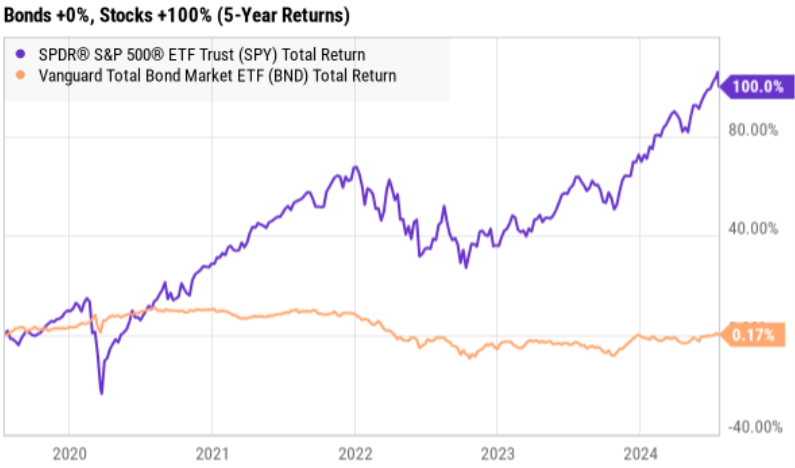

The conventional widsom among so-called investment people is to invest in a “balanced portfolio.” That means to invest in a prudent mix of stocks and bonds (such as 50/50 or 60/40) based on your personal goals and your tolerance for volatility. But over the last 5 years, the balanced portfolio has been horrible, with stocks up 100% and bonds up 0%. Why would anyone want bonds in their portfolio at this point!?

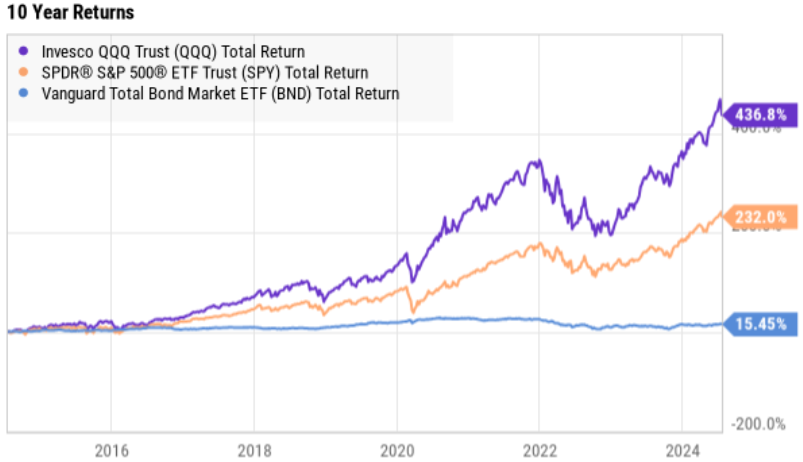

Further still, this isn’t just a 5-year phenomenon, it’s also a 10-year phenomenon (see below), with bonds returning, on average, about 1% per year over the last decade, and stocks up HUGE! Again, why would anyone invest in any bonds at all!?

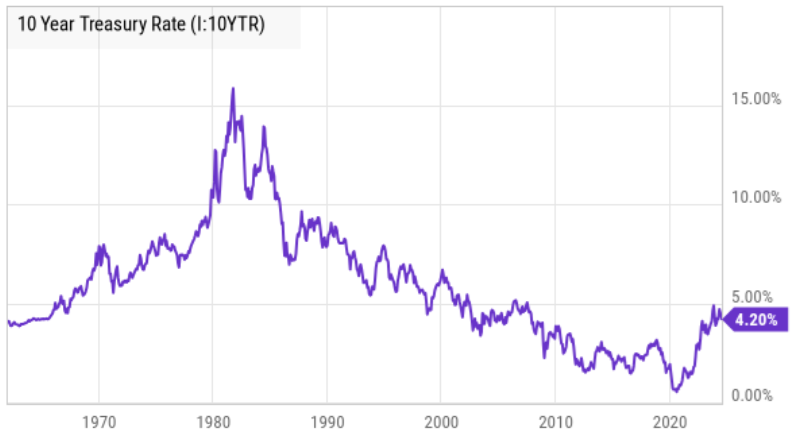

Of course the last 5 years has been an extraordinary time for interest rates, with the fed hiking (from basically 0%) and at an extraordinarily rapid pace higher (you can see this play out on the 10-year treasury rate, below). And of course when rates go up, bond prices go down!

Conclusion: Is the Balanced Portfolio Dead?

Before you go dumping 100% of your life savings into the stock market (whether it be highly-volatile growth stocks or “less risky” dividend stocks), just know that conditions can change rapidly. NO ONE thought the fed would hike rates so rapidly over the last few years (but they did). And in 1983 (see chart above) no one thought the +15% yield on US treasuries would fall to 0% (but it did).

I’m all in on America. I think the market is eventually going much higher (thanks to the hard work of the American and Global population). But if you have an investment horizon shorter than a decade, I wouldn’t be so quick to ditch bonds altogehter.

So to answer the question—NO!—the balanced portfolio is NOT dead. It’s just on life support, but expected to recover—eventually!

And most importantly: disciplined, goal-focused, long-term investment continues to be a winning strategy. Know your goals, and stick to a strategy that works for you!

Follow me for more content like this. Get: The Blue Harbinger Weekly.