There comes a time in every investor’s life when they realize chasing high growth stocks makes absolutely no sense whatsoever. Sure, if you’re 25 and want to roll the dice (on “the next big thing”) go for it. But if you’ve built a nest egg, and you just want your investments to produce big steady income, this report is for you. We countdown our top 10 big yield investments (including REITs, BDCs, CEFs and more) with a special focus on why each opportunity is uniquely attractive right now.

10. Reaves Utility Income (UTG), Yield: 8.2% (Monthly)

In case you haven’t noticed, the market has been ugly lately (and it could get worse). But one type of investment that performs relatively well when the market gets ugly is boring utility stocks. The utilities sector is known for steady low-volatility businesses and reliable dividend income (no matter what the broader market conditions are). And UTG is one excellent way to play this industry for a variety of reasons.

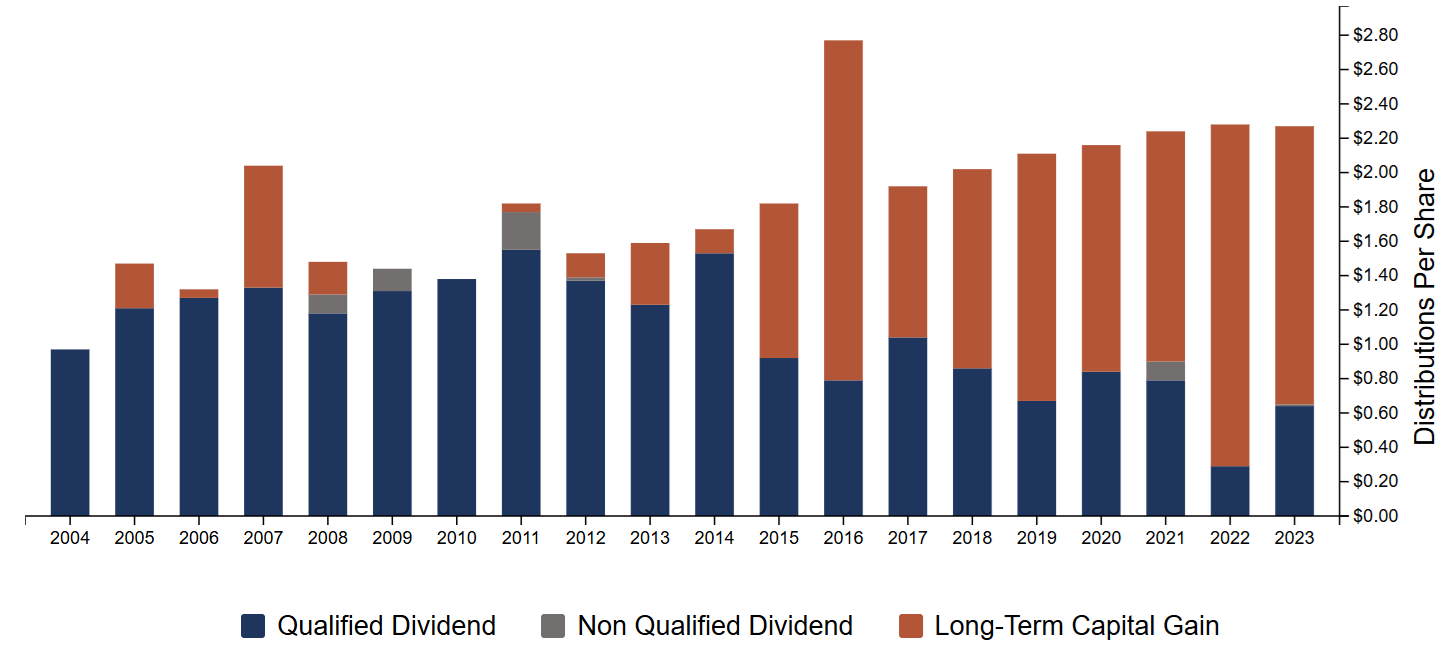

For starters, UTG offers a big 8.1%, that is paid monthly, and has never been cut since the fund’s inception back in 2004. It’s a closed-end fund (“CEF”) so it owns a basekt of stocks (recently 64) mostly from the utilities sector. It also trades at only a small premium to NAV (recently 1.9%) which is consistent with recent history (over the last 5 years) and not bad at all considering the fund uses a prudent amount of leverage (borrowed money was recently 19.5%) to magnify the returns and steady income of this lower volatility (and low beta) utility sector fund.

We’ve been touting the attractiveness of this one since back in February (when the price was a little lower and the yield a little higher) as you can read about here: Contrarian CEF: Attractive 8.8% Yield. However, considering utilities companies are a critical part of the economy (for example, energy demand keeps rising—for instance from the growing demand from data centers), we still find this fund quite compelling if you are an income-focused investor.

You can read our new UTG report here: UTG: Datacenter AI Demand to Boost Utility Companies, Big 8.2% Yield.

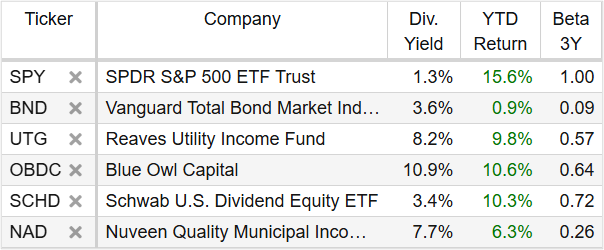

Source: StockRover. Note: Blue Owl’s dividend yield (above) includes past special dividends.

9. Blue Owl Capital (OBDC), Yield: 9.7% (Quarterly)

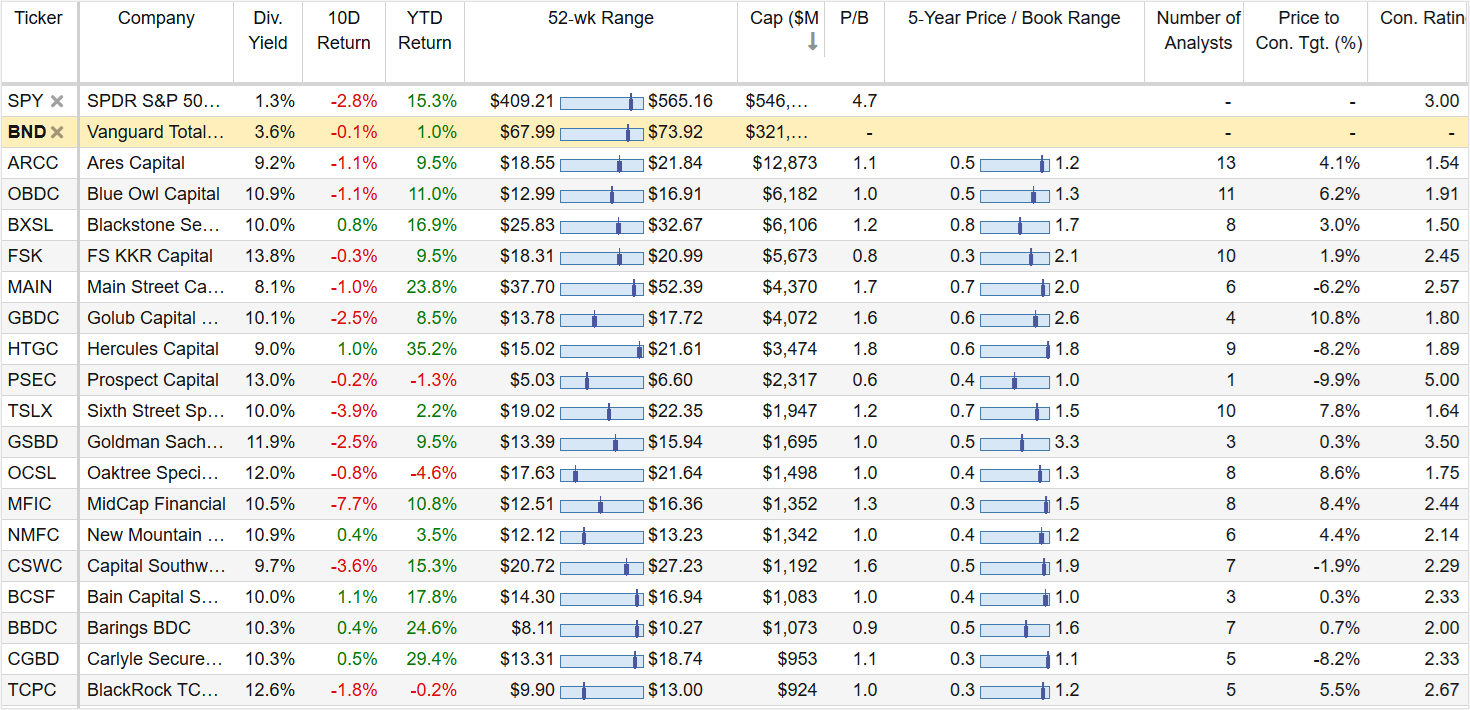

Another industry known for lower-beta volatility and big steady income is the BDC group (i.e. “business development companies). As a business model, BDCs provide capital (mostly loans and sometimes equity investments) to smaller “middle-market-sized” companies.

One reason BDCs are attractive is because they are able to take advantage of lucrative opportunities that big banks are often precluded from (for regulatory reserve-requirement reasons and because the financing arrangements are often just too nuanced for big banks to handle).

We also like BDCs, right now in particular, because they are relatively smaller companies, and small caps are arguably undervalued, especially versus mega caps (which are increasingly overextended according to a growing chorus of investors). Further still, the BDC group has finally just sold off a bit, thereby creating an attractive opportunity to pick up some big yield at a relatively lower price.

In particular, Blue Own Capital is a top BDC that has recently sold off (following May earnings that came in below expectations), and it currently trades at only 1.0x book value (attractive). It also has a strong aggregate rating from the 11 Wall Street analysts covering it (it’s rated stong buy). If you are looking for an attractive big-yield BDC opportunity, Blue Owl is absolutely worth considering.

Honorable Mention:

*Schwab U.S. Dividend Equity ETF (SCHD), Yield: 3.4% (Quarterly)

Although not officially included in our top 10 ranking (because the yield is too low) we’re including SCHD has an honorable mention (because it is a reasonable “dividend-value” strategy that some investors may want to include in their portfolio for specific diversification reasons).

For some perspective, SCHD is not necessarily about “beating the market.” Rather, by investing in dividend value stocks from across market sectors SCHD provides steady “qualified” dividend income (good for taxable accounts, depending on your tax bracket) with less volatility. This is exactly what many investors want (i.e. steady, lower-volatility and higher income than the S&P 500).

SCHD also offers instant diversification by owning around 100 stocks from across all major market sectors, but with slightly lower weights to higher-volatility sectors like technology, and slightly higher weights to lower-volatility sectors like consumer defensive.

SCHD also has a low management fee and a track record of healthy price appreciation (to complement its healthy dividend yield), and this is a long-term trend we fully expect to continue. If you are an income-focused investor, and depending on your personal goals, SCHD is absolutely worth considering (for a spot in your portfolio) and we’ve included it as an “honorable mention” in this report.

8. Nuveen Quality Muni Bonds (NAD), Yield: 7.7%

Switching back to CEFs again, Nuveen offers a variety of municipal bond funds (i.e. funds that hold bonds issues by state and local governments) that are generally exempt from federal income tax. This means the attractive big yields on these funds are even bigger after you calculate the “tax equivalent yield” (people in higher tax brackets achieve higher/more attractive tax equivalent yield).

The caveat is municipal bond funds generally should NOT be held in tax-advantaged retirement accounts (such as IRAs), but instead they are for generating high income in your taxable account (especially if you are in a high tax bracket).

And these muni bond funds are particularly attractive right now for a few reasons. First, muni bonds are fairly save (they are generally investment grade and backed by either the taxing authority of the municipality issuing them or by the revnue of the municipal project they are issued for).

Next, muni bonds funds currently trade at sinificant discounts to NAV (attractive). And they have a bit longer duration (interest rate exposure) than other bond funds (for example, the average years to maturity and duration on NAD are 19 and 12.5 years, respectively (which means if interest rates fall then the price of these funds go up, all else equal). However, these aren’t something you invest in primarily for the price apprecation, you invest in muni bond funds for big steady tax-free income (paid monthly).

And with regards to NAD in particular, Nuveen just announced a large distribution increases in an effort to reduce some historically large discounts to NAV (a good thing). You can read our recent detailed writeup here: Muni Bond CEFs: 2 Big "Tax-Equivalent Yields," Attractive.

The Top 7

The remainder of this report (the top 7 big yields) are reserved for members only and they can be accessed here. The top 7 includes an attractive mix of big yield investment opportunities that are from across multiple market sectors and are particularly attractive right now.

The Bottom Line:

If you’ve reached a point in life where steady income (without all the volatility) is what matters, then don’t go chasing after volatile growth and technology stocks. Rather, consider investing in attractive opportunities that pay high income now, such the ideas shared in this report.

At the end of the day, diversified, goal-focused, long-term investing continues to be a winning strategy.