the economic and other conditions in geographic markets in which we conduct business, changes in the real estate market, changes in healthcare regulations, and the competitiveness of the real estate market. Additionally, our significant growth has resulted in increased levels of responsibility for our management, who may experience additional demands related to managing our current properties portfolio.”

Increasing interest rates pose a risk. DOC describes this risk (in its annual report) as follows:

“Increases in interest rates may increase our interest expense and adversely affect our cash flows, our ability to service our indebtedness and our ability to make distributions to our shareholders, and could cause our stock price to decline.”

Another big risk is healthcare reform. Physicians Realty describes this risk as follows:

“Recent changes to healthcare laws and regulations, including to government reimbursement programs such as Medicare and reimbursement rates applicable to our current and future tenants, could have a material adverse effect on the financial condition of our tenants and, consequently, their ability to meet obligations to us.”

More specifically, Physicians Realty goes on to explain:

“We cannot predict how the Affordable Care Act might be amended or modified, either through the legislative or judicial process, and how any such modification might impact our tenants’ operations or the net effect of this law on us. If the operations, cash flows or financial condition of our operators and tenants are materially adversely impacted by any repeal or modification of the law, our revenue and operations may be adversely affected as well.”

Also important to note, DOC faces regulatory risks that are unique to hospital outpatient assets. For example, in its recent annual report, DOC explains: “The Bipartisan Budget Act of 2015 (H.R. 1314) (the “2015 Budget Act”) provides changes to the requirements for providers who seek “hospital outpatient department” (“HOPD”) reimbursement under Medicare.”

However, DOC believes it is set to recognize premium reimbursement rates on a significant amount of legacy hospital outpatient department assets versus peers due to legislation (Section 603 of the Bipartisan Budget Act) that took effect in 2016.

Specifically, legacy hospital outpatient buildings will be grandfathered in to higher rates that new outpatient buildings will not be able to recognize. However, the benefits depend on how the regulations are implemented.

Conclusion

Overall, we believe Physicians Realty is attractive because it provides investors a rare combination of steady high income and significant growth opportunities. In fact, we like it so much that we ranked it #7 on our recent list of Top 7 High-Yield Healthcare REITs Worth Considering. Simply put, we believe Physicians Realty will continue to perform well (dividends plus growth) regardless of economic conditions. And if you are an income-focused investor, DOC is worth considering.